[ad_1]

A customer watches jeans at a Gap store in San Francisco.

David Paul Morris | Bloomberg | Getty Images

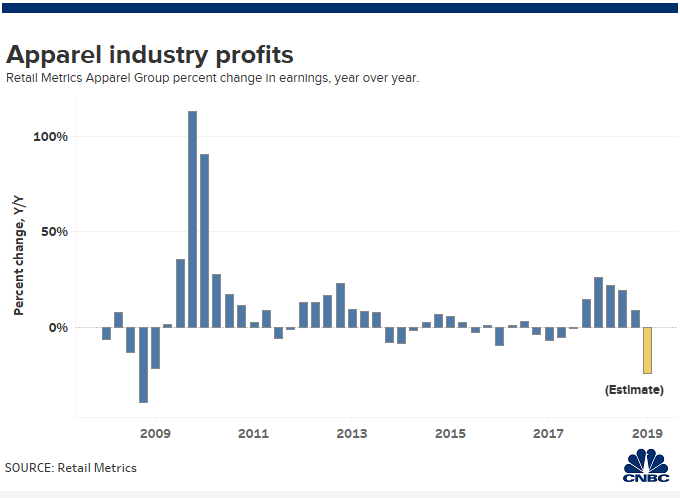

The financial results of clothing retailers have not been so disappointing since the Great Recession.

Companies ranging from Gap Inc. to J.Jill, Canada Goose and Abercrombie & Fitch have released disappointing results in recent days, with issues such as cold and wet weather, low traffic in shopping malls, bad promotions in stores and product errors slip on the results. The bad news has brought down these actions and the entire industry. The S & P 500 Retail ETX (XRT) was down nearly 2% on Friday afternoon and fell nearly 13% this month, making it its worst month since November 2008, while the XRT had lost 20.25%.

Revenues for clothing retailers, as a group, declined 24% in the first quarter of 2019, according to an analysis by Retail Metrics. The group's profits had so far increased since the third quarter of 2017. In the first quarter of 2018, clothing retailers' profits jumped 26%. The last time the group's results were as bad, it's the first quarter of 2008, when they dropped 40%, said Retail Metrics.

"These are all mall retailers that are experiencing traffic problems," said Ken Perkins, founder of Retail Metrics. "The consumer is resisting (…) the numbers are very positive," he added. Problems arise when some companies do not invest in ways to attract customers to their stores and websites, while others do so, he said.

For example, both Walmart and Target have published upbeat financial results reports for the first quarter, particularly drawing attention to the strengths of their apparel businesses. In fact, they have invested in clothing by deploying more of their own private brands for women's, men's and children's clothing.

"It's not that people are buying less clothes," said Craig Johnson, chairman of the CGP. But they do not go to the same places anymore.

The biggest victims of changing tastes are the "classic, feminine and harmful retailers," said Johnson, companies like Chico's and Talbots. "The demand for this product is a fraction of what it was a generation ago, and women do not dress like that."

Ascena Retail Group recently announced plans to completely shut down its Dressbarn business, closing more than 600 sites. Earlier this week, Ascena shares traded at 93 cents.

And while more and more consumers are looking for clothes in unique destinations, such as Walmart and Target, they continue to shop in non-premium chains such as TJ Maxx and Ross Stores, directly from brands such as than Zara, Nike and Lululemon. from Amazon, or online platforms like Stitch Fix and Rent the Runway.

The threat of tariffs has also been a recent drag on retail stocks of clothing – although some have not yet hit.

The White House is still considering imposing a 25% tax on clothing and footwear imported from China. And so many retail executives have had to deal with this issue in their last earnings rounds. Many companies have not yet taken into account the 25% tariffs in their earnings outlook, which could lead to future earnings disappointments if President Donald Trump overcomes this trigger.

Towards the end on Thursday, uncertainty increased when Trump spoke of the possibility of applying 5% duties on Mexican imports as of June 10th. This series of rights, which could gradually increase up to 25% in October, would aim to pressure Mexico to help curb illegal immigration.

"Many companies are vulnerable," said Johnson of CGP.

Since the beginning of the week, Abercrombie shares have fallen by almost 30%, Canada Goose shares by 29.6%, Gap by 15% and Michael Kors parent company Capri Holdings by 13%. 3%. All of these companies reported profits this week.

– CNBC Gina Francolla and John Schoen contributed to these reports.

[ad_2]

Source link