[ad_1]

Over the last few months, Priya Misra considered that the bond rally was mainly due to technical factors such as the positioning in the market which would soon be reversed.

On two occasions, the global head of rate strategy at TD Securities has recommended that her clients bet against the rise in Treasuries, expecting strong economic momentum and high inflation to drive up yields. On two occasions, she was forced to drop the appeal as ties continued to win.

Now she wonders if lower yields indicate cracks in the global economy and the possibility that the Federal Reserve is making a policy error by signaling plans to cut stimulus faster than investors and traders. deem appropriate.

“We can all see why techniques can take us away from fair value for a while,” Misra said. “But if he stays there for two months, that’s when you start to think that it must be something fundamental here, or a big asset allocation here.” It’s not just the positioning because no one is erasing it. It’s a strange market.

The bond rally initially dismissed by investors and analysts as having little fundamental support has proved to be persistent. Yields on 10-year Treasuries are on track to decline for four consecutive months, something they have not done since the start of the pandemic. At around 1.3%, they fell from a more than a year high of 1.77% at the end of March, partly amid the rise of dangerous Covid-19 variants.

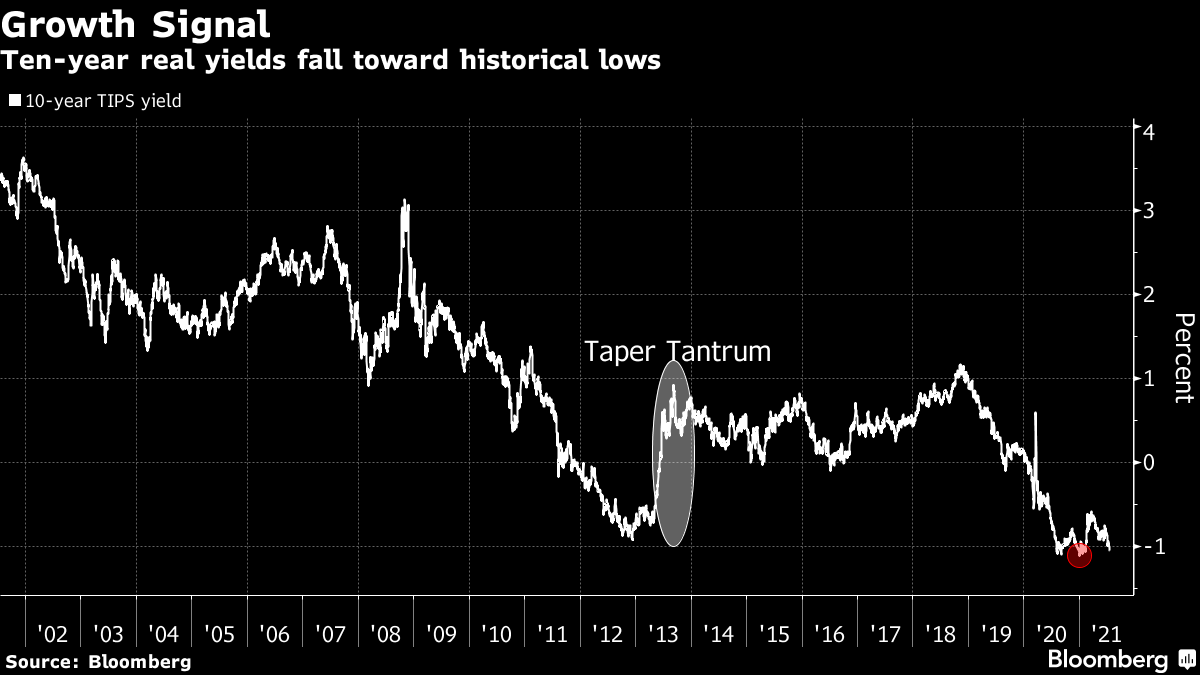

Additionally, 10-year real yields, considered the market’s purest reading on growth because they exclude inflation, have come back below minus 1% and around their lows since February. The slide means next week’s auction of 10-year inflation-protected Treasury securities could generate a record yield.

Disconnection from the market

The latest drop in long-term borrowing costs occurred even after reports this week showed galloping inflation and higher than expected retail sales. The apparent disconnect has left some market players scratching their heads.

“Bond traders were worried about inflation,” said Ray Remy, co-head of fixed income at Daiwa Capital Markets America. The “somewhat alarming” inflation figures and the “continuing” Treasury offer support the widely held view that long-term yields are too low, he said.

But for him, the Fed’s bond purchases, along with its forecast and the advantage of US yields over Europe and Asia are the main driving forces behind lower yields.

Among other possible explanations, short hedging has attracted a lot of attention – essentially market participants bailed out on reflation bets. JPMorgan Chase & Co.’s latest weekly survey showed 23% of customers were selling net Treasuries, up from 33% in mid-June, which was the largest short bias since 2017.

However, the fact that the market is still bearish – meaning more potential for short hedging – suggests the recovery is not over, said Ben Jeffery, strategist at BMO Capital Markets. He expects 10-year yields to decline to around 1.21% in the coming weeks.

Seasonal thoughts

Seasonality is also a consideration. T-bills have tended to rally in July and August as corporate bond sales decline and Japanese investors rush in, according to TD’s Misra. Over the past two decades, 10-year yields have fallen by an average of 4 basis points in July and 16 basis points in August.

But overall, investors and analysts are worried if bond markets are signaling that a significant slowdown in growth is coming amid the resurgence of Covid-19 infections, as are rising inflation. prompts central banks to reduce their support.

While Fed Chairman Jerome Powell told Congress this week that cutting bond purchases was “still a long way off,” one of his colleagues said It’s time.

In a report released this week titled “What Does the Treasury Market Know That We Don’t Know?” JPMorgan strategists said the returns implied an economic growth rate of just 0.5% over the next year, nearly 3 percentage points below their expectations.

The bond market’s narrative of a policy error or slowing growth, however, does not match signals from other assets, with stocks near all-time highs and corporate bond spreads at lows. historical lows.

Misra said she is still looking for 10-year yields to reach 2% by the end of the year, although she has no plans to bet against T-bills just yet.

“I don’t put it on until I see a catalyst,” she said. “I don’t know what the next catalyst will be.”

What to watch

- The economic calendar

- July 19: NAHB Housing Market Index

- July 20: Building permit; starts

- July 21: MBA mortgage applications

- July 22: Chicago Fed national activity index; unemployment benefit claims; Langer consumer comfort; advanced index; Sales of existing homes; Kansas City Fed Manufacturing Activity

- July 23: Markit US PMI

- The Fed’s calendar is empty ahead of its July 28 policy decision

- The auction calendar:

- July 19: 13 and 26 week invoices

- July 21: reopening of 20-year bonds

- July 22: invoices for 4, 8 weeks; ADVICE 10 years

[ad_2]

Source link