[ad_1]

The key to making money in stock is not to be afraid of it. – Peter Lynch

Founded in 1985 in San Diego, Calif., Qualcomm (QCOM) is the world's leading designer of chips for wireless technologies, including 3G and 4G / LTE. The company also aims to be the leader of 5G.

The focus here is on the designer, because unlike traditional chip makers such as Intel (INTC) and Samsung (OTC: SSNLF) (OTC: SSNNF), Qualcomm does not (yet) ) its own manufacturing facilities and chips are produced by subcontractors. as Taiwan Semiconductors (TSM), or provides licenses to produce and use its intellectual property in smartphones, tablets and smartwatches, for example (so-called "factory-free manufacturing" model).

Sign of its technological leadership, companies that manufacture or use chips in their devices located in the aforementioned mobile communication areas are required to obtain a patent license from Qualcomm. It's no wonder that Qualcomm's customers include global technology leaders and smartphone makers such as Apple (AAPL), Samsung, Huawei, LG, Oppo, Sony (SNE) and Xiaomi (OTCPK: XIACF). ) (OTCPK: XIACY). Qualcomm speaks in its annual report of more than 210 companies using Qualcomm technologies in their products and paying royalties to Qualcomm.

In addition, Qualcomm's Snapdragon LTE Modem is widely recognized as the most powerful chip on the LTE market. An attempt by Apple in the production of iPhone 7 to replace Qualcomm chips by Intel chips in order to solve its problem of dependence on Qualcomm has caused performance problems for many iPhones. To avoid this performance problem in its LTE-compatible Apple Watch Series 3, Apple relied entirely on Qualcomm's Snapdragon chips.

According to a report released last week by the Washington Post, Apple's hardware managers used phrases like "the best" to describe Qualcomm's engineering. Another Apple memo describes Qualcomm as having a "unique patent share".

