[ad_1]

Beyond Meat (BYND) is the newest and most important IPO to come on the market in 2019. I became interested in this business very recently, after being intrigued by what I considered to be the very low price of $ 1.6 billion, at $ 25. However, at the close of the opening day, at $ 65.75, or a market capitalization of about $ 4.2 billion, there was definitely less remaining value in stocks at this price level . My objective here will be to determine whether there is still value potential for equities at this new price in order to obtain superior long-term returns, and then ask whether these returns justify the extraordinary risk inherent in a nascent enterprise that is clearly many years after reaching profitability.

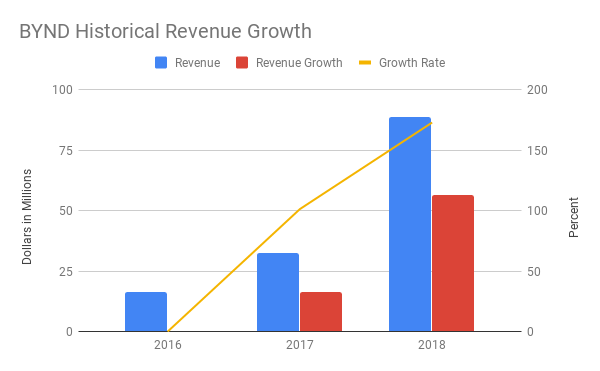

Historical trends look good but not sustainable

First, there's no denying that Beyond Meat is showing incredible sales growth. In 2018, the company achieved a turnover of about $ 88 million, compared with $ 16 to $ 33 million for each of the previous two years. This corresponds to a growth rate of over 100%, which actually speeds up. However, three-digit sales growth is clearly not a sustainable practice. I would therefore like to try to identify the drivers of this growth in order to obtain more reasonable estimates in the long term.

Source: BYND S-1

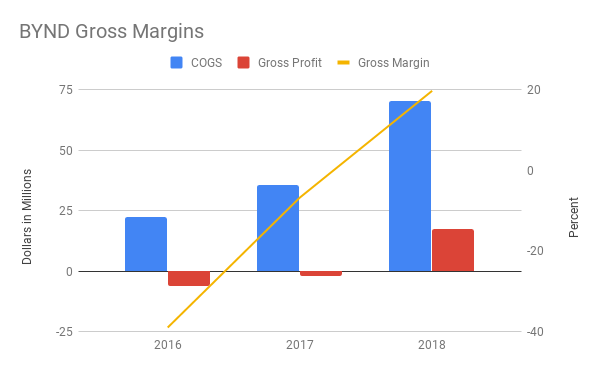

In addition, among this incredible growth that the company has experienced so far regarding sales, it has also been able to significantly increase its gross margins, from -39% in 2016 to 20% in 2016. % in 2018. These margins have grown over time, as sales grow exponentially, the cumulative effect has an incredible impact on gross profits. As for earnings, this trend can not be extrapolated indefinitely in the future, so my goal will be to identify a final limit for gross margins.

Source: BYND S-1

Until now, the historical data is really superb. What is perhaps most encouraging is how the company has already managed to increase its margins to a level that suggests that, by reducing operating costs, net profitability is already possible. By developing the business and realizing economies of scale, it is already possible to see how the 20% of the 2018 gross margin could translate into future profitability.

Identify growth drivers

If you follow my work, you will know that I tend to look for arguments based on numbers. There are certainly many qualitative reasons that will allow Beyond Meat to achieve strong growth, and I would recommend reading about the work of other authors to better understand them. My analysis instead stems from a position to already believe in the company and tries to quantify what it is capable of, in order to generate reasonable expectations and a fair value based on those expectations.

