[ad_1]

The Chinese government’s hidden domestic debt has swelled to more than half the size of the economy, according to economists at Goldman Sachs, who said the government will need to be flexible as revenues are already under pressure from the downturn . in land sales.

Economists wrote in a report that the total debt of local government special purpose finance companies, or LGFVs, rose to about 53 trillion yuan ($ 82 trillion) at the end of last year, against 16 trillion yuan in 2013. This is equivalent to about 52%. It is greater than the amount of public public debt due.

LGFVs are a tool used by governments to borrow money without it showing up on their balance sheets, but are considered a government obligation by financial markets.

There were indications earlier this year that the government was scrambling to reduce that debt as the economic recovery allowed a focus on managing financial risks. Now that growth faces more headwinds, including hesitant consumers, a housing market crisis reducing demand for land, energy shortages and supply chain disruptions, markets are looking for signs of rethink this tough political position.

“More formal local government bond issues and increased flexibility in local government funding will likely be needed to support overall economic growth” as land sales slow, economists led by Maggie Wei wrote in the report. .

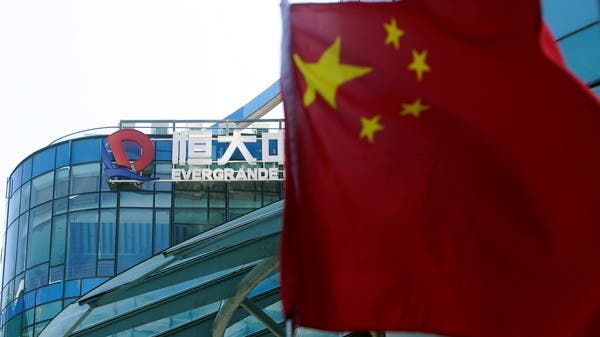

Land sales are a major source of income for local governments in China, and sales have slowed as the crisis worsens at Evergrande Group, a real estate developer in China. To fill the funding gap left by declining land sales income, Goldman recommended that the government increase the share of bonds for 2022 to more than 500 billion yuan from the level of 3.6 trillion yuan this year. year.

Other results

The Goldman Sachs report found that leveraged transactions are mostly concentrated in the construction, transportation and industrial conglomerates sectors, with these three sub-industries borrowing nearly 40% of LGFV’s total debt.

Jiangsu Province also leads all provinces in terms of borrowing volume, with around 8 trillion yuan in 2020.

The report states that around 60% of bonds issued by local platforms are used to repay debts due in 2020-2021, instead of new investments.

Goldman’s calculations are based on an analysis of over 2,000 LGFV statements of their interest-bearing debt, including bonds and bank loans.

Source link