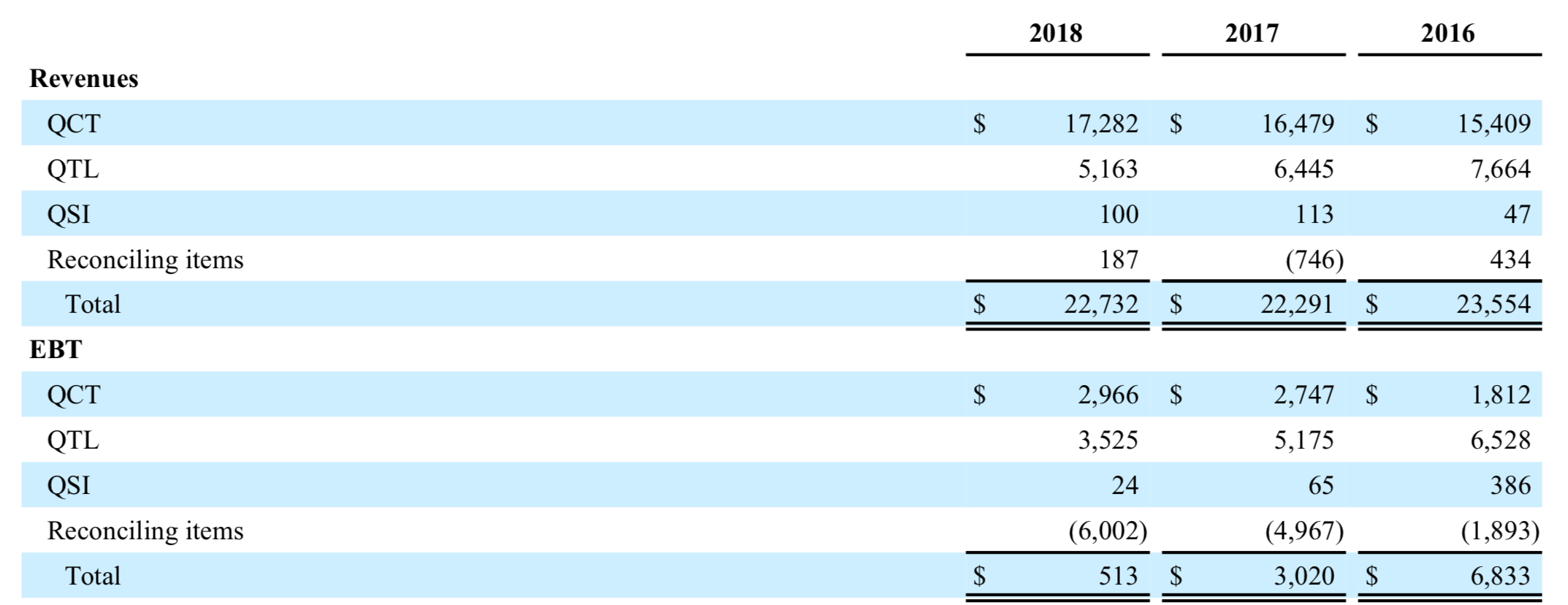

Qualcomm's business consists of the following three segments: QCT (Qualcomm CDMA Technologies), QTL (Qualcomm Technology Licensing) and QSI (Qualcomm Strategic Initiatives). QCT and QTL are revenue generating segments, while QSI makes strategic investments and can be ignored in this context.

The majority of Qualcomm's revenue comes from the sale of mobile communication chips (QCTs). The majority of the benefits are generated by high-margin activities with Qualcomm's patent rights and licenses for 3G, 4G / LTE and 5G (QTL) technologies. According to the source, QTL revenues represent approximately 3 to 7% of the wholesale price of a smartphone sold in the world.

While the QCT sector accounted for 76% of FY 2018 revenues, the QTL sector accounted for 54%, or more than half of pre-tax income (EBT) (see chart below).

Results of the Qualcomm segment for the 2016-2018 financial year. Source: 2018 Annual Report of Form 10-K

Qualcomm has faced headwinds in various legal proceedings since 2014, alleging that the company had abused its monopoly position to inflate prices.

On the one hand, Qualcomm has been exposed to numerous lawsuits against Apple and its suppliers, as well as Huawei, which have suspended the payment of royalties until the end of the lawsuits.

On the other hand, Qualcomm has been fined several billion dollars as a result of various court decisions.

All of these factors have resulted in a decline in Qualcomm's revenues and earnings over the last five years, and the stock price has been under tremendous pressure for fear of further revenue declines. Nevertheless, the shareholders were paid with a dividend of around 5% during this period.

The last five years of the stock literally look like a roller coaster (see figure below):

The Qualcomm stock chart for the period from April 2014 to April 2019. Source: YCharts.

A brief opinion

Most recently, on May 3, 2018, I published an article on Qualcomm in Seeking Alpha, titled "Why it's a business right now," and presented two scenarios for short- and long-term investors .

On the one hand, I discussed the long-term prospects for a possible acquisition of NXP (NASDAQ: NXPI), according to which a leading chip maker in the fields of mobile communication technology, automotive industry and digital payment solutions be created.

In addition, I mentioned the upside potential of the share price in the context of the announcement of a formidable share repurchase program worth $ 20 to $ 30 billion, which corresponds to 27% to 40% of the market capitalization at that time. . At the same time, I discussed the meaning and nonsense of this potential share repurchase program.

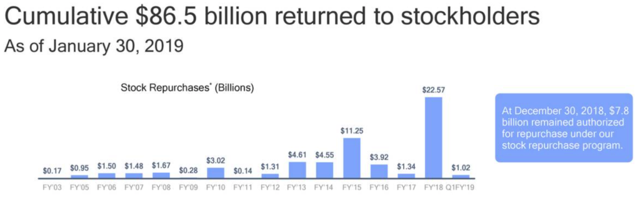

While the acquisition of NXP had been canceled due to a delay in the process of approval by the Chinese regulatory authorities, the company announced a share repurchase program of 30 $ 25 billion on July 25, 2018 (of which $ 7.8 billion was outstanding as at December 31, 2018). .

