[ad_1]

The defense actions were moving Monday after Raytheon and United Technologies decided to merge.

A combined company would generate annual sales of $ 74 billion, making it the second largest aerospace and defense company in the United States.

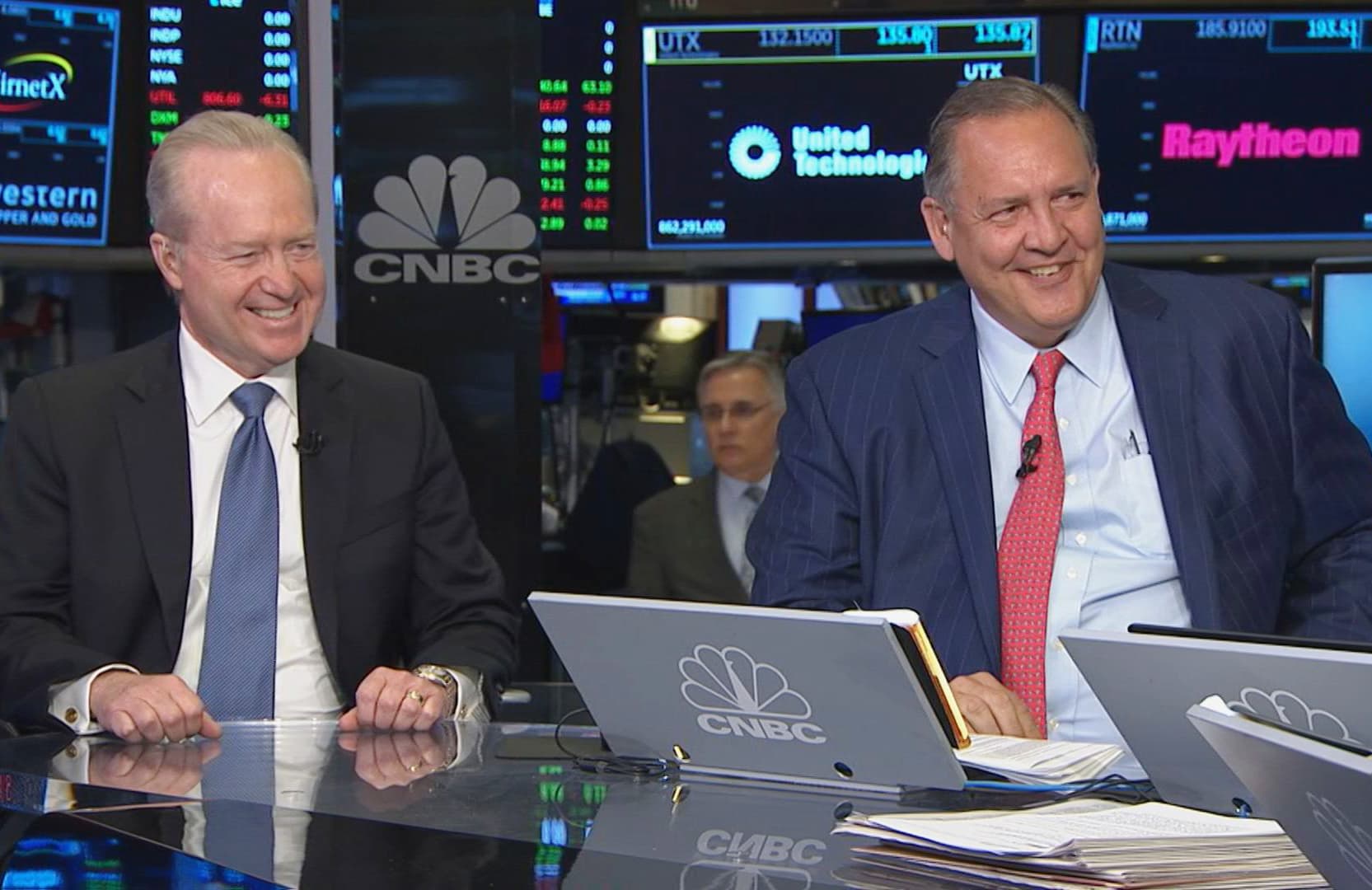

While President Donald Trump is worried that an agreement could make the industry less competitive, Tom Kennedy, Raytheon's CEO, tells CNBC that the two companies are more like partners than they are. competitors.

"We are complementary, we are not competitive," said Kennedy. "They have complementary technologies, which we combine with our technologies to get to the market, in which case we will be able to commit about $ 8 billion in research and development spending and our 60,000 engineers to develop the next tier technologies. to create the next generation franchises so that we can go to the international / global market and win those markets and then bring those things back to the US to create more jobs. "

Sheila Kahyaoglu, an aerospace and defense analyst at Jefferies, said the companies in the sector view mergers as the best way forward.

"That reminds us a lot of Harris and L3, you have to keep moving forward to get ahead." If you think about the budget, that's $ 730 billion, so it's not a Addressable market the size of Uber … it still remains very low, so have a cheap addressable.It's just that these companies are seeing a way to merge, and bigger is better, and the defense seems to be the theme . "

Ron Epstein, a research analyst at Bank of America, sees a formidable actor in the industry after the merger.

"The interest of this transaction is twofold: First, for United Technologies, they trade their air conditioner and Carrier Otis against Raytheon.Will not offend Otis and Carrier, Raytheon is a much better asset with the split of these companies. UTC, Mr. Hayes has turned this portfolio into a technological giant.The combination here … a high-tech defensive wallet is really a spectacular combination. "

Tim Lesko, senior director at Granite Investment Advisors, said the divestments offered buying opportunities for businesses and investors.

"For a long time, we have the impression that the defense actions have been a bit overvalued. We have owned Boeing and United Technologies for a long time, and we have a long history of projects like Raytheon, but they are trading at market premiums. These last two downturns, both in the fourth quarter of last year and in the second quarter of this year, probably created buying opportunities for stocks trading at valuations we found a bit high. Raytheon, as a member of United Technologies, is a definite advantage for a value-oriented manager, like us, because we are not paying a large premium for this position. "

[ad_2]

Source link