[ad_1]

When we last covered Sabra Health Care REIT, Inc. (SBRA), we concluded:

The dividend is expected to be hedged in 2019. We have ignored rent increases starting in 2018, which should be reflected in the net result and the dividend of $ 1.80 should probably be exceeded, even after accounting for maintenance investments. The buffer zone has been destroyed and any other tenant issues are likely to put significant pressure on management. This space continues to be the subject of many problems and investors should be cautious.

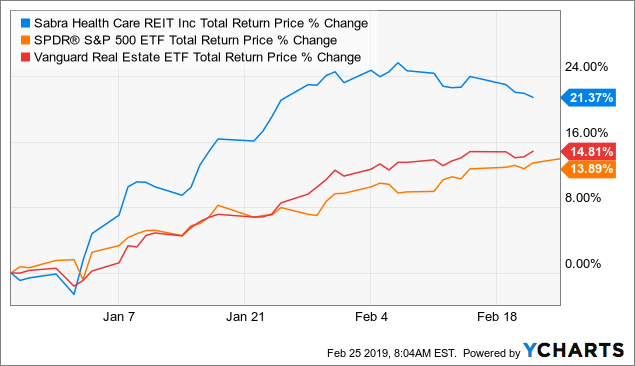

Since then, equities have performed well and outperformed the general equity market rally.

Data by YCharts

After the release of the Q4-2018 results, we decided to check whether the SBRA dividend for 2019 would be clearer.

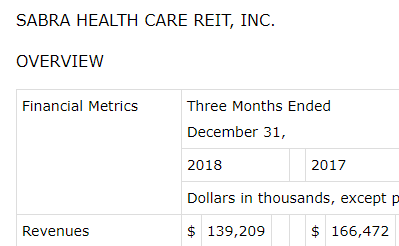

Funds from operations (FFO)

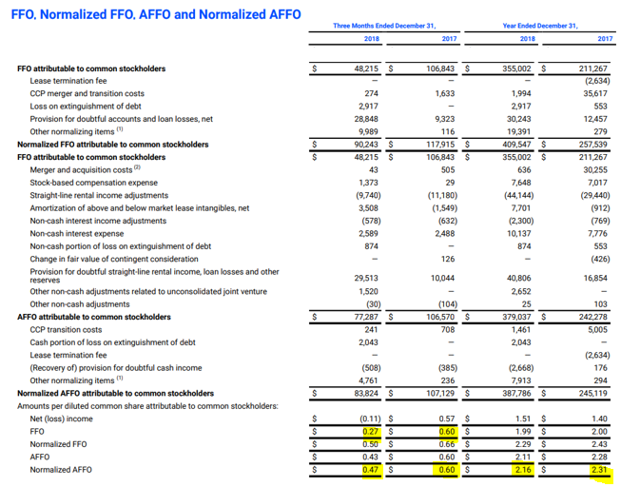

SBRA experienced a horrible Q4-2018, mainly due to straight line rent write-offs that were originally scheduled for Q1-2019. These were related to the properties of the senior care center that created all the problems of the third quarter of SBRA. At 27 cents, FFO had hardly covered the dividend by 45 cents.

Source: additional T4-2018

Normalized Adjusted Cash Flow (FFO) was 47 cents, slightly ahead of the 45 cents dividend. This is a sharp drop from the 60-cent business rate of the company, which was only 3 quarters.

How did we come here

Standardized AFFOs return essentially to each element. Even then, this number is significantly lower. This is partly because of the seniors' care centers, where SBRA has had a great rental success. You can see it in the rental revenue figures for Q4-2018.

Source: press release T4-2018

SBRA mentioned this sale and its timing in the Q4-2018 results.

The sale of 28 facilities currently operated by seniors' clinics for $ 282.5 million is completed on April 1, 2019. In addition, our forecast of results for 2019 assumes that the settlement agreement with the elderly care centers described above are effective, so we are counting $ 5.7 million post-petition. Seniors' Center rent in the first quarter of 2019, and total depreciation and transition costs of $ 69.3 million related to the sale and transition of facilities (the vast majority of which should be no cash flow) that are excluded from normalized and AFFO normalized transaction cash flows.

Source: press release T4-2018

Beyond these sales to be made, SBRA has cut its bad properties in a rather aggressive way (it is we who underline).

During the fourth quarter of 2018, we completed the sale of 18 facilities for total proceeds of $ 91.6 million. bringing our total sale proceeds for the year ended December 31, 2018 to $ 382.6 million sales of 51 specialized nursing / transitional care facilities, six seniors' housing communities and one managed community for seniors. These sales generated a net gain on the sale of $ 128.2 million for the year ended December 31, 2018. The annualized cash NOI attributed to these facilities amounted to approximately $ 34.7 million.

Source: press release T4-2018

Now, the $ 34.7 million NOI divided by $ 382.6 in sales gives a capitalization rate of about 9.1%.

Compare this with investments made during the year.

During the fourth quarter of 2018, we made investments of $ 39.2 million, with a weighted average initial cash yield of 7.40%. These investments include: $ 26.3 million in real estate acquisitions; $ 5.4 million in property additions; and $ 7.5 million in loans receivable. This brings our total investments made in 2018 to $ 673.7 million with a weighted average return of 6.70%.

The agreement on care centers for the elderly was concluded with a capitalization rate of 15.11%, although this will not make matters worse, because SBRA did not already receive rent for those of the fourth quarter from 2018. What we are saying here, is that SBRA has made investments at much lower capitalization rates than the ones it has. Theoretically, acquisitions are better properties with better operators, but the impact on the NOI and portfolio AFFO is brutal.

