[ad_1]

The amount of debt Americans carry has increased, suggesting a return to pre-pandemic spending habits. Find out how you can pay off your credit card debt without dramatically reducing your spending habits. (iStock)

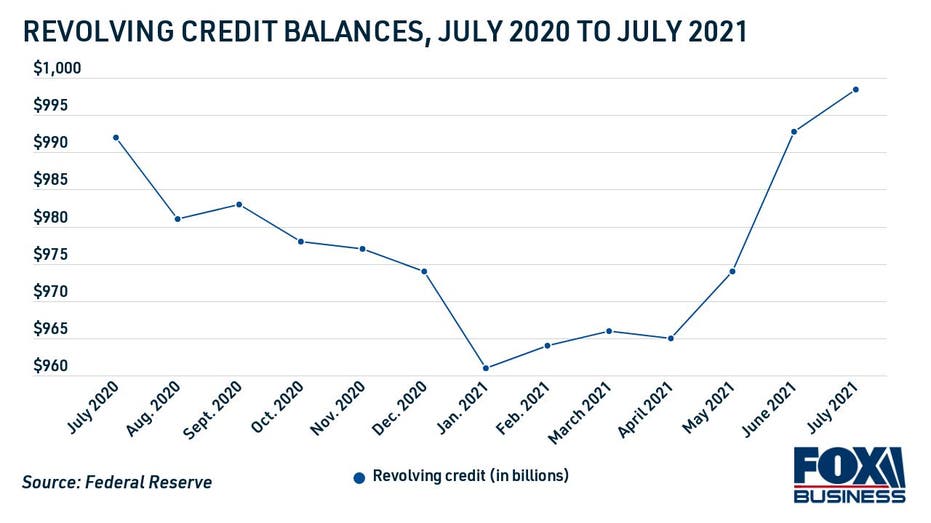

Americans were successful in paying off their credit card debt during the coronavirus pandemic, according to data from the Federal Reserve. But they have since increased their revolving debt balance by using their cards again.

Revolving consumer credit grew at an annual rate of 10.9% in the second quarter of 2021. June was the top month for credit card spending – revolving credit rose 22.3% from year after year. Although spending slowed slightly in July, it still stands at around $ 1 trillion.

WILL A NEW CREDIT CARD AFFECT MY MORTGAGE APPLICATION?

The last time revolving credit balances exceeded $ 1,000 billion was in April 2020, before the COVID-19 pandemic slowed consumer spending.

If you are one of the many Americans who have increased their credit card spending in recent months, you may be looking for a way to cut your spending. There are many ways to pay off credit card debt fast, such as debt consolidation loans, balance transfers, and other debt repayment strategies.

Compare your options in the analysis below and visit Credible to compare debt consolidation products like personal loans and balance transfer cards.

STUDENT LOAN DEBT PREVENTS MILLENNIUMS FROM HOME BUYING

Using a personal loan to pay off credit card debt

If you make the minimum payment on your credit card debt each month, the outstanding balance increases due to variable and high interest rates. Revolving credit card debt is a costly burden that can keep you from reaching financial milestones like buying a home or going back to college.

On the other hand, personal loans have low fixed rates which allow you to pay off your debt within a specified time. Your monthly payment will always be the same and you will know exactly how long it will take you to pay off your debt.

The average interest rate on personal loans was 9.58% in the second quarter of 2021 according to Fed data, assuming a two-year repayment term. In contrast, the average credit card interest rate for all valued accounts was 16.30% over the same period. By qualifying for a lower rate, you can save hundreds of dollars in interest charges while freeing yourself from debt.

Personal loan rates can vary widely from lender to lender depending on the borrower’s credit rating as well as the length and amount of the loan. For this reason, it is important to shop around for the lowest possible interest rate to make sure you get the best rate for your situation.

You can compare the interest rates of several lenders without affecting your credit score on Credible. The table below shows the estimated interest rates for personal loans from actual lenders.

HAVE CREDIT CARDS WITH ZERO BALANCE NEEDED FOR YOUR USE OF CREDIT?

Open a balance transfer credit card

Another common way to pay off credit card debt is to use a balance transfer. This allows you to transfer the balance from one or more credit cards to another credit card, ideally at a lower interest rate. Better yet, you may be able to get an introductory 0% annual interest rate offer, which allows you to pay off your high interest credit card debt without paying interest at all.

Keep in mind that introductory periods usually only last for a set period of months, giving you limited time to pay off the balance during the introductory period before interest begins. Plus, you’ll need a good or better credit score to get the best balance transfer deals.

You will also be charged a balance transfer fee of around 3-5% of the total balance, although some balance transfer cards do not charge a fee. And consider a credit card’s balance transfer limit to make sure it’s not less than the amount you owe.

You can browse the balance transfer offers of credit card companies in Credible’s online financial marketplace.

HOW TO BUILD AN EMERGENCY FUND?

Try an expert-approved debt repayment strategy

You can also try to pay off your credit card debt without taking out another loan or credit card. Two common debt repayment strategies are the snowball method and the debt avalanche method.

The Debt Avalanche Strategy can help you save the most money over time. This is because you will be prioritizing paying off the credit card balances that have the highest interest rate.

The debt snowball strategy can help you get started paying off your debt – you start by paying off the lowest balance, moving to the next smallest balance, and saving the biggest credit charges for the end.

Still need help deciding which strategy is best for you financially? Visit Credible for answers to all your questions about paying off your debts.

SENATE BILL TARGETS STUDENT BANKRUPTCY LOANS

Have a finance-related question, but don’t know who to ask? Email the Credible Money Expert at [email protected] and your question could be answered by Credible in our Money Expert column.

[ad_2]

Source link