[ad_1]

Home Depot (NYSE: HD) is a name I've been in for a while now. It's a stock I've owned in the past, and frankly, I have a little vendor remorse. Well, it's time to put that remorse to bed. Thursday, I bought HD shares, which allowed me to get acquainted with this name for the first time since June 2017. I paid $ 184.52 per share, which, as I will see later, is not exactly a difficult affair. But it gives me exposure to a stock that earns close to 3% and has double-digit growth potential for dividends. These opportunities are rare on the market and I'm waiting for my future with HD.

For some time, I have somehow bundled the HD with another very successful distributor name, Costco (NASDAQ: COST). These two companies basically resisted the "Amazoned" trend that many (including myself) thought would develop in the physical retail space. Because of the high growth indicators produced by this success (and the resulting strong dividend growth), these two companies are demanding a high premium in the market. I have not been willing to pay any premium for a retail physical name for years and, as a result, HD has been relegated to the background of my DGI priority list. However, when I saw Home Depot increase its dividend by more than 30%, my eyes brightened. It's really fantastic. And, whether I like it or not, I essentially had to admit the defeat of my opinion bearish after this result and, again, establish a partnership with the title as a shareholder.

I will speak in a moment of the recent quarter of HD, but I would like to skip dinner and go into the dessert: Home Depot just increased its dividend by 32%, from $ 1.03 to $ 1.36 / share on a quarterly basis. I was expecting an increase of 10 to 15% over the HD this year. In short, this 32% increase essentially increases the passive income goal of HD to one year. This played an important role in the logic of my recent purchase.

Source: QUICK. graphics

After today 's small sale, the company' s futures yield stands at 2.96%. In simple terms, any company that pays a return of about 3% with this type of dividend growth outlook deserves a strong premium in the market. And, to improve the situation of HD shareholders, the company also announced the authorization of a $ 15 billion share buyback program, which would represent a benefit for about 7% of the company's capital. In terms of shareholder returns, the results are no better.

And, while the shareholder return figures were certainly the culmination of the recent earnings report, the rest of the company's earnings-focused data was also good. Admittedly, HD missed $ 90 million in sales, but sales still rose 10.9% yoy. You will never hear me complain about double digit growth, especially at a general retailer.

The HD T4 was 14 weeks in 2018 compared to the 13-week quarter with which it ended the 2017 year. This means that some comparisons are a little off; However, with respect to earnings per share results, management noted that the figure of $ 2.09 for the T4A18 was slightly inflated on a relative basis, with approximately $ 0.21 for the additional week. But even if you subtract $ 0.21 from $ 2.09 and $ 1.88, you can see that the adjusted Q4FY18 was almost 24% higher than the 1.52 USD generated by HD during the 13-week 2007 Q4.

For the full year, sales and earnings per share were also impressive. Home Depot achieved a total business turnover of $ 108.2 billion, up 7.2% year-on-year. The company's comparable sales increased 5.2% year-on-year and US sales 5.4%. Although revenue growth was excellent in 2018, HD's net profit growth was even better. The company generated EPS of $ 9.73 over the fiscal year, representing a 33.5% increase over the 2017 EPS total of $ 7.29. Both results are record annual figures for HD.

