[ad_1]

Subscribe to the New Economy Daily newsletter, follow us @economy and subscribe to our podcast.

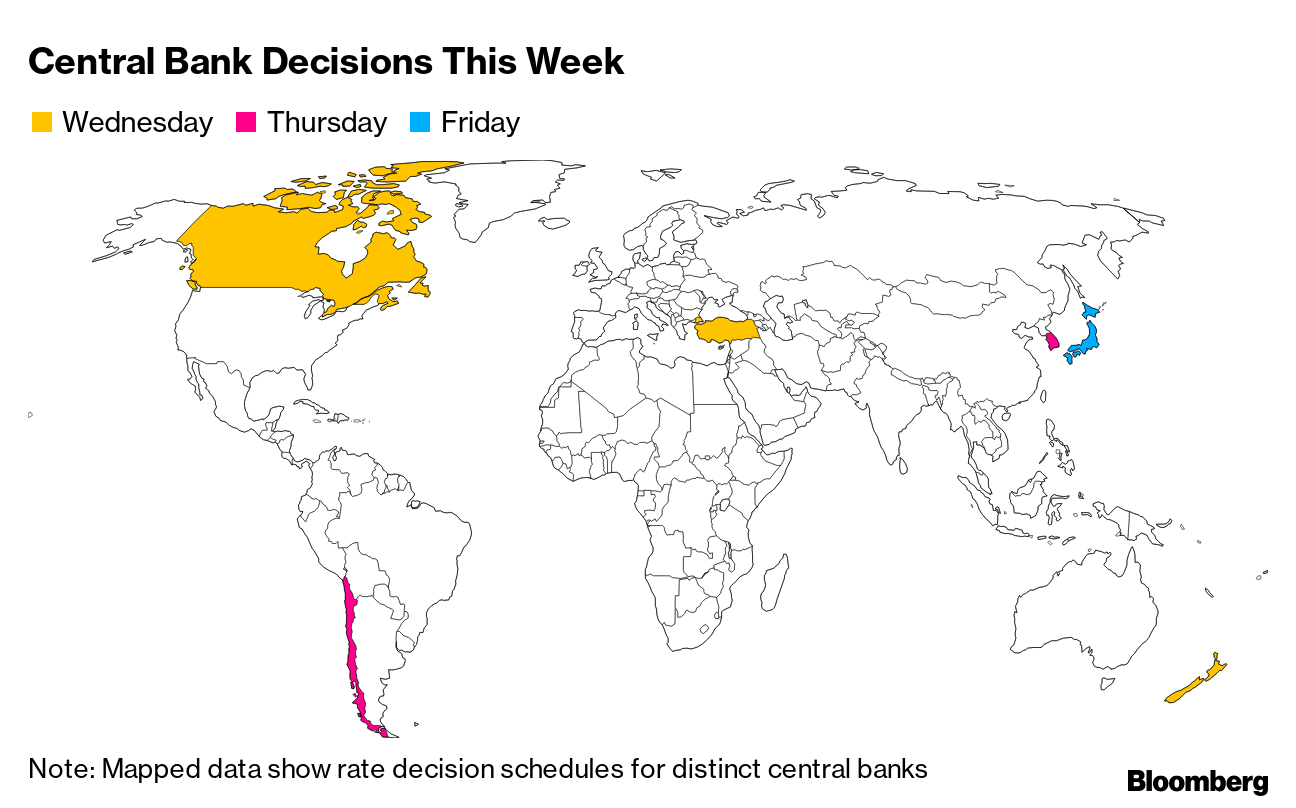

The quicksand of global inflation will focus central bankers from Ottawa to Wellington in the coming days after a month of growing consumer price concern among their counterparts, including the U.S. Federal Reserve.

The Bank of Canada, which is already at the forefront of Group of Seven economies slashing stimulus, will continue this momentum on Wednesday as officials saw weekly bond purchases cut by a third . This new step towards the normalization of monetary policy could possibly point to an increase in interest rates.

On the same day, New Zealand’s central bank may signal an earlier tightening, and Chilean monetary authorities are expected to hike.

Meanwhile, the Bank of Korea may reveal clues to plans for an initial rate hike on Thursday, and the next day Bank of Japan officials may be more optimistic as they focus on their agenda. of green loans, but could still increase their forecasts for consumer prices. this year.

