[ad_1]

Two months ago, I wrote that The new golden age for oil stocks is about to begin Since then, oil stocks have negotiated. above $ 60 per barrel and whether companies could capitalize on higher prices. The rest of the week and the next will provide the answers as more than a hundred oil companies report profits.

If my analysis is correct, we are about to see some oil companies explode their revenues and profits, and predict even higher revenue and profit growth than expected. This will likely come from the combination of higher realized, spot and hedged oil prices, as well as drilling efficiency, all while global oil demand continues to rise.

Of course, a handful of Permian producers will have to curb production until next year for more pipeline and truck capacity. But some shale producers, combining a good cost structure, solid balance sheets, smart management and higher oil prices are about to light the market. In particular, several companies held within the SPDR S & P Oil & Gas E & P ETF (XOP), that I have recommended in front of Jeff Gundlach and other "gurus", seem ripe for big gatherings.

XOP Constituent Earnings

To begin with, let's look at the earnings dates of the 50 major securities of SPDR Oil & Gas E & P ETF:

| Company | Symbol | % of Compartment | ] Date of Effect |

| Matador Resources Company | (MTDR) | 2.259870 | Aug 1 |

| Energen Corporation | (EGN) | 2.087272 | Aug 7 |

| Diamondback Energy Inc | (FANG) | 2.076480 | Aug 7 |

| Cimarex Energy Co. | (XEC) | 2.068490 | Aug. 7 |

| Concho Resources Inc. [19659010] (CXO) | 2,067124 | Aug 1 | |

| Parsley Energy Inc. Class A | (EP) | 2.048496 | Aug. 7 |

| SM Energy Company | SM) [19659010] 1.988964 | Aug. 1 | |

| Resources EOG Inc. | (EOG) | 1.962664 | Aug. 2 |

| Callon Petroleum Company | (CPE) | 1.938066 | 6 August |

| Gulfport Energy Corporation | (GORP) | 1.921947 [19659010] Aug. 1 | |

| Apache Company | (APA) | 1.905463 | Aug. 1 |

| Company Devon Energy | (DVN) | 1.889490 | July 31 |

| Carrizo Oil & Gas Inc. | (CRZO) | 1.864119 | Aug. 6 |

| Andeavor | (ANDV ) | 1.857893 | Aug. 6 |

| Noble Energy Inc. | (NBL) | 1.855434 | Aug 2 |

| WPX Energy Inc. Class A | (WPX) | 1.847026 | Aug. 1 |

| Antero Resources Corporation | (AR) [19659010] 1.843699 | Aug. 1 | |

| Centennial Resource Development Inc. Class A | (CDEV) | 1.842045 | August 6 |

| ConocoPhillips | (COP) | 1.840210 | July |

| Hess Corporation | (HES) | 1.839345 | Jul 25 |

| Marathon Petrol Corporation | (MPC) | 1.833322 | July 26 |

| Phillips 66 | (PSX) | 1.817961 | July 27 |

| Southwestern Energy Company | (SWN) [19659010] 1.813808 | Aug 2 | |

| Anadarko Petroleum Company | (APC) | 1.813308 [19659010] July 31 | |

| PDC Energy Inc. | (PDCE) | 1.811400 | Aug. 8 |

| Chevron Corporation | (CLC) | 1.781826 | July 27 |

| Marathon Oil Corporation | (MRO) | 1.774567 | Aug 1 |

| Exxon Mobil Corporation | (XOM) | 1.752297 | July 27 |

| Western Petroleum Society | (OXY) | 1.746353 [19659010] Aug. 8 | |

| Valero Energy Corporation | (VLO) | 1.737600 | July 26 |

| Cabot Oil & Gas Company | (COG) | 1.732696 | July 27 |

| ] Resource Company na pioneer | (PXD) | 1.721001 | Aug 7 |

| HollyFrontier Corporation | (HFC) | 1.715830 | Aug 2 |

| Murphy Oil Corporation | (MUR) [19659010] 1,710250 | Aug. 8 | |

| Newfield Exploration Company | (NFX) | 1.689962 | July 31 |

| EQT Corporation | (EQT) | 1.678094 | July |

| PBF Energy Inc. Class A | (PBF) | 1.668191 | Aug. 2 |

| Oasis Petroleum Inc. | (OAS) | 1.656051 | Aug. 6 |

| Continental Resources Inc. | (CLR) | 1.653069 | Aug. 7 |

| Chesapeake Energy Company | (CHK) | 1.639447 | Aug. 1 |

| CNX Resources Corporation | CNX) | 1.636465 [19659010] Aug. 2 | |

| Delek US Holdings Inc | (unknown) | 1.633643 | Aug. 7 |

| Range Resources Corporation [1965901] 0] (RRC) | 1.611145 | July 30 | |

