[ad_1]

Co-produced with Treading Softly and PendragonY for High dividend opportunities

Investment thesis

We recently launched a series of reports on how income investors can increase their income by investing in secured loan obligations (or CLOs). In the first report of this series, we explained what CLOs are and how they work. If you have not had the opportunity to read the report, here is the link:

"How to increase your income with CLOs"

In our second report of the same series, we highlighted our preferred investment in CLO, namely: Oxford Lane Capital (OXLC). This report was also published recently on Seeking Alpha and titled: 16% Yield for an Asset Class Tested by a Great Financial Crisis, by Oxford Lane.

Today's article is the third in this series by which we highlight Saratoga Investment (SAR), a BDC that manages CLOs.

SAR is a unique case because it is a dividend-paying BDC. Note that the vast majority of BDCs do not increase their dividends. We are particularly optimistic about the SAR, which recently increased its dividend to $ 0.54 per share. for a forward yield of 8.9%.

SAR manages CLOs and is therefore at lower risk than OXLC or Eagle Point Credit Company (ECC), which invests primarily in CLOs. Treading Softly, my co-author and myself, are OXLC, ECC and SAR long in this sector.

Brief overview of the company

SAR is a manager of BDC and CLO who is rapidly developing assets under management (AUM). SAR will continue to see positive market price action due to its recent offering of notes, adding additional low-cost financing. SAR is a high yielding stock that currently yields 8.9%. As BDC, the dividends are subject to a tax of 1099, so that investors do not receive K-1 tax forms, which is a considerable advantage.

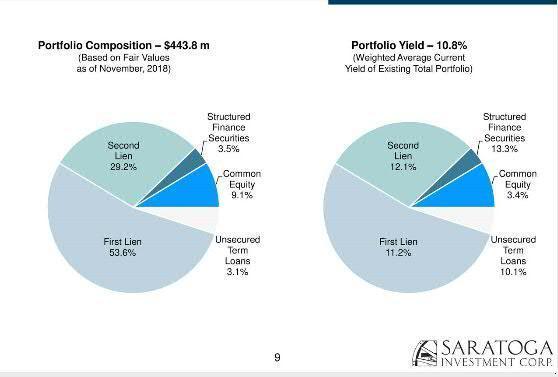

SAR operates as a BDC and invests in mid-market businesses – in the form of loans or direct investments – to seek its income. SAR has also started and managed a CLO. These two main channels provide SAR revenue.

