[ad_1]

Property in Singapore is expensive, whether you are looking to rent, buy your first HDB or move to a private property. Recently, the government has taken steps to cool the real estate market, which should benefit the properties of HDB and make private properties more affordable. However, it will still be very difficult for people to move from HDB apartments to a condo. Beyond exorbitant purchase costs, condos come with a plethora of other costs of up to thousands of dollars more than what you would pay for an HDB apartment. Below, we explore the most common hidden costs of owning a condo in Singapore and how it compares to owning an HDB apartment.

Monthly Maintenance Fees

When you own an HDB apartment, you must pay a monthly retention fee dependent on your city council. Similarly for condos, you will have to pay a monthly maintenance fee to the property management of your condo. However, although you usually pay less than $ 100 a month for the conservation costs of your HDB, the monthly maintenance costs for condominiums rise to an average of $ 300, with fees ranging from up to $ 1,000. These fees depend on the number of people in your condo, the size of your apartment, the type of condo you live in (ie, the luxury condos will have the highest maintenance costs) and amenities offered by the building. With the difference of fees easily adding up to several thousand dollars a year, this "hidden cost" is not something you want to miss before making the decision to buy a more expensive property .

Home Insurance Premiums

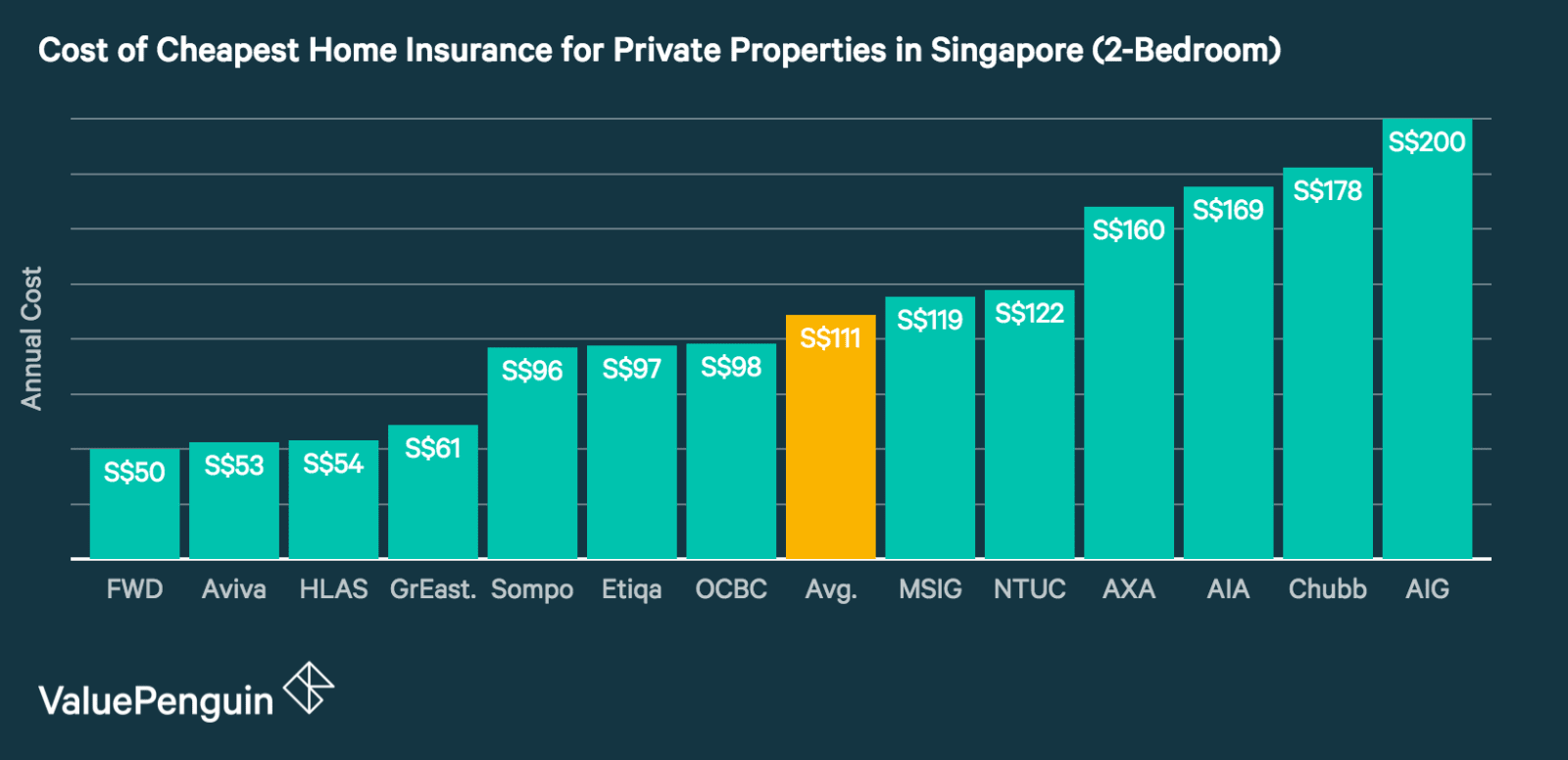

Like the majority of expenses related to private property, your home insurance policy may also become more expensive. For example, premiums for a 4-bedroom HDB apartment can be as low as $ 51 S from insurers like NTUC Income, which offers the cheapest home insurance plans for HDB apartments.