This announcement of the share buyback program catapulted the stock from $ 59 to $ 74 in a few days (which represents a 25% rise in the share price).

During the general stock market correction, uncertainties surrounding a trade deal with China and the legal dispute with Apple, the stock once again hit its trough, at around $ 49 by the end of January 2019.

In addition, in my May 3, 2018 article, I added that Qualcomm 's direction was aimed at resolving licensing disputes with Apple by the end of the year and preferably at the end of the year. l & # 39; amicably. In this context, it was also announced that the Qualcomm licensing model had been revised. The price cap for calculating royalties has gone from $ 500 to $ 400 per device (smartphone makers must provide a given percentage of the device price to Qualcomm).

In this context, I added that the revision of the licensing model should allow for the rapid resolution of license disputes with Apple and Huawei, as well as the prevention of further licensing disputes and legal disputes with other parties. licensees. Therefore, assuming a positive development of the points already described, the Qualcomm course should flow from his Sleeping Beauty sleep.

I have assumed that the price increases observed during the battle for the takeover of Broadcom constituted a small glimpse of the real value of Qualcomm.

So what happened recently?

On April 16, 2019, it was announced that Apple and Qualcomm had agreed to file all litigation worldwide under a settlement involving Apple paying Qualcomm. The companies also entered into a six-year licensing agreement, effective April 1, 2019, including a two-year extension option and a multi-year supply agreement for chipsets.

As a result of this announcement, the Qualcomm stock price has again exploded, recording a rise of about 45% in a few days (see chart below):

The course of action of Qualcomm soars after the announcement of the agreement with Apple. Source: YCharts.

Timothy Arcuri, an analyst at UBS, has not provided any information on the amount of the payment, but estimates that Apple has paid between $ 5 and $ 6 billion to Qualcomm to settle the dispute worldwide.

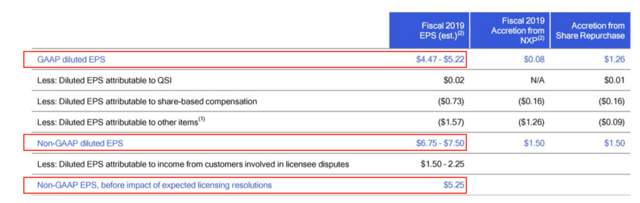

Qualcomm reveals in a regulatory document related to this agreement that it expects additional EPS of approximately US $ 2 as product shipments progress. This expectation is in line with the 2019 forecast announced by Qualcomm in April 2018. As a result, the settlement of the Apple license dispute would have a positive impact of $ 1.50 to $ 2.25 on non-GAAP earnings per share. (see the graph below).

EPS forecast for FY 2019. The source: Qualcomm Inc. 2018 T2 – Results – Call for Results Slides

At the same time, Intel announced the end of its 5G smartphone modem business after the Qualcomm-Apple truce. Instead, Intel will focus on 4G and 5G modems for PC, IoT, and other data-centric devices. This should indicate that 5G modems for iPhones (as well as probably for iPads and Apple watches) will be delivered by Qualcomm from 2020. In any case, Qualcomm is considered the leading designer of 5G modems and already has A 5G processor. modem in his wallet, the so-called Snapdragon X50.

As expected, the settlement of the Apple-Qualcomm dispute has resulted in many analysts upgrades.

First, Stifel leaves Qualcomm's ranks to obtain a purchase price ($ 100) and indicates that the $ 2 earnings per share growth forecast from management suggests that Qualcomm's license fees would not be or very low. slightly reduced.

Secondly, Evercore goes from In-Line to Outperform by re-calling Qualcomm shares "investable" after Apple's settlement. The company is raising its target from $ 60 to $ 90.

Third, JPMorgan (NYSE: JPM) cites Qualcomm's "strong 5G positioning" in its shift from neutral to overweight.

I guess other analysts will follow with bullish comments.

How is the current valuation of Qualcomm attractive?

