[ad_1]

(Bloomberg) – Investors with a record treasure trove to fund struggling commercial real estate find themselves in a tough spot: there’s nowhere to spend it.

The massive wave of defaults expected after the coronavirus closed offices, hotels and shops last year has so far failed to materialize. Today, as the US economy shifts from a pandemic low to a vaccine and stimulus-induced rebound, the window of opportunity for discounted deals is closing before it even closes. really opens.

This may sound like positive news to most Americans, but for a select group of investors who planned to reap big profits from the misfortunes of others, it is a problem. Distressed properties do not come onto the market because the owners have little pressure to sell. Commercial real estate prices have held up – even increased – because so much money is looking for so few transactions.

“We are starting to see frustration turn to despair,” said Will Sledge, senior managing director of the capital markets unit at brokerage firm Jones Lang LaSalle Inc. Investors are “ready to spike the prices and lower their yields in order to simply deploy Capitale. “

U.S. private equity funds have accumulated more than $ 250 billion in commercial real estate loans as of March 23, according to Preqin. That included a record $ 75.8 billion for troubled debt, a figure that rose in response to the eruption of late payments on properties last year.

Fundraisers continue to collect commitments. Cerberus Capital Management closed an opportunistic $ 2.8 billion real estate fund on Monday, exceeding the initial target of $ 2 billion. Oaktree Capital Management said last week it raised a $ 4.7 billion real estate opportunities fund, exceeding its target of $ 3.5 billion.

The stacks of money can grow even more. Nearly 30% of institutional investors are targeting troubled and opportunistic commercial real estate deals this year, nearly double the share at the start of 2020, according to a new survey by CBRE Group Inc.

“With all the capital available, there’s going to be a ‘Three Stooges’ effect,” said Jim Costello, senior vice president of real estate data firm Real Capital Analytics. “They all go through the door at once, but no one can go through.”

This year should be a godsend for struggling investors as $ 430 billion in commercial real estate debt matures. Defaults on commercial mortgage-backed securities soared in 2020, with hotel late payment rates climbing to 24% in June. Investors pulled their playbooks out of the 2008 financial crisis, when home loans were trading for pennies on the dollar.

