[ad_1]

Tesla Inc (NASDAQ: TSLA) with a combination of weak balance sheet, cash flow problems, apparent overcapacity, emerging demand uncertainties, growing negative sentiment, broken stock market again The valuation "to wealth" makes the stock a convincing title. In addition; I am bearish on the company's growth prospects beyond the current estimates and I think the next lower step will be driven by adverse macroeconomic factors. The last bearish that crossed the target is a prospect of lower prices for gasoline. Value-conscious consumers will now have one more reason to move from Model 3 if the argument of affordability of electric vehicles and lower cost of ownership is reduced as a point of sale. Margins are important and Tesla can not afford to lose momentum. I think Tesla has more disadvantages despite a 43% drop this year. This article underlines my downside thesis and sets a price target of $ 120 by the end of this year.

TSLA monthly course graph. source: FinViz.com

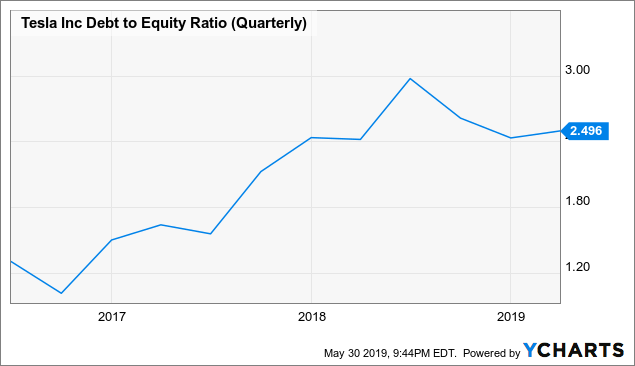

May 2019 will be remembered as the month when the TSLA bears delivered a knockout in the battle against the bulls. This has been a great stock market value for me over the past five years and up. The bearish business that for many years was based on the belief that the TSLA valuation was absurd has long been true. At the current stock price of 188 USD, TSLA is getting closer to its lowest level since December 2016. What should worry investors is that the financial outlook and the macroeconomic configuration may be worse. today only when TSLA was last traded at this level. The company is now more indebted and faces cash flow difficulties at a crucial point in the market cycle.

Data by YCharts

The challenges that TSLA faces are not secret. The stock is already in sharp decline in 2019, but investors and traders must now evaluate the sequence of events. As in many areas of finance and the economy, the battle will be delivered at the margin. Tesla needs this additional buyer, this added efficiency and this cost reduction measure, this additional good news to regain a positive momentum that may not occur.

Lower gas prices reduce the affordability gap for electric vehicles

Do not look now, but oil and gas futures have fallen by 12.3% and 11.2% respectively in the last two weeks. The market is beginning to recognize that among the rhetoric of the ongoing trade dispute between China and the United States is the growing concern of a global cyclical downturn. Clearly, a recession in the United States or the much-feared "hard landing" scenario in China is a negative factor for Tesla, and recent price developments are already a partial proof of this. What I am focusing on is the impact that falling energy prices, especially gasoline, will have on this marginal Tesla buyer.

Table of prices for gasoline and crude oil. source: FinViz.com/ author annotations

According to the US Environmental Protection Agency, the average fuel economy of cars has accelerated in recent years and was last recorded at 24.9 mpg in 2017. Generally, the price of retail gasoline is offset from the wholesale price. The gas price monitoring website, Gasbuddy.com, made the following comments in which it predicted a downward trend in retail prices.

Average gasoline prices are expected to fall for a fourth consecutive week this week, as last week's oil price drop likely began to drive down retail gasoline prices. In the absence of breakthrough in trade tensions between the United States and China, the national average should continue to decline for several weeks.

A 12% drop in the price of retail gasoline in the coming months could save about $ 30 per month for the typical consumer who travels 13,000 km a year. Whether you think it's important or not, the fact remains that consumers will feel the effects of lower prices and, combined with rising wages in the United States, this is just one less reason to rush and order a Tesla. Again, listen to me, we are talking about margins. Although the real elasticity of demand for Tesla vehicles relative to gasoline prices is not known, the difference of 1 to 2% of buyers who are away from a purchase from Tesla because gasoline prices are low could have a significant impact on confidence. The trend in gas prices should be global and not just in the United States.