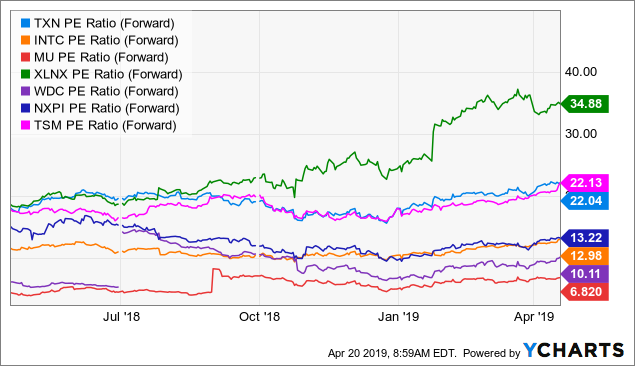

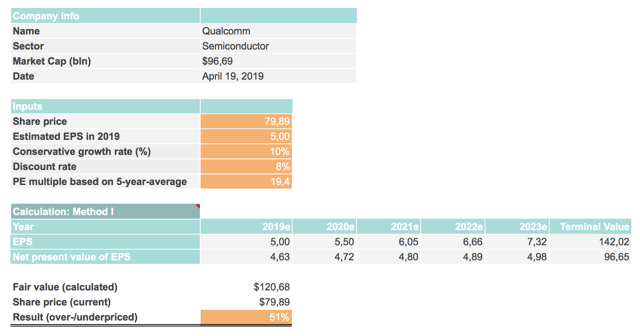

While cash flow is currently difficult to assess in the absence of additional guidance from management, the year's EPS guidance can be used to establish a current valuation against the peer group.

As previously mentioned, Qualcomm's management expects earnings per share of $ 4.47 to $ 5.22 for fiscal 2019. The licensing dispute with Huawei is still pending, I adopt a cautious approach to the valuation base and expect a $ 5 BAP GAAP. Based on the closing price of $ 79.89 as of Thursday last week, the P / E ratio would be 16 for the 2019 fiscal year. Based on the $ 7.50 non-GAAP EPS ceiling. the P / E ratio of 10.65 is even lower.

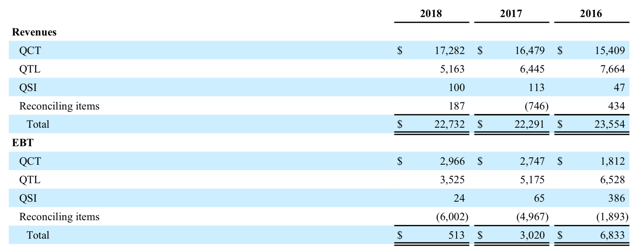

With regard to peer group evaluation, it should be noted that, despite Qualcomm's market leadership and its near-monopoly position in the 5G sector, the licensing conflicts with Apple and Huawei have resulted in reduced transactions. For example, Texas Instruments (TXN) (22.04), Taiwan Semiconductor Manufacturing (22.13) and Xilinx (XLNX) (34.88) have a price / earnings ratio that is at least 37.5% higher than that of Qualcomm.

In addition, companies such as Intel (INTC) (12.98) and Micron (MU) (6.82) have lower P / E ratios. This is not surprising, however, as Micron produces lower-quality chips with NAND and DRAM than Qualcomm, and Intel sells primarily in the computer sector, which is becoming less and less important. In addition, the results of these two companies are influenced by factors such as the slowdown in China and the weakening demand for NAND and DRAM.

On the other hand, the 5G segment is still in its infancy, so that the future earnings of Qualcomm do not seem to have been included in the current valuation. This could mean, among other things, that the price of the shares is currently attractive, despite the recent rise in share prices.

The following figure illustrates the peer group evaluation.

P / E ratios in the Vergleich peer group. Source: YCharts.

