[ad_1]

(Bloomberg) – One hell of a week for hedge funds will be remembered for the damage Reddit traders did in chasing a handful of the shortest names in the $ 43 trillion U.S. stock market.

But why have institutional professionals been forced to reduce their exposure to the market at the fastest pace since the March rout caused by the pandemic?

One of the reasons is that their risk models told them to do it.

While a flood of retail money sent stocks such as GameStop Corp. and AMC Entertainment Holdings Inc., the trading signals that guide how smart money invests flashed red.

Known as Value at Risk, this raw but widely used metric showed just how vulnerable the long-short stock crowd is to losses based on historical price movements.

As day traders battled Wall Street, volatility doubled in 50 companies on the Russell 3000 last week. At the same time, the best-selling hedge fund stocks have gained so much that they have outperformed their preferred long positions to a level rarely seen before.

With institutional clients to worry about, the pros duly cut positions at all levels – while retail investors, who are free from such constraints, charge.

“When risk models go haywire, you break it down,” said Benn Dunn, who helps these managers monitor risk as chairman of Alpha Theory Advisors. “What hedge funds have held for a long time, they have to get rid of to reduce their exposure – to align their risk.”

According to prime brokerage Morgan Stanley, the drop in hedge fund exposure last Wednesday was historic, according to a rule of thumb for a normal distribution of statistical data.

At 11 standard deviations from the mean of data going back to 2010, this deleveraging was the fastest since the pandemic began in March – when there was the biggest move in a decade.

Value at Risk, pioneered by JPMorgan Chase & Co. in the 1990s, attempts to determine the maximum a fund can lose in the vast majority of cases: such as a maximum of $ 50 million per day 95% of the time . While an individual may be free to bear the risk of a large drawdown, hedge funds serving institutional clients like pensions are usually bound by a game plan that limits extreme excesses.

The challenge for smart money last week was that reliable trading models have collapsed. Let’s say a title picker is short GameStop and long Peloton Interactive Inc. Most days when the two are moving in the same direction, one is a cover for the other. Yet the first leapt while the second fell – a negative and costly co-movement.

“If you’re short and long on something else, and the correlation goes down, it increases your risk,” said Melissa Brown, global head of applied research at Qontigo, which provides risk analysis tools.

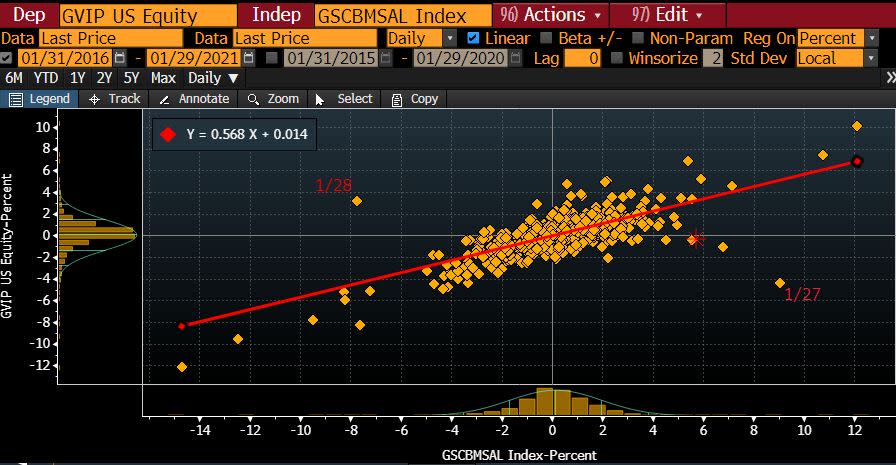

On Wednesday, an exchange-traded fund that tracks the darlings of hedge funds (GVIP) moved seven standard deviations from the mean against a Goldman Sachs Group Inc. basket of Russell 3000 stocks with the short interest rate. The highest. Based on 250 days of data, this is outside the statistical norm.

Of course, this is based on a normal distribution of data, which is not known, especially in modern, complex markets. But it offers a simplified illustration of how the retail crowd has caused unprecedented volatility in the institutional cohort.

There are multiple factors involved in deleveraging and the dust is yet to settle as the retail team once again loads up the most courted names. Beyond those forced to reduce positions as increased volatility pushes up VaR, customer buyouts and margin calls may also have exerted pressure.

But when zoomed out, the frenzy of the week could be yet another sign of a worrying trend in financial markets: The less statistically likely moves occur more often, so called longer tails. big.

“I’ve seen it sell in all kinds of places,” Dunn said Friday. “You see things in the market that just don’t make sense.”

For more articles like this please visit us on bloomberg.com

Subscribe now to stay ahead with the most trusted source of business news.

© 2021 Bloomberg LP

[ad_2]

Source link