[ad_1]

We are only in April, but already this year more store closings – nearly 6,000 – have been announced compared to 2018.

US retailers have so far announced that they will close 5,994 stores and open 2,641 stores, according to Coresight Research's real estate monitoring. This is more places where it is planned to go in the dark than last year. In 2018, 5,864 closures announced and 3,239 openings, said Coresight.

The closures planned include more than 2,000 of Payless ShoeSource, which filed for bankruptcy, hundreds of clothing retailers like Gymboree, Charlotte Russe, Victoria's Secret and Gap and the Fred's discount chain. Meanwhile, channels such as Aldi, Dollar Tree, Ollie's offer store, Five Below and Levi's are planning to open more stores.

On the front of the closures, however, the outlook does not seem to improve, predicts Coresight. It is after 2017 that the year was record for more than 8,000 closings announced by the American retailers.

"I think store closures are going to accelerate in 2019, reaching some 12,000 by the end of the year," said Deborah Weinswig, CEO and founder of Coresight. "The slowdown we experienced in 2018 seems to have been a brief respite in what constitutes a stable trend in the long run."

Owners of shopping centers and shopping malls, looking for solutions to fill empty spaces, have been forced to negotiate terms of lease with tenants and choose less expensive rents.

"It's funny because none of the retailers [closing stores] are surprising, "said DJ Busch, an analyst at Green Street Advisors of Green Street Advisors. But when this happens in a wave, it disrupts the bargaining power. This creates a soft spot. "

Next, homeowners are turning to emerging digital brands like Untuckit Shirt Company, Warby Parker Eyewear Manufacturer and Casper Mattress Retailer, who are opening hundreds of stores across the country after being successful on the Internet. their properties. They hope that adding tenants offering unique experiences, such as Legoland, Crayola Experience and Dave & Busters, will attract buyers to their homes and buy them at the mall.

But Collins from Thasos said that it might not go as planned.

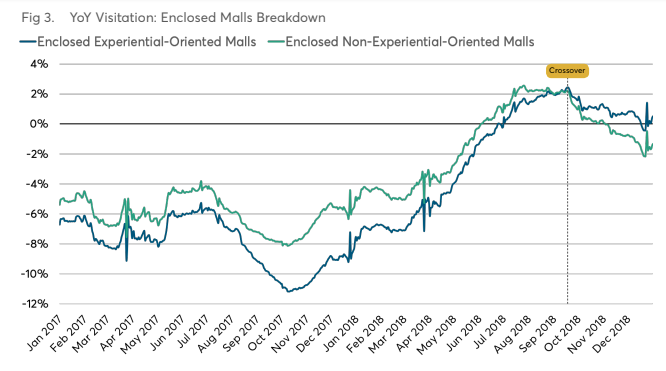

His company found shopping malls with so-called experiential tenants who do not focus solely on selling products, such as Apple, the Italian food hall Eataly and Tesla, did not generate additional traffic. Until the last three months of 2018, indoor shopping malls with "experimental" tenants did not enjoy greater customer attendance, year after year, compared to indoor malls that did not have a home. none of these unique tenants, not specialized in clothing, Thasos said.

Thasos: Experiential tenants do not yet offer a "significant benefit" to the traffic, as the owners thought

"This suggests [real estate investment trusts] Pay too much to bring Tesla and Apple, among others, to generate pedestrian traffic to the property, "Collins said.

With more store closures on the horizon, consumers can expect to start seeing hotels, gyms, apartment complexes, more dining halls and more. grocery stores in traditional shopping centers, transforming them into urban centers. The new Hudson Yards Mall, which opened in New York last month, is the perfect example of this mixed-use model.

Shopping center owners are also experimenting with spaces that allow young brands to frequently change positions, sign short-term leases and gain access to pedestrian data and shopping patterns. Macerich, the third largest shopping center owner in the country, operates a business called BrandBox that she deploys in her US-based centers.

"I think it's a multi-year transition," Busch said. "Clean some of these retailers that last longer than they should have … It will be difficult.Anyone who thinks otherwise is too optimistic.But that does not mean it's a business This can continue to be a good company as under-productive. [retailers] go away, and the big owners invest. "

Shopping center owners including Simon, Brookfield, Taubman, Macerich, PREIT, CBL and Washington Prime are expected to announce their quarterly results in the coming weeks and will provide insight into the current rental environment and how they handle the latest wave of closures. of shops. .

[ad_2]

Source link