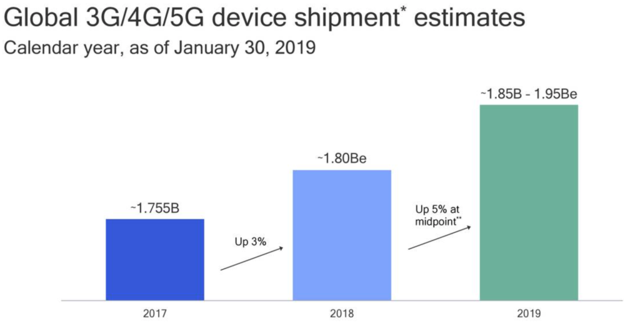

In order to assess the current attractiveness of Qualcomm, assumptions must first be made. According to the results of the first quarter of 2019, management expects a 5% increase in 3G / 4G / 5G device shipments in 2019. The year 2019 will also be the year of the deployment of the 5G (see graph below).

Estimates of worldwide shipments of 3G / 4G / 5G devices from Qualcomm. Source: Qualcomm Inc. 2019 T1 – Results – Call for results slides

If it is now assumed that device shipments will accelerate from 2020 and grow by 10%, Qualcomm's results will be affected accordingly. Assume that Qualcomm's results will only increase by 10% per year over the next five years for the sake of simplicity (I guess Qualcomm's results will be boosted by the deployment of the 5G and the Apple dispute settlement and Huawei, but we need a base .. make a useful evaluation with the available information).

I have prepared two evaluation models for this scenario. In the first valuation model, earnings per share for the next five years is discounted to 8% and a terminal value is calculated. In this model, no growth is assumed from last year. Since the chip industry is cycled, this approach may make sense. Lastly, the fair value is determined on the basis of the net earnings per share for the next five years and the terminal value.

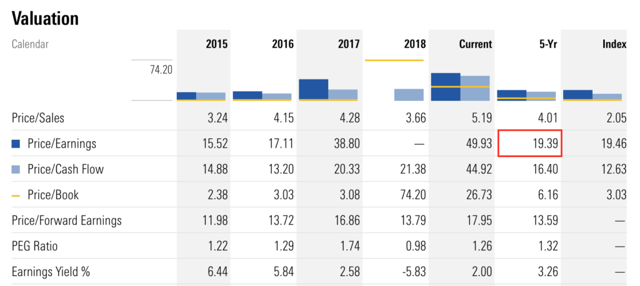

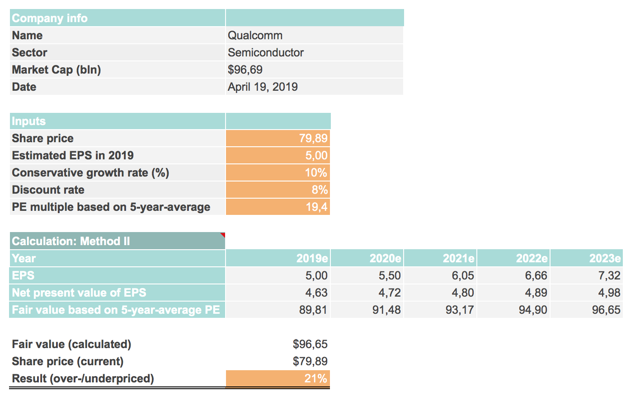

In the second valuation model, earnings per share for the next five years is also discounted to 8%. However, compared to the first model, no terminal value is calculated, but the result of the fifth year is multiplied by the average P / E ratio of the last five years, which, according to Morningstar, is 19.4 (see point red in the following). figure).

Valuation of Qualcomm on April 19, 2019. Source: Morningstar.

Under the first valuation method, the fair value is $ 120.68, which corresponds to a stock undervaluation of 51% (see figure below).

Calculation of fair value, method I. Source: Calculation of the author.

Under the second valuation method, the fair value is $ 96.65, which corresponds to an undervaluation of the stock of 21% (see figure below).

Calculation of fair value, method II. Source: Calculator of the author.

Regardless of the model used as a basis for valuation, it should be noted that Qualcomm has a $ 7.8 billion stock repurchase program as of December 2018 (see the following chart) .

