[ad_1]

The Fadeaway Move

"Fadeaway" is a well-known but quite difficult movement in the basketball game.

A bottom effect or a fall in basketball is a jump shot taken by jumping back, away from the basket. The goal is to create a space between the shooter and the defender, making the shot much more difficult to block. The shooter must have very good accuracy and must use more force in a relatively short period of time. – Wikipedia

Michael Jordan was one of the most popular fashion shooters. Wilt Chamberlain, Patrick Ewing, LeBron James, Kobe Bryant, Hakeem Olajuwon, Dwyane Wade, Karl Malone and Larry Bird are some of the greatest of all times ("GOAT") also known for using this movement. It's no coincidence that those who have worn the fadeaway to perfection are also those on the GOAT list.

Similarly, in recent years, semiconductors have perfected their trend by creating more than sufficient space (profit margins) between them (suppliers) and their "advocates" (customers), making the price of the stock more difficult to "block". ".

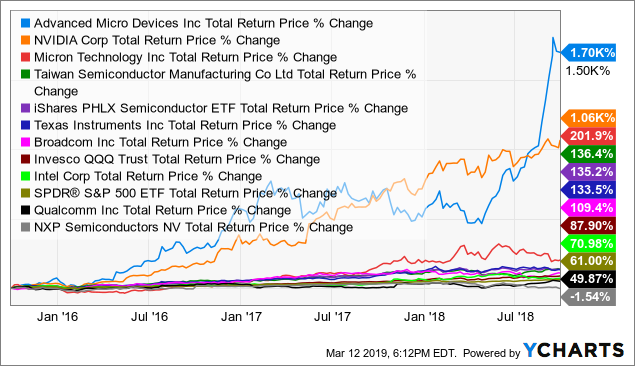

Here's how "semiconductors" have "played" for a period of 3 years, before the fourth quarter of 2018 (ie 9/30/2015-9 / 30/2018):

Some quick observations:

1. Almost all big names have outperformed the entire market (S & P 500). The total returns of Nvidia Corp. (NVDA), Advanced Micro Devices Inc. (AMD), Micron Technology Inc. (MU), Taiwan Semiconductor Manufacturing Co. Ltd. (TSM), Texas Instruments Inc. (TXN), Broadcom Inc. (AVGO) and Intel Corp. (INTC) were much better than SPDR® S & P 500 ETF (SPY).

Only Qualcomm Inc. (QCOM) and NXP Semiconductors NV (NXPI) underperformed the index. We focused on these two companies (with AVGO) in "three Musketeers", our most recent article.

2. With the exception of INTC, all names that outperformed the SPY also outperformed the technology benchmark – Invesco QQQ Trust (QQQ).

3. Four companies – NVDA, AMD, MU and TSM – have outperformed the benchmark iShares PHLX Semiconductor ETF (SOXX). However, only the first three managed to do so decisively.

The top three semifinals (over the last three years) – namely AMD, NVDA and MU – have been featured in some of our articles over the last 15 months. To witness it:

In case you have not understood it yet, we love the semi-finals. We think it's the past, the present and the future. It is difficult (and frankly, it makes no sense) to discuss growth and potential here.

We like the three names – AMD, NVDA and MU – and we all have them.

That said, we love AMD better, mainly because we consider it the best choice in terms of risk / return, but also because we think that AMD has more potential to shine in an already brilliant realm. In other words, it will be easier for AMD to beat and perform than its main peers.

Source: Seedling: It's not just who you want to play with, but how you want to play (Part I), March 14, 2018

In this two-part article, we focused on our favorite half-selections, AMD, MU, and NVDA.

At this point, you (hopefully) can understand why we hold this trio and why AMD is our sunshine.

Just as the three tenors – the Spaniards Plácido Domingo and José Carreras, and the Italian Luciano Pavarotti – have created an incredible singing group in the 1990s and early 2000s, we believe that the three semi-finals create a group in incredible growth in the years 2010 and 2020..

No tears, no fears and only one o Sole Mio: AMD.

Source: Sowing: It's not just who you want to play with, but how you want to play (Part II), March 16, 2018

As you can see, we were on site (already at the end of 2017, more details / proofs below) with the choice of AMD as a semi-trailer of choice at the end of the year. 2017, as well as with the dumping of NVDA.

The same goes for the reversal of our long position on AMD in short position, just before the fourth quarter of 2018. This short position was closed on during Q4 / 2018and since then we have no position in AMD. (Until this week, more details below.)

Fadeaway mode

Nevertheless, we remind you that "the shooter must have a very good precision and must use more force in a relatively short period of time".

The semifinals had the precision and strength, but now it seems that for many of them, time and energy are exhausting.