Central Bank decisions this week

The backdrop all of these institutions face is a post-pandemic global rebound that some officials believe could turn into a lasting inflationary shock. In June, the Fed advanced its rate hike expectations, and even the ever-accommodating European Central Bank acknowledged that prices could rise faster than expected in the coming years.

“There is a risk of a more sustained rise in inflation or inflation expectations, which could potentially necessitate an earlier than expected tightening of US monetary policy,” said Kristalina Georgieva, the The head of the International Monetary Fund wrote in a blog post last week. “Other countries are facing similar challenges.

Elsewhere, China will release gross domestic product data, UK inflation may turn out to have hit the fastest since 2018, the US consumer price report for June will also be released, and Fed Chairman, Jerome Powell, will testify before Congress.

What Bloomberg Economics Says:

“Reopening categories will dominate again in the June CPI report, leaving the stock at a 5.0% year-over-year. Still, the fever may be starting to drop, as Bloomberg Economics expects the Core Excluding Food and Energy Index to post its weakest month-over-month gain since March. “

–Andrew Husby, American economist. For a full analysis, click here

Click on here for what happened last week and below is our recap of what’s coming up in the global economy.

United States and Canada

In the United States, investors watch the latest consumer price data of Tuesday to see if the cost pressures last. Other reports under review include retail sales – which will provide a reading of the strength of spending – as well as industrial production and business inventories.

Fed watchers will await testimony from Powell before the House Financial Services Committee on Wednesday and the Senate Banking Panel a day later. His appearance before Congress is part of the central bank’s biannual report to lawmakers on economic and financial developments and monetary policy.

The Fed’s beige book on Wednesday will also reveal the business outlook for the US economy.

Further north, economists predict the Bank of Canada will cut its weekly bond purchases to C $ 2 billion ($ 1.6 billion) per week on Wednesday, ahead of an expected surge in economic activity. That figure is expected to drop further to around C $ 1 billion by the end of this year or early 2022.

Europe, Middle East, Africa

Much like in the United States, consumer prices will be the focus of concern in Europe this week, with June data due to be released in the United Kingdom, Romania, Poland, Denmark and Sweden, not to mention name a few. Final figures are also expected for France, Germany and the eurozone.

Results are likely to vary across the continent. Economists expect Britain’s inflation rate to hit 2.2%, the fastest pace since 2018, while in Sweden the result could drop temporarily to 1.3%. Due UK labor market data may also be relevant here, indicating whether wage pressures are escalating.

In this context, the comments of policy makers in these two countries are also likely to attract attention. Riksbank Governor Stefan Ingves will take part in a panel discussion at an inflation-focused conference on Tuesday, while Bank of England policymakers Dave Ramsden and Michael Saunders will speak on the following days.

Other data of interest include eurozone industrial production for May, expected by economists to show a small drop after two months of gains.

Elsewhere in the wider region, Turkey’s central bank is expected to leave its policy rate unchanged for a fourth month on Thursday, even after consumer price growth accelerated faster than all estimates in June, at 17. 5%.

Governor Sahap Kavcioglu is trying to keep the line, refusing to raise the benchmark interest rate by 19% but adopting a more hawkish tone in communications and pledging to keep it above inflation. It is facing pressure from President Recep Tayyip Erdogan, who has said he wants to cut borrowing costs this summer.

Asia

The Reserve Bank of New Zealand is expected to remain firm on Wednesday, but may continue to intensify its hawkish tone as the economy’s recovery beats expectations.

Central bank watchers will also be looking for clues to a Bank of Korea’s policy normalization schedule on Thursday, with dissent likely to heighten expectations of a near-term rate hike.

Data on Australian consumer confidence will show how the latest Sydney lockdown affected sentiment, while Thursday’s unemployment figures will show how the labor market is handling the continued border closures.

China released second-quarter GDP data on Thursday that is expected to show a solid 8% expansion from the previous year.

And on Friday, the Bank of Japan will unveil more details on its climate measure and how it will try to get banks to give green loans. It will also release its latest price and growth forecast as Japan enters another state of emergency ahead of a spectatorless Olympics.

Latin America

The recovery has been patchy and the economy remains sluggish, but Mexico is recovering from the coronavirus, and analysts expect strong readings Monday for industrial production, manufacturing and same-store sales.

