[ad_1]

The bankruptcy of Chain 11 of Sears Holdings Corp. (OTCPK: OTCPK: SHLDQ) has become even more confusing and chaotic. A recovery plan is expected to be filed by the end of the day of April 15, but not even their biggest creditor, Eddie Lampert, has yet seen the rough draft of the plan. The company has still not filed its monthly operating report in February. Massive requests for business tax payments are made with uncertainty if there is enough cash to pay them or future taxes. Sears Holdings (OldSears) appears to be "administratively insolvent". The parties are still fighting over the terms of the sale of assets to Lampert, and OldSears spends liquidity to ensure the security of its debt.

Reorganization plan planned for April 15

The reorganization plan for Ch.11 is expected by April 15th. At the February 14 hearing, Drain J. agreed (file 2626) to extend the exclusive filing period until April 15 and to seek acceptance until June 12. OldSears wanted an extension of time to file a plan until June 12, but the Official Unsecured Creditors Committee objected (file 2544) to such a lengthy extension.

I have not seen any court file to request another extension. Either they should file a plan by the end of the day of April 15, or they realize that a reorganization plan can not be confirmed anyway and that they are planning to file a type of document. non-traditional regime that would allow them to get out of Chapter 11 by rejecting the bankruptcy case.

According to a recent court filing (file 3135) of a letter dated April 9, Lampert's lawyers say "ESL also requests a copy of the proposed reorganization plan, which we understand is provided to other interested parties. and should be provided to ESL as the main creditor of the debtors' property ".

So, it seems that a type of plan is created. I am shocked that just days before the scheduled deposit, OldSears still has not consulted with its largest creditor about the plan. They require acceptance (at least two-thirds of the dollar amount and the majority of debtors in this category) from at least one category of creditors for a plan to be confirmed. as well as compliance with other standards. Lampert controls several classes of creditors. You have to wonder what's going on in the world here.

Many SHLDQ investors are waiting to see how the $ 35 million that Lampert had promised to pay for the releases would be allocated to specific claim categories, including shareholders, as part of a chapter reorganization plan 11.

Administratively insolvent

Under paragraph 1129 (a) (9), administrative claims must be paid in full, unless the owners agree to a lower amount, for the court to confirm a recovery plan. There is, however, a way to bypass the full payment of these administrative claims and confirm the turnaround plan, but this is not an easy way to go. For example, Justice Bernstein, who is a Bankruptcy Judge in the Southern District of New York, affirmed the reorganization plan for Teligent Inc. 282 B.R. 765 (Bank S.D.N.Y. 2002). The plan was confirmed even though the company was administratively insolvent and only paid the administrative claims on the dollar, as none of the 454 holders of these claims had insisted on full payment. In fact, if someone had made the request for full payment, it is highly likely that he would have received nothing in recovery because of the company's extremely poor financial situation.

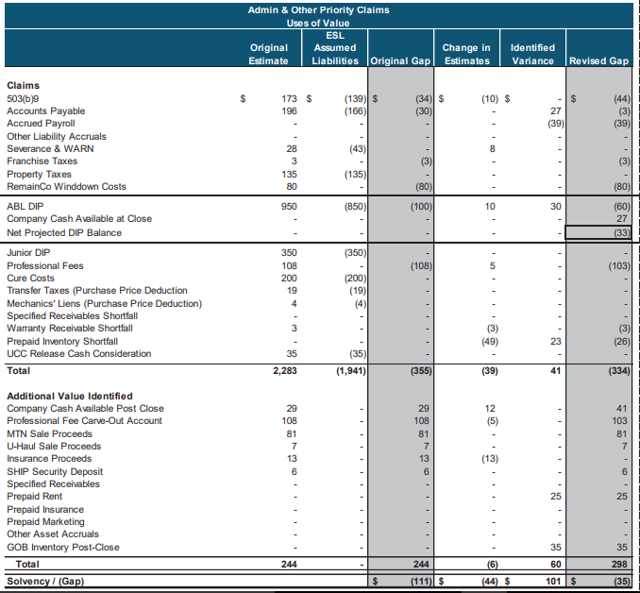

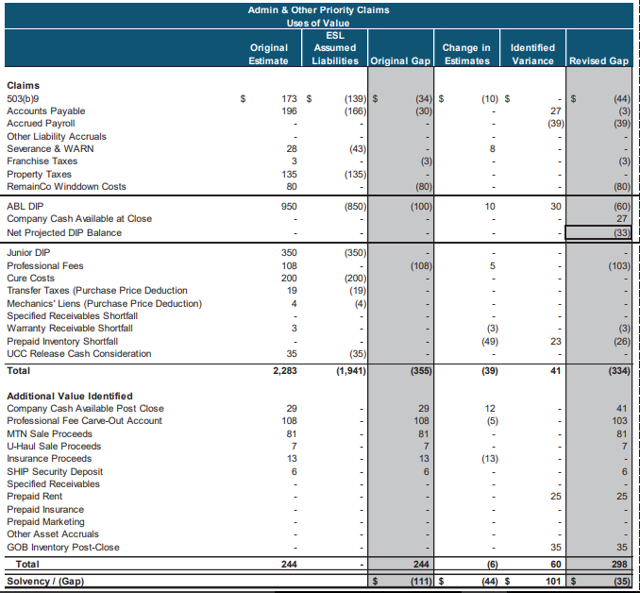

OldSears knew for months that he was administratively insolvent. They even had a weekly follow up for this, as shown in the table below. They expected to be insolvent a negative $ 111 million, but they were trying to make "wishful hacking" adjustments to reduce that amount to $ 35 million. I'm not sure about the status of some of these adjustments, but two of the items are likely to be much worse than these February 3 estimates.