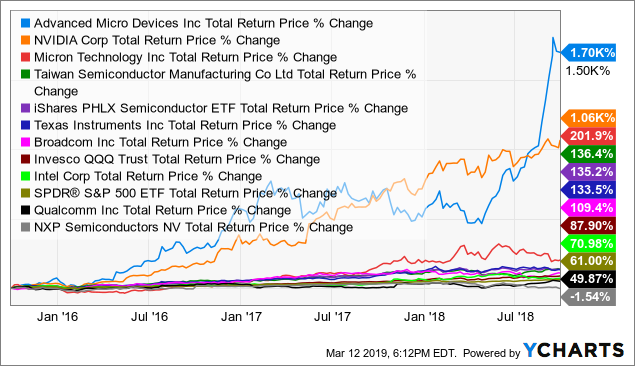

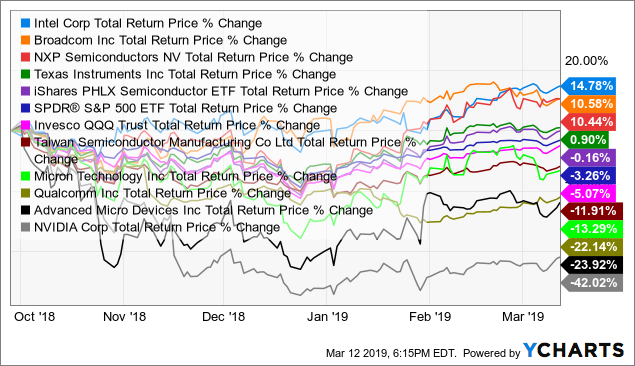

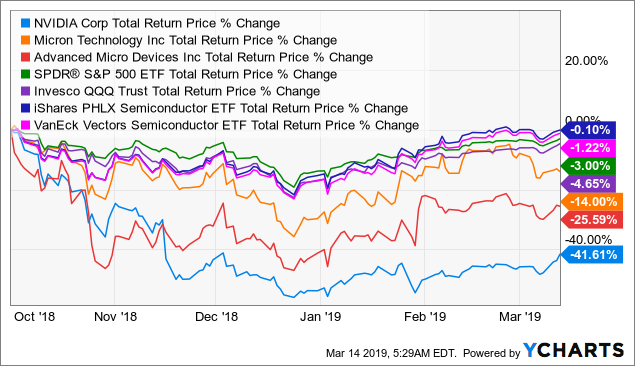

Here is how the same list of companies above has evolved since the beginning of the fourth quarter of 2018 and up to now (closing price of 3/12/2019):

A quick observation: only four names outperformed the global market (S & P 500), the technology sector (QQQ, XLK, VGT, FDN, IYW) and / or the reference of semiconductors.

The total returns of the iShares PHLX Semiconductor (SOXX), SPDR® S & P 500 (SPY) and Invesco QQQ Trust (QQQ) ETFs since 01.10.2018 are higher than those of Taiwan Semiconductor Manufacturing Co. Ltd., Micron Technology Inc. , Qualcomm Inc., Advanced Micro Devices Inc. and Nvidia Corp.

Only Intel Corp., Broadcom Inc., NXP Semiconductors NV, and Texas Instruments Inc. performed better than the benchmark.

The "Fadeaway Mode" is even more stunning when we focus on the NVDA, MU and AND trio.

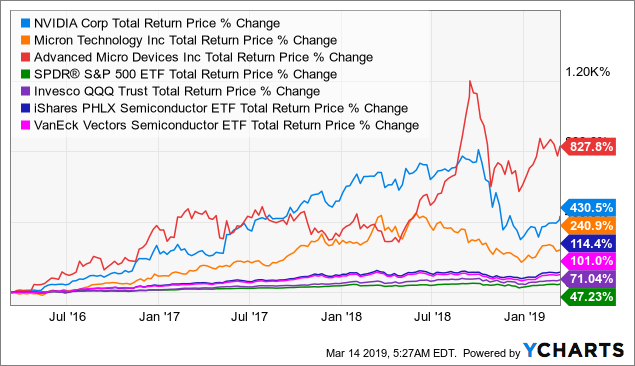

Total return – Last three years (until 13/03/2019)

The last three years have only been paradise for the trio, even though we include the last few very difficult months.

AMD (+ 828% TR), NVDA (+ 431%) and MU (+ 241%) left dust to all other benchmarks, whether diversified (SPY, QQQ) or focused (SOXX, SMH):

- ETF iShares PHLX Semiconductor (SOXX) + 114%

- VanEck Vectors Semiconductor ETF (SMH) + 101%

- SPDR® S & P 500 ETF (SPY) + 47%

- Trust QQQ Invesco (QQQ) + 71%

Total return – 2018

Nevertheless, if we look at 2018 on a stand-alone basis, including its devastating fourth quarter, it's no longer a mixed bag.

While AMD has managed to finish the year as the top performer in the S & P 500 index, NVDA and MU will remember 2018 far less affectionately.

Source: FactSet

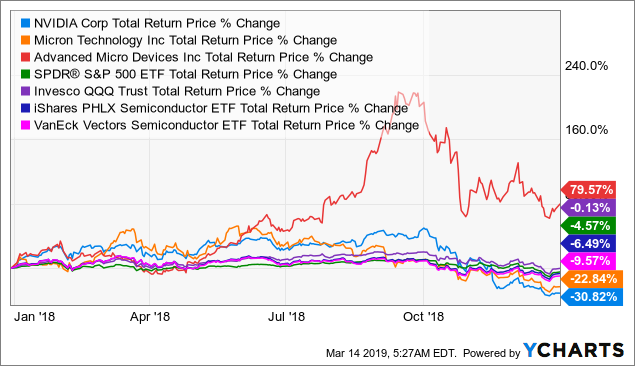

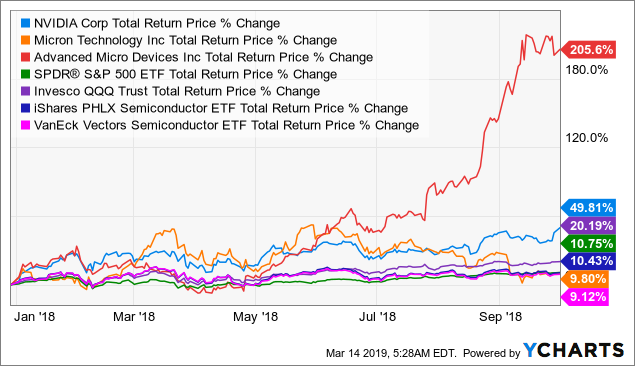

That said, 2018 should not be considered as a whole. Since the last quarter was so different from the previous three quarters, here is a split view from 2018 until the decisive date (October 1, 2018):

- Total return from 01/01/2018 to 01/10/2018

"The gold era" during which AMD (+ 206%), NVDA (+ 50%) and, to a much lesser extent, MU (+ 10%) outperformed the main ETFs of the semi -conductors (SOXX + 10%, SMH + 9%). ), as well as the main indices (QQQ + 20%, SPY + 11%) of one mile.

- Total return from 01/10/2018 to 13/03/2019

Then came the 01/10/2018 and from that date, things are not the same in the semifinals. Since then, it's like a mirror image compared to the one we've experienced in the first three quarters of 2018. NVDA (-42%), AMD (-26%) and MU (-14%) are far behind the leaders of semiconductor ETFs. (SOXX flat, SMH -1%), as well as the main indices (QQQ -5%, SPY -3%).

Obviously, we are witnessing a real fadeaway. The question now is to know what the future holds for these semifinals and we will try to find out throughout the rest of this article.

