[ad_1]

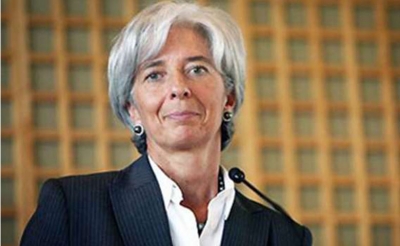

IMF Managing Director Christine Lagarde confirmed at an IMF meeting in Dubai entitled "Laying the foundations for good governance in public finance"

Arab world Without a stable base, even the best policies can stumble. Tax policy will lack credibility.

The head of the International Monetary Fund said some oil-importing countries had improved their growth, confirming that it was below pre-crisis levels. The budget deficit is still large and public debt has increased rapidly, rising from 85% of GDP 10 years later. Public debt currently exceeds 90% of GDP in about half of these countries.

Oil exporters have not fully recovered from the 2014 oil shock and the future is largely uncertain despite modest growth.

"Due to declining revenues, the fiscal deficit is only slowly decreasing, despite major reforms in spending and revenues, including the introduction of VAT and production taxes, which have led to a significant increase in public debt 33% in 2018 ".

The countries of the region have not yet fully recovered from the global financial crisis and other major economic upheavals of the last decade, she said in her interpretation of the global and regional situation.

Lagarde said the IMF's forecast for global economic growth, which is expected to grow 3.5 percent this year, is 0.2 percent below previous forecasts. The fund manager emphasizes that global risks are higher today and are mainly related to trade tensions and difficult financial conditions. He did not deny that the countries of the region would be affected by the decline in world trade, workers' remittances, capital flows, commodity prices and financing conditions.

Lagarde pointed out that the foundation is to establish sound public financial frameworks through laws and institutional arrangements to achieve the goals that allow countries to plan their budgets in the medium term and reflect clear objectives. One of Lagarde's weaknesses in this regard is the short-term vision and lack of credibility.

Focusing on the short-term horizon makes it more difficult to implement reforms as important as reducing the public sector wage bill, putting in place effective social protection systems and eliminating poverty. harmful subsidies on fuel prices, said Lagarde.

I'm coming to the credibility of public finances. I am referring here to factors such as large expenditures not included in the budget and low risk management. Throughout the region, sovereign wealth resources are often allocated directly to projects, without going through the regular budget process. In some countries, state-owned enterprises have high borrowing rates, including extrabudgetary ones. Addressing these budget risks will not only enhance the credibility and transparency of the budget, but will also help to fight corruption. The credibility of the budget calls for better risk management, with a more comprehensive budget based on realistic forecasts.

The good news is that many countries have already started to clean up their public finances, many of them with help from the Fund. Here are some examples:

In its review of the achievements of some Arab countries in strengthening their budgetary frameworks and efforts made by many countries, Tunisia has made no effort in this regard, especially the efforts of Saudi Arabia. , Kuwait, the United Arab Emirates, Sudan, Qatar and Lebanon to set up financial units. This is a useful first step in strengthening the fiscal framework.

Algeria has recently adopted a new, medium-term, medium-term finance bill, and Bahrain has put in place a public finance program aimed at achieving a medium-term equilibrium.

Mauritania, Morocco, Jordan and Lebanon are making significant progress in planning and implementing public investment in the medium term.

Egypt is currently publishing a risk profile on public finances with its budget and an internal risk assessment of the budget is being published during the year. The UAE is also launching a public finance risk management project, with support from the Fund, and this year will launch its first test to measure the pressure on public finances.

Speaking of corruption, Lagarde said weak governance and corruption were associated with a sharp drop in growth, investment, foreign direct investment, tax revenues – and at higher levels of government spending. inequality and exclusion – a major confounding factor of fiscal policy.

On the reform side, Ms. Lagarde said that in the area of public finance, there is a need to increase the transparency of public finances by highlighting all aspects of the budget and public accounts. This would provide a clearer picture of the fiscal position and expected prospects, the long-term costs and benefits of any change in the existing policy, as well as the potential fiscal risks that could lead to deviation. It is possible to improve this aspect in this region.

She pointed out that international critics have recently increased its engagement with member countries in the area of governance and corruption. Over the past year, a new framework has been put in place to participate in member countries' efforts on these issues in a more systematic, equitable, efficient and frank manner, and work on the implementation of this framework will continue. .

Source link