[ad_1]

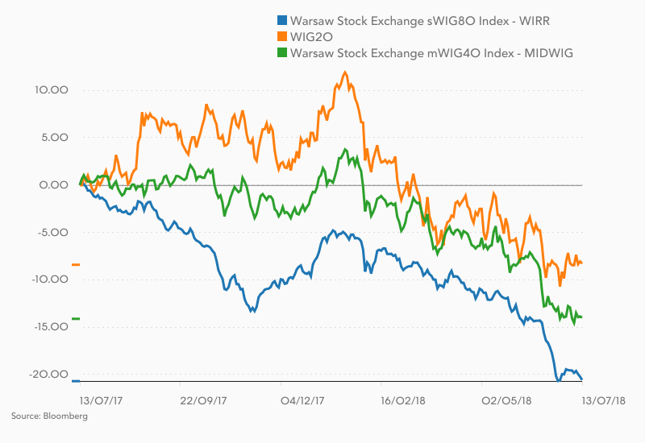

Small companies listed on the WSE were supposed to be the best investment in 2018

year. However, at mid-term, sWIG80 is the weakest market sector.

Why "babies" in the stock market are down despite a 5% increase

In the beginning I will answer honestly that

I do not know But I decided to check some tracks that can lead to sources

the weaknesses of sWIG. The weaknesses are spectacular and generally unexpected. again

at the beginning of the year, the experts strongly agree that "

2018, sWIG80 will be better than WIG20 " Some analysts in their

the forecasts went even further and expected this year sWIG80

will increase by 20-30%.

Well … until the end of the year is still

a lot of time and a lot of things can happen. Even double the stock prices on the WSE.

But at mid-term, small and medium-sized enterprises are portraying poverty and

the despair. As of July 13, the sWIG80 has lost more than 13% since the beginning of the year

it is quoted 24% below the peak of March 2017. Use of standards

The American is therefore a bear. After the declines in recent months, it has been broken

the long-term uptrend line has also been established.

It does not even mean that

the market has again decided to teach analysts and investors a lesson,

the opposite direction to the expectations of the majority. The fact is that it's getting harder and harder

explain this bad behavior on the Polish stock market. Especially that sWIG80 is considered

is for the index, which better reflects the structure of the Polish economy

overweight WIG20 banks and public giants. So, how to explain that the dynamics of the GDP turns

about 5% per year, and sWIG80 decreases by 20% year-over-year?

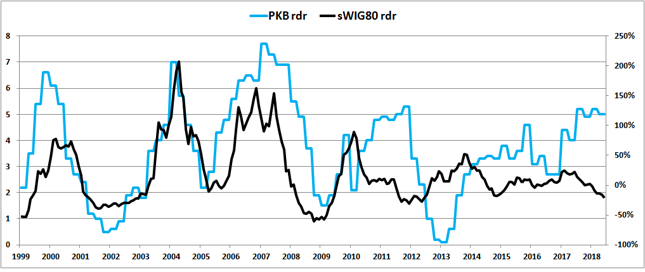

A Macroeconomic Trend

Until 2010 sWIG and GDP went

together as on a leash. Later, they went a little apart, what you could have been

explained by the GDP disturbances related to Euro 2012 (this index was

pumped in 2011 with infrastructure investments) as well as in advance

through the stock market of the 2014-16 recovery. Also a shot of sWIG at the turn

2016/17 could be justified by expectations of accelerating growth

what really happened at that moment. But why

happened in the last 12 months, it is difficult to find an explanation.

Or, therefore, the stock market expects a sharp decline (or

almost a recession) in the Polish economy, or we are dealing with an abnormal

investment opportunity.

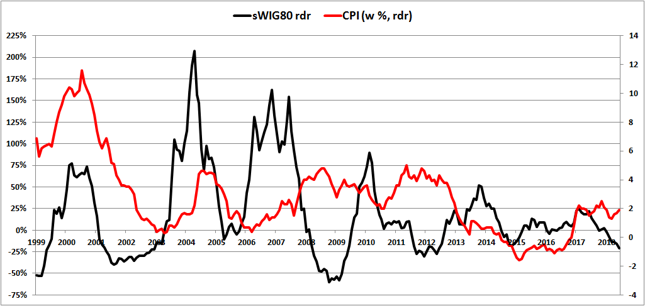

The second macroeconomic trend

is the sWIG relationship with price inflation. In previous cycles

SWIG80's economic momentum has outpaced the dynamics of the commodity price basket

Consumer Services (CPI). It should be noted that the previous dynamics of sWIG preceded it

deflating hole on IPC. Both indicators rose until spring 2017. But then

price inflation has slipped from the pattern: instead of heading towards the cycle

maximow (or about 4-5%) remained in the 2% area, and in early 2018

even unexpectedly fell to 1.3%.