Past earnings and other financial aspects

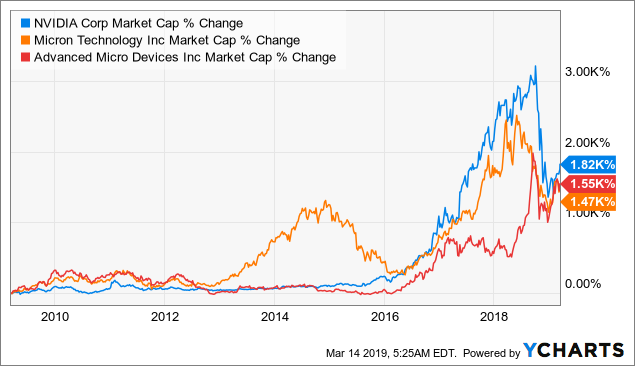

First of all, it is important to note that NVDA alone represents a market size almost 50% greater than the combined market capitalization sizes of MU and AMD.

That said, it is worth noting that while the current trend is down for NVDA and MU, and on the rise for AMD. In other words, the gap (in size) is narrowing and we expect it to narrow further, to go further.

The table below is a perfect illustration of this amazing series of semi-finals, illustrating the evolution of the trio's market capitalizations over the last decade.

Ten years ago, the three companies were tiny farms that no one was watching. At the height of their evaluation (each independently), the three companies were worth more than $ 300 billion (!), With NVDA accounting for two-thirds.

Given that the current combined market capitalization is more than 40% (or about 60% three months ago) lower than the combined combined peak levels, it may seem (to some of you) that these companies are losing their "mojo". We, however, would not make such a generalization; at least not yet …

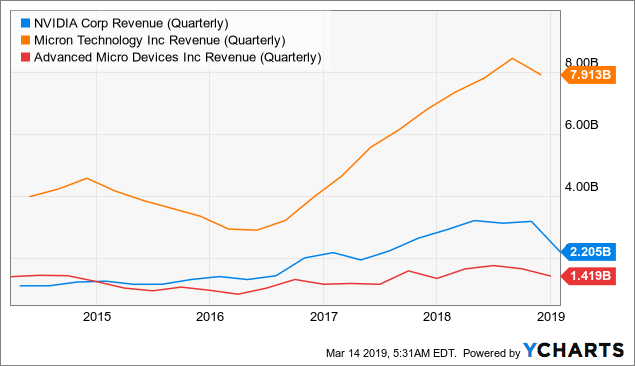

Over the last two years, MU was in a league of its own, doubling more than its average quarterly revenue from 2016 to 2018. However, the golden time of MU is now over and its flagship DRAM and NAND products are expected to decline continuous in the foreseeable future.

It is precisely for this reason that Wells Fargo (WFC) analysts have simply lowered their expectations of Micron, citing concerns about the price of DRAMs. WFC analysts now expect revenues of only $ 22.58 billion ($ 29.9 billion, -25%!) And EPS of $ 5.26 (instead of $ 5.87; %) in 19 years.

Risks include the highly volatile prices of DRAM and NAND, the need for relatively large capital investments and the significant fluctuations in Micron's profitability that have occurred in the past and which we believe should continue.

Nevertheless, WFC still attributes MU "outperformance" with a PT of 50 USD, analysts of the bank remain convinced that "the inducers of secular demand in the long term remain intact".

Nvidia, the group that has experienced strong growth over the last five years, until the fourth quarter of 2018, is the upheavaler. On January 28, 1919, Nvidia took the market off guard by drastically reducing its forecast for the fourth quarter of 2018. Due to weak gaming and data center sales.

Perhaps drawing lessons from the Apple experience (AAPL), Nvidia prepared the market for the worst, then – when the real numbers were announced (Feb. 14) – the two companies delighted investors with more optimistic forecasts for years to come.

In the case of Nvidia, the company guided its revenue for fiscal year 2020, still better than the market, more bearish, according to a consensus (after the "preparation" of 28/01/2019), in the 39, waiting for a 5% decline.

The fourth quarter was an extraordinary quarter, unusually turbulent and disappointing. In the future, we are confident in our strategies and growth drivers. – Jensen Huang, CEO of Nvidia

Earlier this week, the company announced the acquisition of Mellanox (MLNX) for about $ 6.9 billion. Although, once the transaction is completed, Nvidia expects the purchase to be immediately accretive for gross margin, earnings per share and non-GAAP FCF, we do not believe that this acquisition will displace the purchase. Needle too much.

Looking at the most recent data for the fiscal year:

- Turnover: NVDA: $ 11.72 billion, MLNX: $ 1.09 billion (an increase of 9.3%, in the event of zero cannibalization)

- Net income: NVDA: $ 4.14 billion, MLNX: $ 134.26 million (an increase of 3.2%, in the event of zero cannibalization)

So, even if we assume a "sum of all parts" (without cannibalization), based on last year's figures (and we do not think NVDA would be able to repeat them …), this agreement is not a game changer.

Although Nvidia is probably the best buyer of Mellanox – unlike other interested parties such as Microsoft (MSFT), Intel, Xilinx (XLNX) or IBM (IBM) – this does not mean that Mellanox is in a position to create miracles for Nvidia. A nice, profitable addition? Sure. A game changer? Certainly not!

AMD also proposed downward projections for the first quarter of 2019. The company sees only revenues of $ 1.2 billion to $ 1.3 billion (compared to a market consensus of $ 1.47 billion), citing the softness of the graphics. (A large mining inventory of cryptocurrency must be erased.)

In summary, everyone speaks / understates the numbers in 2019 compared to 2018.

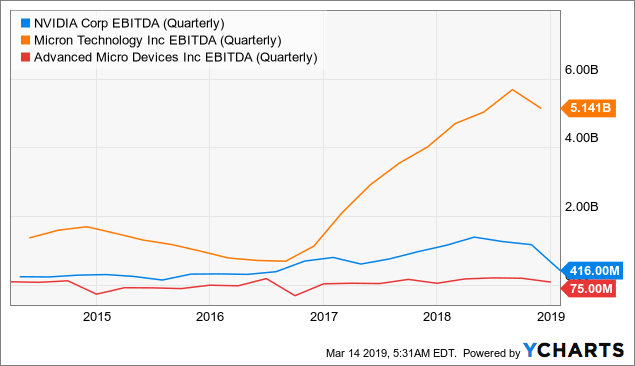

Micron benefited from phenomenal margins (see below) which resulted in an incredible EBITDA. To put this in the right context: MU's most recent quarterly earnings were respectively 3.6 and 5.6 times higher than those of NVDA and AMD. At the same time, the EBITDA of the MU is 12.4x and 68.5x higher than that of NVDA and AMD, respectively.

