[ad_1]

Aurich Lawson / Getty Images

Robinhood’s decision to temporarily limit purchases of GameStop and other highly volatile stocks at the end of January was the focus of today’s hearing of the House Financial Services Committee.

At the hearing, Robinhood CEO Vlad Tenev said the extreme volatility in stocks that led to Robinhood’s restriction was a “five sigma” event with a “1 in 3.5” chance of occurring. millions ”. This made the situation virtually impossible for the company to plan for, Tenev said. “In the context of tens of thousands of days in the history of the US stock market, a 1 in 3.5 million event is fundamentally incomparable.”

As we’ve seen before, the high volatility of GameStop and other so-called “meme stocks” over the past month has forced Robinhood to provide much more collateral to the clearing houses that actually process its trades. Tenev said Thursday that those collateral obligations increased tenfold between January 25 and January 28, as GameStop went from $ 76 per share to over $ 347, then dropped back to $ 193.

“Despite unprecedented conditions, what happened is unacceptable to us,” Tenev said. “To our customers, I am sorry and I apologize. We are doing everything in our power to ensure that this does not happen again.”

Where is the money?

Tenev has said repeatedly that Robinhood has never had a liquidity problem in terms of hedging its users’ actual positions. But the company lacked immediate capital to cover these collateral requirements, which meant its only alternative was to temporarily limit sales of these shares until it could raise more funds (or until the shares become less volatile).

Some members of the House financial services committee were unimpressed by this dispute over what “liquidity” means for Robinhood. “Your customers wanted to buy the stock,” representative Van Taylor (R-TX) said at one point. “You wouldn’t let them do it because you didn’t have the capital to allow them to do it.”

Tenev has also been criticized for not communicating the reasons for these restrictions clearly and quickly to customers. Representative Carolyn Maloney (D-NY) noted that Robinhood’s first January 28 blog post announcing the restrictions contained “no disclosures about capital requirements” and only “vague language on trade restriction” . The initial impression, she hinted, was that Robinhood was “[making] the rules as you go. “

Since being forced to halt trading, Robinhood has attracted more than $ 3.4 billion in additional investment which Tenev says “shields the company from market volatility and other swan-related events.” black”. And although he apologizes, Tenev also said that “other companies have done similar things by restricting purchases. [of these volatile stocks], which suggests that this is a systemic issue rather than just a Robinhood issue. “

But Representative Alexandria Ocasio-Cortez (D-NY) pointed out that “when Robinhood prohibited its clients from purchasing additional shares of certain stocks, other brokerages simply adjusted the margin requirements on those stocks.” . This, she suggests, could mean that “the problem is not with clearing houses, but you just haven’t managed your own margin rules or you haven’t managed your own internal risks.” .

Some committee members also focused on Robinhood’s business model, which generates the majority of its revenue by selling its “order flow” to market makers like Citadel (who then reduce the profits from the improved pricing a bit. that they can bring on exchanges.). “When you don’t pay for it, it’s not free,” Rep. Brad Sherman (D-CA) said of Robinhood’s commission-free transactions. “You are the product, someone else [i.e., Citadel] is the customer. “

“If removing income from payment for order flow would lead to the removal of commission-free trading, doesn’t that mean that trading on Robinhood isn’t really free to begin with, because you’re just hiding the cost?” Ocasio-Cortez added in some pointed questions.

Deregulate or re-regulate?

While Tenev apologized for the mistakes Robinhood made, he also blamed what he called outdated and moribund business settlement rules that put great strain on the system. Under the current T + 2 schedule for stock settlement, market makers actually have two full days to formally settle a trade (i.e., transfer shares / cash) after it is made. When a stock’s price is particularly volatile, the clearinghouse needs more collateral to cover any potential price changes that could occur on either side of the trade in that two-day interval.

