[ad_1]

The shares had their best trading day for some time on Tuesday as investors took a break from their sale to gauge the real effects of the trade war with China.

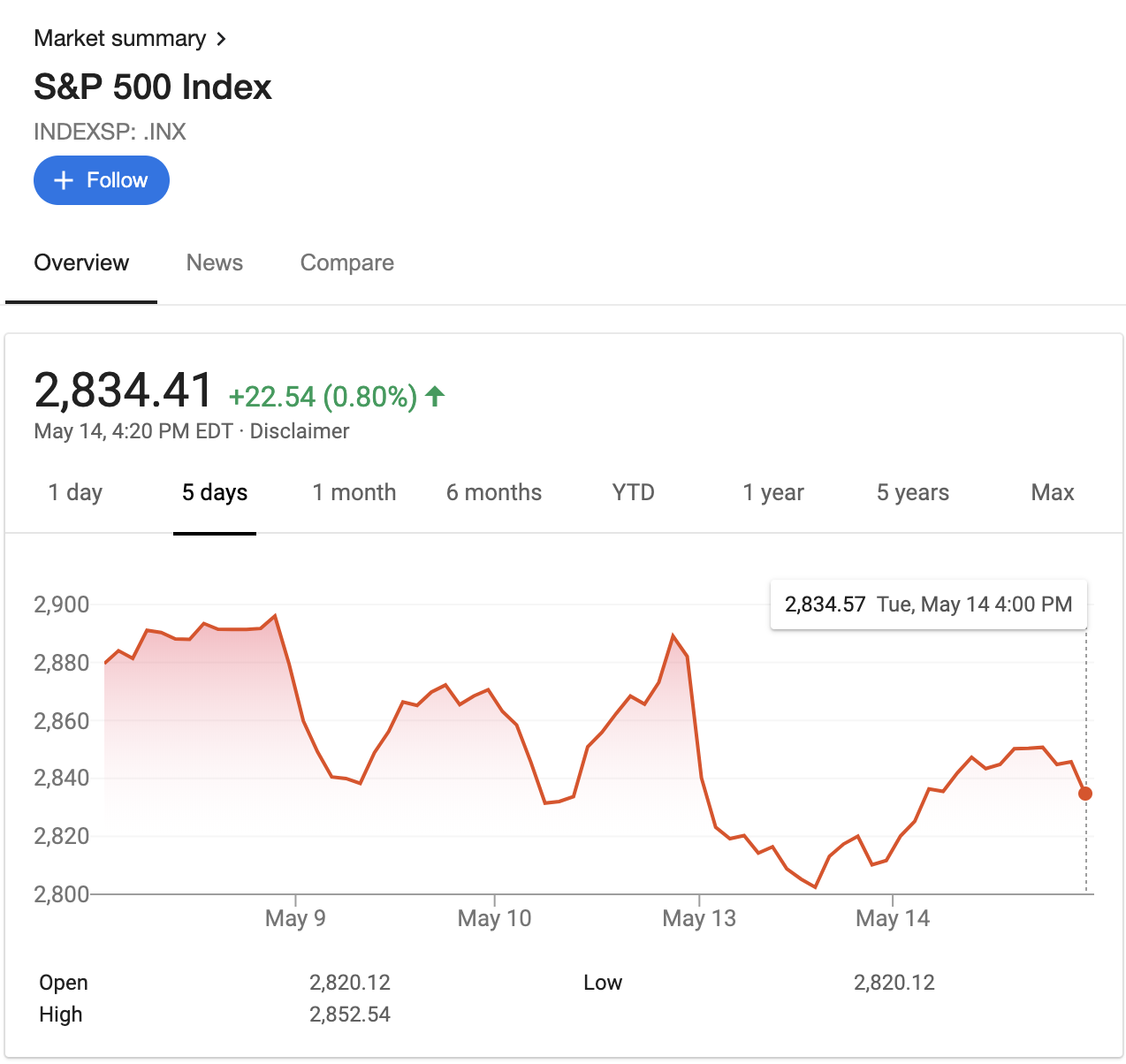

The Dow Jones Industrial Average and the S & P 500 both absorbed some of their losses, with the DJIA climbing 207.06 points to close at 25,532.05 points and the S & P at 2,834.41 points. 0.8% increase. The Nasdaq Composite Index closed its trading day at 7,734.49.

While some investors see the rebound as a dead bounce, what the markets can support, other investors point out that the fundamentals of US investment have not changed, even though the costs will increase.

Indeed, economists cited by the New York Times think that the gross domestic product of tariffs in the United States will fall by only 0.3 percentage points in the long run.

Nevertheless, this assessment does not take into account the impact on consumer portfolios and consumer confidence if prolonged trade war and rising prices forced ordinary Americans to rethink their consumption habits.

Even modest gains from today's trade do not compensate for all market losses since the start of the new wave of tariffs, when the United States withdrew from the negotiations and imposed new rights on goods.

[ad_2]

Source link