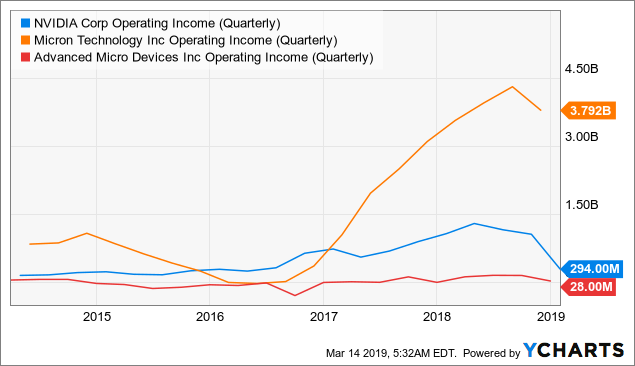

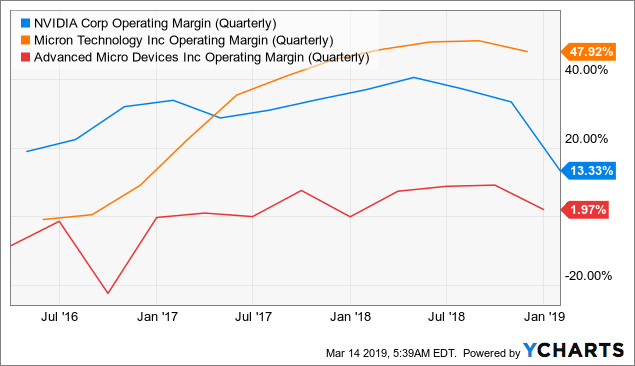

- Operating result (quarterly)

The same table (as EBITDA) is established for the operating result. MU lives (that is) lived on his own planet (profitability).

Note the sharp decline in Nvidia's operating profit, bringing it down to levels that the company has only known for more than five years.

Looking at the graphs below and the previous ones, one can not wonder why AMD, a company that is growing very well and generating relatively high margins (see below), is unable to translate its growth into profitability improvement.

In terms of results, AMD still has a long way to go.

- Operating margin (quarterly)

We talked about Micron's unrealized operating margins – and that's it. As Nvidia got closer and hit the 40% mark it was not that long ago, MU was earning 40% + (and even 50%!) Over the last 18 months. This is nothing crazy.

If you're wondering why AMD is struggling to turn growth into revenue, here's your answer. High costs / expenses absorb the bulk of growth, leaving too little for shareholders to take home.

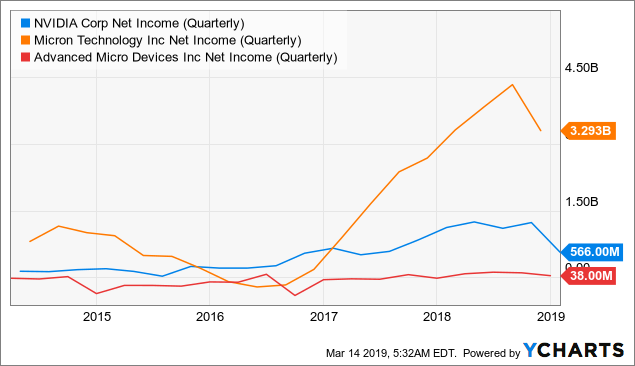

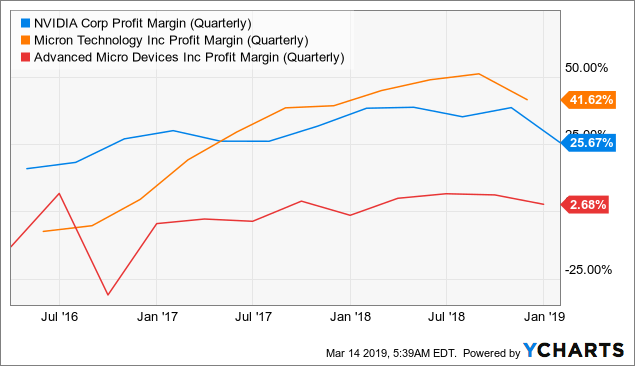

- Profit margin (quarterly)

Profit margins are even more overwhelming than operating margins. Micron is almost capable of activating this on a 1: 1 ratio. Every dollar of operating profit loses very little to become a net income of nearly $ 1.

If only MU could continue to work so forever, I assure you that his shares will not be traded with multiples of 4-6x as long …

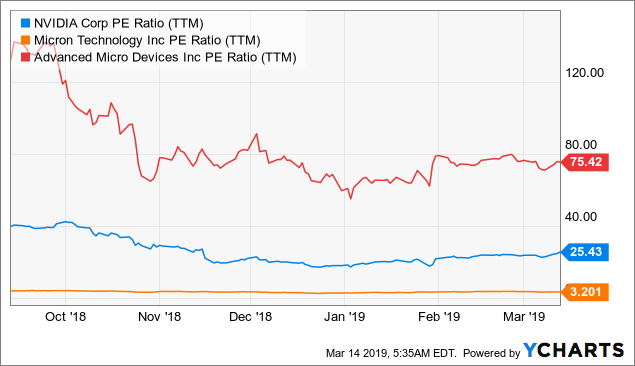

- PE ratio (last 12 months)

Speaking of which, Micron TTM P / E is probably the most attractive that Wall Street has ever seen of a company of this size, over a (relatively) long period. The problem of the company / stock is that everyone knows that this "gold rush" is going to end and that stocks are a reflection of it since the beginning of the rush.

AMD, on the other hand, negotiates at multiples that can not be justified from a simple financial point of view. Of course, this is the replica of MU, as investors expect AMD's superior results and (especially) results to improve over time, reducing P / E.

NVDA is (or was supposed to be) "the adult in the room" and provides more reliable / consistent results. Entered the last quarter and redistribute the cards. We expect that NVDA's P / E TTM will soon break the 30 mark, to 40!

