[ad_1]

The Dow has had an incredible race over the past 100 years

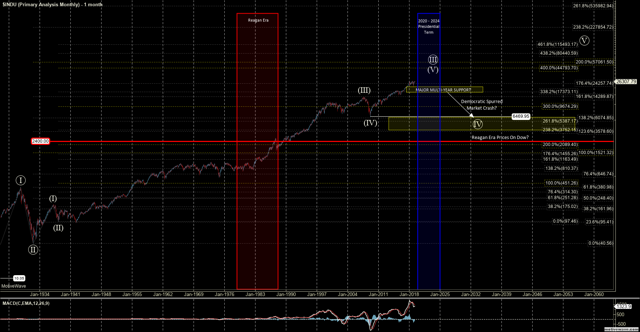

The Dow Jones Industrial Average has seen an incredible evolution since its 2009 low in relation to the latest financial crises that have hit global economies. After peaking at 14,198 on October 1, 2007, the Dow Jones fell by some 54% to a low of 6469 on February 28, 2009. Since this trough and in the most recent peaks, the Dow has gained more than 20,000 points or more than 300% as he approaches 27,000.

Even more impressive is the race the Dow had made during the much longer period that has passed since the depths of the Great Depression. At the bottom of the depression in July 1932, the Dow traded at only 40 after peaking at 386 on September 1, 1929. This 346-point drop from the 1929 peak and the 1932 lows was a fall of 90 % of Dow's value. Of course, this minimum of 40 and the following of 27,000 represent a gain of more than 67,000%. If we take a more recent dip, if we take the minimum that was reached after the collapse of 1987 at 16:16 and the last peak of 27,000, we have a gain of more than 1,500%.

So, after such an incredible race of these major historical backgrounds, the question we ask ourselves is this: how far can this race go and are we really in reserve for the biggest sale of history? American?

The biggest sale of American history to come?

In an interview with John Catsimatidis last week, Stephen Moore, former President Trump's choice at the Federal Reserve, was talking about the economy, the stock market and the policies that some Democratic politicians have recently promoted. Moore nominally named the new Green Accord, Medicare for All, Repair Payments and Guaranteed National Income. He then added that "If people really thought that these ideas would come into play and enter the White House, you would see the biggest sale in the stock market of American history, and it's a danger".

To date, the largest sale of American stock market history has occurred between 1929 and 1932, while the market had fallen by nearly 90%. So, if we were to make an even larger sale than this drop, say 91%, the Dow Jones Industrial Average would drop more than 24,000 points and fall below the 2400 level. Levels never seen since the 1980s.

Now, even though, in the long run and over the next decade, I think the stock market will experience the biggest sale of all time that most of us have experienced. I do not think its impact is as important as that of the accident of 1929 – 1932, but I think however that it will probably result in consequences for the world economies.

Moreover, this correction will not be caused by any particular political party, nor by the policies of that party, but rather by the collective social mood of participants in the stock market and the larger economy as a whole. This same collective social mood will drive the policies that will ultimately take effect, but these policies themselves will not be the engine of any market correction. We have seen time and time again that experts would assure us that if a particular event occurred, the market would certainly act in a certain way. The vast majority of the time, however, these predictions are not fulfilled as promised. More recently, we saw this when we were almost convinced that if Trump won the election, the market would inevitably collapse. Not only has this not happened, but since the election, the market has increased by more than 30% since the election of Donald Trump.

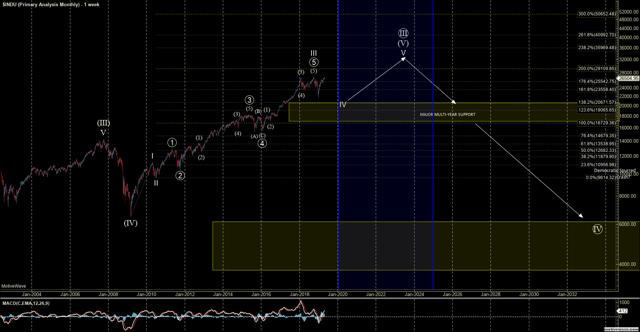

The market could close on its last step

Two weeks ago, I wrote about what I saw in the Dow's shorter time frame. In this article, I noted that we are close to a point of short – term inflection. As the subject of this article focuses on the general trend of degrees, I will focus the analysis on the look of the Dow chart in a multi-year rather than a multi-year perspective.

As can be seen from the graph below, I count the Dow in the last stage of a wider third wave off the trough of 1934. Now, as I noted in the previous article on shorter time frame, I still think this generational bullish trend is not over yet. The Fibonacci levels that I'm currently monitoring are between 29 109 – 40 992. So, as long as Dow is going to support it in the long run, I'm still waiting for these higher levels to be achieved in the future. next few years before ranking at the top of the decades.

All that being said in a more macro perspective, I think we could very well be at the last stage of our journey and be on the verge of entering a large bear market. The key long-term support levels I am looking at over this period are currently in the 20,671 to 16,729 zone. If the Dow moved into this zone, it opened the door to a greater market correction that could ultimately bring it back to the lows that were hit in 2009 and potentially even lower.

Given that this decline in these levels is likely to occur from levels higher than those in which we are currently trading, a decline to the 6,000 would be a much larger drop in percentage points. This would be the largest drop by this generation, which makes sense given that the fourth and fourth largest waves are of the same degree as the second wave that began in 1929.

Anyone who is stationed at the start of this next crash will probably be blamed for provoking it, but the reality is that we are on this path no matter who takes office. The policies adopted will reflect the feelings of their constituents and not the underlying cause of a stock market crash. So, although I agree with Mr. Moore that we may see a very large stock market crash in the not-too-distant future, I do not agree that the Democrats will be the cause. There is only one true cause of the ups and downs of any freely negotiated market: it is the collective sentiment of those who participate in this market.

THE MARKET PINBALL ASSISTANT

"Here, under your wave diagram, I reached profitable trading at 93.18%"

"If you want to be on the right side of the market … it's the service for you – a great way to monitor the market and know that your portfolio is still geared to the trend."

"Although no methodology works in all cases. . I have never seen anything so coherent "

"Best market sentiment tracking site on Seeking Alpha. Clear explanations and a lot of interaction with users. "

"This service far surpasses all the others I've encountered."

Click here for your free trial today.

Disclosure: I / we have / we have no position in the actions mentioned, and we do not intend to initiate a position within the next 72 hours. I have written this article myself and it expresses my own opinions. I do not get compensation for that. I do not have any business relationship with a company whose shares are mentioned in this article.

[ad_2]

Source link