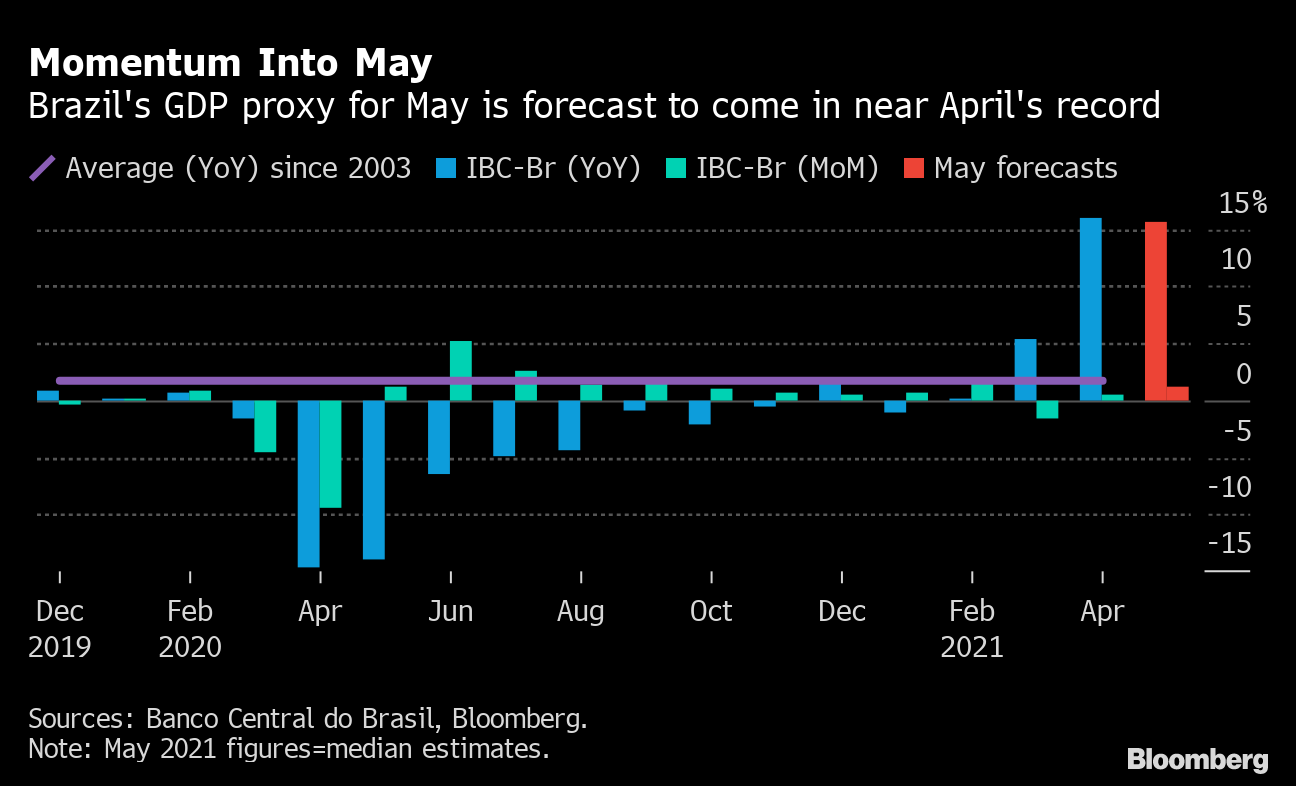

Brazil’s economic activity data, due on Wednesday, could come as a surprise as May’s figures outperform April, despite the pandemic drag, rising inflation and borrowing costs.

Momentum in May

Brazil’s GDP proxy for May set to hit April record

Sources: Banco Central do Brasil, Bloomberg.

On Wednesday, a third Latin American economy could join Brazil and Mexico in tightening monetary policy.

Chile’s central bank chief Mario Marcel made it clear last month that a rate hike was “definitely going to happen this year” as the economy had returned to pre-pandemic levels and inflation was just below the top of the bank’s target range. Analysts see a clear possibility of a quarter point increase to 0.75% here.

Colombia posts retail sales, industrial production and manufacturing for May on Thursday. Argentina’s national inflation figures and those for Buenos Aires are expected to show monthly rates of over 3% and just under 50% on an annual basis. Data from Peru is expected to show a pickup in activity in May while unemployment in the capital, Lima, remained in double digits in June.

– With help from Catherine Bosley, Jana Randow, Demetrios Pogkas, Benjamin Harvey, Peggy Collins and Malcolm Scott

[ad_2]

Source link