Future results and other financial aspects

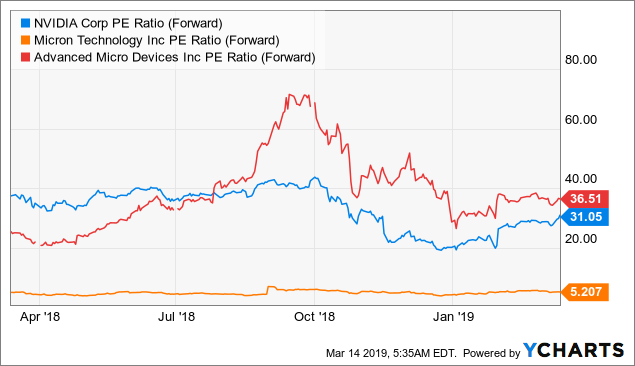

If you think for yourself, MU is a good deal, with an advanced P / E of only 5.2x – think again. Recall that the TTM P / E is 3.2x, so we are talking about a 63% increase in the multiple. This could be a big mess for shareholders, unless profitability drops as quickly and harshly as some analysts predict.

Given the disappointing results of NVDA, it is not surprising to see its advanced P / E almost equivalent to that of AMD in the 30s. It will not be the first, nor the last time this duo could meet on this map (go from the front). Nevertheless, we think that over time, the red line (AMD) will be lower than that of NVDA (blue line).

And who knows? In 2-3 years we may have a gathering of the three companies, trading at (more or less) the same multiple. This would be something we have not seen for a very long time.

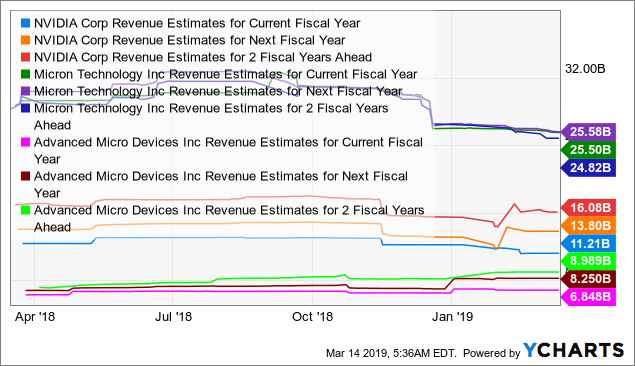

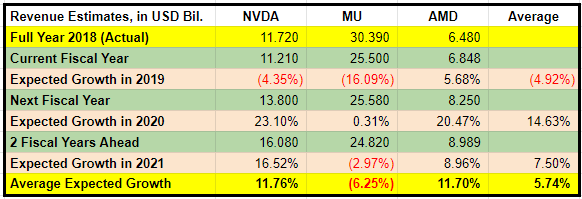

* For the current fiscal year, the next fiscal year and the next two fiscal years

Here are the current estimates of market revenues for the foreseeable future:

Now, let's present the above data a bit differently:

Source: Author, based on Y-Charts data (as of 13/03/2019)

What can we learn from this table with respect to future income growth?

- MU is completely out of the game of growth.

- Although NVDA and AMD are expected to grow about the same, AMD's growth is expected to be smoother, smoother and more consistent on average, while for NVDA, it is more of a question of the future. following recent difficulties (and in the event that society will overcome them)

- Past growth is indeed not an indicator of future growth. The latter will be much softer and slower for these companies.

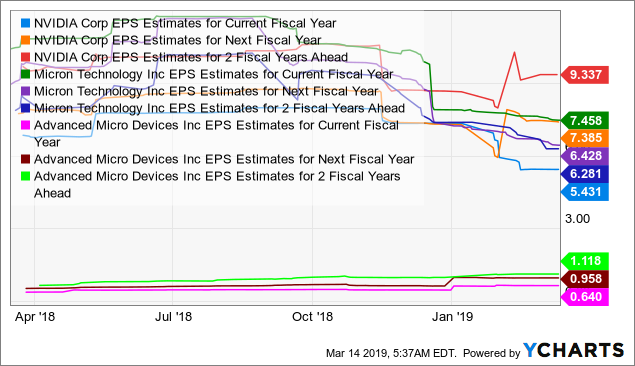

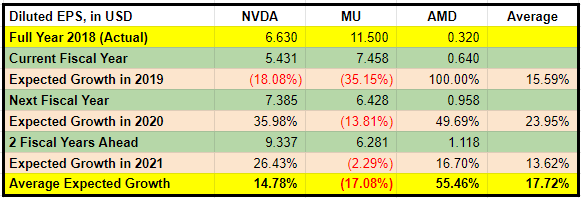

* For the current fiscal year, the next fiscal year and the next two fiscal years

Here are the current market EPS estimates for the foreseeable future:

Now, let's present the above data a bit differently:

Source: Author, based on Y-Charts data (as of 13/03/2019)

What can we learn from this table with respect to future income growth?

- AMD is in a league of its own. However, it is important to keep in mind that AMD has gone down very badly and can easily outperform. In addition, AMD's expectations for finally starting to earn money (in terms of results) are long overdue. Will this time be different (and AMD would be closer to $ 1 a year)? Only time will tell.

- MU is also in a category of its own, but about 3 levels lower than AMD … The market is seeing MU 2018 BPA fall by half in about 3 years. If this is the case (ie US $ 5.75 EPS) and based on a stock price of approximately US $ 40, the multiple will be approximately 7x, more than double the current P / E of TTM !

- At present, the market believes that the Q4 / 2018 and 2019 would be only a slowdown and a short-term delay, in Nvidia's long-term massive growth scenario. Like few other analysts, we strongly doubt that NVDA can grow faster than 30% in such a short time. This seems unrealistic, as such a rate of growth was only achieved during the crypto boom, which even the company itself admitted to have disappeared.

How are we playing this?