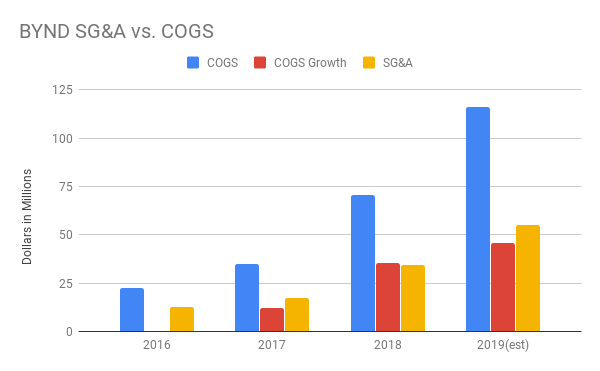

In the S-1 of the company, I found a very clear trend associating sales and business expenses with inventory growth. Because COGS is representative, if not perfectly proportional, to the volume of sales, I think it's a good starting point for determining how quickly the company can sell more products. At this point in the game, it is important to move more products, placing them on more shelves, in front of more customers. So, instead of judging the sales team based on revenue, I think it's worth evaluating them based on the number of products they've moved. Note that my estimates for 2019 are a simple annualization of the first quarter guidance contained in the S-1 of the company.

| 2016 | 2017 | 2018 | 2019 is. | |

| COGS | 22.494M | 35.772M | 70,36M | 116.00M |

| Inventory growth | N / A | 13.278M | 34.588M | 45,64M |

| SG & A | 12.672M | 17,143M | 34.461M | 55.00M |

| Efficiency | N / A | 77.5% | 100.4% | 83% |

Source: BYND S-1

As can be seen in the chart, SG & A costs are in line with COGS growth – rather than with themselves. So, while the ratio of sales to SG & A is increasing, as others have already pointed out, it is interesting to see this as this implies increased efficiency . Comparing SG & A with the growth of COGS helps to understand how and why this efficiency increases. . For the most part, I think it's best to understand sales, administrative and other overhead costs, such as customer relationship building and brand valuation – which are worth more than just individual sales. It therefore seems plausible that this relationship between growth in the cost of production and sales, administrative and other overhead costs is likely to continue. In the future, selling expenses, administrative expenses and other overheads will be the number to watch for – the bigger, the better it is – and the efficiency that the company achieves on these expenses.

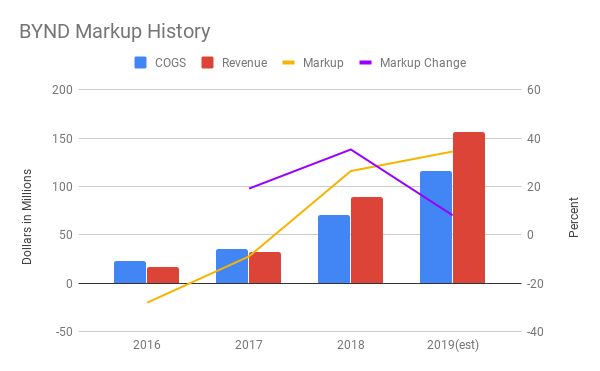

Next, it's important to look at where the margins seem likely to peak. I like to look at the margins, in this context, in an unorthodox way, preferring to calculate the markup. Instead of calculating what percentage of revenue is a profit, I like to understand how much profit is generated in addition to the cost. Since gross margins can never exceed 100% and the margin grows exponentially as costs approach 0% of revenue, I think margin observation is a better way of determining where the margins will eventually reach their maximum. Again, this next chart simply annualizes the Q1 guide found in S-1. These numbers are therefore probably lower than the mid – point of the year, but I think it 's useful to be on the conservative side.

Source: BYND S-1

It should be noted that the change in the profit margin has been reduced as of 2019. Again, this could be compromised by comparing only the expected performance in the first quarter, which, for a growing company with growing margins, could be below the midpoint of the year. Nevertheless, I would like to stay on the conservative side here. It therefore seems that the markup reaches a terminal level in the 40% zone, even optimistic, at 50%. I will use 45% in the future. This would have gross margins of the order of 29 to 33%. In fact, since a large portion of operating expenses is investment in growth, it should be possible to reduce sales, administrative and other overhead costs considerably, so as to achieve profitability, even using the current parameters. . However, given current market prices, it is clearly impossible to convert a few million dollars in gross profits into a profitable, multibillion-dollar investment.

