[ad_1]

An analysis of a year of liquidity and trading data

Pressed to explain who uses them and why 99% of cryptographic currencies let all their air out, fly around the room emitting a raspberry sound, collide with the wall and collapse behind the sofa forever.

The party is over. Some however may present a credible use case. "Token-denominated securities" could be one of them: a more open and efficient way to trade in stocks and notes and to distribute cash flow.

Supporters of "Safe Token Offers" (STO) have been telling this story for just over a year. This data report examines the market, finds that few buyers buy it, questions market participants to find out their point of view, and reveals shortcomings in the ground-use scenario that explain their failure.

In October 2017, the market for "initial coin offerings", or ICO, reached a peak with more than 100 capital increases finalized through the sale of cryptographic chips, according to the Token Data market data provider. The promoters believed that these tokens were an innovation comparable to the stock company: it was not a claim on cash flow, but a vessel allowing direct participation and capture. the latent value of the network effects. The "symbolic" networks collecting funds during this month ranged from prosaic networks, such as a free cryptographic exchange called Cobinhood ($ 13.2 million), to a ridiculous one, like Dentacoin, "the blockchain solution of the global dental industry. "($ 1.1 million).

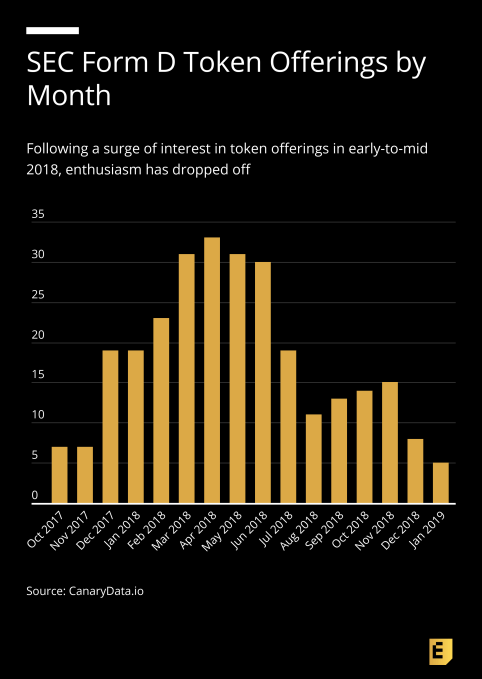

At the time, it was almost unheard of for such a project to recognize that his token could be a security like the ordinary stock certificate. In the following months, the US Securities and Exchange Commission (SEC) sent dozens of subpoenas to token issuers, stating that they were not in agreement . In March following, the number of registrations with the SEC for new token offers accounted for more than half of the total ICO transaction activity for the month.

As SEC and ICO cooling progresses, new enthusiasm for paperwork

The sudden popularity in 2018 of the so-called "security token" was undoubtedly a paper rush to the detriment of money. However, there is a case of use for "symbolized titles" that deserves to be considered. Bitcoin showed how the property could be digitally secured and transferred without an intermediary. Token security could do the same for investment contracts. "Smart Contracts" are a value proposition that has been discussed in cryptocurrency long before Bitcoin.

There is reason to be optimistic that this form of programmable ownership can bring efficiency, transparency, liquidity and access to the US $ 1.7 trillion annual private placement market. The value proposition is that smart contracts will reduce the cost of compliance during primary and secondary trading. Issuers benefit from reduced liquidity premiums and a larger number of competing buyers for their offer. Investors benefit from increased access to investment opportunities in the growth phase. It's a fascinating story about US capital markets, which for nearly two decades has deprived retail investors of any exposure to growth investments.

The decline of the small-cap IPO has reduced retail opportunities in terms of risk and return

This value proposition, as well as a tale of lowering market regulation, has led some to believe that securities would make a bull market cryptographic. The hype machine of Wall Street has gone from crypto; Security tokens are one of the few places where the greedy listener can detect the faint echoes of his passage.

Media tastings

- "If it works, you'll see earthquakes on Wall Street."

- "Apple and Tesla shares on blockchain could be next big success" – CNBC headline

- "2019: Offers of digital securities become the new ICO", -CoinDesk

- "Why Security Token Offers Replace Initial Coin Offers" – Silicon Valley Business Journal

Starting at 30,000 feet, the use scenario for token securities seems compelling. As in many blockchain projects, user-level zoom out and misaligned incentives appear for the major players in the market.

- investors: Digital tokens involve technological risk, regulatory risk and market risk. Without a liquid market ready to wait, private equity investors have little incentive to superimpose the risk to the return on risk they already understand.

- brokersEffective bankers and broker-dealers charge a premium for the primary issue; the more effective they are, the less incentive they have to adopt, especially since their investors do not claim this product.

- TransmittersAs markets are flooded with private capital, very few quality issuers are unable to raise funds. The better the investment opportunity, the more likely it is to access funds and top quartile investment banks, where investment decisions have decisive effects on the market. The interest in innovation that disrupts these relationships is therefore inversely related to capital adequacy, a repetition of the pattern in US issuers accessing new equity financing options under the JOBS Act.

If you build it, will they come?

To determine if new token security issues are finding their way into the market, Canary Data, an open cryptographic research initiative, has undertaken a comprehensive search of the SEC's news feeds and EDGAR database. , starting in 2017 and ending in mid-January, looking for public statements and deposits related to security chip offers. It is an imperfect method; our database of offers is constantly evolving as new information becomes available. But in an emerging segment of the financial markets, it reflects the level of credible and traditional activity.

We have filtered the chips that are in the mold of the "utility token" ICO, offering a financial instrument as a form of access to a valuable network effect. Many of them have registered as securities, but it is the value proposition of a traditional symbolic security – a cash flow claim, represented symbolically – that interests us.

[ad_2]

Source link