[ad_1]

California Governor Gavin Newsom signed an spending deal earlier this year to help some of those hardest hit by the pandemic. The plan includes stimulus checks of $ 600 to $ 1,200 – money some Californians have already received.

Initially, the plan was aimed at helping low-income families, but in May Newsom announced that the plan would be expanded to include middle-income families. Lawmakers approved and Newsom signed a plan to send stimulus checks of up to $ 1,000 to more California adults.

That means the Golden State Stimulus now provides at least $ 600 to two-thirds of Californians.

The California Franchise Tax Board said the expanded Golden State Stimulus funds will begin rolling out in September 2021. Residents have reported on social media that they received the first round of payments on September 3, and other Californians have reported online that they had received funds. of the second round of payments on Friday.

Here’s what you need to know about Golden State Stimulus controls.

Who receives a check?

Individuals and households earning between $ 30,000 and $ 75,000 per year would receive a payment of $ 600. All households earning up to $ 75,000 with at least one child, including immigrants to the country who illegally file taxes, would receive an additional payment of $ 500.

This is the second round of cash payments made by the state in response to the pandemic. Earlier this year, people earning less than $ 30,000 received a payment of $ 600. Immigrants earning up to $ 75,000 who file taxes, including those who also live in the country illegally, also received the check. State officials chose a higher eligibility limit for these people because they did not get federal stimulus checks.

In total, the state would spend $ 11.9 billion in direct cash payments.

Am I eligible?

If you meet the following criteria, you are eligible.

- You have filed your 2020 taxes.

- You are either a CalEITC beneficiary or an ITIN filer who earned $ 75,000 or less (total CA AGI).

- You lived in California for more than half of fiscal year 2020.

- You are resident in California on the date the payment is issued.

- You are not eligible to be claimed as a dependent.

Click here for a full list of qualifications.

When can I expect to see the money?

Those who have applied to have their tax return paid by direct deposit should allow up to 2 weeks from the time the Golden State Stimulus payment is pending for processing. In the meantime, those who have opted for paper checks should allow up to 4-6 weeks for mailing.

When is the next batch coming?

A spokesperson for the California Franchise Tax Board said the next batch will be released on October 5. After that, other lots will be published on unspecified dates.

“Payments will be issued in as many batches as necessary to eligible taxpayers who will file their tax returns for the 2020 tax year by October 15, 2021,” the spokesperson said in a statement. “The lots will be released every two to three weeks and we hope to make almost all of the payments by the end of the year.”

How are the lots delivered to eligible residents?

Payments are made to taxpayers at random, according to a spokesperson for the California Franchise Tax Board.

How much money will I receive?

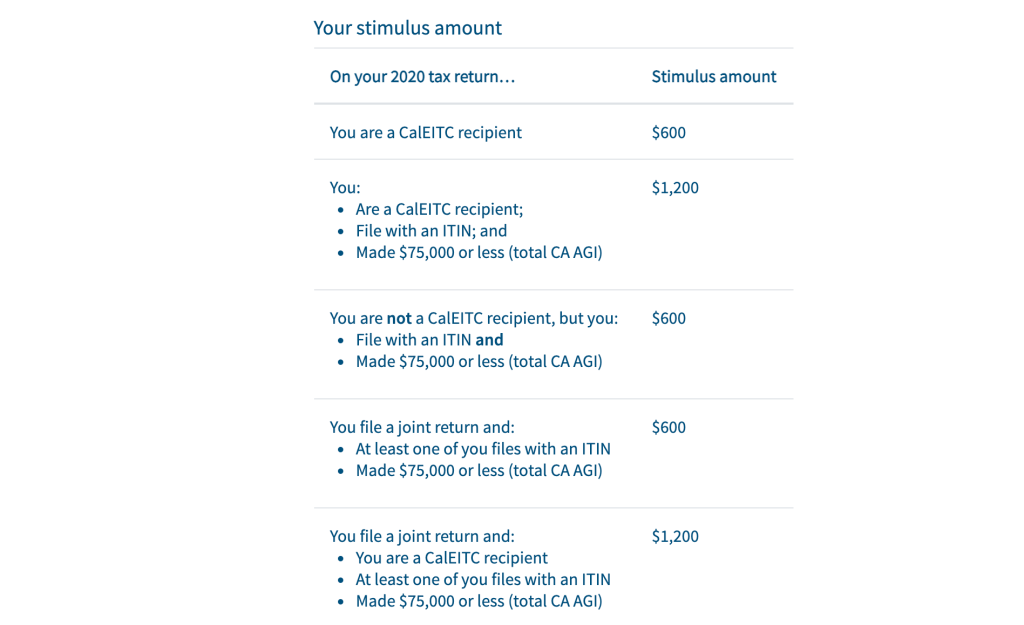

You can use the table below to determine whether you will receive a payment of $ 600 or $ 1,200.

[ad_2]

Source link