[ad_1]

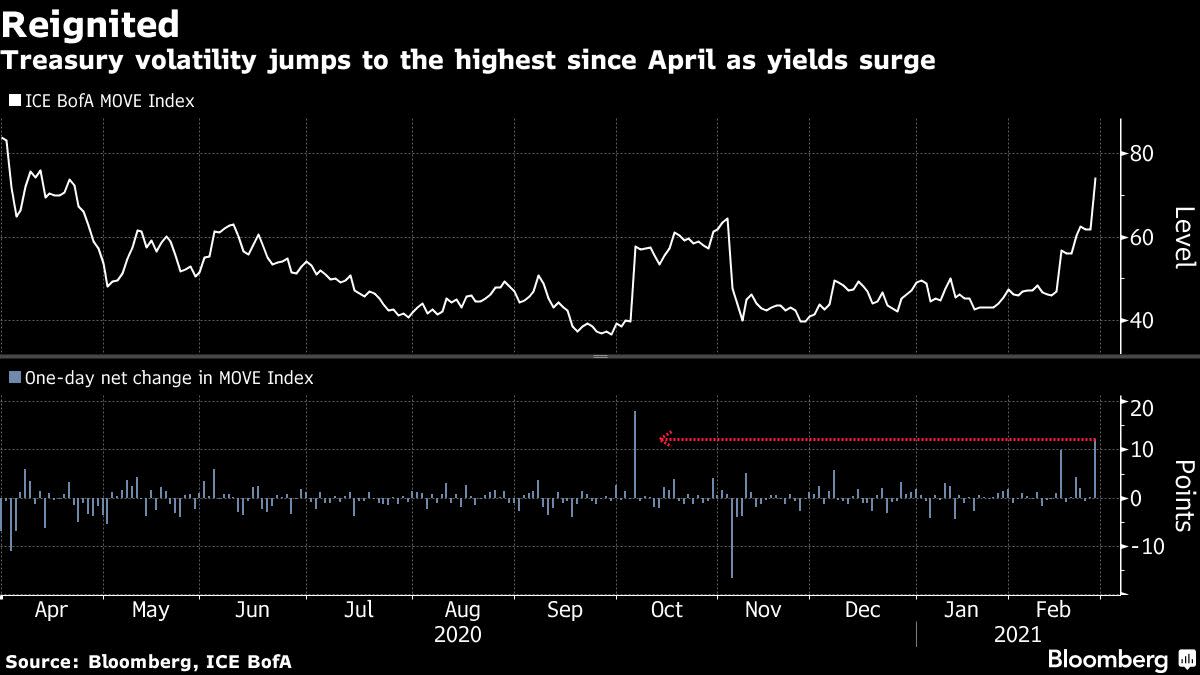

(Bloomberg) – Sovereign bonds extended a rebound, U.S. equity futures rose and the dollar fell on Monday, signaling a slowdown in markets after the crisis sparked by the fall in government debt last week.

Yields on Treasuries stabilized and Australian and New Zealand debt surged. Australia’s 10-year sovereign yield slipped the most in a year after the central bank doubled its purchases during its regular bond-buying operation, in a further attempt to pacify income markets fixed.

The rally in bonds helped S&P 500 and Nasdaq 100 stock futures advance, while stocks in Japan, Australia and Hong Kong surged. On Friday, the S&P 500 slipped and tech stocks rebounded slightly as a rally in Treasuries pushed the 10-year yield down to 1.40%.

Most of the 10-group currencies rose, with the Australian and New Zealand dollars among the outperformers despite data showing that China’s economic recovery slowed in February. Commodities rallied as oil rose above $ 62 a barrel.

“With a strong change in yields due to the improvement in growth prospects and the reopening of prospects, the appetite for risk is maintained,” said Esty Dwek, head of global strategy at Natixis Investment Manager Solutions. “The pace and magnitude of changes in returns is more important than the absolute level, suggesting that as long as the change is gradual, risk assets should be able to absorb them.”

Global bonds stabilized after steep losses last week, after central banks from Asia to Europe gave assurances that political support remains in place. This helped bring Treasury yields back to their highest level in a year and put a floor below stocks. Investors have become nervous about the prospect of faster inflation leading to tighter policy, with traders stepping up the Federal Reserve’s positioning to start raising interest rates as early as next year.

“The market is testing the Fed and global central banks for their seriousness here,” Al Lord, managing director of Lexerd Capital Management, told Bloomberg TV. “There are growing expectations and concerns about inflation, and it’s playing out in the markets.”

Over the weekend, the U.S. House of Representatives passed President Joe Biden’s $ 1.9 trillion Covid-19 aid package. The bill heads to the Senate, where Biden will have to woo Republican support or avoid losing a single Democratic vote.

There are a few key events to watch out for this week:

The Caix China manufacturing PMI is due on Monday, the Reserve Bank of Australia sets monetary policy on Tuesday, the US Federal Reserve’s beige book is due for release on Wednesday, OPEC + production meeting on Thursday, Fed Chairman Jerome Powell to discuss the economy at a Wall Street Journal event Thursday. On Friday, the February U.S. employment report will provide an update on the speed and direction of the country’s labor market recovery. Beijing is expected to unveil its main economic targets on March 5, when the National People’s Congress meets for its annual meeting.

Here are some of the main movements in the markets:

Stocks

Futures on S&P 500 rose 0.8% at 10:26 a.m. in Tokyo. The S&P 500 Index fell 0.5%. Japan’s Topix index gained 1.7%. Australia’s S & P / ASX 200 index rose 1.5%. The Hang Seng Index climbed 1.7%.

Currencies

The yen was trading at $ 106.57 to the dollar, the offshore yuan at 6.4739 to the dollar, up 0.1%. The Bloomberg Dollar Spot Index fell 0.3%. The euro was at $ 1.2093, up 0.2%. .

Obligations

Australia’s 10-year yield fell 27 basis points to 1.65%. The yield on 10-year Treasury bills remained stable at 1.41%.

Basic products

West Texas Intermediate crude rose 2.2% to $ 62.83 per barrel, while gold rose 0.6% to $ 1,743.60 per ounce.

For more articles like this, please visit us at bloomberg.com

Subscribe now to stay ahead with the most trusted source of business news

© 2021 Bloomberg LP

[ad_2]

Source link