Let's start with Advanced Micro Devices:

Keeping in mind the table above, here is how we play with AMD driving FORTUNE in the last 16 months:

Note: once we sold the long position on 9/4/18 (# 4), the $ 20 call we sold on 31/31/18 (# 3) went from " covered "to" bare ". This naked sale of call was closed on 10/30/18 (n ° 5b)

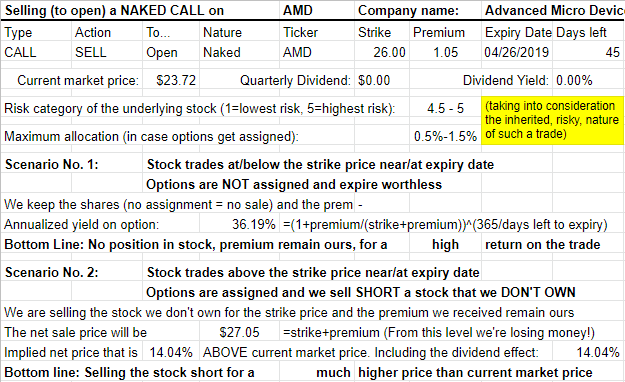

Here's what we wrote to our subscribers regarding the last exchange (# 6) run earlier this week:

This is a sale of a naked CALL option (ie with no option to purchase), so the risk is obviously high!

As you already know, our belief in semiconductors is pretty weak. As a reminder:

- Last week, we pulled our "first choice" designation from Micron (MU)

- Three weeks ago, we sold a covered call on Nvidia (NVDA) (the trapping value decreases even)

- On 09/04/2018, we not only sold our long position Advanced Micro Devices (AMD), we also sold stocks short (that is, reversed our position) to 27 , $ 28

In summary, we do not expect this segment to present excellent news that will drive prices much higher from now, even in the rosy scenario.

In addition, if AMD was overvalued (in our opinion) at 27.28 USD six months ago, you can imagine that today, we are even less enthusiastic about the title at this price.

The option we sell will only make us an AMD vendor if the shares are above USD 26 and are allocated to us. Even in this case, the net price (from which we will be short) is $ 27.05 = strike ($ 26) + premium ($ 1.05)

At present, it is estimated that AMD's earnings will be known on 24/04/2019, two days before the option expires. Of course, any delay in reporting (at a date after 26/04/2019) would make this option less risky than it currently is (assuming AMD reports its results two days before the date of expiry). The reason is simple: volatility (extra).

Since a large portion of an option is attributed to the current and expected volatility of the stock, removing the threat of post-profit movement will significantly reduce the value of the premium in this case.

In any case, here are the possible scenarios for selling this bare purchase option:

Keep in mind that selling a naked purchase order means that the upside risk is (mathematically) unlimited because the stock can go up in the infinite (and beyond). Therefore, the margin requirement is high and that is precisely why we play this business with a relatively short term expiration date (in just 6 weeks); otherwise, selling the AMD CALL 26.00 at a price of $ 2 (almost twice as much) would make a lot of sense, since the 7/19/2019 should fall before AMD publishes its results for the second quarter of 2019, in other words, in both cases, it is likely that we will face only one emergency until the expiry date. If you are ready to lock in the amount of margin required by this transaction, feel free to execute the July 19th deadline instead of the April 26th deadline.

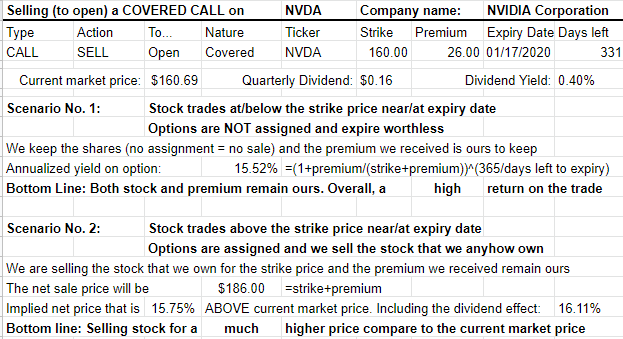

As for Nvidia:

Keeping in mind the table above, here is how we play NVDA, driving FORTUNE, in the last 17 months:

Note: The last transaction of 2/20/19 (n ° 4) was executed with a "double dose": i) covered sale (risk index: 1, the safest) against our long position (1/3 of full); ii) bare sale (risk rating: 5, the most risky), which means that the risk is much greater.

Here's what we wrote to our subscribers about the last exchange (# 4) run three weeks ago:

We had organized NVDA before the launch of the service and sold it for $ 217. Then, when the stock fell in November-December 2017, we opened a smaller position (about 1/3 of what we sold), which reached about $ 300 (October 2, 2018).

By mid-2018, we already thought that the action was too expensive. So we sold a $ 280 CALL but this option was never awarded because the price dropped like a rock and at the expiration date the price of the action was already more than divided by two (!).

So we end up with the bonus we received, but also with the stock …

Our revised price target for the stock is now $ 100 to $ 180; yes, there is no typo here. We will not be surprised by any movement (short term), upward or downward. However, as you can see, the disadvantage (60 USD) is 3 times the upside potential (20 USD). It is clear, therefore, that we lack conviction and that we are more afraid of this inconvenience. Therefore, it is a very easy trade for us, because it entails no risk for us.

If the option is awarded, we would receive a total price (net price) of $ 186 (= strike of $ 160 + premium of $ 26), a little higher than our PT and even higher than the price we paid ($ 184.50).

If the option is not awarded, we get almost half the risk of loss, right off the bat. It may be necessary to relieve the pain, if and when …

Since we do not see much chance that the stock is trading much higher, we are trading this as proposed / double cap:

On the one hand, we sell covered calls that fully protect our long position. If the option is granted, we will recognize these against the sale price, as we usually do with the options granted (the profit and loss account is fully allocated to the underlying stock).

On the other hand, we perform the same trade as a bare sale (obviously for a much smaller stipend), which is very risky, but we keep it small.

In the monthly report, you will see two transactions, one with a risk score of 1 and one with a risk rating of 5. Do not be distracted by this double presentation.