| California Resources Corp. | (CRC) | 1.603374 | Aug. 2 |

| Laredo Petroleum Inc. | (LPI) | 1.595031 | Aug. 1 |

| Whiting Petroleum Company | (WLL) [19659010] 1.589189 | July 31 | |

| QEP Resources Inc. | (QEP) | 1.573093 | July 25 |

| Denbury Resources Inc. | (DNR) | 1.479314 | August 7 |

| SRC Energy Inc | (SRCI) | 1.393211 | Aug 1 |

| Jagged Peak Energy Inc. | (JAG) | 1.126288 | Aug. 8 |

As you can see, although the fund is named after E & P, there are also downstream companies (refining), as well as intermediate companies (pipelines and storage). For today 's purposes, I will look at the E & P.

Also in the ETF are the Exxon and Chevron majors, which I just write negatively in Exxon & Chevron Plus Long "Forever" Stocks, which is an important accompanying piece to this article for a full understanding of my ideas.

The big idea I am following is that oil prices should follow the spectacularly rising earnings of many shale companies. Thomson Reuters expects earnings growth of 144% in Q2 for a 19.3% increase in revenues in the energy sector. It's huge, but stock prices were stuck, presumably, on the fear of another spike in the oil supply.

The E & P I Watch This Week

Interestingly, one of my favorite E & P fell out of the wallet. I have several times recommended Encana (ECA) – "Buy Encana on the Maximum of Pessimism" is archived at the Margin Investment Safety Investment Department – and continues to recommend it.

In a nutshell, Encana, which reports on August 1, offers a significantly improved balance sheet compared to a few years ago, focusing on four key assets, including the Permian, rising earnings, a rising dividend and a redemption.

What I expect Wednesday is that the company continues to improve its revenues, free cash flow and earnings growth. As we learned in their recent update Permian Update Encana's take-out arrangements for the Permian prevent it from suffering the big differences that some other companies make. This is very important because the Permian is where the most important growth comes for shale plays.

My expectation is that Encana beats on all measures. This could propel the stock towards and potentially through $ 14 a share that he has struggled to break. Analysts have been slow to update Encana who, I believe, gives her some fuel if she actually beats.

Also on August 1 are Apache, Concho, Chesapeake, Marathon, Matador and WPX among others. Everyone has their own expectations, but these are some of the things I think could go up significantly.

Concho which recently merged with RSP Permian, to become the largest producer in the Permian, could see immediate synergies as companies made adjustments before closing. The stock has been limited for months and has just undergone a slight correction. I think that could reach new heights.

Apache does not receive the love of analysts recently as he continues to reduce his activities. Their turnover is estimated at 1.77 billion dollars, against 1.38 billion last year.

Chesapeake Energy much criticized in recent years, began to rally. Its recent divestment of Utica's assets positions it more fully in the short and medium term as a petroleum deposit, even though their long run still seems to be natural gas. As I discussed in this interview with Forex Analytix, I have calls on Chesapeake and I believe that they will once again offer the hope of a more complete rebound.

Marathon, Matador and WPX I am not close, however, I will take their results as a harbinger for similar actions.

On August 2, many investors will watch EOG Resources . Analysts do not get a lot of love despite their very low cost of production. Analysts are concerned that bottlenecks emerging from the Permian are hindering production. Investors did not seem too worried and rewarded EOG this year with a gain of about 19%.

