[ad_1]

From mobile payment to mobile payment, Asia is currently at the forefront of digital payment space, thanks to e-commerce and the adoption of digital portfolios, said the 2018 Global Payments report released by the technology company of payment Worldpay.

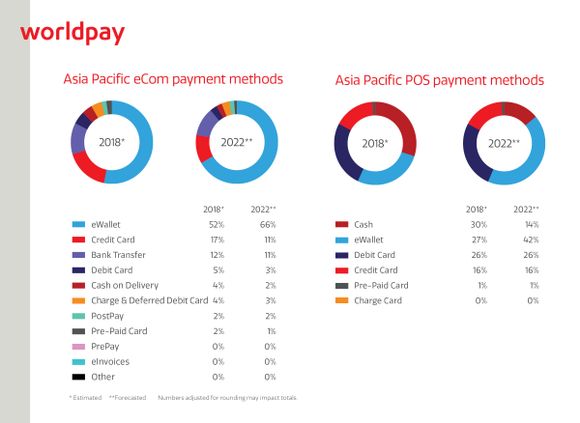

The company predicts that there will be "dramatic changes" in Asia from money market portfolios to electronic wallets over the next five years, with debit and credit cards retaining their current share. With respect to e-commerce, digital portfolios will continue to be dominated by Asia, particularly China, where digital portfolios will account for two-thirds of the volume of regional payments by 2022.

"Whether these portfolios are Alipay or WeChat Pay, or GrabPay or Go-Pay, there are many new digital portfolios on the market to entice consumers to behave. And with the use of mobile, we will no longer see the change continue in the future, "said Phil Pomford, Managing Director of Worldpay Asia Pacific, Global Enterprise eCommerce, at a press briefing .

Elsewhere in Asia, Worldpay predicted that e-commerce growth in India would be 21.2% for the next five years, the market remaining far from being saturated in terms of Internet access or phone penetration mobile.

For Indonesia, Thailand and Malaysia, bank transfers will continue to lead the way. While cash-on-delivery accounts for just over 4.5% of e-commerce spending in Asia, it is the most used payment method in the Philippines.

In Singapore, mobile commerce is poised to become the most preferred channel in 2019 and will account for 52% of all online sales in the city.

On the coming law proposed by the Monetary Authority of Singapore (MAS) to regulate digital wallet operators, Mr Pomford said he did not see the decision influencing the payments and fintech sector.

"For us, this is a natural step forward in terms of regulating the industry. It also creates a level playing field, "he said.

E-portfolios are expected to account for 12.7% of online payments in Singapore by 2022, a CAGR of 14% over the next four years. The growth of alternative payment methods is also reflected in store sales, with e-portfolios expected to record a compound annual growth rate (CAGR) of 32% by 2022, representing approximately 9.4% of outlets in Singapore.

Pomford noted that alternative payment methods such as Australia-based Afterpay – an immediate payment system that allows consumers to buy products in installments – are also starting to gain popularity, particularly in Singapore and Hong Kong.

While new players in the digital payments industry continue to make their way into different markets, Pomford added that there would be consolidation at some point, with each market finding a dominant mode of payment.

"In Southeast Asia and in Asia as a whole, each market is different. If you are a global trader, this is certainly not a unique solution for the region, "he added.

Chinese history

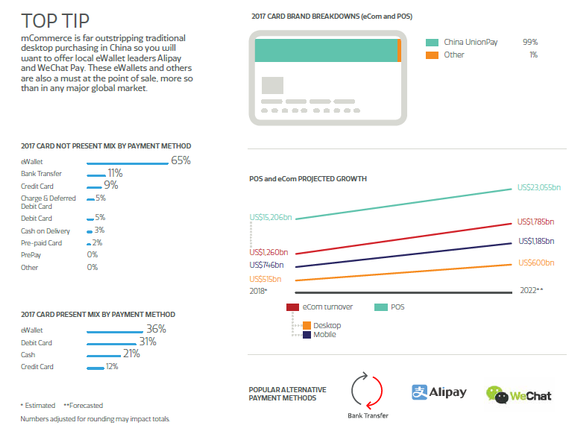

In China, adoption of the digital wallet has never been stronger, driven by payment platforms based on mobile applications such as Alipay and WeChat Pay.

According to the report, per capita e-commerce spending in China is just above the global average. Yet, the percentage of payments made through a digital wallet is staggering: 35.7% at the point of sale and 64.8% in e-commerce.

The use of the digital wallet also accounts for nearly two-thirds of e-commerce transactions in China, the report says. Digital wallets are so popular among Chinese consumers that they also direct point-of-sale payments, accounting for more than a third of card market share.

According to Worldpay, Chinese consumers categorically choose the seamless integration and trusted environment offered by these all-inclusive apps. "Chinese consumers buy, discuss, share invoices, share discounts and codes based on their purchases, and securely buy a seemingly endless selection of items, all in the same trusted application.

"With mobile, Asia is without a doubt the vanguard of digital payment. China is obviously the forerunner, but the likes of Hong Kong and Singapore are also closely following the act. Even in developed countries, mobile telephony continues to grow. And in emerging markets, it's still growing significantly, "added Pomford.

Read also:

Asian companies hold a stake in half of Vietnam's licensed payment services

Grab obtains $ 50 million in financing from KASIKORNBANK, marking the entrance to the payments market in Thailand

[ad_2]

Source link