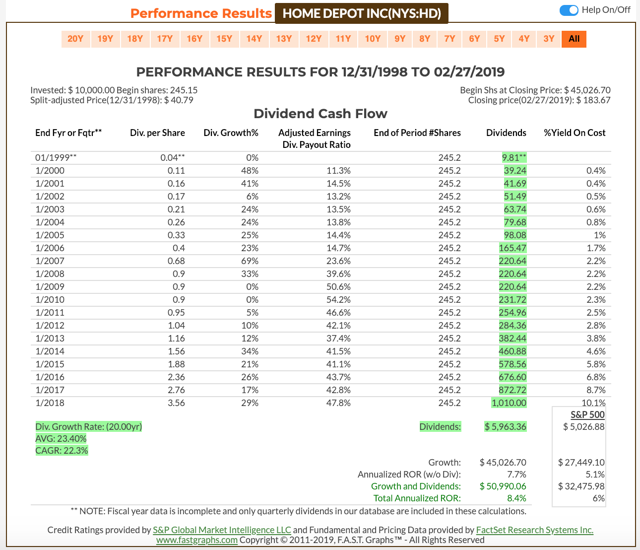

It is this strong earnings growth that is fueling the massive growth of HD dividends. HD has made a name in the world of dividend growth over the years. The company has a series of annual dividend increases of nine years now. HD froze its dividend following the Great Recession and raised it every year in 2010. Since then, the company has provided investors with an annual double-digit increase every year except one (the first ever increase after gel was only 5%). % annually). Taking into account this 5% increase, the compound annual growth rate of the dividend has been growing since around 20%. The company raised its dividend from $ 0.225 in November 2009 to $ 1.36 today. In other words, today's quarterly dividend is more than six times higher than it was in 2009. That's how real wealth is created.

I've already mentioned the buyout before, but I wanted to point out that not only is HD generous with its buyout, but that it's also very good at reducing the number of its outstanding shares. In the last five years alone, HD's management has reduced the number of outstanding shares by more than 14%. This not only helps to improve the bottom line, but also results in large dividend increases like the one we have seen today over the long term. If Home Depot had not repurchased nearly 190 million shares in the past five years, the burden of dividends would be much heavier today. I often talk about the benefits of a company that increases the dividend while reducing the number of shares. Well, Home Depot is a perfect example.

The company has provided the following guidance for the 2019 fiscal year, a 52-week year compared with the 2018 fiscal year, a 53-week year:

- Comparable sales growth of about 5.0% for the comparable 52-week period

- Sales growth of about 3.3%

- Five new net stores

- Gross margin of about 34.0%

- Operating margin of about 14.4%

- Net interest expense of about 1.2 billion dollars

- Tax rate of about 25.5%

- Share buybacks of approximately $ 5.0 billion

- Diluted earnings per share growth of approximately 3.1% to $ 10.03

- Capital expenditures of approximately $ 2.7 billion

- Depreciation expense of approximately $ 2.3 billion

- Cash flow from operations of approximately $ 14.1 billion

In response to the fourth quarter results, the shares sold slightly. I think it's because of the relatively slower growth (3.3% of the business figure and 3.1% of the business turnover) that management advocates in 2019. Count Given the fact that HD shares are trading at a premium (~ 18x the EPS forecast of 2019), I can understand the market pause. However, I would not be surprised if management is not only cautious because of the many economic hurdles the world faces today that have caused fears of slowing growth. This flexible focus seems to be a trend in many sectors / industries at the moment. It will be very interesting to see if these weak guides become a reality or if these management teams make a bag of sand, preparing to exceed expectations.

Whatever it is, I must say that HD is not cheap yet. Paying 18x forward for a physical retail name is a lot (for me, at least). In a fairly recent article I wrote on Home Depot, I stated that my price target was $ 165. I will always like to buy HD stock at $ 165 (I had the chance to do it by the end of December, while the market was collapsing, but I did not give the Priority to Home Depot, it's a pity, but I still did some good business, so elsewhere, so I'm not going to piss me off too much). At $ 165, HD would trade for a term profit of about 16.5 times. For me, it's probably closer to fair value.

However, I have always had a lot of success with buying stocks of companies after the significant increase in dividends. That's why I bought shares of Home Depot at $ 184.52 on Thursday. In my opinion, no sensible management team would increase its dividend by 30% if it was not really confident in the direction its company is taking. I am happy to pay a little more to access this strength (as well as the much higher dividend yield).

Since HD is still trading above my fair value goal, I was not willing to go all inclusive. The shares I bought Thursday represent about 1/3 of the position of my portfolio. That's why I would definitely like to see more weaknesses in Home Depot, which would give me the opportunity to fill my position at lower prices. My next price target will be in the range of 165 to 170 USD (my previous fair value range). As I have already said, I would feel very comfortable about paying about 16.5 times for HD stock. After that, I would probably buy about $ 150, which would be about 15 times the term profits.

I do not necessarily expect HD stock to sell this stock so early. For most of the past decade, it has exceeded 20 times the profits. However, it is important to note that during periods of recession, this economic model is struggling and that stocks are trading between 12 and 13x as a result of the Great Recession of 08/09 (it's also at this point the company was forced to freeze its funds (dividend).

