[ad_1]

In May, a Reddit poster hit WallStreetBets with one sure thing Advice on Scorpio Tankers Inc. The oil shipper, trading at one-fifth of the value of its assets, has been a garish buy with storage rates skyrocketing, insiders capitalizing on the rise and oil returning after a brief negative period.

There is an opportunity to see “100% returns within the next year,” the user said.

Eight months later, the payoff: a loss of 17%.

Another WallStreetBets poster was just as breathless about their brilliant idea of Tesla Inc. runs in 2018. The result: a loss of 1330%, excluding borrowing costs, assuming they stick to it.

Choosing stocks is difficult. Almost nobody has an advantage, and it’s no shame when a call fails.

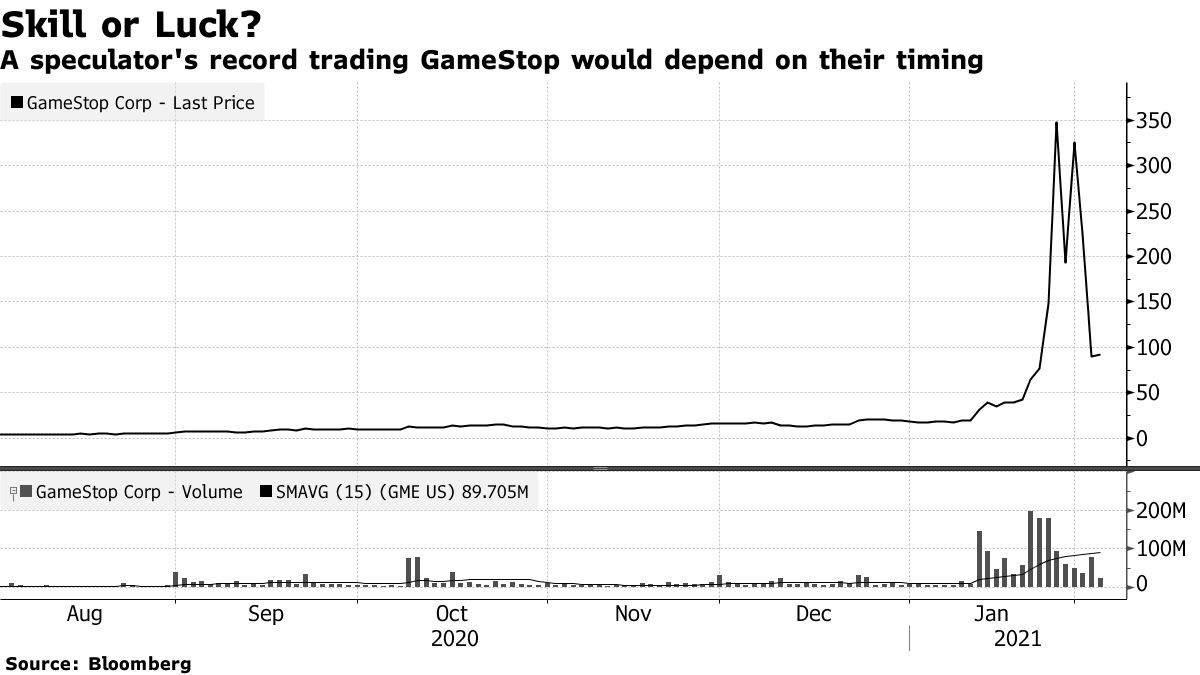

But in all the hagiography given to Reddit traders who have hung on GameStop Corp. Before it skyrockets, it’s worth remembering that a sufficiently large sample of predictions will always yield a few winners. It’s hard to find evidence of investing genius elsewhere.

It is these cautionary tales of stock picking that are documented in the research spanning this era of WallStreetBets. A new The newspaper finds that on average, when retail traders on Robinhood Markets buy a stock, it doesn’t perform better over the next three to 20 days.

In fact, it tends to get a little worse.

“Robinhood’s obvious lack of skills in investors overall is consistent with the fact that commission-free investors behave like uninformed noise merchants,” wrote Gregory W. Eaton and Brian S. Roseman of Oklahoma. State University and T. Clifton Green and Yanbin Wu of Emory University.

The authors also found that the buzzed stocks on WallStreetBets saw a spike in activity on Robinhood a few days later, a sign that there is likely significant overlap between the two communities.

To isolate investment skills, academics adjusted 2020 returns based on recent price movements and risk factors such as valuations and a firm’s size. The bottom line: when you remove the possibility that these traders are just chasing market trends, they don’t end up picking future winners.

The results do not mean that all brokerage retail investors are bad stock pickers. In fact, the four researchers found that an increase in purchases of shares in a company by the entire group predicted higher future returns. The problem for the The Robinhood contingent is that they typically stack on a stock almost a week past the bulk of their peers.

“While retail traders as a whole appear to be investing in the same types of securities that are popular among Robinhood investors, we are finding that the broader measure of retail is leading multi-day Robinhood trading, which may help explain the difference in performance, ”the authors wrote.

The research only covers the first eight months of last year as Robinhood stopped publishing the number of users holding each stock in August.

To be fair to Robinhood, it seems likely that the model isn’t limited to their platform. Another The paper showed that smartphones in general make people more likely to buy risky assets and chase past returns – in part because apps allow them to trade in the evening without thinking too much.

Bragging rights

As the GameStop rally returns to Earth, the new research could offer a look to fans whose bragging rights over the past week have come to a head.

Yet many of them would dispute his findings, given the number of this new generation of investors who appear to have made fortunes while beating hedge funds – largely fueled by commission-free trading platforms. .

When markets were attacked by Covid in the roughly six months through July 2020, a portfolio comprising the most popular stocks in the Robinhood app returned 105% annualized, according to Wolfe research.

GameStop Corp., the poster child for retail speculation, is still over 238% higher this year, even after its recent slump. Add Sundial Growers Inc. and AMC Entertainment Holdings Inc., and the Robinhood crowd seems to have several incredible success stories.

The phenomenon remains relatively recent, so firm conclusions about the stock selection skills or otherwise of those involved may be premature. And for those speculators who have reaped profits on these platforms, it doesn’t matter if it’s picking the winners or following the momentum of the market.

The success of retail traders in general has been documented by various academics through different time frames and methods. In one Last year, Ivo Welch, a professor at the University of California, Los Angeles, showed that a Robinhood portfolio of holdings exceeded market benchmarks and a quantitative factor model in the two years through mid -2020.

Welch’s work has focused on stocks that are largely owned by users, rather than those that see an increase in buying on the platform. The recent article clearly focused on whether more purchases from Robinhood actually lead to superior performance – or not.

“Our evidence suggests zero commission investors on the whole behave like loud traders, with changes in Robinhood ownership unrelated to future returns,” the academics wrote.

[ad_2]

Source link