Where does this inflation dependence from the CPI come from?

business evaluations? When prices for consumer goods rise, it means that the business

the sellers and producers of these goods increase their nominal income. And if

revenues grow at least as fast as costs and then the stock companies

all increases profits. And then their valuation increases. Meanwhile, a lot more than a year

Corporate Boards complain to shareholders that they are not able to pass on

customers increase the costs of labor, fuels and raw materials. They come from here

Disappointing Results and Stock Prices Lower

Result

But is this really true? by

Bloomberg data in 2017 from sWIG companies generated PLN 24.25 billion

turnover figure. That's 20% less than the year before. Forecast for 2018 have

Expect to generate PLN 30 billion revenue. It's more or less as much as it's

2015-16. The Bloomberg analysts consensus is to work through

swig companies just over 1.1 billion PLN profit – 12% more than the previous year. the

As a result, the entire index is currently trading at a relatively low c / z in a row

10.1. It's more or less the same as during the fall of 2011. Cheaper (and a lot of it

cheaper) was only in early 2009, so during the world's heyday

recession.

So, valuations seem pretty

attractive and tempting to buy shares of "kids" at a reduced price. On the other hand, however

parties dumped parties can take a lot of time to cheaper and get more and more

more attractive before they become more expensive. It's interesting to pay attention to the fact that

that in nominal terms, the current bear market (correction?) is relatively shallow.

Declines of more than 50% from the top are already in the history of sWIG (and earlier

WIRR) has arrived. Nobody can guarantee that this time we will stop around -20%

or -30% as in 2011 or 2001.

Flow Track

Thus, neither the surroundings

macroeconomic or business results seem to justify such a deep sale

small enterprises. All the more so as the sWIG80 has significantly lower returns

than WIG20 or even mWIG40. Here is the interpretation

The ancient Romans knew that

every thing is worth as much as someone is willing to pay for it. This saying

in its entirety, it applies to company shares. We have three groups of investors on the WSE

– This is the actions of buyers. There are major foreign players (funds, banks

investment, etc.). These investors invest only because of the minimum liquidity limits

in companies with WIG20 and perhaps even smoother mWIG assets. They do not generate

therefore the demand for small business shares

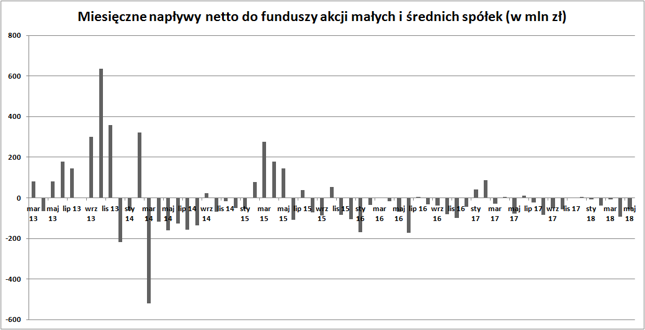

The second largest category is the country

institutional investors who, from time to time, venture out

Swing companies. Only for many

months, large by balance are forced to sell shares. The OFE are sold,

because the mechanism of the so-called slider forces them to transfer more and more amounts

to ZUS. With OFE more cash flow than incoming flows, forcing the offer of shares – also

small enterprises. The same thing – although for other reasons – happens mostly

TFI. After the collapse of 2008 and the poor performance of the WSE over the past decade, the Poles

they have not apologized to stock funds so far. Most prefer to locate

savings in safe or pseudo-safe

(corporate bonds, total return fund). And we can see it in

cash flow statistics for TFI customers. Fund for Small Stocks and

average companies in the last 12 months have only noted twice an influx

cash. From May 2017 to May 2018, more than 400 million left the TFI "mission"

zł. Who will even buy occasional cheap shares?