Tesla recently confirmed the orientation of 360,000 to 400,000 car deliveries in 2019, a relatively broad range of 10%. Realistically, a lower number would be considered a disaster. The order backlog of Q4 will be just as important. The point here is that if we assume a scenario of escalating trade war, record oil production, refineries being put back into service after spring maintenance and the prospect of a global slowdown, all this points to a Bearish scenario for Tesla's demand.

The bearish case of Tesla

- Low balance sheet / cash consumption

- Demand issues, capacity> demand over 1 to 3 years

- Saturation in key markets (North America / Scandinavia)

- Weakness of the S / X model (design of the S model obsolete even taking into account the recent update)

- Model 3 Cannibalize Potential Buyers of Low Cost S / X Models

- Loss of trust of Elon Musk (potentially considered a given liability)

- China's cyclical weakness (tightening consumer credit / slowing growth)

- Lower gasoline prices (more disadvantages), which keeps marginal customers on the sidelines

I am confident that future sales and growth will be below current expectations. Tesla has simply expanded its capacity too quickly and not everyone wants it and the headwinds create a weaker operating environment. Tesla is not immune to a recession and the chances are increasing. A dreaded "hard landing" in China could make the future Shanghai Gigafactory a true relic of exuberance. I do not think Tesla goes to zero, but the risks here are important and we have not seen the bottom yet.

Rising short-term interest will increase sales pressure

According to YCharts, the latest reported interest on TSLA was reported for May 15, representing about 21% of the outstanding shares, with a clear increase in recent weeks, in line with the current sale. I expect that in the next update of short interest rates taking into account the data up to May 31, this ratio will increase as some large-cap stocks presenting the highest interest rate in the market regularly reach levels above 30%. What I am focusing on is that this measure still has a positive potential based on the company's short-term record of interest, which had reached 28% in 2012. The current weakness is that it's a good thing. encourages the bears to bring down prices. This means that in the absence of a major catalyst or major positive development, the stock will likely remain under pressure and under attack. On the basis of recent commercial transactions, the main long-term investors have decided that the time has come to sell.

Data by YCharts

Conclusion

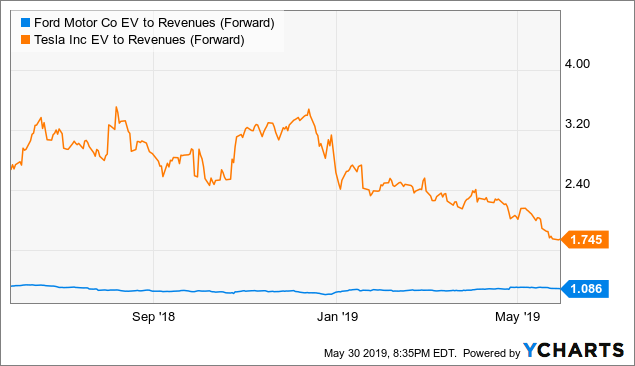

I manage a short Tesla position via the options. My price target is $ 120, which is about 36% lower than the current price. I think that he can reach this level in the next year. The price target is based on a comparison with Ford Motor Co (NYSE: F) which trades at 1.1x the value of the company's futures income (EV / FWD earnings). TSLA would be equal to a multiple of F at around $ 117. Ford has a better business model and a better product line, relying on fuel-efficient vehicles while incorporating hybrid options. Although I like Ford as a brand, I am not a stock buyer here either. The macro-bear business would have far-reaching implications for the entire market and, of course, F would also be affected.

Data by YCharts

If the shares of the TSLA reach $ 120, the price may still be too high. An estimate of $ 22 billion and a profit of 18x for the 2010 fiscal year would, in my opinion, be fair. However, the possibility of a further deterioration in outlook and a weaker-than-expected financial situation would open the door to further decline. A global recession could very well bring down the TSLA modeling of less than 50 USD by 20 to 30% compared to sales forecasts. For bearers looking for lower levels, the risk is that the current macroeconomic winds are much less benign than the configuration implies. A quick and favorable resolution with China, Trump's withdrawal of tariffs with Mexico and better-than-expected operational figures would be an advantage for TSLA, which helps the stock find a fund. I think the risks are down.

Disclosure: I am / we are TSLA short. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link