[ad_1]

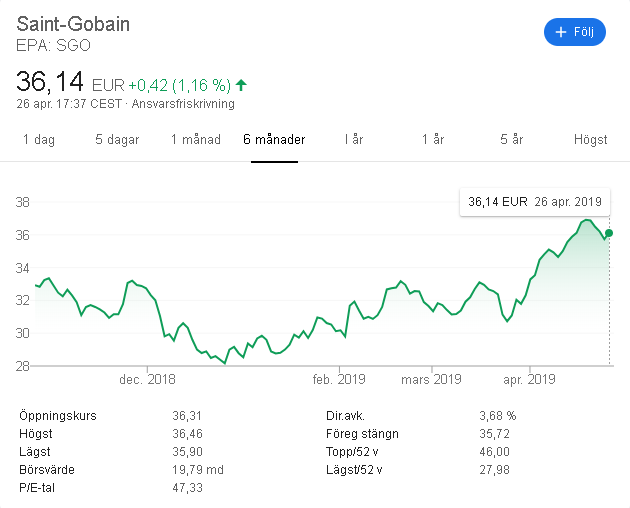

The building materials giant Saint-Gobain (OTCPK: CODGF) (OTCPK: CODYY) has recovered much of the stock market depression suffered at the end of 2018 / early 2019. My entry point in the title of me provides excellent returns so far, given the short time I have held it.

Although macroeconomic factors have certainly played a role in the rise in share prices, the truth is that the company has published excellent results for 1Q19. In this article, I will review them with you and translate what it means for my position in the stock, as well as how I view it for the future.

Let's start that.

Mirrors and materials provide benefits

Saint-Gobain has worked very well in the short term, since the purchase of my shares and since its lowest level in 2018/2019.

(Source: Google Finance)

The reasons for this development are many. Overall, the macroeconomic development on the international markets gives the company an important tailwind. However, let's look at the results of 1T19 to add a little more color here, and go to "other" reasons.

The company had:

- Positive pricing dynamics of 260 bps.

- Strong growth in volume of 310 bps.

- Positive exchange rate impact of 60 basis points.

- A positive impact of 10bps on the group's structure, with mergers and acquisitions of the company, the costs being offset by the divestment / divestment program.

- Same-store sales increased by 5.7% / 570 bps, driven not only by price, but also by volume, despite more challenging weather conditions.

Sector by sector

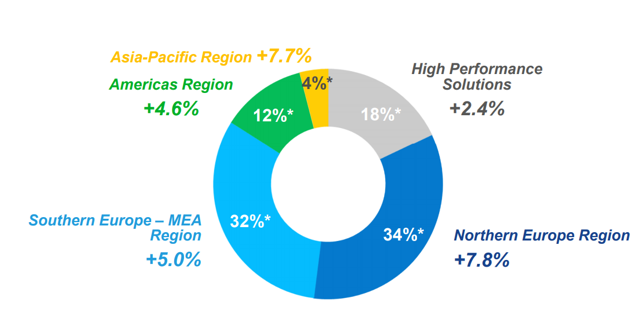

(Source: 1Q19 Introduction)

A joy to see, these numbers. Regional trends are also strong, with each region of society, with the exception of Africa / Middle East, showing a positive sales / growth trend that can reach double digits.

Despite continued weakness in the automotive industry, HPS (High Performance Solutions) solutions provided excellent growth over the quarter, among favorable non-automotive industrial markets and increased focus on value-added products ( VAP). Gypsum and mortar products sold particularly well in Northern Europe, with smaller increases in glass. This includes Scandinavia, where growth has been excellent due to the buoyancy of the building / construction industry. Overall, and across all geographic segments of the company, the Gypsum, Mortar and Building glass product groups drove the excellent increase in sales in the first quarter.

Overall, most sectors achieved strong results. The Middle East and Africa were rare men, with declines specifically in Turkey. (Source: press release 1Q19)

General developments

(Source: Presentation 1Q19)

The company provides ongoing updates on the progress of its new organization and its Transform & Grow program. Up to now, updates and progress have been encouraging. The company's program of recruiting national / capable national level executives for national positions (such as a Vietnamese / neo-Vietnamese business man / woman for part of Vietnam operations) also gave results. Although some consider this practice controversial, I think it is positive.

(Source: Presentation 1Q19)

Business Outlook

The business outlook for 2019 remains positive. The company expects growth in every region and every segment, the focus being always on the following points:

- Focus on selling prices in relation to current global inflationary pressures.

- Company savings program aimed at achieving € 300 million in savings, including € 50 million to be realized in 2019.

