[ad_1]

Kathy Lien, Managing Director, Foreign Exchange Strategy for BK Asset Management

Daily Report on the Foreign Exchange Market July 9, 2019

Over the next 24 hours, 3 main event risks could change the currency rate. The most important will be Federal Reserve Chairman Powell on the economy and monetary policy and the Bank of Canada. Both events may be nothing, but there is also a great possibility that the market brings new revelations.

For the, everyone is watching the testimony of the Fed Chairman, Mr. Powell, to justify the latest rebound in the currency. The job report was better than expected but was it enough to tip the Fed's balance? Could they consider keeping rates unchanged this month or delivering only a reduction in insurance?

At their last monetary policy meeting, the central bank made it clear that easing depended on data. Since then, apart from the increase in hirings, the rest of the economy is weaker – the rise, decline, gender diversity, decline, activity of the sector slowing down. However, with the United States and China agreeing to resume trade negotiations, vigorous easing may not be necessary.

Given the positive tone of recent Fed meetings and the time elapsed since his last Congressional testimony, we believe that Powell will spend much of his time on Capitol Hill, explaining why the central bank believes the arguments in favor of A significant increase over the past few months. If the Fed chairman focuses on the risks ahead and devotes much of his testimony to examining the slowdown in the economy, we could see a turnaround and a dip below 107.50. could rise above 1.13, but the largest gains should be recorded in the Swiss franc and. However, if his testimony is full of optimism, we should witness a much stronger recovery in the world. The deal will most likely be dovish and will be ignored if Powell is optimistic but exacerbates a negative dollar reaction.

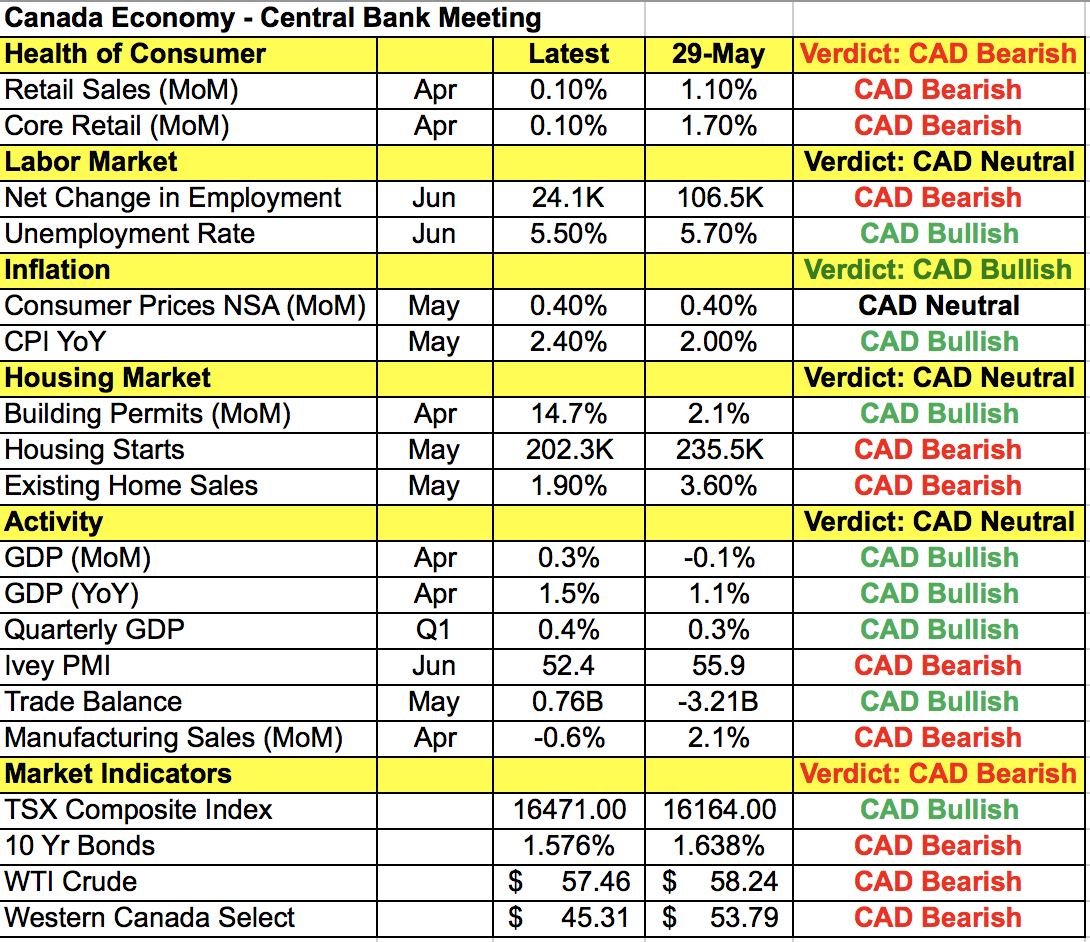

As for the Bank of Canada, they are the last man standing and everyone is wondering if the central bank will finally turn to the dovish. When they met in May, Canadians had a brave face and described their recent slowdown as temporary. Since then, we have seen the first signs of weakness in the Canadian economy, but it is too early to say whether it is a slowdown or a normalization. has barely increased in April but it is after a very heavy expenditure in March. were lost in June, but May was a record month for the job market and wage growth accelerated. Since these are only tentative signs of slowing down, we think the Bank of Canada may want more evidence before it becomes dovish. So, if they maintain their positive outlook and say that the recent missing data is temporary, they will resume their slide to new lows in a year and a half. However, if the tone of their monetary policy statement is more cautious, we may see a longer-term trough in USD / CAD.

Fusion Media or anyone involved in Fusion Media will not accept any liability for loss or damage arising from the use of the information, including data, quotes, graphics and buy / sell signals contained in this site Web. Please be fully aware of the risks and costs associated with financial market transactions. This is one of the most risky forms of investing possible.

[ad_2]

Source link