So, even though some people may think, "Yeah yes, HD at 15 times ?! You must be crazy, Nick," it's important to remember that history often repeats itself with respect to the forks. of values and this was not the case. So long that HD has traded for a much lower premium than today.

We are 10 years in an economic expansion. All cycles end at some point. I do not know when the next recession will hit, but I'm about 99% sure that the HD will suffer.

It may be necessary to wait until then to buy the rest of my actions HD. But now that I have offered myself an entry level, I am happy to sit still, collect this dividend of about 3% and expect better prices. I would rather go that route than wait for an indefinite amount of time to take stock during a recession. I like the fact that HD is increasing my income stream now, in the present. If I was only investing with capital gains in mind, I would have definitely waited. But, as you know, my passive income stream is a priority of the mind, and HD seems to be an important part of adding to my dividend growth machine.

This is an approach similar to the one I took with Illinois Tool Works (ITW) after the announcement of a dividend increase of about 30% the year before. latest. In this scenario, I was able to go down on average after buying ITW shares at $ 140 in August 2018 and again at $ 123 in October. I've talked about it in my ITW articles at the time, but its sharp increase in the dividend has prompted me to pay a bit for the first batch of shares purchased. I guess you could say that it was a mistake to do that (ITW still trades below $ 140). However, in the same vein, I'm always happy to take stocks that yield more than 3% and double-digit dividend growth prospects. ITW has offered this opportunity after the unexpected rise in its dividend and HD has followed suit this week. I suspect that over time, these two high quality names will evolve higher. So, why wait to add a little visibility when they meet my expectations in terms of income?

Only time will tell if this increase in the dividend leads to a rise in the security or if the recent weakness will return to normal and if HD will return to the level of $ 160 that it had raised at the end of the year. last year. Anyway, I'm happy to be back, using an acceptable growth / dividend yield to justify my purchase. High quality companies like HD rarely make big sales. If you are a value investor like me, it's hard to take stock. However, from time to time, I do not respect my rules and I think that a 32% increase in the dividend is reason enough to do it.

I think it's clear that some retailer names are separating from the group, and Home Depot is one of them. In 2016/2017, I basically sold retail because I was worried about pressures being exerted by Amazon.com (NASDAQ: AMZN) (and other e-commerce names) on the segment. Obviously, Home Depot has done well since, proving that the opponents (me included) are wrong. Walmart (NYSE: WMT) is another example of a company that seems to have crossed the threshold (although WMT does not offer as much dividend growth prospects as HD, which is why I bought HD and not WMT) .

HD and WMT have well integrated online and physical retail components and are experiencing strong growth thanks to this. However, this is not the case in all areas. The other big names have a lot of difficulties. When I sold the HD, I also walked out of the pharmacy, selling Walgreens Boots Alliance (NASDAQ: WBA) and CVS (NYSE: CVS). I've also sold Target (NYSE: TGT) and Kroger (NYSE: KR). I've been able to block profits on all these trades with the exception of CVS, on which I suffered a loss of 11%. But if you look at the stock charts of many of these names since 2017, you will find that they have continued to fall. In addition, I clung to Amazon, which continued to skyrocket.

So, in general, I distinguished myself relatively well in going out of the retail business. However, I am not ashamed to admit it when I am wrong. At the time, I had totally underestimated Home Depot and therefore undervalued the title. The market has been clearly defined since I sold my shares in 2017 and, for the time being, all I can say is to congratulate all those who have stayed long and who have enriched their wealth. Now I'm here with you, enjoying this walk. I do not intend to sell this name in the future. You know what they say: "Trick me once, shame on you, and fool me twice, shame on me." Well, I will not be fooled twice by this name of retailer. I hope to keep it for years and collect these growing dividends along the way!

If you enjoyed this article, stay tuned for the upcoming Seeking Alpha Marketplace service I am currently working on, the Dividend Growth Investor Club. I hope it will be a place where high-income people can meet and discuss their ideas while we are all seeking financial freedom. I will publish a variety of proprietary content, including individual stock research, sector-wide watch lists with relevant fundamentals, and model portfolios with different target and growth dividend yield thresholds for club members. I work hard and I get closer to the launch. I think we're in a week or two, so get ready to tie up and take this ride with me.

Disclosure: I am / we have been for a long time HD, AMZN, ITW. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link