[ad_1]

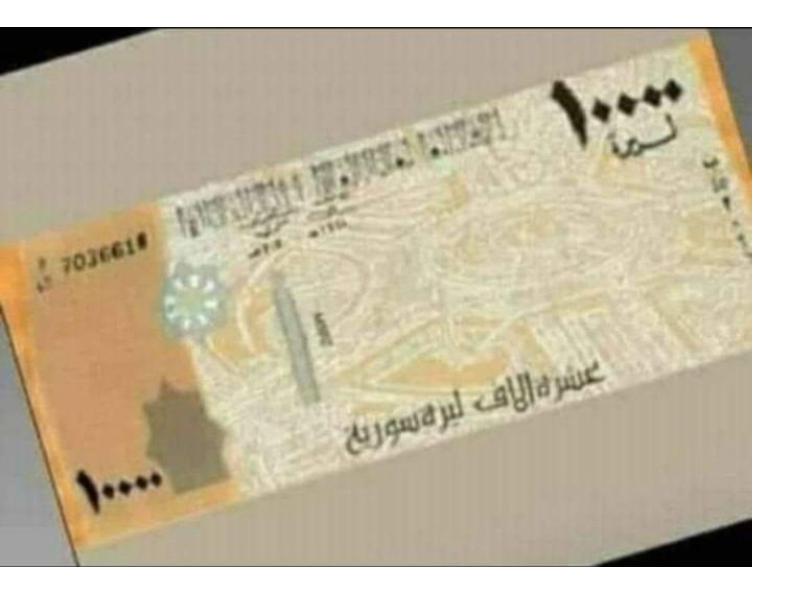

Since February 17, Syrians have been circulating on social networks an image that would belong to a (10,000) denomination banknote that the Central Bank of the Assad regime had placed on the Syrian market after the record collapse in the price of Syrian pound.

However, the regime’s media was quick to deny the news and cited platforms concerned with the release of fake news as saying the news is fake and that a photo of 10,000 people has been altered based on it. use of Photoshop, according to what was shown by the coroner. ally site to analyze the images.

This comes at a time when Syrians are not ruling out the regime’s takeover of issuing a cash denomination of higher financial value, similar to the denomination of 5,000, as loyal economists launch new cash denominations, especially with the Syrian pound registering its lowest ever record, rising to 3,600 pounds to the US dollar, amid news of store closures in the capital, Damascus and others areas under Assad control.

As director of the Securities Commission, Abed Fadliya, had previously called on the Central Bank of Syria to introduce a cash denomination of 10,000 pounds at a time when all authorities and official institutions affected by the statement persisted in denying it. The Assad regime’s intention to introduce a new cash denomination, thus forcing Syrians to accept preferential declarations. Seriously unlike the others.

Fadlia’s call came amid her claim that the Central Bank was about to announce a 5,000 pound bill, which took place on January 24, when she announced the launch of the biggest banknote of the country’s history, when the Central Bank refused it.

Fadliya attacked the Syrians at the time on pro “Melody” radio, criticizing their “unjustified fears” which he said were behind the delay in the central bank issuing new denominations of liquidity , while Economy Minister Muhammad Hassan al-Khalil blessed the cash issuance, saying the economy has started to improve. It’s just a matter of exchanging one banknote for another ”, as he said.

Contrary to expectations, the Syrian pound lost around 10% of its value three days after the introduction of the 5,000 lire denomination, and it has continued to decline over the past two months to record its lowest level in history. of the Syrian pound at a rate of 3600 to the dollar, according to the Syrian Pound Today website, increasing the likelihood that the Asad system will offer a higher denominator in cash.

Today, Syrians find a previous statement from the Central Bank in which it denied its intention to issue a denomination of 2,000 lire, but Duraid Dergham, the Governor of the Bank of Syria at the time, came out in 2017 announcing the first denomination in cash. the equivalent of $ 4 which was introduced after the imposition of international sanctions on the Assad regime, so that the price of the Syrian pound fell immediately after.

After less than a year, the People’s Assembly in Assad’s government passed a draft resolution allowing his central bank to issue cash denominations of the Syrian pound up to 5,000 lire, so Dergham came out reassuring the Syrians saying that proposing the denomination of 5000 “takes time. for design and subcontracting, and offering it is a necessity for Syria to take an important place economically. As he said.

Although there are no realistic figures reflecting the actual size of the actual issuance of cash in Syria or of a party that monitors the issuance of cash in Syria, the system tends to increase the issuance of cash. liquidity to finance 30% of the value of the budget deficit for 2021, or 2.5 trillion pounds, after the reluctance of private banks and individuals to finance the system, through bonds and loans.

It should be remembered that the Assad regime is aware in advance that the Syrian pound will collapse to great levels, which will prompt it to print currency denominations, in addition to its inability to control the rate of exchange. exchange the pound against the foreign dollar and control the black market in setting prices instead of the bank, according to what researcher and economist Khaled Turkawi told Orient Net earlier.

[ad_2]

Source link