[ad_1]

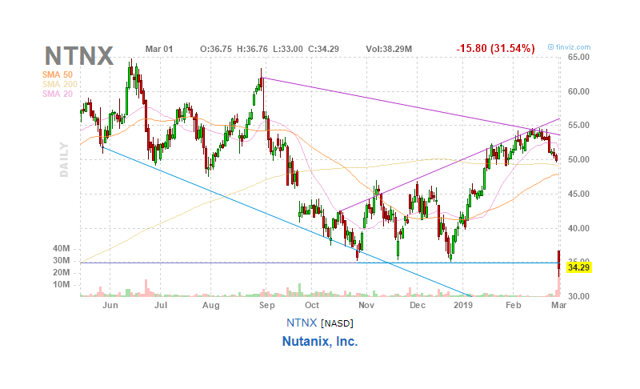

Nutanix (NTNX) behaved very well in the USD portfolio, but the forecast for the third quarter was a somewhat brutal awakening. What to do with actions?

A company such as Nutanix, which uses substantial valuation multiples, can not afford to fail in execution, especially since the company is not profitable and should not be before a certain time.

However, that's what happened, and the big question, of course, is whether it was an isolated case or something more structural.

This is what happened, according to management. In 2017, they really increased their expenses in lead generation, with a huge increase of 75%. This paid off in 2018, then a number of things happened:

- They got great efficiency on these expenses, increasing sales and the backlog.

- They have focused too much on existing customers because it is easier than converting non-customers into customers; In our view, this is also due, at least in part, to the proliferation of their product portfolio and the attractive opportunity to sell it to existing customers.

- They spend less on new customers, which they did not notice right away, as expenses continue to generate 75% lead generation.

- Management has assumed that efficiencies will continue and that due to cost pressures (the company still does not generate profit), they have begun to reduce the funds generated by lead generation. .

In our view, the pressures here stem from the proliferation of their products as the company has developed and launched many new products in the last two years.

This created both cost pressures and the attractive opportunity to sell these new products to existing customers, which led to overlooked lead generation.

The good thing about this is that it looks like an internal problem, which seems to be resolving. The company has been correcting this since December and will continue to correct this (Q2CC):

So we took action in December and reallocated dollars in December. We did the same thing in January, and we are doing it now in the third quarter. We will repeat this in the fourth quarter, reallocating more money on demand and avoiding, in some cases, non-sales recruitment.

But that adds to the cost, of course, and it may have something to do with the disappointing EPS forecast for the third quarter (a loss of $ 0.60). From the Q2CC:

And if you look at spending quarter over quarter, it was $ 297 million in the second quarter. We guided $ 330 million, $ 340 million in the third quarter here. Nearly 75% of the expected quarterly increase in spending actually corresponds to the actual growth rate. And we can not do much about it. We expect the turnover to be higher and would have easily absorbed these expenses.

What is reassuring is that 75% of this increase represents only the rate of progression. In addition, management says that there will be no similar increase in spending from Q3 to Q4, which seems to be an exception.

It is also possible that this just looks like an internal problem, but to larger factors. There are a few reasons to look here, as competitor NetApp (NTAP) also suffered from weaknesses, which they blamed for the market downturn. Management does not buy this (Q2CC):

So, for now, we really think it's an internal problem. I mean, we looked closely at our winning rates and, if so, had a slight steady rise. Conversion rates for our pipelines remained relatively stable. We are reviewing our Global 2000 customer base and we continue to buy. This quarter is a record for us in terms of the number of transactions of $ 1 million, $ 5 million and more than $ 0.5 million. So, a lot of these things really go in the direction of internal things as opposed to external ones.

Or maybe there are competition concerns? This too was rejected by management (Q2CC):

But there are problems that we have also encountered, as our product is 10 times better than 3 years ago. We had one or two workloads four years ago. Now we perform just about all the tasks. We used to run on a server four years ago. Now, we use a multitude of servers and we have all these different form factors reserved for software and the form of subscriptions. We have a much larger clientele than we had three or four years ago. The recovery of business is much better than three or four years ago. The mark is bigger. The Magic Quadrant Gartner is a novelty of recent years.

The company has indeed a considerable external validation of Gartner (Q2CC):

Just this quarter, our database services offering, Era, was named Product of the Year 2018 by CRM. And for the second year in a row, Gartner has recognized our platform as the market leader in its Magic Quadrant for HCI systems. In fact, our software has been ranked as the best HCI solution by Gartner in the last six years, according to two different magical quadrant reports.

There may be mitigation forces, because the company has undergone several changes in the last 18 months:

- Focus on software sales

- Transform these revenues into recurring revenue

- Presentation of a host of new products.