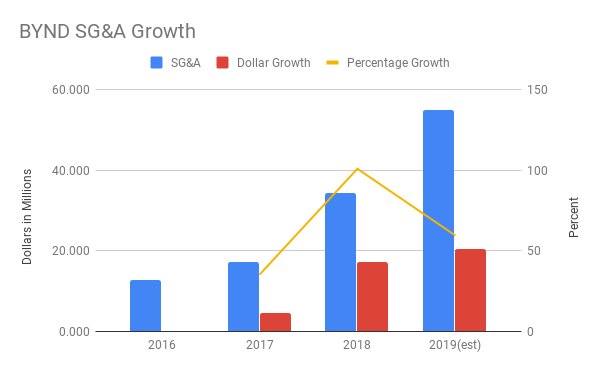

The last factor I want to look at is the acceleration we should expect. While it's really wild to expect a 100% growth rate acceleration, I'm looking for an acceleration of dollar value growth rather than a percentage growth. Ideally, this should be able to continue to accelerate until the company reaches a semblance of maturity – but in doing so, growth rates are likely to decrease over time as higher dollar figures compare less favorably to the overall picture. Since selling, general and administrative expenses are related to product sales, it is prudent to estimate future growth.

Source: BYND S-1

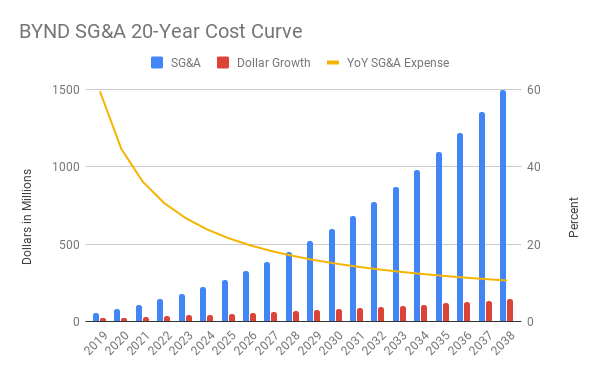

As can be seen in this last chart, growth in SG & A expenses did not increase, or at least did not increase, at a constant rate. Using the 2018 value as a baseline, however, it seems plausible that dollar growth is increasing by about 5% plus $ 3 million a year. As the growth of the dollar becomes a lower percentage overall, the growth rate from one year to the next will moderate to a more reasonable level, even if growth dollar continues to accelerate.

Finally, I would like to take a look at the tangible capital investments and the number of products that the company is able to produce from a given investment in facilities. Although the construction of more facilities is a capital expense rather than an operating cost, it makes sense to link these plants to selling, administrative and other overhead costs that I consider an investment. In 2017, the company had $ 14 million of property, plant and equipment on the balance sheet and spent $ 34.8 million in cost of goods sold. In 2018, they totaled approximately $ 30.5 million in property, plant and equipment and spent $ 70.4 million in cost of goods sold. The efficiency seems to diminish a bit, with 248% of tangible fixed assets produced in 2017 and only 231% in 2018. Nevertheless, it is quite similar and I'm expecting bigger savings from the rest of the year. scale in the future. production facilities to process 250% of their product value per year.