Qualcomm has been buying back its shares since FY 2003. Source: Qualcomm Inc. 2019 Q1 – Results – Call for Results slides.

In addition, Qualcomm had short and long-term debt standing at $ 16.39 billion in the first quarter of 2019. In contrast, cash and marketable securities represented $ 10.32 billion. If we add to that the $ 5 billion to $ 6 billion USD of Apple, Qualcomm has a net balance sheet without debt (see the following figure).

Qualcomm key figures as of December 2018. Source: Qualcomm Inc. 2019 Q1 – Results – Call for results slides.

In addition, investors are rewarded with a dividend yield of 3.10% currently on Thursday's closing price (the latest increase was raised by 9% to $ 0.52 per share and quarter). Nevertheless, two years ago, the dividend was increased by double-digit growth rates. Now that the legal dispute with Apple has been settled, I suppose that the legal dispute with Huawei will also be resolved in the short term and that Qualcomm will again raise the dividend by double-digit growth rates.

The chart below illustrates the performance of Qualcomm's dividend since 2009:

Qualcomm Quarterly Dividend Payments Since Fiscal Year 2009. Source: Qualcomm Inc. 2019 Q1 – Results – Call for Results Slides.

What additional growth factors could Qualcomm have?

1) The semiconductor sector in general

Nowadays, almost all electronic devices contain chips, be it television, a smartphone, a tablet, a smartwatch, an automobile or a coffee machine. But these are not just chips. The technology is now so mature that these devices must communicate with each other and become more and more powerful (keyword: "Internet of Things").

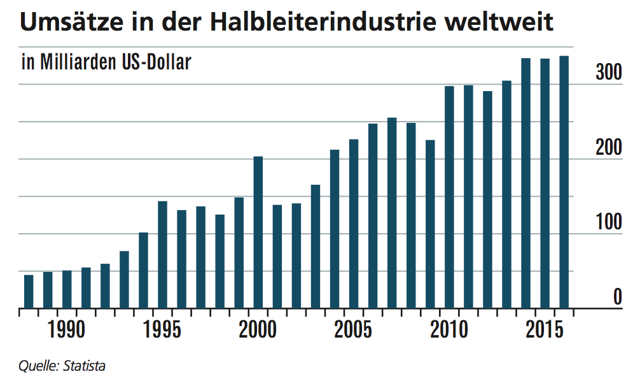

In my opinion, the semiconductor sector is almost a consumer goods market that will grow even faster in the future, driven by developments such as electric cars, autonomous driving, robotics, artificial intelligence and wearable devices. My hypothesis is confirmed by an article in the German magazine Focus Money, according to which the global market for semiconductors would increase by 16.8%, reaching more than 400 billion dollars. The share of semiconductors in electronic devices is expected to reach a record of 28.1% and beyond (Focus Money, issue 43/2017).

Emerging markets such as China and India are another stimulus. For example, 41.5% of all semiconductors were installed in China in 2015 (Focus Money, issue 34/2017).

The graph below shows that, after the outbreak of the financial crisis in 2007, sales of semiconductors have only slightly decreased, but in 2010, a strong recovery confirmed my thesis.

Revenues in the semiconductor industry worldwide. Source: From Focus Money, issue 43/2017.

2) Wide range of products in forward-looking markets

According to Qualcomm's management, the commercial deployment of 5G technology is expected to begin in the first half of 2019. 5G is a key technology on the road to the "Internet of Things" era, such as the autonomous driving, "the Internet of Things". "And the increasing digitization of the realms of life." At the same time, 5G will contribute to the broadcasting of ultra-high definition (4K) video streaming and virtual reality.

The immense potential of 5G technology and Qualcomm as a designer and beneficiary of this technology is certainly understandable.

In addition to its strong positioning in mobile communications, Qualcomm has a competitive advantage: its wide range of products in forward-looking markets, such as augmented reality and virtual reality.

The areas of virtual reality and augmented reality offer immense potential and represent a huge market of the future. The most powerful new chip from Qualcomm, "Snapdragon 845", unveiled in December 2017, can be used in VR / AR headsets as well as in smartphones.

