[ad_1]

After several months of debate, the Pact Act (Action Plan for the Growth and Transformation of Enterprises) was promulgated on May 22nd. Article 137 of this text paves the way for the privatization of the Française des Jeux (FDJ), the majority of which may now be sold.

The FDJ, second European lottery and fourth world, is today a joint-stock company of mixed economy. It enjoys a state monopoly over online and point-of-sale lottery (raffle and scratch) games, as well as sports betting at points of sale (online sports betting is open to competition). ). The law also states that the FDJ will retain the monopoly in the same state, but within the framework of a concession of a maximum of 25 years. Apart from general considerations, the exact modalities of the privatization of the FDJ are not known even though government actors have occasionally launched ideas, including a reduction of state ownership from 72% to 20% and an IPO.

A company that does not know the crisis

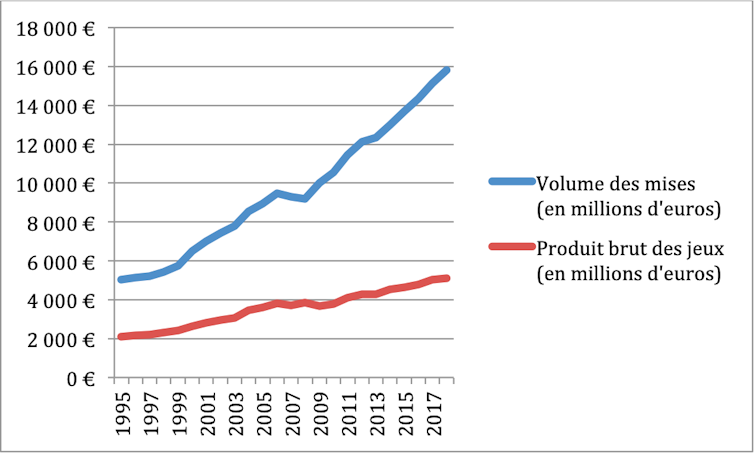

The FDJ has an activity in constant progression and is only slightly affected by the economic situation even if one notes a small weakness during the crisis of 2007-08. We also note that the share distributed to players is growing steadily (difference between the volume of bets and the gross product of games), the dynamism of the activity to spread more widely costs. This dynamism is worth noting as competition has exploded with the proliferation of opportunities to play online where the notion of national monopoly loses its relevance.

Annual reports

On the gross proceeds of the games, the State levies a tax defined by decree of the Minister in charge of the budget and framed by the law. For 2018, this tax amounts to approximately 65% (3,346 million euros), not including corporation tax (83 million in 2017), miscellaneous contributions and dividends on income (130 million for 2017, of which 72% for the State), all of which represents approximately 3.5 billion euros. The system of taxation has been renovated under the framework of the Pact Act (Article 138), but subject to certain reservations. Privatization will not change much, as the share of dividends is relatively low in government payments.

However, the FDJ managed to achieve good margins with EBITDA representing 17.5% of revenues (equivalent of turnover, after taking into account player payouts and public levies) and a net result representing almost 9.5%. An opening of capital will therefore have limited consequences on the state's revenue, which benefits more from taxation than from the return on capital.

A baroque composition of capital

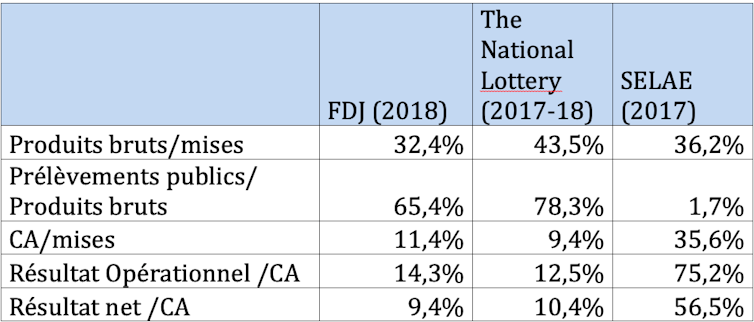

At the European level, even though the respective situations of the different national companies are difficult to compare, the FDJ is the operator that "returns" to the players the largest share of bets (67.6%). A level equivalent to that of Selae (Sociedad estatal loterias y apuestas del estado) in Spain, but much higher than that of the National Lottery in the United Kingdom (53%), managed by a commercial corporation (Camelot) wholly owned by the Ontario Teachers' Pension Fund in Canada, or the Deutsche Lotto-Toto Block (DTLB, "Lotto") in Germany (almost 50%). In these countries, it is in particular to the "good causes" (sport, education, environment, charity, etc.) that revenue is redirected, even if the state is not disinterested.

