[ad_1]

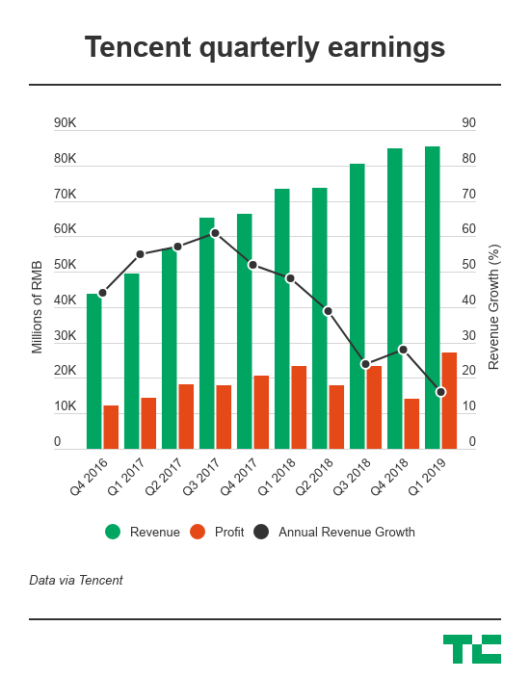

Tencent, the largest technology company in Asia, has had an appalling 2018 year because of the freezing of monetization of new games in China, but it is clear that the situation has changed.

Game for Peace, the company's new mobile game success, has not yet started the recovery of the company after a few quarters of slowdown, but its booming financial technology division has neutralized the company. effort.

The Chinese titan of social media and games closed the first quarter of 2019 with the lowest growth in revenue since its IPO, reaching $ 12.69 billion, an increase of 16% over the previous quarter. ;last year. On the other hand, net profit reached the record $ 4 billion, exceeding analysts' estimates.

Although the most famous for WeChat, Video games have been fueling Tencent's earnings and share price for many years. The lucrative segment suffered from a prolonged licensing freeze last year that prevented Tencent from monetizing some successful titles like PUBG, and the impact was still felt in the last quarter.

Online gaming revenue for the first quarter fell to 28.51 billion yuan (4.1 billion US dollars), compared with 28.78 billion yuan a year ago. Nevertheless, this is a testament to the global appeal of PUBG and Fortnite to say that the decline in revenues has not been precipitous despite the problems in China.

The sluggish period may soon come to an end, with Tencent recently given the official go-ahead to start charging its substitute for the PUGB, Game for Peace, a less violent version than its predecessor. The new game earned $ 14 million in the first three days after its release, ahead of the widely announced global fort Fortnite ($ 4 million), according to Sensor Tower data.

In addition, Tencent announced the introduction of "season passes" – using the same monetization technique as PUBG and Fortnite – to the popular games Cross Fire Mobile, Honor of Kings and QQ Speed Mobile, which could also boost monetization in China.

Fintech business and enterprise-related services were Tencent's second-largest revenue group with 21.79 billion yuan (3.16 billion US dollars), up 44 percent from a year earlier. Over the past few quarters, the company has begun to isolate the profits from its growing Fintech business, which includes its popular payment service, WeChat Pay.

Unlike Facebook, Tencent has not recently aggressively monetized its social media empire for its advertising inventory. Online advertising revenue increased 25 percent to 13.38 billion yuan (1.94 billion US dollars), representing 15.7 percent of total revenue.

This is thanks to the increase in advertising revenues of Weixin. In total, WeChat and its Chinese version, Weixin, have crossed the threshold of 1.1 billion benchmark monthly active users. His QQ, 20 years old, a traditional discussion application of the Chinese era of personal computers, continued its growth and reached 823 MAU.

Netflix by Tencent The video style streaming service has also contributed to the increase in advertising revenue. Tencent Video, which has paid huge amounts of money to license content to surpass that of Baidu. iQiyi and Youku from Alibaba reached 89 million subscribers during the season.

[ad_2]

Source link