Qualcomm has developed a reference headset for this purpose, which was presented at the Mobile World Congress held in Barcelona from February 26 to March 1, 2018.

The first customers of the AR / VR headsets sector are Oculus (a Facebook company) and HTC, which are also among the biggest suppliers in this segment.

Thus, Qualcomm is represented not only on 5G and the Internet of Things, but also on the future markets of virtual reality and augmented reality.

3) Growing expansion of mobile communication technologies in emerging markets

Demand for 3G and 4G / LTE is growing, especially in emerging markets such as China and India. In India, Qualcomm has entered into a partnership with Reliance Industries Limited, the most valuable Indian company in terms of market capitalization. Mukesh Ambani, CEO of Reliance Industries Limited, has set a goal of providing mobile communications throughout India. To this end, in 2016 it launched the telecom group "Jio" and acquired more than 100 million customers in ten months. In the coming months, the customer base is expected to reach 250 to 300 million customers.

This means that in addition to China, more and more people in India will turn to smart devices. In addition, the "Jio Phone", launched in September 2017 and designed to be an affordable smartphone for the Indian population, is equipped with Qualcomm's 4G technology, which should have an impact on Qualcomm's revenues over the coming quarters. .

India has a population of 1.3 billion inhabitants. Assuming you only equip half of the Indian population with smartphones and Qualcomm earns the lower limit of 3% of the retail price on each device at an average retail price of $ 300 per device, this would represent a number of $ 5.85 billion in additional business for Qualcomm. This would translate into a 25% revenue increase based on 2018 revenue. This example only applies to smartphones. This calculation does not take into account the fact that more and more smart devices are equipped with LTE and 5G modems in the future. The price of $ 300 is very realistic, even relatively low, because Apple in India, for example, offers refurbished iPhones at this price.

Qualcomm also has a strong presence in the Chinese smartphone market, the largest in the world. The Huawei, Oppo and Vivo vendors, which compete in China with 19%, 18% and 17% market share, followed closely by Xiaomi and Apple, are all Qualcomm customers.

All of these factors represent Qualcomm's technological leadership and "gap" in the current market, while indicating its likely role in the increasingly digitized and networked world of the future.

4) Potential acquisition of Dutch chip maker NXP Semiconductors

Qualcomm's general manager, Steve Mollenkopf, gave an interview to CNBC after settling the dispute with Apple. He was faced with the question of whether a possible acquisition of NXP Semiconductors was still being considered, as China would have given the go-ahead for a potential acquisition in negotiations with the US government. Steve Mollenkopf commented: "We are grateful to learn, but the time is up.The time is up."

At first glance, it seems the CEO has shut the door, but it could also be a bargaining tactic.

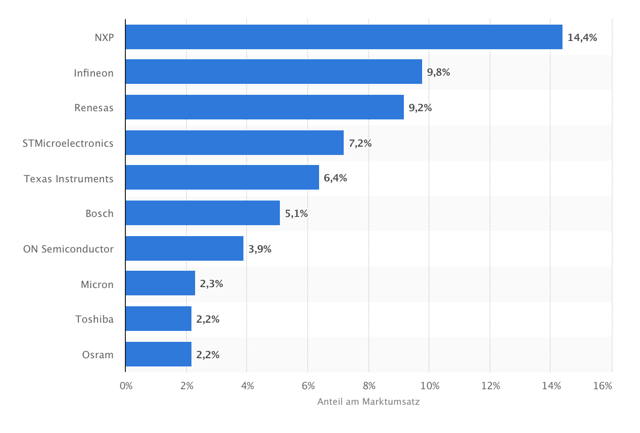

In my opinion, Qualcomm could use the available balance sheet money and Apple's contract entries to acquire NXPI. This acquisition could make sense for a number of reasons.

NXPI is one of the largest chip manufacturers in Europe and, with a market share of more than 14%, is the leader in the automotive sector for connected and autonomous cars, ahead of the German company Infineon (OTCQX: IFNNF).

