[ad_1]

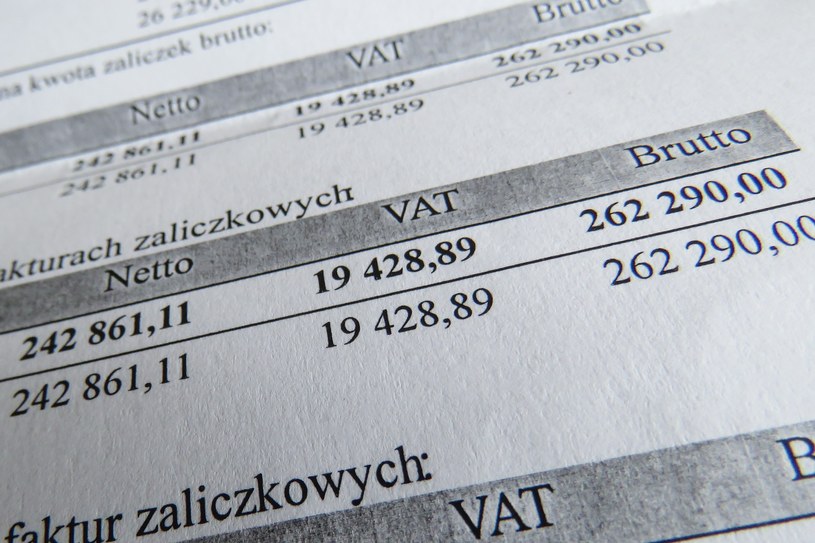

The charges related to participation in an organized criminal group and the issuance of several hundred "virgin" VAT invoices, amounting to more than 10 million zlotys, were given to Dawid S. and Robert O. Men were arrested for three months.

/Tomasz Kawka /News East

The procedure for issuing false invoices lasted from February 2017 to November 2018 this year – said Piotr Marko, spokesman for the Lublin Regional Prosecutor's Office, who oversees the case.

According to the findings of the investigation, early 2017, members of the criminal group have bought a limited liability company based in Warsaw. The company was declared as a VAT payer, but it did not operate any businesses.

Dawid S. and Robert O. have used the company and, as its representatives, have sent several economic entities across the country at least several hundred "empty" VAT invoices. The documents referred to the alleged sale of auto parts and construction services, worth more than PLN 10 million. In fact, there were no such transactions.

On November 22 this year, at the order of the prosecutor, Celwiętokrzyskie celno-fiscal office agents in Kielce arrested Dawid S. and Robert O. Both men were charged with involvement in an organized criminal group and lies on VAT invoices issued.

After the interrogation of the suspects, the prosecutor seized the court of arrest requests, because of the imminent penalty that threatened them and the fear of the decree. The court upheld the prosecutor's arguments and arrested them for three months.

Both suspects are subject to new, stricter criminal provisions regarding the issuance of "empty" VAT invoices as of March 1, 2017. For unreliable invoices with a total value greater than PLN 10 million they provide for a five-year sentence and even 25 years of imprisonment. .

Investigators consider that the problem is development-related, as prosecutors do not rule out new detentions. The false invoices were probably used to extort VAT. The investigators will determine and bring the perpetrators to justice.

[ad_2]

Source link