Look beyond

By understanding what's driving growth, rather than extrapolating growth rates and hoping for the best, I think it's now possible to combine everything to get a rough estimate of growth in the economy. company, in figures. Once the numbers reach a level that could be described as "mature", with low growth, then it is possible to value this mature company and make rebates at the back to identify a fair value for today. # 39; hui. In addition, we can assess our expectations for cash consumption over the next few years and ask if dilutive events may be necessary in the future. The optimal solution for the current shareholders would therefore be to buy at a minimum price, to make the shares appreciate at excessively high prices, to proceed with a capital increase, and then to lower the shares when the company will achieve profitability and can begin to reward shareholders. directly with redemptions and dividends. Of course, my own philosophy would prevent me from owning shares if I considered them too expensive. On the positive side, I explain why it is acceptable (if not ideal) for companies to issue shares, even when stocks are highly undervalued, as long as they have in mind a higher alternative investment with money, in my previous contract. strategy article "The three R's of the distribution of big capital".

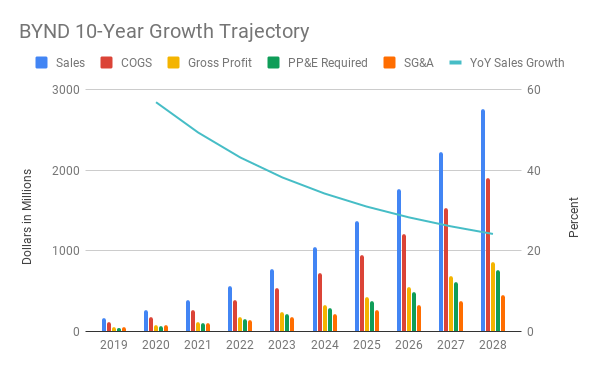

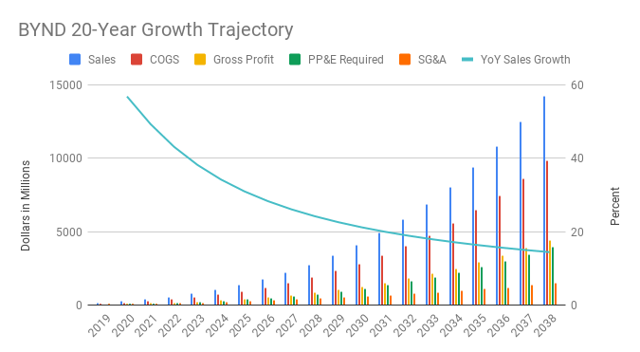

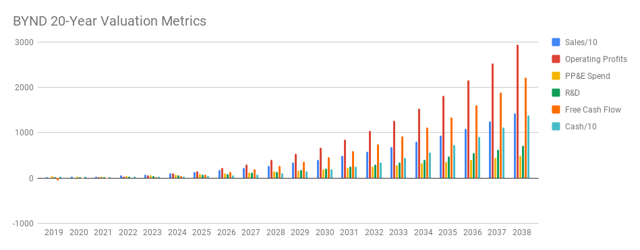

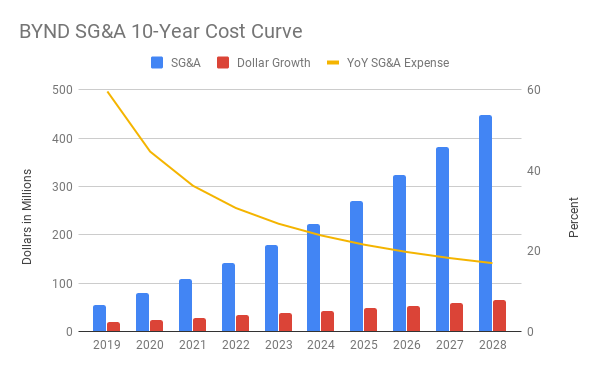

To start with, let's go back to SG & A. Beginning with an estimate of SG & A for 2019 of $ 55 million and increasing by $ 20.5 million + 3 million + 5% per year, here is the growth curve of spending for the ten next twenty years.

Source: Author

With an average conversion efficiency of 87% of sales, administrative and other overhead costs into a larger number of products sold, and a 45% mark-up, this next pair of graphs indicates the number of installations needed to produce all the necessary products, as well as total and gross sales. profits.