Market shares of semiconductor manufacturers in the automotive sector. Source: Statista.

In addition, NXPI's Mifare smart card technology is considered one of the most widely used contactless smart card technologies in the world. According to NXPI, it has sold more than 10 billion cards and more than 150 million card readers. In terms of market share, NXP ranks second behind Infineon, but ahead of Samsung.

The combination of Qualcomm and NXPI would achieve over $ 30 billion in annual revenue and a leading position in markets such as mobile communications, the Internet of Things, security solutions and the industry. automobile. The total volume of these markets is expected to reach 138 billion USD by 2020, offering considerable growth potential.

In addition, the acquisition of NXP will allow Qualcomm to further diversify its revenue streams, reduce its reliance on smartphones and even have its own manufacturing facilities. As a result, Qualcomm will be less dependent on different sectors and will be able to create synergies and reduce costs through internal production, which could result in higher margins in the QCT business. In this way, the benefits have additional growth potential.

Another major competitive advantage of the NXP acquisition is that Qualcomm could better protect its technologies and thereby its competitive advantage by eliminating subcontractors and allowing chips to be manufactured in its own manufacturing facilities.

5) A possible trade agreement with China

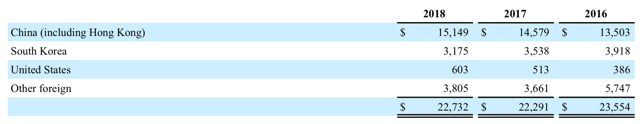

A possible trade deal with China could give a boost to Qualcomm's shares, as 67% of revenues in 2018 were generated with Chinese partners (see chart below).

Regional Distribution of Qualcomm's Revenues for FY 2018. Source: 2018 Annual Report of Form 10-K

At this point, it should be mentioned that in China, the Huawei, Oppo and Vivo sellers are running a duel with market shares of 19%, 18% and 17% respectively, followed closely by Xiaomi and Apple. It is interesting to note that these companies are all Qualcomm customers.

In addition, a commercial agreement could help Qualcomm and Huawei resolve their licensing dispute and allow Qualcomm's management to focus fully on its operations in the future.

This agreement could also help Qualcomm better protect its intellectual property in the future and maintain its leading market position in various sectors.

All the potential growth factors mentioned above represent Qualcomm's technological leadership and gap in today's environment, while demonstrating its likely role in the increasingly digital and networked world of the future. .

Conclusion

Know what you own and why you own it. – Peter Lynch

The largest price gains are often made over a short period of time, as was the case recently with Qualcomm. It is therefore important to make assumptions and be patient until these assumptions come true. In my opinion, this is one of the key factors of stock market success.

The legal dispute with Apple – one of Qualcomm's most prestigious and important customers – is now resolved, allowing the company to fully focus on its operational performance in the future .

The 5G generation in mobile communications is currently in the deployment phase, so that it can be assumed that profits and cash flow will increase after the second half of 2019. Regardless of this, Qualcomm continues to have solid fundamentals.

Its strong positioning in the areas of the Internet of Things and augmented / virtual reality offers additional growth potential. The increasing expansion of mobile devices in emerging markets is also expected to boost growth. A potential trade deal between the US and China could drive up the stock, as more than 60 percent of Qualcomm's revenue currently comes from Chinese partners.

Qualcomm has a favorable valuation relative to the comparator group and is fundamentally undervalued by more than 20% despite the rise in the share price due to the Apple settlement.

In addition, a pending stock repurchase program of approximately $ 7.8 billion and a dividend yield of over 3% currently also provide attractive shareholder value in the future.

Regarding the dividend, it is worth mentioning that it has grown at a double-digit rate until two years ago. Now that legal disputes have been settled and, as a result, cash flows are expected to increase, it can be assumed that the dividend will rise again to a double-digit rate.

This makes Qualcomm interesting not only for value investors, but also for dividend income investors.

I wish you a lot of success with your investments!

Disclosure: I am / we are long QCOM, AAPL. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link