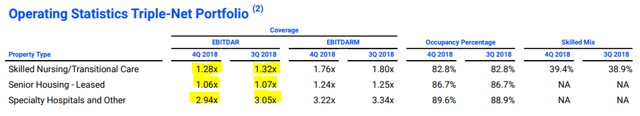

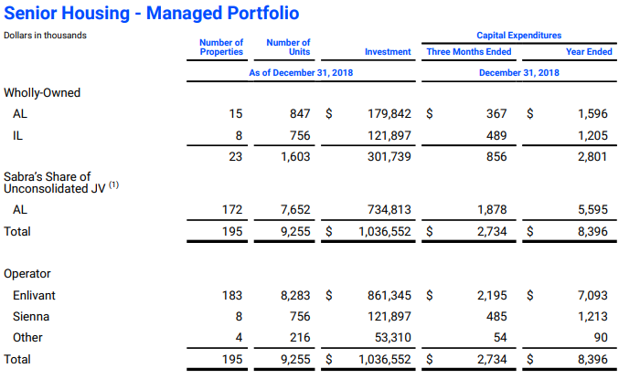

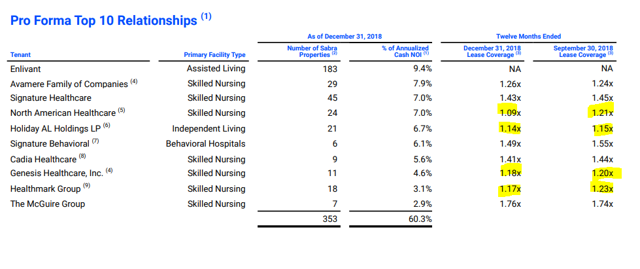

Rent cover EBITDAR

The rental coverage of tenants has worsened this quarter and reached levels that we would describe as rather painful. What is unusual is that SBRA gets rid of what they consider "bad properties". Are we still at a level below 1.30X in qualified nursing homes.

Source: additional T4-2018

A good portion of the portfolio will reset rents in January. This increase, together with the increase in wages paid by tenants to its operators, as well as the latest rise in interest rates, should help to strengthen ties.

Declassification, capital increase, support and dividend reduction

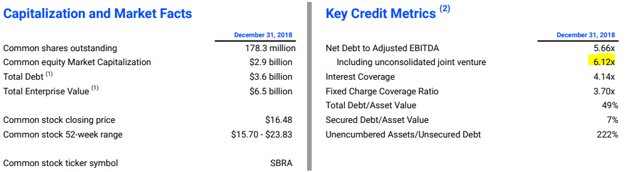

Fitch has taken a negative position vis-à-vis society and we think this is right.

Source: additional T4-2018

That was at one point after the Q2-2018 where Fitch still had SBRA with a stable outlook. With full leverage now operating at 6X, SBRA is on ultra thin ice.

Source: additional T4-2018

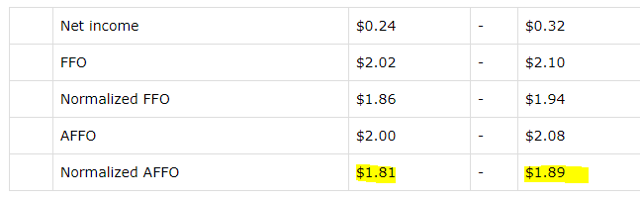

We think the company could raise equity if the stock moved in the $ 21 to $ 22 area. SBRA also guided for 2019 as follows.

Source: press release T4-2018

According to the company's own forecasts, the $ 1.80 dividend will be fairly tightly hedged. AFFO ignores the capital expenditures that SBRA will spend on its properties. We have debated ad nauseum the question of whether capital expenditures should be included or not (our opinion is yes, they should be), but even counting only the capital expenditures of their managed portfolios, a number that everyone agrees to count, the situation is gradually worsening. . Adjusted for these expenditures, standardized FFO would be between $ 1.77 and $ 1.85 for 2019.

Source: additional T4-2018

This brings us to know if they will reduce the dividend in 2019. For now, with the status quo, the probabilities are always less than 50%, but the smallest tenant problem could force the hand of the society. Will it happen? We think that at this stage the chances have been very favorable.

Source: additional T4-2018

Just look at the deterioration of North American Healthcare in a quarter, for example. This is a big tenant for SBRA. We have 3 others flickering under 1.2X. The odds that one of the three remaining players will explode and require a financial ROE over the next 18 months is one hundred percent. We are not 100% sure that this will happen in 12 months and therefore we are not betting for the moment that a dividend reduction will take place in 12 months. However, we are now convinced that he will be one at some point, unless there is a great miracle.

The wheel of fortune is a very comprehensive service, covering all asset classes: common stocks, preferred shares, bonds, options, currencies, commodities, ETFs, EFCs, etc.

Enjoy the two weeks free trial and access our:

- Monthly, where all trades are monitored.

- Trading Alerts. We do not trade every day, but we average one transaction per trading day.

- Model Portfolio, aiming to beat the performance of the S & P 500.

- "Prepare for 2019", a series of 19 episodes gathering our best choices in eleven sectors and eight segments.

What are you waiting for ?! Time, it is money!

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Additional information: Please note that this is not a financial advice. It may seem like, but, surprisingly, it is not. Investors are required to exercise due diligence and consult a professional who is aware of their objectives and constraints. Tipranks: No evaluation

[ad_2]

Source link