The resource development of the centennial company of Mike Papa (formerly EOG), could be the most interesting stock to hear on Monday. Dad warned about the issue of Permian take-away, but also said that Centennial's unhedged approach would benefit the company. I tend to agree that uncovered companies could experience big profits.

On Tuesday, we receive Harold Hamm's continental resources which is also largely unhedged at this time. Citigroup degraded Continental in May and the title has not worked well since. In Continental's preliminary production report on July 24, they reported a 25% growth over last year. With higher realized prices, profits should improve considerably. Will the price of the action follow?

Also on Tuesday is the "Mother Fracker" themselves, Pioneer Natural Resources. The company continues to focus on the Permian and noted that delivery contracts to the Gulf Coast insulate it from abrupt differentials. CEO Timothy Dove earlier this year: "Our oil contracts on the Gulf Coast not only expose us to prices related to Brent, but also isolate us from the recent widening of the Midland-Cushing oil price differential. Gas transportation contracts provide flow insurance, with over 75% of our production sold in Southern California. "

I believe that Pioneer, which has peaked at 15%, could see a return to these levels, establishing a break in the coming months.

August 8, Occidental Petroleum reports. I touted this stock since it was around $ 60 a share. I believe that its growing production and its enviable intermediate asset purchases augur well for this big Permian producer. Estimates of what it could receive for intermediate assets are about $ 5 billion. For a company with a total long-term debt of only $ 10.31 billion and a market capitalization of $ 63 billion, it is my dividend stock. favorite in this sector.

I buy

I buy additional shares of Encana, Chesapeake Energy, Centennial Resources, Continental Resources, Pioneer Natural Resources and Occidental Petroleum. I see this basket as likely to catch up with the rally that the EOG and the oil price have seen.

I am also thinking about Concho, but I do not think I have time to go back before profits because I need to read a little more. I will listen to their income call and decide if I would like to add it to the group. I think I will do it.

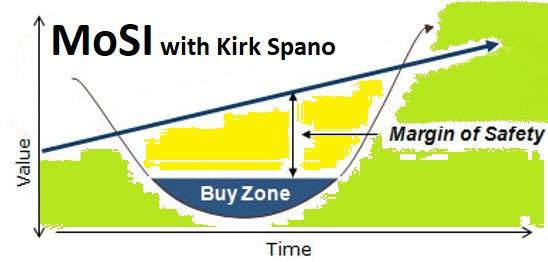

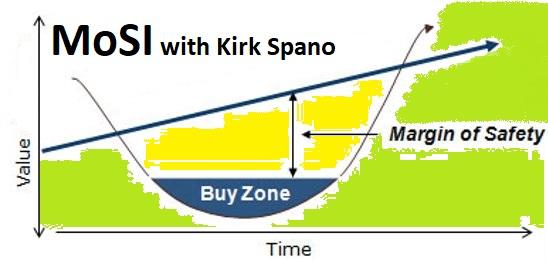

Margin of Safety Investing members have been reading these companies for some time. They have received a companion piece for this article that contains several swing option trades that I believe will increase our stocks and LEAP positions.

===============================================

July 31st is the LAST DAY to get the $ 500 safety margin Investing at the founders rate of $ 365 a year compared to the $ 499 regular price

Get a free trial today to grab your chance to receive ideas on investing in energy, the world of "smart all" to come, as well as many other opportunities for growth and dividends at great prices.

Learn from the top-ranked analyst, winner of the inaugural "Next Great Investing Columnist" award from MarketWatch and Kirk Spano, an exclusive advisor, to help build a portfolio that resists the risks and rewards of investing. A changing world.

Disclosure: I am / we are long CDEV, CHK, CLR, ECA, OXY, PXD.

I wrote this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose title is mentioned in this article.

Additional Disclosure: I own a registered investment advisor – bluemoundassetmanage … .com – however, publishes separately from this entity for self-directed investors. Any information, opinion, research or reflection presented does not constitute specific advice because I do not know your situation perfectly. All investors must take special precautions to take into account the risk, as all investments can lead to losses. It may be in your best interest to consult an investment advisor before proceeding with a transaction or investment

[ad_2]

Source link