[ad_1]

Less than two weeks ago, I wrote that Las Vegas Sands (LVS) offered traders an excellent entry after Macau's gaming revenue figures, lower than expected . In this article, I discuss another number that came lower than expected. In this case, the gains. Despite the decline, I believe the company is still a solid buy.

Source: Las Vegas Sands

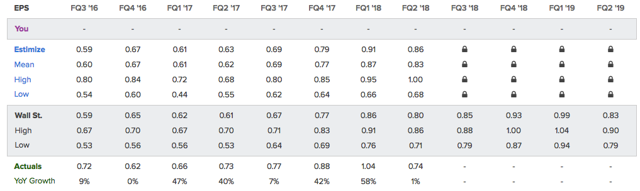

This is an ugly EPS number

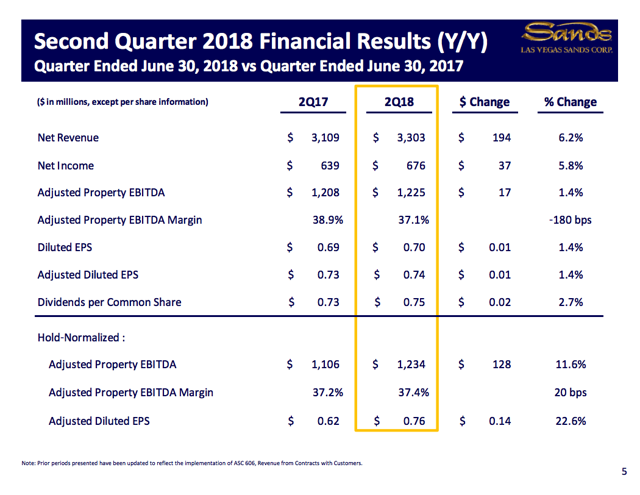

EPS arrived at $ 0.74. That's 6 cents below expectations. This is the first shortfall since the fourth quarter of 2016. Four quarters have experienced EPS growth of more than 40% since the beginning of 2017. However, the last quarter saw a drop to 1.4%, the lowest since Q4 / 2016.

The second quarter of this year saw an increase in revenues of 6.2%, 0.4 percentage points higher than the growth in net income. Adjusted properties EBITDA increased by 1.4% while adjusted EBITDA margins decreased by 1.8 points. Note that the company has beaten sales estimates, which indicated that net sales would be below $ 3.3 billion.

Source: Presentation of Las Vegas Sands Earnings for Q2 / 2018

At this point, one must ask if the bull is in danger given these poor results. However, I do not believe these results are a reason to sell. One of the reasons to stick to this company is the strong market of Macau

Macau is hot red

Although the company officially calls Las Vegas Sands, it is important to recognize that about 60% of the company sales are generated in the Chinese game hotspot of Macau.

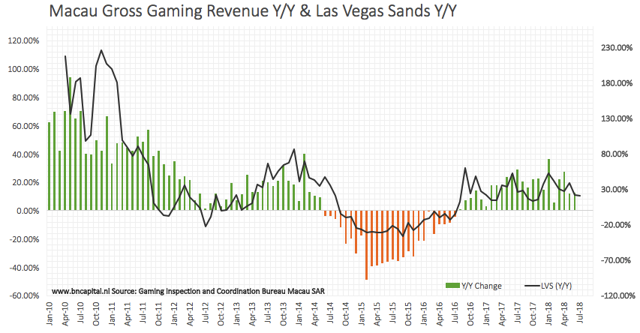

One of the graphics that I have shared in my most recent article in Las Vegas Sands can be seen below. It shows the true strength of the Macau gaming industry despite the weaker month of June than expected. Gaming growth has been close to 30% since the beginning of 2017. This is comparable to the growth rates observed before the slowdown in 2014 and 2015.

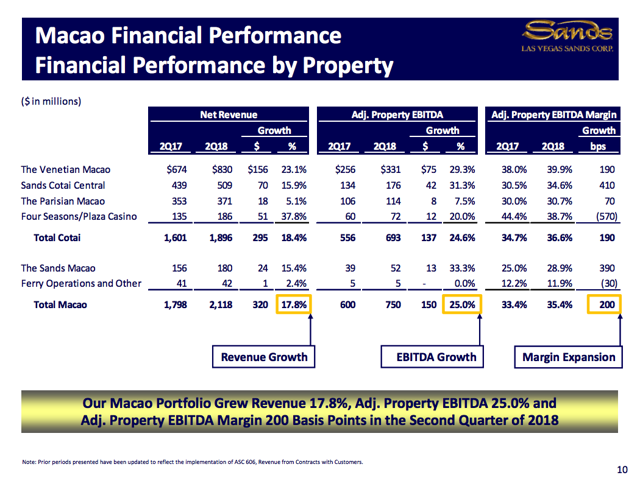

Las Vegas Sands has once again proved that its main properties are able to use this favorable environment to increase its sales and EBITDA. Las Vegas Sands has a 35% market share in Macau, which is 5 times higher than Wynn's (WYNN) market share. That said, the overview below reveals that total sales growth was 17.8% in the second quarter. Adjusted real estate EBITDA increased by 25% while the EBITDA margin increased by 2 points to 35.4%. In addition, the average gain per VIP table per day increased by 29.8% while the mass table gain increased by 11.5%.