On the battlefield only

individual investors who are

(statistically) ages . And we know that with age, the tendency to go down

risk and investment research "pearls" in the sea of investment sludge.

Even the veterans of the WSE go to the next scam:

(and unpunished!) the use of confidential information or scandalous

practices of certain majority shareholders . This type of strident booty

Polish capital market reputation and discourage investors from buying

actions in general

There is no fashion for this in Poland

the stock market, by politicians and some media misnamed "casinos"

or "szulerni". The average Pole now prefers to invest in expensive real estate

than reasonably valued shares. And that's all

it will probably not change so soon.

Company Trail

You can also address the issue in

"detective" style and check which companies are "guilty"

if bad performance of sWIG. The list of the most degrading assets (in relation to year

up to one year) opens Trakcja, reduced from up to 82% in the last 12 months. she

the question of "foundations" – especially fatal

results for the first quarter aggravated by the loss of confidence in the authorities

after the case of May 2018. Then we have Idea Bank, who lost a year

close to ¾ of market value

the result of the scandal GetBack . It is said that the market is the bank of Leszek Czarnecki

he was one of the biggest brokers in the sale of Wroclaw bonds

of the debt collector

70% of the capital invested in

Braster shareholders lost their year. she

innovative,

start-up, whose product simply "did not catch" . Well, it happens. more than

Two-thirds of the capital was lost by investors who bought shares in Elemental a year ago

Holding. The recycling company has not pampered recently with financial results,

although they do not seem so weak to justify the scale of reduction. right here

the risk factor can be a rather high short-term debt. another

"Patient" is overvalued by 66% Cormay, who like Braster is still not

he has achieved profitability. He was severely affected by several other companies injured or

involved in the GetBack case: Getin (-60%), Quercus (-50%) and Altus

(-46%).

| The largest losers in sWIG80 |

|||

|---|---|---|---|

| Company | Modify year | Weight in the index | |

| 1 | TRACTION | -82.2% | 0.49% |

| 2 | IDEABANK [19659024] -74.8% | 0.58% | |

| 3 | BRASTER | % -72.0 | 0.22% |

| 4 | ELEMENTARY | -67 , 4% | 0.96% |

| EKOEXPORT | -66.0% | 0.21% | |

| 6 | Cormay | -65.0% [19659025] 0.31% | |

| 7 | TORPOL | -61.7% | 0.36% |

| 8 | GETIN | -61.6% | 0, 96% |

| 9 | PCM | -60.6% | 0.81% |

| RAFAKO | -55.5% | 1.30% | |

| ] | URSUS | -54.9% | 0.39% |

| 12 | Stelmet | % -53.7 | |

| 0.33% | |||

| 13 | ] ABPL | -49.6% | 1.29% |

| 14 | ASTARTA | -49.2% | 1.55% |

| [19659023] QUERCUS | -47.6% | 0.43% | |

| 16 [19659025] ALTUSTFI | -45.0% | 1.24% | |

| 17 | ZEPAK [19659024] 34.7% | 1.30% | |

| 18 Current and Intermediate | [19659026] -34.1% | 1.91% | |

| 19 | Lubawa | % -33.1 | 0.33% |

| APATOR | -32.6% | 2.33% | |

| Source: stooq.pl. On 13.07.2018 |

|||

But it is mostly companies o

relatively low weight in sWIG. Let's look at the qualities that are in

the index of "children" weighs the most. The top twenty are responsible for 47% of the weight

the entire index. In this group, they stood out negatively (that is, they fell more than they did).

same index) only three companies: Elektrobudowa (-37%), Apator (-31%) and Neuca

(-27%). As you can see, what a company is a different story

Looking through the prism of evaluations and

the degree of discouragement of investors in stock market in "maluchów" takes a lot of time

the position becomes more and more tempting. On the other hand, more companies

they warn that the results may deteriorate, the best example being the last

the history of Budimex . The construction giant, despite the boom in construction, noted

disastrous results in the second quarter, and its market value in four

month decreased

Nearly half !

It is also dangerous to make a point

macroeconomic view. The Polish economy was running

at the end of the business cycle. Height

in the coming quarters will be braking . Maybe enough

quickly. In this perspective, the relatively low current valuation of companies can be

prove too high. But if the sWIG80 suffered a drop of 4000 more

points, then you can buy almost in the dark.

Krzysztof Kolany

[ad_2]

Source link