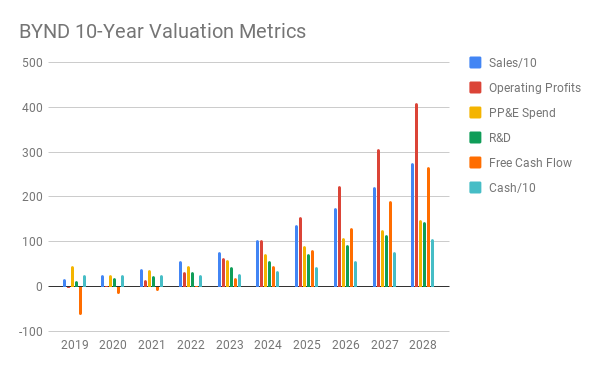

Finally, this last series of graphs shows, over ten to twenty years, the operating profits, contrasting with the cash charges related to the investments. I have separated the R & D operating expenses here because I consider this as an investment in the future, as any other investment. For a number, I used 5% of sales, which is lower than the current price, but probably higher than expected in the future, as a food company. However, the company may have good reason to spend much more than the industry in research and development, with high-tech products. This also shows the accumulated cash on the balance sheet assuming reinvestment in 3% bonds. This would probably bring more benefits elsewhere, but I have noticed that many tech companies like to rack up money, and I would prefer the standard to be conservative here. This will serve as added value for every dollar in addition to evaluating my business. To make the graphs a little easier to read, I divided the business figure and the money accumulated by 10, in order to align them further on the rest of the values.

Key values in this latest chart include 26-year estimates of free cash flow at $ 266 million and $ 2220 million at 20 years. It should also be noted that the net liquidity shown in the balance sheet never falls below approximately $ 250 million, which indicates that, in accordance with this general pattern, a capital increase will not be necessary. After 10 years, accumulated liquidity reaches $ 1,071 million and nearly $ 14 billion at the end of the next 20 years.

Evaluation and conclusion

Of course, with any long-term horizon estimate like this, there are a ton of places to go wrong. As such, this article and my analysis constitute only an approximate framework of expectations and an evaluation objective corresponding to these expectations. For other investors who believe in the mission and the successful implementation of Beyond Meat's strategy, and who do not think that I've made a lot of far-fetched assumptions about the future, this evaluation should prove useful.

Based on my FCFTR methodology, I estimate BYND at 50×2028 free cash flow, plus cash flow, with a discount of 15% per annum at approximately $ 3.6 billion. With BYND Friday close to $ 66.79, a market capitalization of $ 4.2 billion, I consider the company to be overvalued at around 20%, against an annual return forecast of 15% / year. In my 20-year figures, I estimate BYND at 25 times 2038 free cash flow plus cash, also discounted at 15% per annum, to reach $ 4.33 billion. Over a longer horizon, BYND seems to be quite appreciated compared to a 15% / year yield expectation.

Unfortunately, with the soaring IPO, I can not see any outstanding value in BYND anymore. Ideally, for a company as young as the growing one, I would like to be very well paid to take the risk of investing. The goal is to be able to buy with a significant discount, even with an expected annual return of 15%. This would sell at or near fair value, with significant short-term returns, and minimize long-term risk, or outperformance for long-term holding. Unfortunately, the market beat me after opening up almost 100% of the initially cheap price. However, with the immense volatility inherent in IPOs, I think there is a reasonable chance of falling back, where an opportunity may arise. As such, I will seek to sell $ 50 put options (a market capitalization of $ 3.15 billion), with the potential to write more to lesser strikes. Once the options are available, this should present a compelling revenue opportunity, the disadvantage being a long position on a high risk / highly profitable stock, at a price that seems more than fair.

Disclosure: I / we have no position on the actions mentioned, but I can initiate a long position on BYND within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link