Annual reports of companies and author's calculations

In the end, the privatization of the FDJ, contrary to that envisaged by Aéroports de Paris (ADP), does not seem to pose insurmountable economic problems between a relative monopoly, a global preservation of the financial interest of the State and the mechanisms of regulation of games improved by the Pact Act (subject to knowing the concrete modalities).

On the other hand, the current baroque composition of its capital raises more questions. As already highlighted in 2007 Sebastien Turay in his book devoted to the French games ("The French games: state jackpot?"), If the state is the majority shareholder of the FDJ with 72% stake , 28% are divided between actors more or less "folkloric" which are part of the history of the FDJ and some of which represent an orientation in favor of good causes (but not all). With the exception of the staff, they are the heirs of the lottery systems that preceded the creation of the FDJ, especially the veterans associations. It is the latter who would be the most exposed in the event of privatization which could sign the end of a certain number of privileges.

«Broken jaws and privileges

Among these, the "Gueules cassées" (now Union of the injured face and head because of the expansion of their missions, 9.2%) and the Federation André Maginot (4.23%) are the most emblematic shareholders. These are the main creators of lottery games in France in their modern version (lottery games are much older). Over the years, they have seen their participation drop, with the state gradually taking over because of the monopoly nature of the activity.

Screen shot of FDJ group site.

As indicated in the annual report 2018 "broken mouths", the bulk of the income of the association comes from financial income (mainly the dividends of the FDJ, but also investment income due to a comfortable cash of nearly 180 million euros). These revenues also regularly feed a foundation sometimes associated with management that is questionable. We also note that the association persists in having a risky financial management of its investments since in 2018, losses of 7.2 million euros were recorded (with it is also true of unrealized gains € 5.1 million).

This is at least an unusual way to manage investments for an association. The structure is also very sensitive on the subject of the independence of its management, vis-à-vis the State in particular, insofar as it considers itself the shareholder of a company, does not receive public money and does not use donations. Indeed, a report of the Court of Auditors in 2000 described an unorthodox organization, with for example employees contracting loans at unbeatable rates … with the association.

Yelkrokoyade / Wikimedia

While social security was created in the meantime (1946) and the "broken mugs" of the First World War are now dead, and with all due respect for the mutilated of the contemporary face , the maintenance of this privilege seems anachronistic with regard to all the causes that could just as legitimately benefit from this financial support. The motive for creating the national lottery seems very worn, knowing that it was basically the concession of a privilege by the state to a category of the nation that had particularly deserved it.

Sustaining "cheeses"

Other shareholders, with even smaller participation, are in the same situation. For example, the Confederation of tobacconists, an organization representing tobacconists, controls 2% of the capital of the FDJ and receives comfortable dividends from the FDJ (2.6 million euros in 2018), although we have not been able to identify them. communication on this subject from the Confederation. The Mutuelle du Trésor holds 1% but we have not been able to clearly identify its allocation given the changes in mutual structures. However, we can see that Bercy's officials in the successive operations of restructuring of the FDJ and very present on the board of directors of the FDJ have not forgotten.

Let us also mention the Comalo (Marseille Lotteries Company), a private company owned 66.6% by two individuals, which holds 0.6% of the shares. Its income statement 2017/18 reports a turnover of 0 euro, income only financial (872 000 euros, FDJ dividends mainly) but operating expenses (including wages) 266 000 euros, the all with a comfortable cash of about 2.9 million euros …

Let's not forget among the shareholders the staff of the FDJ. Through a mutual fund (FCPE), employees hold about 5% of the capital. For 2017, they received dividends of 6.5 million euros (2 929 euros per person on the basis of the 2 219 employees of the FDJ and its subsidiaries), not counting employee profit-sharing and participation. , 4 million euros (10,545 euros per person) as well as long-term benefits of 3 million euros (1,352 euros per person). With an average annual salary of € 84,137 (payroll taxes and employer contributions included), it can be said without fear that the status of employee of the FDJ is enviable.

But is this status threatened? As are the advantages of minority shareholders? The government has already indicated that the historic shareholders could retain their participation and that the staff could even increase their capital, which amounts to perpetuating "cheese" with questionable legitimacy since it is a monopoly granted by the State which is now destined to be put into play regularly via the concession system. It remains to be seen what the legal and financial consequences of an "expropriation" of the historic shareholders could be …

Source link