Here are the possible scenarios for this trade:

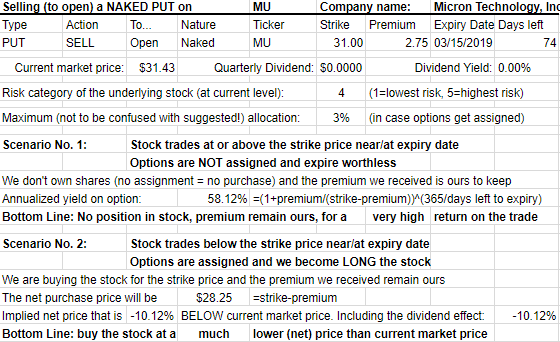

Last but not least – Micron

The truth is that we designated MU as one of our best choices for 2019 * in the information technology sector, when equities traded at extremely disrupted levels (with the overall market) at the end of December 2018.

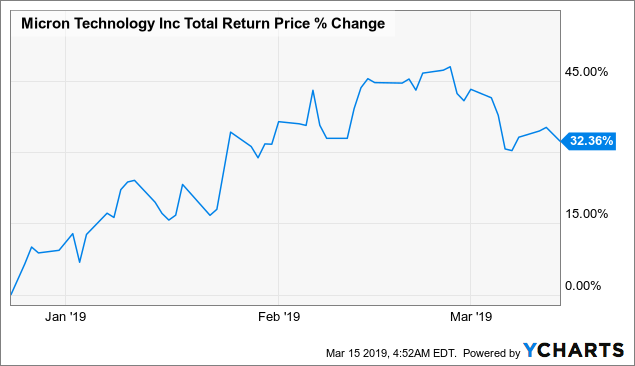

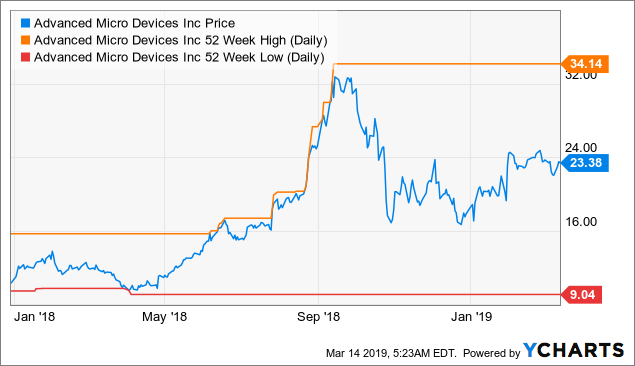

We also sold the MUTE option from 15/03/2019 to 31/03 to 31/03 for a premium of $ 2.75. This option expires today (March 15, 2018) worthless. You can see the annualized return of this trade, in the image below (indicating the possible scenarios at the time of the sale).

However, at the end of February, we "dethroned" MU from his "first choice" designation after a quick run of about 50% of the trough at his peak in the space of just two months!

Data by YCharts

With today 's expiry of the option we have sold, we no longer have direct and / or indirect position related to MU.

Outlook and price objectives

We have already discussed the specific directions for each company for the next quarter / year, so it is useless to repeat ourselves.

Whatever the case may be, Wall Street takes these perspectives into account when evaluating and estimating future profits.

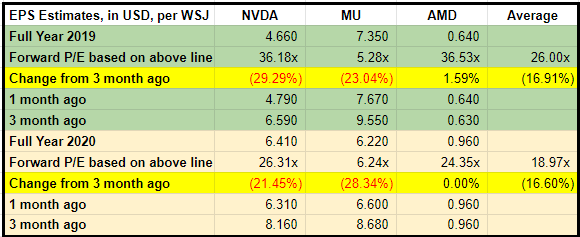

Below are current estimates of EPS for the next two years. Pay close attention to the sharp reviews that EPS estimates for NVDA and MU have been applying over the last three months.

Wall Street has reduced its expectations by 20% to 30% overall, and this could only be the beginning, not necessarily the end.

Source: Author, based on Wall Street Journal data (as of 13/03/2019).

At the same time, the EPS estimates of AMD remain very stable and have not changed a bit. This means one of two things: either AMD is a very predictable society (which is not …), a much more promising operation (it is!) Compared to the other two semi-finals.

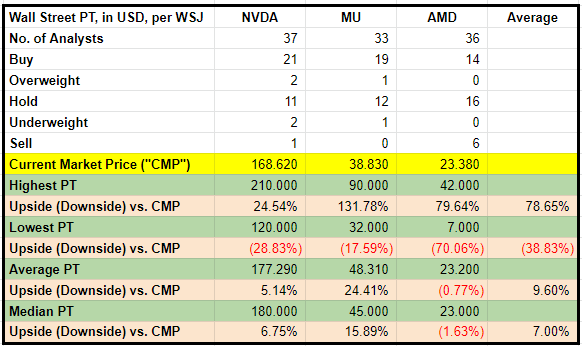

As for what Wall Street sees for the three companies in terms of physiotherapists, everything is in place, ranging from euphoria to depression.

As always, we ignore the extreme forecasts (ie "the highest" and "the lowest") and we stick to Main Street, in particular by referring to the mean and median estimates, the latter having tend to be more reliable and better reflect the general feeling. That said, with respect to analysts' expectations, our main motto is: Respect and Suspect; more of the latter than the old …

Source: Author, based on Wall Street Journal data (as of 13/03/2019).

Looking at the table above, here are some quick and immediate observations:

1. UM has the highest upward potential (based on the highest average, median and PT), as well as the lowest negative potential (based on the lowest PTs).

2. Despite the fact that Wall Street relies on AMD to behave more robustly than its peers, there is not much meat left on that bone, according to the average and median PTs. In other words, AMD is valued as is (another justification for our recent sale of a nud call here).

3. Although NVDA seems to benefit from a higher upside potential compared to AMD, you can see that even the highest PT is not as optimistic. Nobody thinks that the title will soon reach its 2018 highs.

Bottom line

Au minimum, 2019 sera une année difficile pour NVDA et MU, comparé à 2018. Tandis que pour MU, ce sera plus long encore, mais avec beaucoup de chance, NVDA pourrait redevenir fort en 2020. Cela dit, la baisse attendue (du bénéfice de la société) en 2019 est si profonde que nous n'achèterions pas la baisse aussi tôt dans l'année. Nous nous attendons à plus de douleur avant un gain significatif.