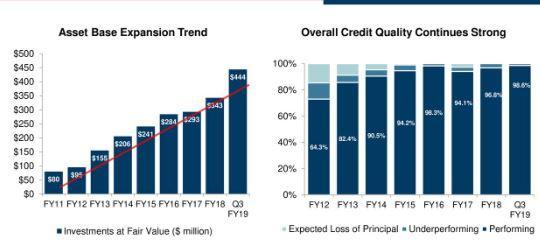

Source: SAR earnings slides

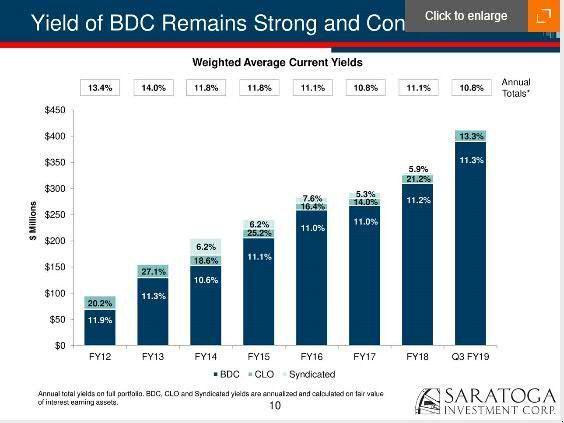

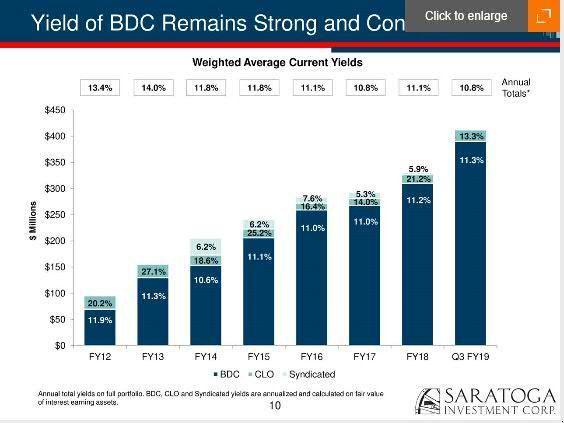

SAR focused more on BDC's loans than on its heavy reliance on its unique CLO. Last year, SAR increased its CLO to $ 500 million. This represents an increase of $ 200 million, almost double the size of the COL. SAR oversees CLO and collects management fees to ensure that loans within the CLO meet their credit ratings and function properly. This increase was perfectly adapted to the moment when the market for leveraged senior loans recorded a massive drop in prices. As a CLO manager, he oversees the addition of these loans to his CLO – every dollar invested has a positive impact on the performance of its tranche holders.

Source: SAR earnings slides

The SAR portfolio consists primarily of senior and subordinated loans. These provide stability to the SAR portfolio and its overall return allows for the continued issuance of 9% shares for a 10% return.

To help finance growth as well, SAR recently offered $ 40 million of outstanding notes maturing in 2025. These notes yield 6.25%, much less than the returns of their portfolios and traded under the names . Saratoga Investment Corp. 6.25% (SAF). This will help the fund continue to grow its net investment income at a lower cost than issuing additional shares.

Strong historical growth

SAR management has overseen the strong growth in assets under management and the net asset value of its investors, while maintaining a high net investment income.

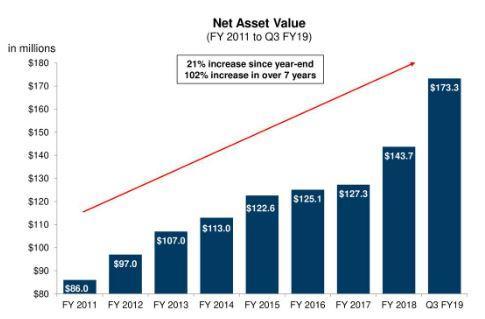

Source: SAR earnings slides

Assets under management of SAR have increased by 455% since 2011. This would be a sign of concern for investors as SAR has diluted its shares or has quickly become indebted on debt to ensure its growth. However, this massive increase in assets under management – generally a 13% change from the previous quarter – is consistent with the steady improvement in the strength of SAR credit relative to its underlying assets. In the last report, only two loans were considered unrecorded. How has this rapid growth in managed assets reflected for SAR shareholders? VN growing fast.

Source: SAR earnings slides

The NAV of the SAR has grown strongly. This NAV is a fundamental part of its strategy. An increasing NAV raises the question of the profitability of the growth of this NAV. The answer is strong.

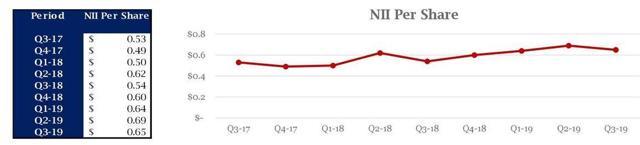

Source: SAR earnings slides

SAR's net investment income, essentially the remainder of its income after fees, experienced strong growth. This growth is reflected in a growing dividend, which we will discuss later. This clearly shows that the SAR growth efforts have not been to the detriment of shareholders, but to their direct benefit. The growing size of SAR has allowed it to access capital less expensive than issuing shares, as shown by the recent note placement. These notes are cheaper than issuing the same amount in shares, which will enhance the growth of the SAR NII. We strongly expect the SAR NII to continue to grow in line with its growth and to prudently maintain a strong credit-focused portfolio.

