[ad_1]

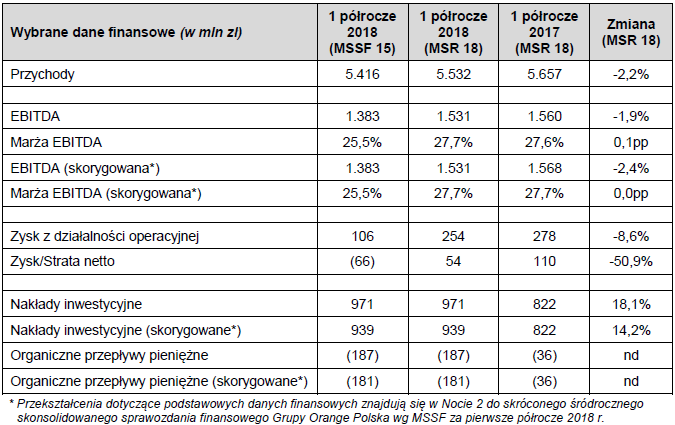

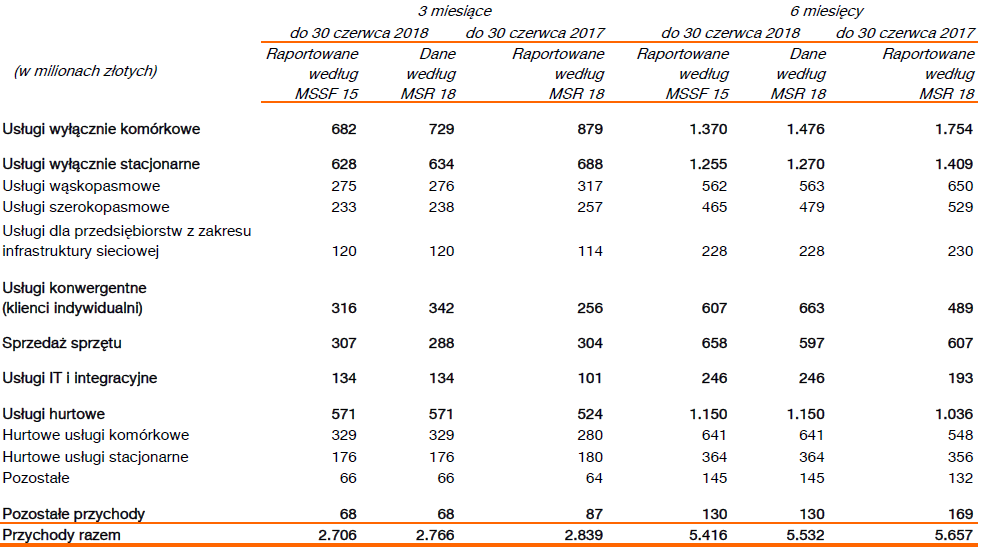

Orange Polska's turnover in the first half of the year amounted to 5.53 billion PLN according to IAS 18 and 5.42 billion PLN according to the new IAS 15 standard . In this second approach, the company recorded a net loss of PLN 66 million. [1965900] According to IAS 15, telecom EBITDA over the last six months amounted to PLN 1.38 billion and operating profit to PLN 106 million [1945900]. The company has significantly increased its investment spending – from PLN 822 million in the first half of the previous year. up to 939 million PLN of adjusted expenses during the previous semester

Nearly 10 million mobile phone customers

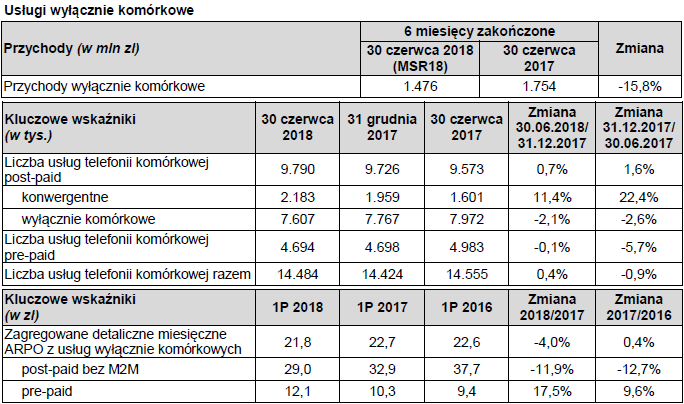

By the end of June this year Orange had 9.79 million subscribers to mobile telephony (0.7% more than at the end of last year), of which 2.18 million also used other business services (11.4% Furthermore). The number of prepaid users decreased by 0.1% for six months. up to 4.69 million

