[ad_1]

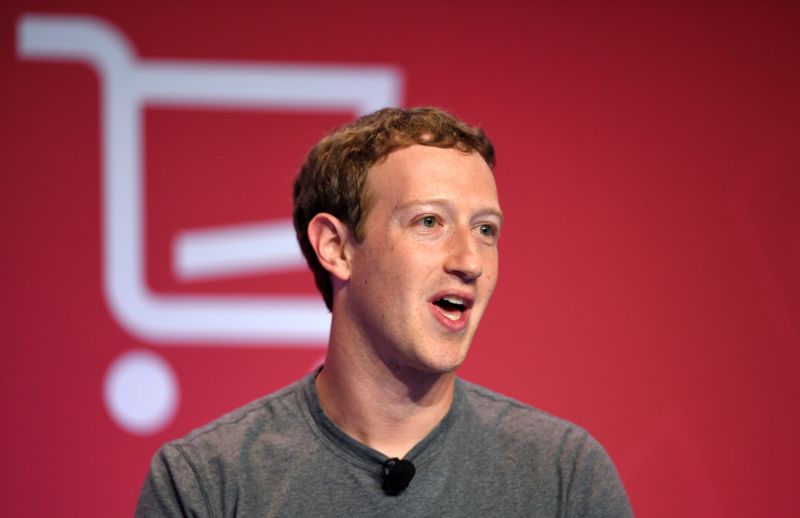

GENE LLUIS / AFP / Getty Images

According to the Wall Street Journal, Facebook is seeking to raise up to a billion dollars for a new cryptocurrency-based payment network that could compete directly with conventional credit cards. We previously covered reports that Whatsapp, a Facebook-owned company, was developing a cryptocurrency product, but the company would also create cryptocurrency for Facebook itself.

It is not clear how the product would work. The newspaper reports that Facebook is trying to raise around $ 1 billion from conventional financial institutions to "strengthen the value of the coin to protect it from sharp fluctuations in bitcoin prices."

This suggests that it could be a "stable currency" whose value is tied to the dollar or other conventional currencies. The cryptocurrency on which Whatsapp works would apparently be linked to a basket of currencies.

According to the newspaper, Facebook may want to position its payment network as a direct competitor of Visa and Mastercard. Supposedly, using a network of block strings could free traders from 2% to 3% fees that they must pay to accept conventional credit card payments.

One of the great strategic advantages of Facebook is the fact that a good number of websites already use the Facebook APIs to allow users to log in with the help of their personal information. Facebook ID. It could be simple to extend this existing infrastructure to allow users to shop on third-party websites using their Facebook credentials.

The case for Facebucks is unclear

Apparently, Facebook is also considering using its cryptocurrency to pay users a fraction of a cent each time they view an ad, according to the newspaper. The justification for this (or perhaps the explanation of the newspaper) seems however a little confusing.

According to the Journal, paying users "would reward the kind of genuine interaction that Facebook, assaulted by robots and hate speech, is trying to encourage". But it is unclear how these payments would discourage robots or hate speech. On the contrary, botmakers would inevitably intensify their efforts to generate fake traffic with bots in order to win Facebook's cryptocurrency.

Facebook is also facing the basic dilemma that I reported in my February article on the WhatsappCoin rumor: One of the key selling points of blockchain networks is that they are totally open and decentralized. Open software platforms tend to promote innovation and grow rapidly.

But the opening of blockchain networks makes them attractive for fraud, hacking, money laundering and other problematic behaviors. If someone steals the private keys from your bitcoin wallet, for example, it can steal your bitcoins, and no one has the power to cancel the transaction. This approach will not be a ploy for a traditional payment network like the one Facebook is trying to create.

Facebook would probably try to solve these problems by tightly integrating the network into the Facebook platform. Facebook will probably have to compensate users against losses and hire people to monitor the network in case of money laundering. But at this point, the network will look a lot like a conventional closed payment network, with strict rules on who can use it and how. It is not clear that building such a network with the help of a chain of blocks adds value to creating a payment network at the same time. 39, using conventional databases.

[ad_2]

Source link