“The current two-day period for settling trade exposes investors and the industry to unnecessary risk,” Tenev said. “There is no reason why the world’s largest financial system cannot settle transactions in real time … If we had had real-time settlement capability and the infrastructure was modernized, we wouldn’t would not have seen similar problems. “

Ken Griffin, CEO of Citadel, stopped short of asking for a real-time trade settlement in his testimony before the committee. But he said relaxing the rules to a one-day turnaround “would reduce counterparty risk overall.” While instant or same day trade clearing would be nice, Griffin said it would essentially require that “all systems … are running at all times every day with no possibility of error.”

Rep. Andy Barr (R-KY) pointed out through his questioning that the current capital requirements were put in place in the Dodd-Frank Wall Street reform bill of 2010. “If anyone has a problem with [Robinhood]”, he said. Rep. William Timmons (R-SC) added that Dodd-Frank is “probably to blame for this exorbitant capital requirement that you couldn’t meet. . Well-intentioned legislation is somewhat responsible. “

Other members of the House, such as Representative Rashida Tlaib (D-MI), have argued vigorously for a 0.1% financial transaction tax, which would discourage speculative betting on stocks even and limit high frequency algorithm based trading. She noted that Hong Kong has implemented a tax on financial transactions twice as high, limiting high frequency transactions without harming the significant growth of this market.

But Jennifer Schulp, director of financial regulation studies at the free-market-focused Cato Institute, told the committee that these taxes “often fail to raise funds and distort trade in unforeseen ways.” , but it often detracts from the long term goals of individual investors by affecting institutions that trade. “

While Schulp allowed a financial transaction tax to reduce overall market volatility, she added that she doesn’t think it would have had that effect in the particular case of GameStop’s recent stock moves, which were mainly due to massive purchases.

Diamond needles

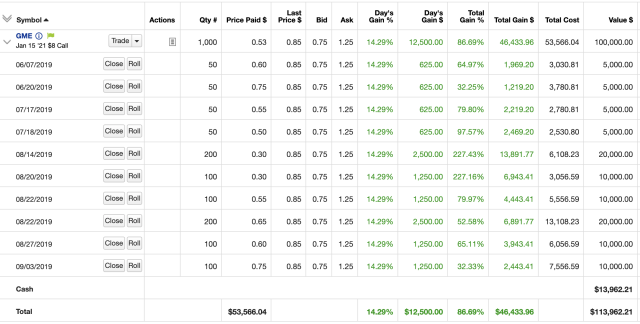

To represent the retail traders who helped push the GameStop bubble up, the committee heard from Keith Gill, aka DeepFuckingValue on Reddit. He first invested in GameStop in mid-2019 (when the stock was valued at less than $ 10) and significantly increased the value of the stock on the WallStreetBets subdirectory. “The market underestimated the prospects for traditional GameStop businesses and overestimated the risks of bankruptcy,” he said. “I grew up playing video games and shopping at GameStop, and I plan to continue shopping there. GameStop stores deliver real value to players and real revenue to GameStop. ”

Gill, who has now made millions on an initial investment of around $ 50,000, said he still thinks GameStop is an attractive investment at its current price of around $ 40 per share. His optimism is in large part thanks to GameStop’s potential to pivot towards a more focused ecommerce strategy. “As for me, I like the stock,” he says. “I am as optimistic as ever about a possible turnaround and I remain invested in the company.

Less represented at the hearing were the many other investors who bought the stock at or near its peak in late January, only to see their investments collapse within days. Representative Jim Himes (D-CT) brought up the case of Salvador Vergara, who took out a personal loan of $ 20,000 to invest in GameStop to see the value of his stock drop by 80% in a few days. “We need to be thoughtful about this,” Himes said of how to manage retail investor access to the market.

The committee also heard from Reddit co-founder and CEO Steve Huffman, who said Reddit has found no evidence of bots or foreign agents playing a significant role in trying to unduly inflate shares through the sub. WallStreetBets directory. “We will comply with the demands of the regulators, but we believe the community was well within the limits of our own policies,” he said.

“It’s a real community,” Huffman continued of WallStreetBets. “The jokes, memes, and sometimes self-deprecating bad language reflect this. There is significant depth in the community based on the affinity users show for one another.”

[ad_2]

Source link