[ad_1]

Renowned economist Mohamed El-Erian said Monday’s liquidation in global stock markets indicates that investors are reconsidering the sustainability of investments in China.

El-Erian cited the ongoing regulatory crackdown in Beijing and the crisis in real estate developer Evergrande, which is working to avoid the default of a massive $ 300 billion debt due Thursday.

The property developer, China’s second largest, has reportedly started offering to pay off investors’ debts at a discount.

Fears of the Evergrande collapse and damage to the Chinese economy as a whole caused the Hang Seng Index in Hong Kong to drop 3.3% as real estate stocks fell.

During the session in America, the S&P 500 fell at least 2% and the Dow Jones Industrial Average lost more than 800 points. In Europe, the German DAX fell more than 2%.

El-Erian believes the Evergrande infection is already starting to show up in markets, and it also comes at a time when Beijing has imposed restrictions and rule changes on a wide range of businesses in recent months. He urged tech companies, education providers, food delivery services and more to reform their business practices, with the cohesive theme of state assertion of control over the corporate sector.

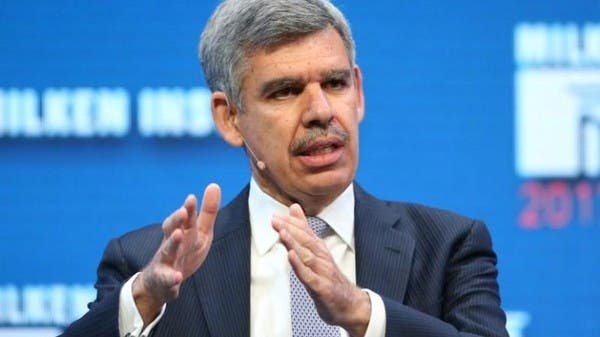

Allianz’s chief economic adviser and the former CEO and co-chief executive of bond giant Pimco said the contagion of the Evergrande collapse to the markets is due to the shaking of global financiers’ confidence in the market. real estate sector, because it can Arguably, China has stopped supporting the company as part of its market rebalancing measures. Punishing excessive business risk, on the other hand, does not see the need to intervene because the risk is not systemic.

ويكمل “إلا أنه يرى أن الأمر لا يمكن النظر إليه بهذه البساطة. ما ينتج عن ذلك هو أن الناس يتساءلون عن أحد المبادئ التي كانت راسخة لدى المستثمرين, وهي أن الحكومة ستقف دائما وراء القطاع المالي”, “حاليا, هي ليست كذلك. ليس الآن At least”. Add to that an attack on various sectors which has shaken investor confidence that China is a viable market.

El-Erian said the Chinese market is going through a transition phase and some investors believe Evergrande could repeat the “Lehman Brothers” scenario for China, referring to the collapse of the US investment bank which has caused the 2008 global financial crisis.

He denied the possibility of another financial crisis similar to 2008, saying, “I don’t think we have reached this point”, but this [الشعور] exists ”, which now leaves open the question of whether long-term investor confidence in the outlook for investing in Chinese markets will be permanently shaken.

“But remember, context matters,” El-Erian said, noting that Chinese economic growth is losing momentum, the United States is showing signs of slowing down and the Federal Reserve “is facing a very difficult period. uncertain “as it plans to curb emergency stimulus measures.

“The big question is whether you have a stock market crash or a policy error shaping the behavioral case for markets to buy lows, and that’s what will be tested over the next few sessions,” he said. he declares.

On Tuesday, the Federal Reserve will begin a two-day policy meeting in which investors expect the central bank to indicate when it could start slashing purchases of US Treasuries and US Treasury bonds by $ 140 billion per month. mortgage backed securities.

Source link