Follow-up of the administrative solvency 3 February 2019

The $ 139 million in the above table for 503 (b) (9) administrative claims (some vendor claims) that Lampert / ESL is responsible for the payment will most likely be significantly reduced, which means that OldSears would have to pay further more of these administrative claims. . The amount paid by Lampert is reduced by at least $ 23 million ($ 69 million deficit at closing for prepaid inventory, minus $ 40 million that would have been paid for severance pay ). Lampert actually says that the lack of prepaid inventory was even more important.

The other problem is professional fees. The table above had the estimate at $ 108 million. My current estimate is over $ 128 million. The total professional fees payable after the close of the February 11 sale amounted to $ 73.736 million, not including the fees paid to Lazard, based on individual court reports. (This total is the standard retainer of 20% on fees.) I estimate $ 37 million in additional professional fees and $ 18 million in additional fees for Lazard. The main reason for the high estimate of additional professional fees is that Weil, Gotshal & Manges (OldSears lawyers) did not charge a fee until January 31st. Their last fee / fee deposit was made on April 8 (file 3084) for $ 9.498. millions for only the month of January. Many other law firms and financial advisors also charge OldSears.

How much money has OldSears?

It seems that Ray Schrock of Weil, Gotshal (Advocate of OldSears) made very misleading statements. In a letter dated March 6 (file 2767) to Lampert's lawyers, he stated:

"The sellers did not have money available at 12:01 am, New York time, on that date (February 11, 2019). Bank of America, N.A., in its capacity as administrative agent within the meaning of the DIP, opened all the cash balances of the sellers and immediately used them to reduce the balance. "

Notice how he declared "all the money from the sellers".

In a letter sent April 4 by Schrock to the same lawyers, he said:

".. in the interest of transparency, please note that the Winddown account currently contains approximately $ 93 million."

It therefore appears that, on February 11, "all cash from the sellers" was not used to pay the balance of the DIP. His statement was extremely misleading (I was misled) and should have been qualified to state that it did not include cash from the wind up account or any other account not included.

The monthly operating report for the month of February has not yet been filed with the US custodian. I can only assume, because of all the disputes regarding various financial items with OldSears and ESL, that it is impossible to create this required monthly deposit. When (or if) will be deposited, the cash declaration will be interesting to see, as will the rest of the balance sheet items after the sale of most of their assets.

Major problem of cash collateral

The lawyers for the conventional lien trustee (file 3050), ESL (file 3135) and Cyrus Capital (file 3142) have recently filed documents in support of the motion to prohibit OldSears from using a cash collateral. They say OldSears uses cash from the sale of inventories and other two-thirds guarantees to pay the huge professional fees in recent weeks instead of using cash from the Wind-down account. They also claim that the value of their collateral has dropped significantly.

It does not appear that OldSears denies the use of this money and claims that they have the right to use the money under the DIP agreement, as Schrock stated in the same letter as above : "… the current use of the cash collateral is in accordance with the applicable provisions of the final DIP order". He further stated,

"… We do not believe that the ESL sureties have lost their value and that their interests are more than adequately protected by the adequate protective provisions already contained in the definitive DIP order."

Really? So, why do the tickets sell for 20?

This motion is very late. The money has already been spent. I have spoken to Wilmington Trust's lawyer and other people about the current warranties and the value of these warranties behind 2lien banknotes. I am not convinced that there are many specific warranties for these tickets. I am also not comfortable with a payment via a 507 (b) claim.

Investors are confused

It seems that some investors have been baffled by two recent news items. First, Sears posted on its previous website a statement regarding the opening of new, smaller stores. Due to the way some media reported this news, investors may have thought OldSears was opening new stores. Lampert / ESL are opening these stores – not Sears Holdings Corp./SHLDQ/OldSears. The second news was that Transform Holdco LLC (Lampert / ESL) wanted to buy Sears Hometown and Outlet Stores, Inc. (SHOS) at $ 2.25 per share. This potential offer has nothing to do with SHLDQ.

Conclusion

This bankruptcy case only gets more and more chaotic as the process progresses. For investors in SHLDQ shares and unsecured bonds, the only hope of recovery is the $ 35 million promised by Lampert for the releases. The reorganization plan should, in theory, specify how this money will be allocated to different classes of claims. Questions about potential recoveries for noteholders are too uncertain to allow rational recommendation.

The reorganization plan is expected by April 15, but if Sears Holdings is administratively insolvent, I have major doubts that this plan can be upheld by the court. A critical hearing is scheduled for April 18 regarding the disagreements over the sale last February and the use of the cash bond guarantee. There are other items on the agenda that day, but I'm not sure that they will all be settled that day.

Disclosure: I / we have / we have no position in the actions mentioned, and do not plan to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

[ad_2]

Source link