Of course, the sales force also has to deal with these changes, which might have somewhat mitigated their message and reduced their productivity, or as management says (citing the former CEO of Intel , Andy Groove) (Q2CC, our accent):

Let chaos reign and then chaos. So we left chaos in the first half of '18 with a product portfolio in terms of lack of crisp messages and of course when we realized we needed to do a better job of messaging and classifying and so after.

There is other bad news ahead, however:

- It takes 4-8 quarters for new sales recruits to reach their maximum speed (after 8 quarters, they are expected to be able to handle larger leads).

- Europe is 12 months behind the United States.

On the latter (Q2CC):

Obviously, the EMEA region is probably 12 months behind the United States. It has really brought the existing clientele together and will continue to do so over the next six to nine months. But they will probably start to notice the effects over the next 12 months.

As spending is a global issue, its impact on EMEA leaders has not yet been revealed.

Good points

One may wonder if there were positive results during the quarter. Well, some we have already mentioned:

- The second quarter was in fact a good quarter, it is the outlook for the third quarter that pushes investors to flee (with a decline of more than 30% of the shares at the time of writing).

- The company's retention rate is "well over 90%" according to the management, the details will follow during the day of investors on March 20th.

- The company has been very successful in the EMEA region. That's why she brings key people to the Americas, including Chris Kaddaras, current sales manager for EMEA, to lead the Americas and EMEA sales organizations.

- They achieved several key successes during the quarter, including a record number of contracts over $ 5 million.

- Subscription services accounted for 47% of revenue in the second quarter, but will reach 70% to 75% of billing in the 3 to 5 quarters.

- The new products (beyond the core) were purchased by 21% of customers and management is confident that they can bring this figure to 40% of the current value of the AVS (which took 4 years).

Orientation

For the third quarter, from the PR profit:

- Revenues of between $ 290 million and $ 300 million

- Bills between $ 360 million and $ 370 million;

- Non-GAAP gross margin between 75% and 76%;

- Non-GAAP operating expenses of between $ 330 million and $ 340 million; and

- Non-GAAP net loss per share of approximately $ 0.60, related to approximately 183 million weighted shares outstanding

This is indeed a shock, it means a non-GAAP loss of more than $ 100 million and revenues well below expectations, with expected revenues of $ 331 million and EPS of -0.25 dollar.

Cash

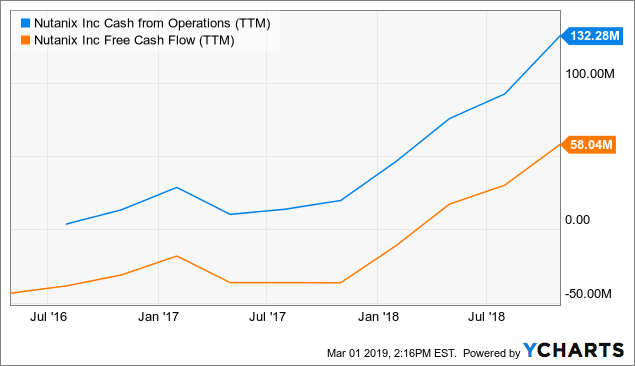

Data by YCharts

One of the concerns is the fact that the company is making losses and that profitability is not in a close perspective. However, the figures above, which show an improvement in market cash flow, should allay fears.

These figures do not yet include the results of the second quarter and this quarter has not been as good, but there is also no reason to panic (Q2CC):

In the second quarter, we generated cash flow from operating activities of $ 38 million, which benefited from the $ 17 million contribution from the retirement savings plan. Free cash flow for the quarter was negative $ 4 million. Performance was also positively impacted by $ 17 million in private employment benefits during the quarter.

The company will not run out of cash so soon as it closes the second quarter with cash and short-term investments of $ 966 million, up $ 1 million from the first quarter. The company also has outstanding convertible notes worth $ 429.6 million.

Evaluation

Data by YCharts

The value of the company is about $ 5.5 billion; With revenues of about $ 1.3 billion, the revenue is 4.2 times that of the 2019 fiscal year (completed in June). This is not expensive.

Conclusion

The company still has a lot of work to do, and while it can restore the new business pipeline, it also offers many additional sales opportunities with a host of new products that are just starting to generate attraction.

But investor confidence has naturally been shaken and the recovery of this process will take a long time. An analyst even urged the group to introduce Chris Kaddaras, a marvel of sales in the EMEA region, to analysts' day and its next call for results.

And this on the condition that the diagnosis of the direction is the good one and that there is no more fundamental change (and / or deceleration) on the market.

Since we are still in the dark of this name, we will give them the benefit of the doubt and let it pass, but we would not be buying a new job here.

Disclosure: I am / we have been NTNX for a long time. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link