[ad_1]

Retail traders have targeted the silver market after their successful attack on short sellers at game retailer GameStop.

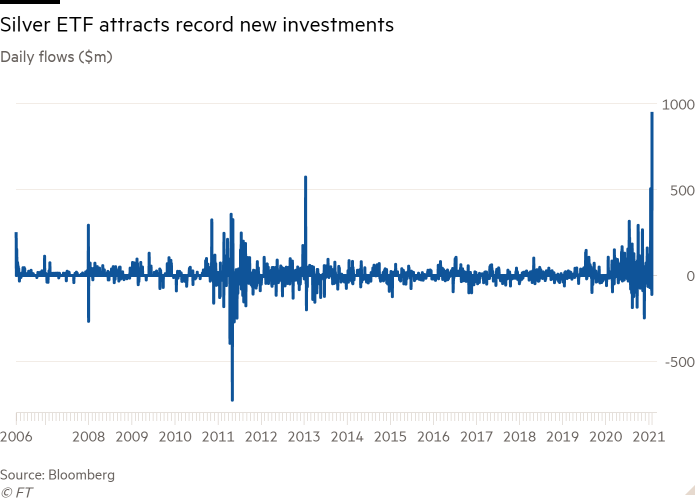

The world’s largest silver-backed exchange-traded fund, the iShares Silver Trust, registered nearly $ 1 billion in inflows on Friday, according to data from BlackRock, the fund’s sponsor. The jolt in the new investment came after a user on Reddit’s WallStreetBets forum urged people to buy stocks and options to put pressure on banks.

Silver prices rose 6 percent to $ 28.61 per troy ounce when trading began in Asia on Monday. This follows a 6% jump last week and a rally in precious metal miners’ shares, with New York-listed First Majestic rising 29%. “It’s a race of idiots, it’s financial anarchy; someone is going to be hurt, ”said Ross Norman, a veteran precious metals trader.

Last week, user TheHappyHawaiian said that buying ETF shares would “force the physical delivery of money” into the fund’s coffers, causing “short pressure” on the market, pushing up the market. price of money.

The user said on the forum that it would be “unbelievable” to charge the big banks in the futures market “dearly” for what he claimed to be bets on the falling price of silver. The rallying call echoed that of other WallStreetBets users who last week applauded their success in causing significant losses at Melvin Capital and other hedge funds.

The 37.05 million increase in the number of shares of the iShares Silver Trust on Friday was the largest one-day increase since the ETF began trading in April 2006, according to data from BlackRock. The ETF is backed by physical money held in vaults, which means it has to buy the precious metal when it receives new investments.

The ‘short squeeze’ attempt was reminiscent of a similar effort by oil barons William Herbert Hunt and Nelson Bunker Hunt, known as the Hunt brothers, in 1979 and 1980. They bought billions of dollars in silver in one attempt. to corner the market. They were later sanctioned for market manipulation and went bankrupt after the price of silver collapsed in an event dubbed “Silver Thursday”.

In 1998, Warren Buffett’s Berkshire Hathaway pushed silver prices 90% to a 10-year high after quietly building up a huge position in the silver market.

Analysts said it would be more difficult for retail investors to influence the price of silver relative to that of a single stock, given the large over-the-counter precious metal market that banks trade for the. account of their customers.

“We are convinced that the influence of retail investors on money will not last that long,” analysts at Commerzbank said.

About $ 6 billion in silver was traded in the silver market in November, according to the latest statistics from the London Bullion Market Association. London coffers hold around 33,475 tons of silver, valued at $ 23.8 billion, they said in January.

Mr Norman said the Reddit forum’s targeting of the big banks was out of place because they used futures contracts to hedge their physical holdings of money, meaning they were not speculating on falling prices.

“There is a misnomer here that banks are constantly running short positions, but from a price point of view, they are neutral, they have long and short cancel each other out,” he said.

Additional reporting by Chris Flood in London.

[ad_2]

Source link