[ad_1]

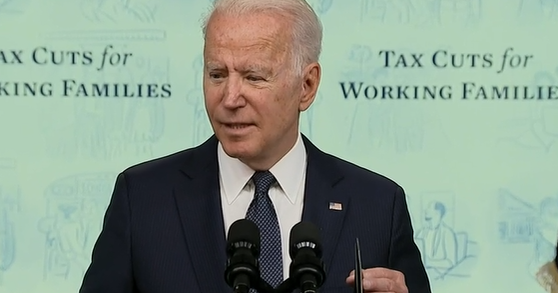

President Biden hailed the moment as historic as families with nearly 60 million children receive about $ 15 billion from the first monthly payments of the Advanced Child Tax Credit. President Biden and Democratic lawmakers are hoping that the money, as part of the latest round of COVID-19[female[feminine the pandemic relief adopted earlier this year is just the start.

The American Rescue Plan, which was enacted in March, extended the child tax credit to $ 3,600 per child under six and $ 3,000 per child aged 6 to 17. He also made the tax credit fully refundable and advanced half of it to families as monthly payments.

Households with children six and under will receive $ 300 per child each month, while families with children six to 17 years old will receive $ 250 for each of the next six months.

“It can change the lives of so many families,” Biden said. He argued that the expanded monthly child tax credit has the ability to reduce poverty in the same way that Social Security has reduced poverty among the elderly. He said the expanded child tax credit will be one of the things he and Vice President Kamala Harris will be most proud of when they finish their term.

Harris called Thursday “the day the American family got so much stronger.” She said that while the payments could be monthly, the impact will be generational.

“For the first time in our country’s history, working American families are receiving monthly tax breaks to help pay for essentials such as doctor’s visits, school supplies and groceries,” the secretary said. to Treasury Janet Yellen in a press release. “This major tax break for the middle class and this step in reducing child poverty is a remarkable economic victory for America – and also a moral victory.”

About 86% of families who receive payments receive them by direct deposit. The rest will receive checks in the mail, the Treasury Department said.

Political experts say the move will cut America’s child poverty rate by nearly half, with an even greater impact on black and Hispanic children. Before changes were made under the American Rescue Plan, low-income families often received a smaller child tax credit than families with higher incomes because the tax credit didn’t. was only partially refundable. Families with more than 26 million children who previously would not have received the full child tax credit because their income was too low under the old rules will now receive the full credit.

“This is the most gradual change ever to the US tax code,” Colorado Senator Michael Bennet said on Wednesday. He laid out a plan to revise the Child Tax Credit and make monthly payments to the Senate in 2017. “This is the biggest blow to child poverty in American history.”

Democrats – some of whom, like Connecticut Rep. Rosa DeLauro, have long advocated similar policies – are pushing to extend monthly child tax credit payments beyond 2021. As part of his draft US plan for families, Biden called for monthly payments to be extended. until the end of 2025.

“To those who say we can’t afford to give the middle class a break, I say we can afford it, making sure that the people at the top and the big companies, over 50 of which don’t paid no tax last year, only to start paying their fair share, ”Biden said.

While members of the Senate conclude a bipartite agreement on infrastructureDemocrats are also preparing to use the so-called reconciliation process which allows them to pass other items on the Biden agenda without needing 60 votes in the Senate. The increase in monthly child tax credit payments would be part of this $ 3.5 trillion budget resolution. Discussions about the length of its extension are ongoing, but Sen. Ron Wyden of Oregon, whose Senate Finance Committee is reportedly responsible for drafting it, said his goal was to make it as long as possible.

“It will undoubtedly be extended for a very significant period of time, and we will see if we can get the tenure we are fighting for,” Senate Majority Leader Chuck Schumer of New York said at a press conference this week. last on the subject. . He reiterated his call to make the expanded tax credit a permanent part of the tax code on Monday in the Senate.

Some Republican lawmakers have offered their own monthly payments for children, but none are expected to adhere to the Democratic version passed as part of a reconciliation program. No Republican voted for the US bailout, which included the temporary increase in the child tax credit.

Children’s groups are also pushing to make the expansion permanent – arguing that it cannot be left to future lawmakers to ensure the benefits for millions of families continue.

“We talk a lot about the possibility of halving child poverty, but if you just change your perspective on it, allowing this program to expire in a year to come is essentially allowing the child poverty rate to double. children when this policy is gone, “said Zach Tilly of the Children’s Advocacy Fund.

In the meantime, lawmakers, advocacy groups and the Biden administration have worked to publicize monthly payments and ensure low-income Americans who don’t have to file taxes are in the tax system. to receive payments.

The first payments automatically included families who signed up for stimulus checks last year, even though they normally don’t file taxes due to their low incomes. As a result, families with more than 720,000 children who otherwise would not have received a child tax credit will now receive payments starting this month, the Treasury Department estimates.

And awareness continues. Over the weekend, the IRS hosted a series of events in 12 cities across the country over the weekend to help people who don’t normally file tax returns get the payments and set up a series of online tools to help non-filers who are eligible for the child tax credits register to receive payments and verify their eligibility for payments. Even if families register late for child tax credit payments, they will still receive the full amount of advance payments by the end of the year, a senior administration official said.

On Monday, the IRS extended some of its child tax credit documents to Spanish and other languages to help reach eligible families. Other groups have launched a series of public awareness campaigns on multiple platforms.

To receive the full amount, eligible families include single parents filing up to $ 112,500 and married couples who jointly file with a combined income of up to $ 150,000 per year.

[ad_2]

Source link