During the last semester, the average monthly revenue per user of the mobile phone amounted to 21.8 zlotys, or 2 percent. less than a year earlier. In the case of the subscriber, it decreased by 11.9 percent. up to 29 PLN, and for a user of a prepaid offer – increased by 17.5%. PLN 2.5 million

2.5 million fixed Internet customers

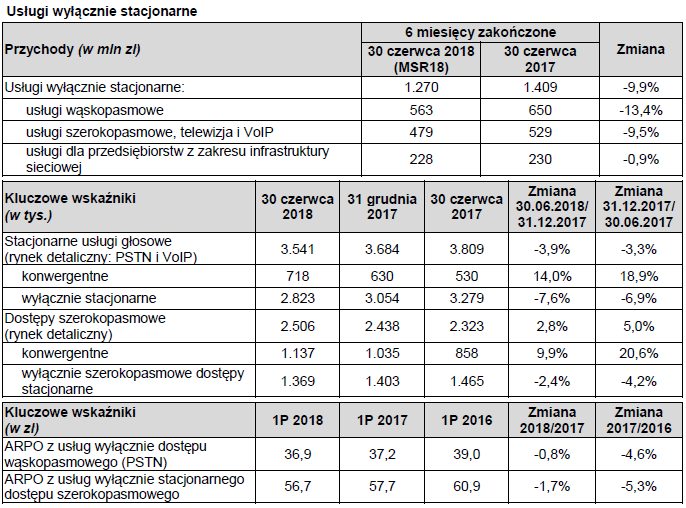

Orange revenues derived from fixed-line telephony services decreased by 9.9% per year. up to 1.27 billion PLN. The most – from PLN 650 to 563 million – decreased revenues from fixed telephony.

Only this telephony at the end of June this year. 2.82 million telecom customers used the network, 7.6%. less than a year earlier.

However, the number of fixed Internet users has increased by 2.8% annually. up to 2.506 million. Already 1.14 million of them (9.9% more than in the middle of last year) have also used other Orange offers.

In recent years, fixed-line service rates in Orange have declined. In the case of telephony, the average monthly income per customer increased from PLN 39 in the first half of 2016 to PLN 36.9 in the previous semester and, in the case of the Internet, from PLN 60.9 to PLN 56.7. PLN

1.14 million Orange Love Customers

Orange Polska emphasizes this from its convergent services, from February last year. Offered under the Orange Love brand in late June, it has already benefited 1.14 million customers, against 858 thousand. a year earlier and 568 thousand Mid-2016

The turnover of these customers (calculated according to IAS 18) rose from 489 million PLN in the first half of the previous year. up to 663 million PLN during the last semester. However, the average monthly income per user rose from PLN 108.8 to PLN 101.6, which Orange Polska explains by increasing the saturation of its clientele with these services

Benefits costs decreased by 10% over last year. up to 394 million PLN. The company reduced by 2.1 percent. 1.508 billion zlotys of foreign purchases, mainly due to lower settlement costs than other operators of PLN 50 million

Orange Polska's organic cash flow in the second quarter decreased by 32 million PLN against PLN 218 million a year earlier. During the first half of the year, the company generated less than PLN 187 million in organic cash flow, compared to PLN 36 million a year ago.

In April-June, the group's investment expenditure increased by 33.4% to PLN 583 million. During the first half of the year, Orange Polska's investment expenses amounted to PLN 971 million and amounted to 18.1%. higher than last year. In the presentation of the result, the Group maintained the target of adjusted investment expenditure of PLN 22.2 million for the whole of 2018.

– Our financial results in 2Q 2018 were mainly influenced by three factors. First of all, the very strong positive impact of cost optimization is reflected in a decrease in indirect costs of 10% in annual terms. On the other hand, the trend in revenue was supported by dynamic growth in convergent offerings, IT and integration services and wholesale services, and was penalized by the decline in revenue. hardware sales. And thirdly, the real estate sales negotiations last longer than expected, which affected both the evolution of EBITDA and the cash flow generated – said board member Maciej Nowohoński

– After the first semester stable and converge with our expectations. EBITDA for the first half represents just over half of the annual plan. As a result, we confirm the year-end adjusted EBITDA target of approximately PLN 3 billion in accordance with IAS 18 and PLN 2.75 billion in accordance with IFRS 15. – Nowohoyski added.

[ad_2]

Source link