[ad_1]

Welcome to larger edition than expected Oil markets every day!

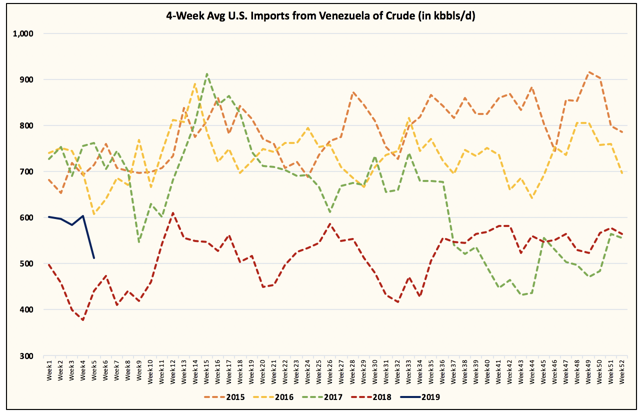

On January 28, 2019, the United States imposed sanctions on PDVSA, Venezuela's state-owned oil company. Following the announcement of the sanctions, we wrote in the chat that this should not have a significant impact on the oil market. We said that Venezuela would be able to ship its oil to the Caribbean or sell it to third-party oil traders who could resell it in the US and in other regions.

But we now see that oil sales through triangulation are cut off, as third-party oil traders find it difficult to unload Venezuela's cargo because of the risks of sanctions. At least for the next 4 to 6 weeks, we think the sanctions on Venezuela could have a pretty big impact on US crude storage. It takes 10 to 11 days for Venezuela's exports to reach the United States. The effects of sanctions will begin to manifest in the coming weeks.

Do not forget that in the past four weeks, US crude oil imports from Venezuela averaged about 500,000 bar / day.

Source: EIA, HFI research

If the Venezuelan crude falls to 0 b / d, this would leave a gap of about 3.5 kb per week. In addition, it will likely not be bridged short-term gap in any other country, as Saudi Arabia and Iraq have already significantly reduced their exports to the United States, leaving a further large gap between crude imports. In addition, Brent-WTI spreads have not declined, as global crude oil supplies are also reduced, US crude oil export barbs are broadly open.

This means that US crude exports are likely to remain high, while imports will fall, leaving the potential for a change in the US crude inventory balance to fall.

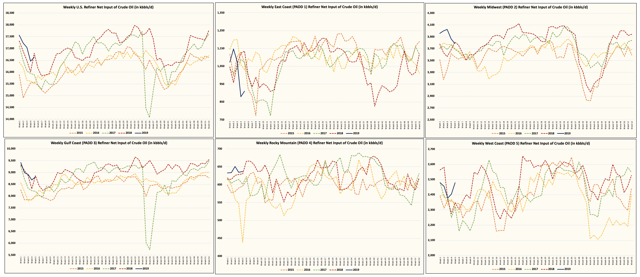

Of course, keep in mind that we are in the refinery maintenance season and refineries may choose to stay in maintenance a little longer than expected. The refineries should cease their maintenance activities by the second half of March:

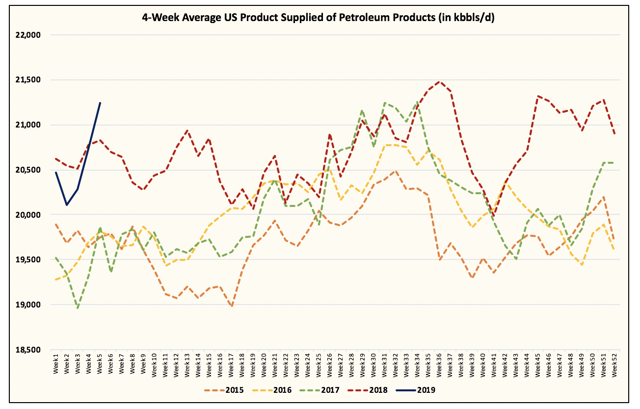

But this is going to be an extremely interesting montage on the oil market. Why? The sanctions imposed by Venezuela have disrupted the flow of crude in the south of the country, the serious world shortage of sour crude is worsening. WCS Houston is now trading fast at a price higher than WTI and coking margins are being erased. This means that amidst this debacle of sanctions imposed by Venezuela, refineries may choose to reduce throughput through extensive maintenance. This, coupled with the fact that global demand for refined products is still stellar, indicates that product storage will begin to decline significantly as refineries are undergoing maintenance.

From an oil trade perspective, this means that crack margins are expected to start to improve significantly over the next two months. But the side effect of reducing the overall flow of refineries is that crude oil will not skyrocket immediately. This means that as the cracks improve, the world's refineries will come out of this extended maintenance season with crude stocks and tight products.

In addition, if US crude imports from Venezuela declined significantly, crude oil storage in the United States would have shown relatively optimistic changes in storage equilibrium over the next few months. All of this is in line with the very optimistic outlook for oil prices.

To support our vision, Brent's time covers, as we wrote in the OMF, are now downgraded 1-2, 2-3, and 1-12.

The 1-2 month period best illustrates the tightening of the global supply outlook and we believe this is what the market is seeing as well.

All stars can align …

The stars can be aligned in one direction from the second half of 2019. The drop in oil prices in the first half will stimulate end-user demand, as the fall in demand may not correspond to around 1 Mb / d modeled by consensus. In addition, the low oil prices today will spill over to the lower base supply for American shale, which is expected to expand in the second half of 2019. Finally, the decline in oil prices today will have a negative impact on oil prices. The low refinery margins will encourage refineries to maintain longer demand growth in the second half of the year.

If the United States and China solve the trade war problems in March and the global economic indicators do not collapse, it is quite possible that all the stars will align so that Brent reaches $ 90 / here's the second half of 2019. A key indicator to watch out for, however, is the US dollar, as we need it to be lower in the second half as well.

But from the fundamental point of view of the oil market, the stars are aligned. Our projections for the second half of 2019 indicate a deficit of about 1 Mb / d, which will result in a Brent greater than $ 80. We think this, combined with the fact that the Saudi incentive indicates that an average Brent North price of $ 80 + will help us reach this price level.

In the coming months, we will create an oil trading portfolio. We have put in place a framework to understand oil price trends in the short term and we look forward to launching this new oil trading portfolio to mitigate the volatility of long-term energy holdings. For readers interested in the methodology or the way we think about this framework, we have published an article on the weekend that describes it to our subscribers. We also offer a free 2-week trial so you can sign up here and see for yourself. We hope to see you join the HFI research community.

Disclosure: I am / we are short DWT. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link