However, for a condo of similar size, you can expect to pay S $ 122 with the same insurance company. In some cases, we have found that insurers charge between 10% and 90% more for condominiums than their HDB flat equivalents. This means that switching from an HDB to a condo can mean paying a few hundred dollars more in premiums each year, especially if you plan to increase your content and renovation coverage.

Transportation Costs [19659003] Transportation is one of the highest hidden costs of owning a condo. One of the amenities of HDB is that they are usually established in areas close to public transport and other amenities. However, condos are more likely to be built in places far away from amenities and public transportation, since developers usually expect you to already have a car. This means that you will probably have to buy a car to live in a private property, which represents an additional cost of $ 18,200 a year for maintenance and car loan payments.

Even if you decide to stick to public transportation, you will probably pay up to 16% more to buy a condo near an MRT station, and end up paying $ 624 more in public transportation costs per year because of your longer daily commute

SP Utility Bills

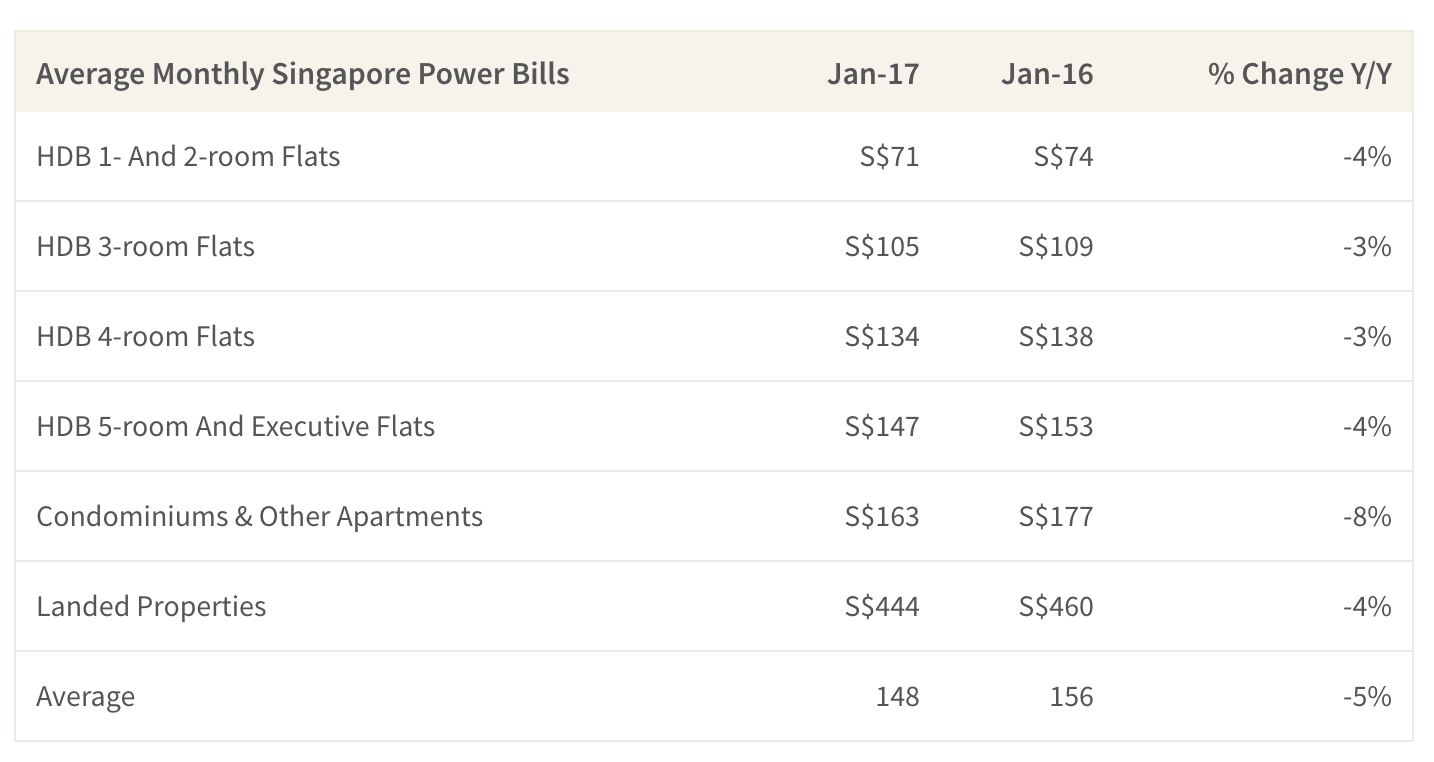

responsibilities such as mortgage payments, loans and insurance, few people consider the minutiae of the monthly costs of the service. home ownership. However, even something as small as your Singapore bill (SP) can end up being much more expensive for condo owners than HDB owners. In fact, the average SP bill for a condo in 2017 was $ 163 per month, 43% more than the average cost of an HDB SP bill. This means that you will be spending $ 588 more per year to provide your condo with basic services.

Separation Reflections [19659003] Due For convenience and privacy, some may think that private properties are worth all the extra costs. In addition, private properties do not have ambiguities around their sales value with which BHD owners have to struggle, making them "safer" investment opportunities. Whatever the reason for your purchase of a private property, the best way to stay financially afloat in one of the most expensive cities in the world is to forecast costs beyond the price of a property. buy the house of your dreams.

Published in ValuePenguin

news POST

Buy this article for republication.

[ad_2]

Source link