[ad_1]

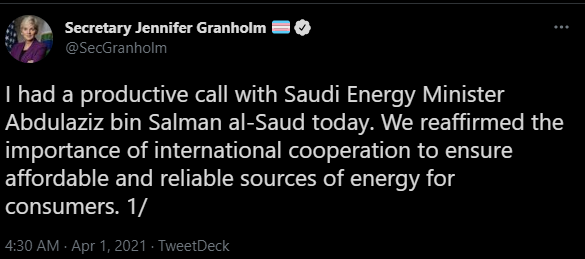

Tweet from the US Secretary of Energy 1

2/3

Investing.com – This is the first contact between a senior official in the US Department of Energy under President Joe Biden and his counterpart in Saudi Arabia, the world’s largest producer and exporter of oil.

US Energy Secretary Jennifer Granholm said on Twitter that she phoned Saudi Energy Minister Prince Abdulaziz bin Salman.

This is to reaffirm the importance of international cooperation to ensure reliable and affordable energy for consumers, according to Granholm’s tweet.

This is the first telephone conversation with Saudi Arabia by a US official before the OPEC meeting since US President Joe Biden took office.

The United States has said in its communication with the Kingdom that energy should be kept at affordable prices.

Energy Minister Prince Abdulaziz bin Salman said the cautious stance of “OPEC Plus” was the right choice, adding that the recovery was still incomplete.

The Saudi energy minister added, during his speech at the meeting of OPEC and outside producer countries, that caution must be maintained for the recovery to take place.

Prince Abdulaziz bin Salman said OPEC + continues to respond to market needs and will strive to find solutions.

Prince Abdulaziz bin Salman said at the opening of the OPEC + meeting last month that a cautious and restrained approach must be taken.

During these times, according to sources, it appears that OPEC + has agreed to gradually reduce production cuts, starting next May.

An OPEC + source said that “a majority within the group supports extending the one-month oil production cut,” according to Reuters.

On the other hand, the sources said that the gradual easing of OPEC + oil production cuts covers the months of May through July.

OPEC + agreed early last month to cut production by more than 7 million barrels per day to support prices and reduce oversupply.

This is in addition to Saudi Arabia’s voluntary reduction of its production by one million barrels per day for two consecutive months in February and March.

The price fell 3.9% during the month of March, while it rose 23% in the first three months of 2021.

While West Texas fell 3.8% during the month of March, while it rose 22% during the first quarter of this year 2021.

The increase was driven by several factors, including the adverse weather conditions that hit Texas, which resulted in the disruption of many refineries (SE :).

At the same time, the pace of Coronavirus vaccinations has accelerated, raising hopes of a rapid economic recovery and emerging from the repercussions of the shutdown and increased demand.

What fueled prices at the end of March was the suspension of tanker transit on the world’s most important waterway for about 5 days, after a Japanese ship grounded in the canal. from Suez.

OPEC + has lowered its forecast for oil demand growth in 2021 by 300,000 barrels per day, in light of concerns about the market recovering amid further closures to tackle the Corona virus.

Despite the continued flow of OECD commercial stocks, they are still above the 2015-2019 average.

The committee expects demand for oil to increase 5.6 million barrels per day this year, down 300,000 barrels per day from its previous forecast.

JPMorgan said in a research note that he believed OPEC + would exercise caution at its meeting this week by extending most of its production cuts until the end of May.

GB Morgan (NYSE 🙂 added that Saudi Arabia would extend its voluntary two-month reduction until the end of June.

“We expect the alliance to start ramping up production with increases of 500,000 barrels per day, starting in June and continuing into August,” he said ahead of the OPEC + meeting on Thursday.

The bank said Saudi Arabia was likely to reverse its voluntary 1 million b / d cut in July into two batches of 500,000 b / d each.

Nymex crude trades during these times ahead of the OPEC + meeting, up 2% to $ 60.25 a barrel, while Brent crude trades 1.7% higher to $ 63.8 the barrel.

[ad_2]

Source link