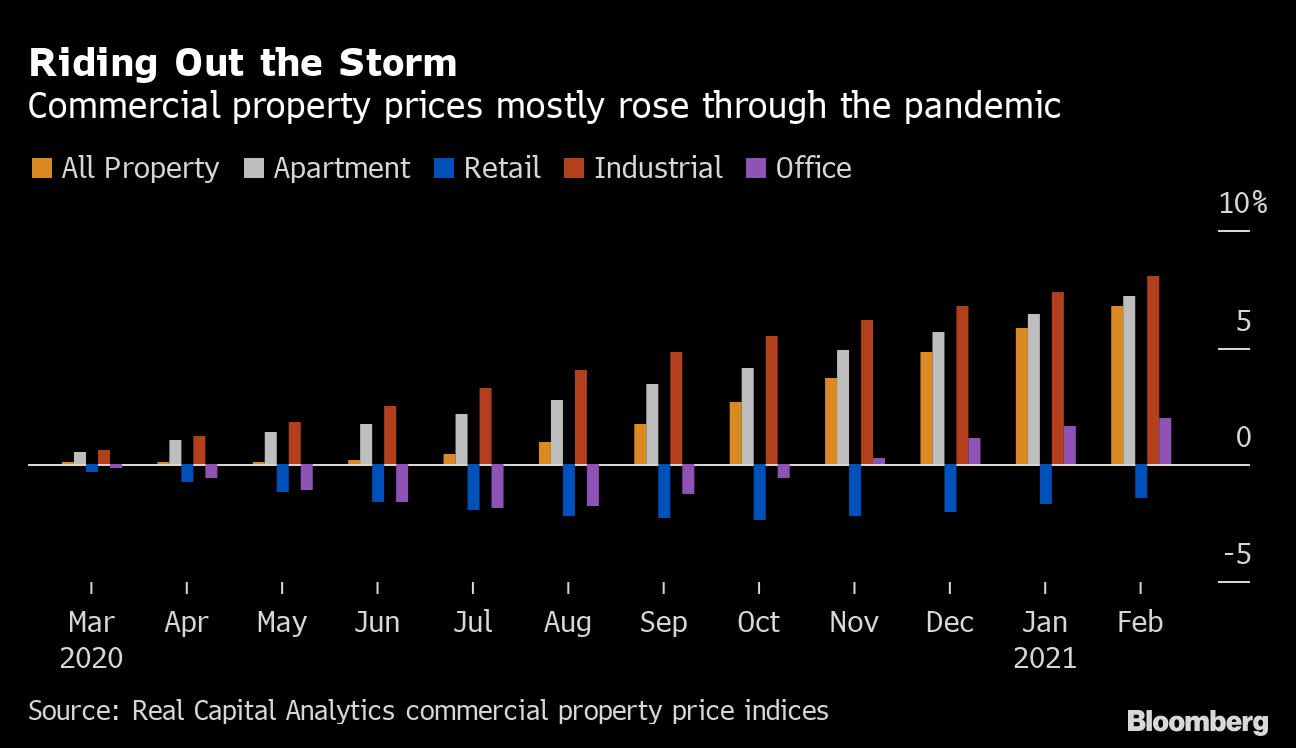

But instead of forcing borrowers to pay or refinance on onerous terms, lenders have offered maturity changes and extensions – lifesavers to wait for the recovery. Bad debts fell and house prices held up. Commercial real estate values rose an average of 6.8% in the 12 months to February, according to data from Real Capital.

Now troubled properties are in recovery mode as vaccines free people to travel, invade malls and return to offices. Consumer spending is expected to increase 6.1% in 2021.

“This is not the time when borrowers give up after hauling their properties through this difficult time,” said Jonathan Pollack, global director of Blackstone Group Inc.’s real estate debt strategies group.

Jones Lang LaSalle valued $ 24 billion in potential debt contracts last year, and only about $ 1.4 billion has ever come to market, according to Sledge. Distressed debt pools traded in a range of 85 cents to 95 cents on the dollar, he said.

Yaakov Zar, CEO of Lev, a matchmaker for borrowers and commercial real estate lenders, received a call from a friend offering 100 cents on the dollar for overdue loans.

“If you pay the par, it’s not in distress,” Zar said. “Even in a situation where everything was failing, there is still too much dry powder.”

There will always be troubled opportunities as some building owners struggle to refinance or decide to stop investing in losing projects. And some properties, like shopping malls, face long-term consumer shifts that will be difficult to overcome. But a post-Covid tsunami of distress is not in the cards, said Brian Stoffers, global debt president at CBRE.

“Those who anticipated the big hits are going to be sorely disappointed,” Stoffers said.

Ticking clock

For struggling fund managers, time is running out. Most closed-end funds have two or three years to pay back the money they’ve raised or lose the right to operate it. Not everyone can wait that long to deal with the payroll and other expenses.

Stockdale Capital Partners has until December 2022 to deploy a $ 550 million fund it closed in February of last year, according to Dan Michaels, managing director of the Los Angeles-based private equity firm, which focuses on troubled opportunities in the Southwestern United States. He may have to ask investors for an extension.

“You look at 1,000 deals,” Michaels said, “Find a 100 you like. Work on 10. Close one.”

With few transactions coming to the market, fund managers are looking to darker corners for opportunities. One potential source is banks that want to clean up their balance sheets to be attractive for mergers, said Pat Jackson, CEO of Sabal Capital Partners in Irvine, Calif., Which has generated $ 4 billion in home loans.

Sabal has been in talks with a regional lender since December about purchasing a multi-million dollar portfolio of debt while the bank prepares for an acquisition. The challenge is to make an offer that pleases the seller while still leaving a profit margin for Sabal, Jackson said.

“You bid on a deal and it’s’ Congratulations! You won! “Jackson said.” And then you think, did I pay too much? “

(Updates with Cerberus and Oaktree raising funds in the sixth paragraph.)

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted source of business news.

© 2021 Bloomberg LP

[ad_2]

Source link