[ad_1]

Originally published on May 24, 2019

Reader thing, a strange thing happened today.

Believe it or not, it has been almost three years since the British voted in favor of leaving the European Union. But these same British people, who have been suffering for a long time, have just taken part in an election of members of the European Parliament. (This place is a kind of waffle shop designed to give the European Union a respectable veneer of democracy).

Talk about glacial progress. Although, of course, this should not happen. Britain was due to leave the EU on March 29th of this year.

But the unfortunate British Prime Minister, Theresa May, has failed to concoct any arrangement that is sufficiently approved. You know, the kind that keeps enough people happy (on both sides of the Channel).

Ms. May still hangs on her job … by a thread. Rumors abound that she may resign imminently. Which means even more uncertainty, as the Conservative Party chooses a new leader and (therefore) the prime minister. And I thought that Argentine politics was volatile …

Meanwhile, the markets are experiencing their own dose of volatility due to the rapid deterioration of US-China relations (thanks to the United States' heartbeat). In the latest developments, even non-US companies in the United Kingdom and Japan would be cutting ties with Chinese company Huawei, following US sanctions imposed on the organization.

Inventories are down … bonds and gold up. A reminder of the need to own a range of things. You never know what's happening around the corner.

While stocks were stuttering, the status quo has just been confirmed in … India, believe it or not. Prime Minister Narendra Modi has just won a landslide victory in the world's largest democracy. Which was not exactly what the polls had predicted … again.

Winners of the US-China trade war

But let's go back to the relations between the United States and China. We hear a lot about the size of the US trade deficit with China, which means that the former imports much more than it exports. But what is the cause of this deficit? What are the major categories of traded goods that lead to such a state of affairs?

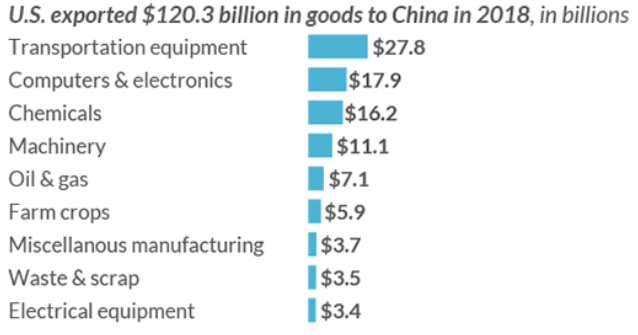

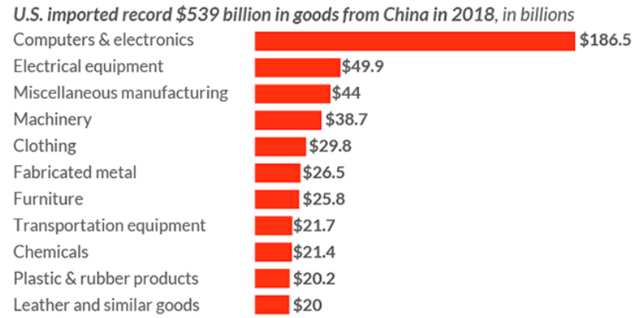

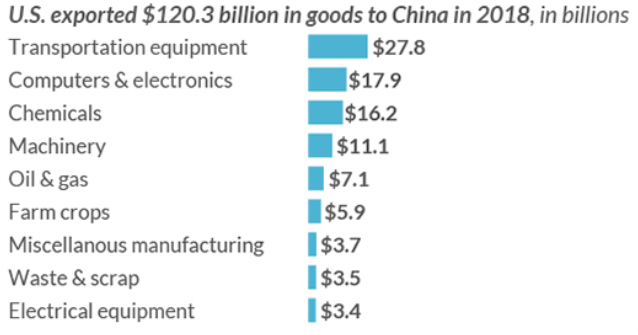

The following two graphs show it well. The first shows what the United States exports to China. The second shows what it imports from China.

This brings things into a much clearer focus. Electrical products ("computers and electronics" and "electrical equipment") account for 44% of all US imports from China.

Of the total trade deficit of $ 419 billion in 2018, $ 215 billion is related to electrical products. That's more than half of the total.

Again, we have to ask … who benefits from what the United States is doing in their trade dispute with China?

First, a huge amount of electrical equipment from China must be manufactured by (or on behalf of) US companies, under their own brands. The most obvious example is the Apple iPhone (NASDAQ: AAPL). All of these products are made in China and represent about 40% of all smartphones sold in the United States (and at higher prices). This compares to around 15% share of the global iPhone volume market.

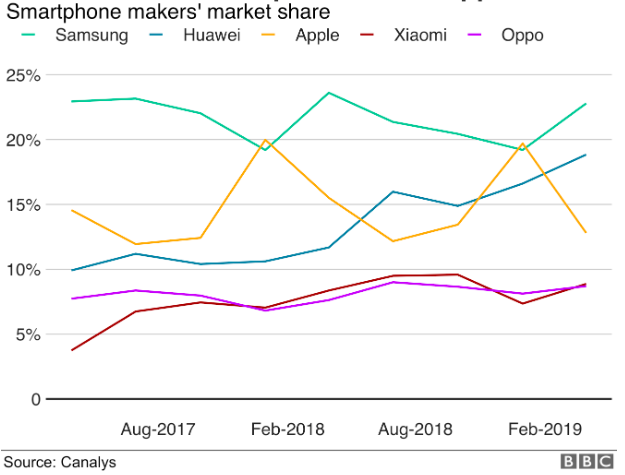

The graph below shows the volume market share of the five largest smartphone companies in the world. Together, they account for about two-thirds of total production. Samsung (OTC: SSNLF) is South Korean, Apple is American and the other three are Chinese. (Vivo, another unlisted Chinese company, holds another 7% market share.)

Phones and laptops from China are currently not subject to tariffs. But, at this rate, they could be soon. If not, what's the point?

If this happens, will Apple transfer all of its production to the US, or at least the part that meets the demand of US consumers? Maybe, but it would take years. In any case, this may not generate many new jobs. I would expect factories to be highly automated to mitigate higher wage levels compared to China.

So who will benefit from all this?

Regarding smartphones, it seems that Samsung is well placed. A few months ago, I replaced my old iPhone with a Samsung model much cheaper. That's about a quarter of the price of an iPhone, but it's three times more than what I need. This seemed to be an "obviousness".

Looking at the small print on the back, I can see that it was made in Vietnam. On this note, it has already been reported that some Chinese manufacturers are relocating their final production to Vietnam to circumvent US tariffs.

So we have two probable winners right away. Samsung Electronics is the only major manufacturer of non-Chinese smartphones and whose production is not Chinese. Meanwhile, Vietnam is an alternative and inexpensive manufacturing center in Asia.

But I would expect that all kinds of other manufacturers of gadgets and non Chinese electric gadgets will also benefit. It is then that US importers seek to circumvent tariffs on Chinese products. Now where could they look?

Congratulations to companies from South Korea, Japan and Taiwan. You have not done anything, but you are all winners. Do not forget to send a thank you note to Mr. Trump for all the new jobs that he is about to create in your countries.

Disclosure: OfWealth expressly prohibits its authors from having a financial interest in the individual securities that they recommend to their readers, other than collective investments such as exchange-traded funds.

Editor's note: The summary bullets for this article were chosen by the Seeking Alpha editors.

[ad_2]

Source link