[ad_1]

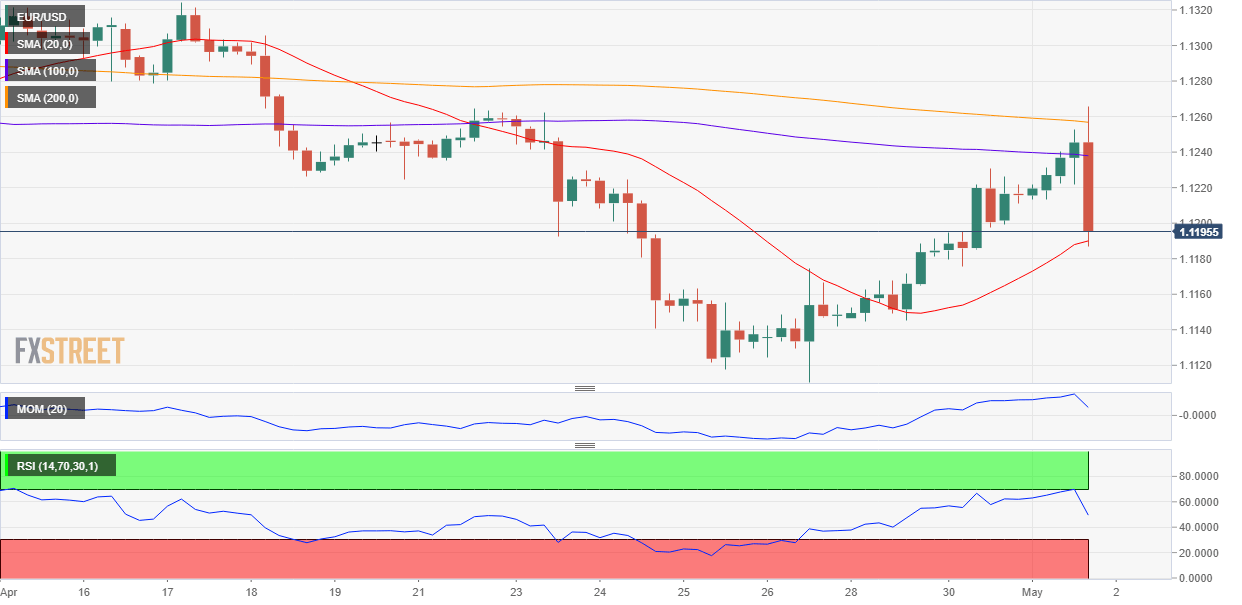

EUR / USD Current Price: 1.1195

- The US Federal Reserve has left the rates unchanged, as expected, and reduced the IOER on "technical adjustments".

- Fed chief Powell reaffirmed the current position of the central bank, saying the global risk had declined somewhat.

US data softer than expected pushed the EUR / USD up before the most important event of the day, the Fed's monetary policy decision. The pair hit 1.1249, underpinned by weak manufacturing output in the United States, with ISM Manufacturing's official PMI setting at 52.8 in April, exceeding the US market forecast. 55.0 and less than 55.3. On a positive note, although not enough to drive up the dollar, the ADP survey showed that the private sector created 275,000 new jobs in April, well over the expected 180,000. The March reading was revised upward to 151K. The pair extended its lead with the Fed's decision, as the central bank maintained its rates while reducing the interest rate on excess reserves to 2.35% from 2.40% previously. Although this is a technical operation aimed at keeping federal funds in the range, market players did not appreciate. The EUR / USD has extended its lead to 1.1264, ahead of Powell's speech. The head of the central bank caused a reversal of confidence on the dollar, insisting that the soft inflation charged in the first quarter was due to time factors. In addition, he said that the reduction of IOER did not reflect the direction of monetary policy, while indicating that global risks had somehow diminished, mentioned the progress in the US trade negotiations -Chinese and the withdrawal of Brexit. The pair lost the 1.1200 level with the development of the press conference.

This Thursday, Markit will release the final versions of the April manufacturing PMI for the Union, which should not be subject to relevant revisions. For the EU, the flash estimate is 47.8. The United States will publish April Challenger job offers, weekly unemployment figures as well as non-farm productivity and unit labor costs, all of which will be relevant before the release of the report. payroll in the non-farm sector, Friday.

Before the Asian opening, the EUR / USD parity is barely more than the 38.2% retracement of its last daily decline, at around 1.110, after briefly exceeding the 61.8% retracement of the same slide. In the 4 hour chart, a bullish SMA of 20 converges with the mentioned 38.2% retracement, which reinforces the support. The technical indicators fell significantly in positive limits, while the price was not able to erase the 100 and 200 SMAs. The risk is now biased downward as only firm gains above 1.1280 would be able to build a case.

Support levels: 1.1190 1.1150 1.1110

Resistance levels: 1.1240 1.1280 1.1320

View live chart for EUR / USD

[ad_2]

Source link