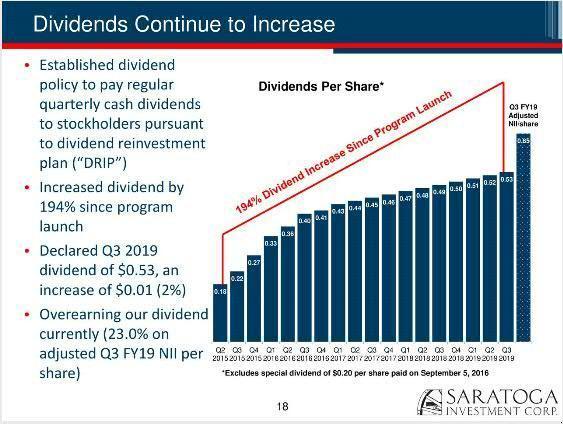

The dividend

The SAR dividend is published quarterly and is experiencing sustained and sustained growth. The dividend has been increased for 17 consecutive quarters. It's very remarkable!

Source: SAR income slides

Even more remarkable, the dividend increases have been strong and they have increased by 194% since the second quarter of 2015.

At the moment, SAR realizes a dividend surplus of 23%, which means that further increases are coming. This also provides the SAR with an extra amount of powder to complete relutive transactions. SAR management anticipates additional dividend increases.

The 8.9% high performance of the NAS and its continued growth justify a possible future investment, as this company will easily reach 10% of current prices after continuous increases. However, the SAR continues to climb to reach its previous prices of September 2018.

Data by YCharts

Another reason why a SAR investment would benefit people in search of immediate income is that it systematically generates high returns while allowing capital appreciation or preservation. The silent winner status of SAR has offered a continued opportunity to invest to capture this high yield.

L & # 39; s future

The RS is at a fantastic point of its growth. The market yield is well below the return of its portfolio, and the recent issuance of notes provides an inexpensive way to acquire additional funds over the issuance of shares in the market. SAR management has a fantastic track record in conservative growth. 99% of its investments are considered to have a good credit rating by the SAR management.

The primary risk to SAR is the floating nature of its loan portfolio; since the prime rate is expected to remain stable or face a reduction later this year, SAR revenue will also decrease. This concern is however mitigated by the use by the SAR of a LIBOR at three months and a fixed rate, usually ranging between 6% and 8%, and up to 9%. 75%. This means that even small changes in the prime rate will have no impact on SAR's ability to grow as strongly as the others.

SAR exposure to CLOs is limited compared to companies such as Oxford Square Capital (OXSQ) or Prospect Capital (PSEC). This benefits investors. In general, a BDC too invested in CLO debt or equity tranches is exposed to greater risks than those of a fund like Eagle Point or Oxford Lane, designed to mitigate the risks associated with the CLO. BDCs are limited to exposure to the OCOL that they may have. SAR manages its CLO and holds only a limited amount of the equity tranche, which was required at the time of its issuance. This provides management income with limited fluctuations in NAV due to changes in value of the CLO tranche.

Investor to take away

An investment in SAR has many advantages:

- Increasingly high yield

- Strong solvency of obligors

- Fast-growing AUM that exceeds its performance

This company has a promising future, prudent management and increasing returns. Investors should consider adding this to their mix of BDC investments. We consider that the purchase of SAR is less than $ 25.00 as its increasing performance and conservative nature will increase its performance over time.

Thank you for reading! If you liked this article, please scroll up and click "Follow" next to my name to receive future updates.

High Dividend Opportunities, the # 1 service for investors and retirees

We are the largest community of income and retiree investors with over 2200 members. We recently launched our Portfolio of stocks and preferred bonds meet the needs of conservative income investors.

Join us to get instant access to our model wallet target a return of 9 to 10%, our preferred share portfolioand income tracking tools. You also have access to our report entitled "Our favorite choices for 2019"

Disclosure: I am / we are long SAR, ECC, OXLC. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link