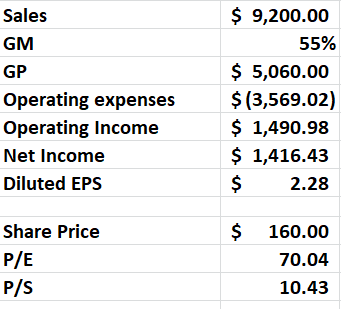

Notez que notre ami et partenaire, Trapping Value ("TV"), estime que "NVDA atteindra seulement 2,28 dollars de bénéfice par action", sur la base de ce calcul:

Source: Nvidia: Fin du jeu

Bien que nous ne soyons pas aussi baissiers que la télévision, nous constatons que le cours des actions se négocie plus près de 100 dollars que de 200 dollars en 2019, tout comme l'année dernière.

Notre stratégie dans ce domaine, telle que décrite ci-dessus, signifie que si NVDA négocie plus de 160 USD vers la date d'expiration, nous vendrions notre position acheteur et ouvririons une position vendeur à un prix net de 186 USD. Nous ne croyons certainement pas que le stock vaut plus que cela, pour le moins.

Globalement, notre vision de NVDA est baissière et, en tant que telle, notre notation actuelle du titre est "une vente conditionnelle" = conservée pour le moment, mais nous vendons entre 180 et 185 USD.

MU est celui sur lequel nous trouvons le plus difficile de passer un appel, car nous ne serions pas surpris de le voir au-dessus de 50 USD / action, ou en dessous de 30 USD. Les deux cas ont de bons arguments, et tout est question de la gravité des "blessures", maintenant que ses principales activités ont atteint leur point culminant. La question clé est la suivante: cette glissade sera-t-elle progressive le long de la montagne ou ressemblera-t-elle à sauter d'une falaise?

Notre stratégie concernant MU est d'attendre. Nous craignons que le potentiel de performance ne soit très limité, compte tenu des attentes du marché selon lesquelles il s'agirait plus d'une chute, mais d'un ajustement progressif à une demande en baisse pour les produits de la société. Par conséquent, au stade actuel, nous préférerions nous mettre à l'écart et regarder. Si les actions revenaient à 20 $, nous pourrions reprendre la charge.

Globalement, notre vision de MU est également baissière, mais nous ne considérons pas le stock comme étant aussi vulnérable que NVDA. En tant que tel, notre notation actuelle du titre est "neutre", mais nous serions des acheteurs avec des niveaux beaucoup plus bas, en raison du risque excessif (et du potentiel de hausse limité) que nous identifions ici.

AMD est le nom le plus intéressant et le plus prometteur de ce trio, mais même dans ce cas, la majeure partie du potentiel de croissance est attendue pour les périodes au-delà de 2019. Pour nous, comme vous pourrez le voir ci-dessous, AMD a toujours été une histoire d’évaluation. Tant que la société fait des cacahuètes sur le résultat final, nous jugeons le stock attrayant en dessous de 16 $ et surévalué au-dessus de 25 $.

Ce n’est qu’une fois que nous verrons AMD gagner 1 USD par an en EPS, que nous pourrions commencer à penser que le titre pourrait valoir la peine d’être transféré dans les 30 USD pour y rester.

Dans l’ensemble, notre vision d’AMD est plutôt optimiste à long terme, tout comme elle l’a été au cours des 16 derniers mois. Le principal problème que nous voyons pour AMD est son incapacité (à ce jour) à traduire la croissance des revenus et de meilleures marges en résultat net. AMD n’est plus une start-up et, quand une entreprise aussi mature ne gagne que 0,32 USD par an, il n’ya aucun moyen de justifier des évaluations représentant des multiples de 81-107x, lorsque les actions se négociaient entre 26 et 34 USD.

En tant que tel, notre notation actuelle du titre est "neutre", car nous attendons qu'AMD nous "montre l'argent". Il existe également le risque que son groupe de pairs (NVDA, MU et peut-être même les 3 mousquetaires: AVGO, QCOM, NXPI) entraînent le cours de l'action d'AMD vers le bas avec eux.

N'oubliez pas ce que nous disons toujours et croyons fermement en: Macro Trumps Micro. Même les actions les plus performantes et les plus résistantes auront du mal, voire l'impossibilité, à résister à un marché orageux et malheureux.

À long terme, ce sont les tendances macro-globales, générales et du marché qui régissent (et mènent) le monde, bien plus que les attributs / informations spécifiques aux micro-entreprises.

Tu éclaires le ciel, au-dessus de moiUne étoile si brillante, vous m'aveugle, ouiNe ferme pas les yeuxNe t'efface pas, ne t'efface pas, oh

Source: "Gouverner le monde" – Take That

Globalement, on peut dire que les semi-conducteurs ont dominé le monde ces dernières années, jusqu'à la fin du troisième trimestre de 2018.

Ne vous méprenez pas: les sémis ne vont nulle part et ce n’est pas comme si on s’attendait à ce que ce segment brûlant disparaisse complètement. Cela est vrai pour le trio dans cet article, autant que pour le trio dans mon article précédent.

Néanmoins, tout comme la performance majestueuse de "Take That", issue des Jeux olympiques de Londres 2012, la cérémonie de clôture implique: Semis, tu as éclairé le ciel, au-dessus de moiBeaucoup d'étoiles, si brillantes, tu m'as aveuglé, ouiNe fermez pas vos lignes (de production)Ne t'efface pas, ne t'efface pas, oh

Tôt ou tard, vous pourrez gouverner le monde (encore)!

La roue de la fortune est un service très complet, couvrant toutes les catégories d’actifs: actions ordinaires, actions privilégiées, obligations, options, devises, produits de base, FNB et CEF.

Profiter de la essai gratuit de deux semaines, et accéder à notre:

- Revue mensuelle, où tous les métiers sont surveillés.

- Alertes de trading. Nous ne négocions pas tous les jours, mais nous émettons en moyenne une transaction par jour de bourse.

- Portefeuille modèle, visant à battre la performance du S & P500.

- "Se préparer pour 2019“, Une série de 19 épisodes regroupant nos meilleurs choix dans onze secteurs et huit segments.

Disclosure: Je suis / nous sommes depuis longtemps NVDA. I have written this article myself and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have any business relationship with a company whose actions are mentioned in this article.

Information supplémentaire: Short NVDA 17/01/2020 160.00 APPEL

Short AMD 26/04/2019 26.00 APPEL

[ad_2]

Source link