[ad_1]

Fundamental Forecasts for the USD: Neutral

US Dollar Discussion Points:

- Rate Hikes interest and expectations support the US dollar. [19659006] US President Trump's global trade war campaign tarnishes the loonie's appeal.

The DailyFX Q3 US Dollar Forecasts is available for download.

We move to neutrality on the US dollar this week based solely on the current strength of the US economy but note that the rise in the currency could be tempered by US President Donald Trump. commercial war campaign. The recent announcement of additional duties on Chinese imports of $ 200 billion has not really helped ease the tensions in the market, while President Trump's apparent disapproval with regard to the Huge trade surplus of Germany worries the European Union. The reciprocal trade measures of China and the EU will weigh on the US economy, but it will take months before their effects are recorded or felt.

Commercial warheads and guided tours – Recommended reading :

The impact of tariffs and trade wars on the US economy and the dollar

A war to trade more, not less – What's Hiding behind United States-China Rates

As the trade war continues, the US economy remains robust, allowing the Fed to continue to normalize its monetary policy by raising interest rates. Recent higher-than-expected increases in inflation and record-high unemployment are expected to confirm two 0.25% rate hikes this year (a total of four or 1%) with three further increases to next year. While annualized GDP growth of 2% in the first quarter could have missed expectations by 2.2%, the economic impetus from the president's tax cut program will continue to help the economy to move forward. develop.

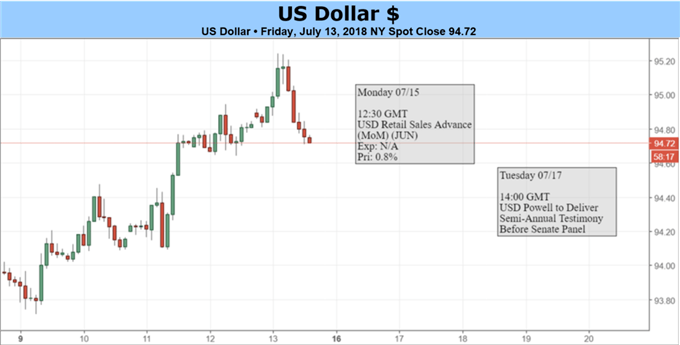

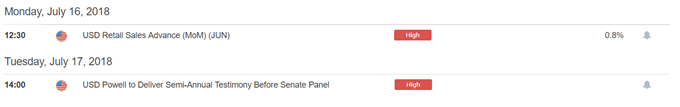

Looking forward to next week (Monday, July 16) [19659017] The two stars of the economic calendar come earlier this week with the testimony of Fed Chairman Jerome Powell on Tuesday for traders. In an interview Thursday, Powell said that the US economy is "in a good position from a cyclical point of view close to maximum employment and stable price targets". He warned, however, that the recent escalation of the trade war could weigh on the current strength of the economy.

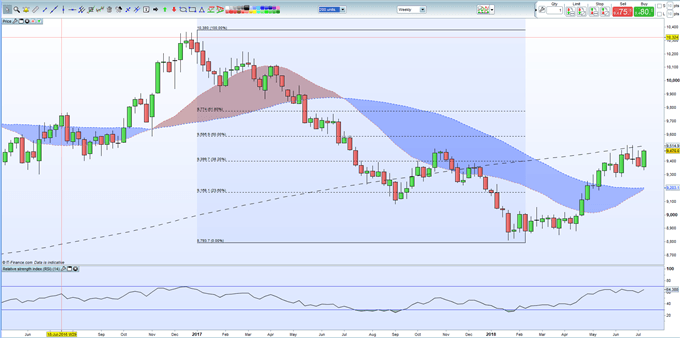

DailyFX Economic Calendar for the week ahead. ] Survey on the US Dollar Index the 200 Day Moving Average – Weekly Chart

USD Technical Analysis: DXY In summary, the US dollar remains strong and will likely continue to grow, although the rise may be difficult. The risk / reward ratio suggests that buying USD versus weaker counterparties remains the best way forward and, on the other hand, that the greenback's short selling can be done. Prove expensive. guides – Traits of Successful Traders and Main Trading Courses – While Technical Analysts are Likely to Interest at Our Last Elliott Wave Guide [19659033]. — Written by Nick Cawley, Analyst

To contact Nick, write to [email protected]

Follow Nick on Twitter @ nickcawley1

Source link