Source: Presentation of Las Vegas Sands earnings in Q2 / 2018

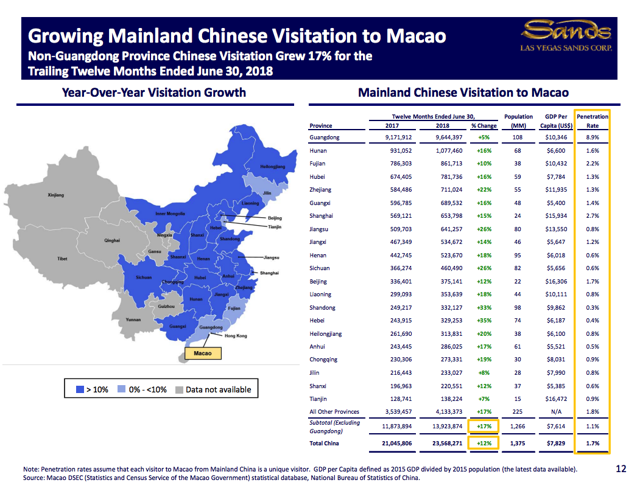

And that does not stop there. A year ago, Las Vegas Sands predicted that Chinese tourism figures would start to accelerate. This has proven to be a very accurate prediction. In the second quarter of 2017, total growth in Chinese visits to Macao was 3%. A year later (T2 / 2018), we see that this number has accelerated to 12%. The penetration rate went from 1.5% to 1.7%

Source: Las Vegas Sands Presentation of Profit T2 / 2018

The total number of overnight visits to China increased by 10 , 7% while the mass market increased by 21%. In other words, there is absolutely no denying that the largest market in Las Vegas Sands is in very good shape right now. Especially as the company occupies a dominant position in Macau.

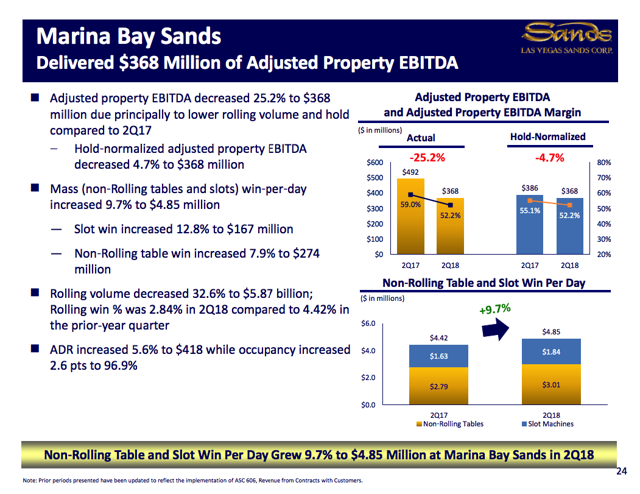

Singapore ruins the party

Marina Bay Sands, headquartered in Singapore, saw its adjusted EBITDA of $ 368 million. This is down 25.2% from the second quarter of 2017, as gains in tables and non-mobile slot machines accelerated 9.7%. Even though fewer bets and a lower percentage of earnings seem to be the reason the company has missed out on profits, there are no concerns about future growth in Singapore. Personally, I agree that there is no reason to worry. I believe that Marina Bay Sands will improve its operating results over the next few months, which should give a favorable wind to the company in the third quarter (and beyond).

Source: Las Vegas Sands Q2 / 2018 Earnings Presentation

The same goes for Las Vegas, which recorded an adjusted EBITDA growth rate of -2.5%. Table games fell 2.8% to $ 342 million as the winning percentage fell 8.7 points to 7.7%. On the other hand, hotel room revenues rose 10.4% to $ 149 million, a record high in the second quarter. And even though the hotel room business figure only accounts for a very small portion of the company's revenue, it's good to note that the hotel segment records the growth rate of Las Vegas.

Takeaway

I had hoped. However, there are strong signs that indicate extra strength in the third quarter. The company beat sales estimates, which was mainly due to the strong business sentiment in Macau. Macau continues to benefit from the increased number of visitors while Las Vegas Sands is in a unique position to benefit from this trend.

The only problem was the low win rates in Singapore that reduced the company's results. However, even these markets (Las Vegas included) see additional growth when it comes to the number of visitors and the strength of the general market.

I remain bullish and I maintain my price target of $ 90 over the next few months. Note that I wrote this article before the first opening of the market after the publication of the results. At this point, the stock is slightly down more than 3% (pre-market). Even if it gets worse, I will not change my bullish thesis since it is entirely based on the situation in growing markets like Macau. I could even use a bigger trough to add some stock to my long position.

Stay on the lookout!

A big thank you for reading my article. Please let me know what you think of my thesis in the comments section below. Your contribution is very appreciated!

Disclosure: I am / we are LVS long

I have written this article myself, and it expresses my own opinions. I do not receive compensation for this (other than Seeking Alpha). I do not have a business relationship with a company whose title is mentioned in this article.

Additional Disclosure: This article is for the sole purpose of adding value to the search process. Always take care of your own risk management and asset allocation.

[ad_2]

Source link