- The company's CapEx program, focused on growing CapEx out of Northern Europe, as well as related productivity and digital transformation increases.

- Increased R & D spending to support its high value strategic objective.

- High levels of FCF generation

By examining what the company has managed to date, there is reasonable security that will allow it to achieve most, if not all, of these long-term goals.

To take away

The company has announced an excellent first quarter, with organic growth in almost all areas of the company. In summary, business is good, despite the difficult industrial outlook for the auto industry and construction delays in some areas (Turkey / Africa). This allowed the stock, which was already recovering on a monthly basis, to return to a level of about € 36 on Friday.

At these levels, and considering my purchase price, my investment has increased by 24.96% in less than 4 months (including dividends), which translates into a CAGR of around 98%, which is indicative of my own investment strategy and considerations not only in Scandinavia where I live but throughout Europe where I am mainly active.

The company has once again shown that it can thrive even in difficult industrial climates. Although my expectations of the company have been moderate, it seems that the more positive range of my expectations for the stock has materialized, and a sudden decline to less than € 30 / share seems rather unlikely at this stage .

The company just works too well.

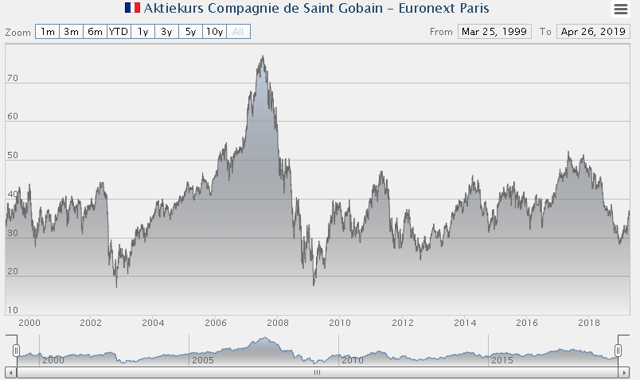

Saint-Gobain – A cycle to consider – but maybe not at this price

The share price of the company can always be considered attractive, considering the very long lead time for your investment and the acceptance of a dividend yield of 3.7% (my own to me is nearly 4.6%).

However, I will not buy more from this company during this evaluation. Not because it's not a good company, it's true. Due to future macroeconomic uncertainties and my overall exposure to building / construction cyclicals at its limit, my price targets for this company are well below € 36 / share, making it an irreproachable investment at current prices. .

The purchase of a construction company during a risky period such as this one requires different safety margins.

(Source: Börsdata)

Although we can look at long-term stock prices and other key indicators such as the P / E, P / S and P / B numbers, and judge the current stock price very favorably (and I repeat it , I would not blame anyone for investing here, provided you have moderated your expectations), I am also focusing on a more obvious undervaluation in the case of companies of this type.

In my opinion, the obvious undervaluation of this giant is almost over for now. In my opinion, if you did not buy back in March, or even better, earlier, you unfortunately missed the "greatest" opportunity here and you'd better wait for the next one.

I say that because I believe it is a company you want to own, but not at any price – and certainly not in today's riskier economic climate.

Time to sell?

No.

A gain of ~ 25% / CAGR of 98% is excellent, but my position in this company is for the long term. My selling point would be somewhere above a stock price of 44 to 45 euros, which, in my opinion, would indicate an overstatement in terms of key statistics if we look at the historical trends of this company and those sector.

The more short-term oriented investors / traders could sell at this point – gaining 25% in these few months is not a bad idea, but doing it at this point would go against my overall strategy. objectives for this particular investment.

In my first article, Saint-Gobain: Undervalued innovation outside France, I had proposed a fair value price of 42 to 44 euros for the action, taking into account historically accurate growth BPA 4 to 5% per year for the company, even the specific risks to the company. From this level (44 € +), one should at least come back to consider giving up some of the participation, and if we reach this level, you can expect me to write an article about it.

I will therefore keep my shares and position close to 1% of the overall portfolio allocation. In retrospect, digging so deep in Saint-Gobain in such a short time could have been exuberant on my part, but Mr. Market seemed to want to give me a little pause here and the company produced more positive expectations and risk considerations. I was confident in the long-term viability, but I was not expecting such a quick recovery. With the exception of the 1Q19 macro-quarter, this would probably not have been the case (at least not as excessive as now).

Recommendation

At the date of this article, I consider that Saint-Gobain is a "hold" at these levels of ~ 34-38 € / share. I will not buy more from the company at this point.

I will update this article or publish an updated thesis if things change and / or in conjunction with future updates of the results.

Thanks kindly for reading.

Disclosure: I am / we have been for a long time CODGF, CODYY. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link