[ad_1]

Copyright of the image

AFP

The value of the Iranian currency has reached unprecedented lows in recent months

Six months of exemptions from US sanctions granted to countries that are still buying oil from Iran ended Thursday.

President Donald Trump reinstated the sanctions last year after giving up a historic nuclear deal that he wants to renegotiate.

Iran's leaders have remained provocative in the face of sanctions and have promised to overcome them, but the substantial impact they have had on the country is clear.

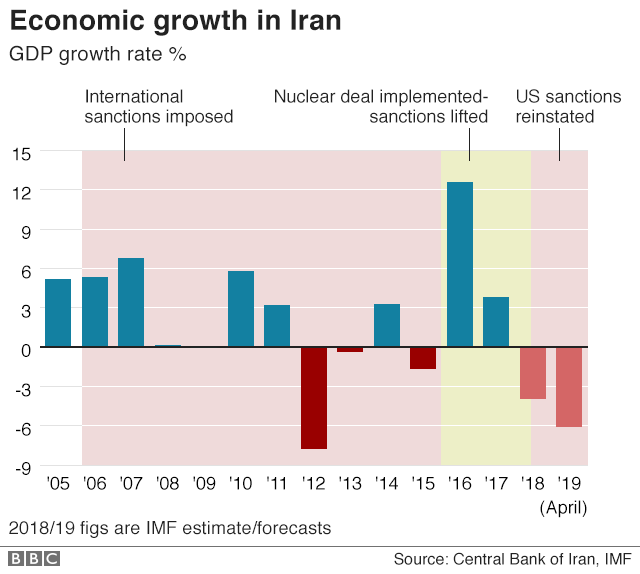

Slide to a deep recession

The Iranian economy has been hit hard for several years by sanctions imposed by the international community on the country's nuclear program.

In 2015, President Hassan Rouhani agreed to an agreement with the United States and five other world powers to curb Iran's nuclear activities in exchange for the lifting of these sanctions.

The following year, after the implementation of the agreement, the Iranian economy rebounded and GDP grew by 12.3%, according to the Central Bank of Iran.

But much of this growth has been attributed to the oil and gas industry, and the recovery of other sectors has not been as significant as many Iranians have hoped.

Growth returned to 3.7% in 2017, contributing to fueling the economic discontent that has led to the largest anti-government protests in Iran for nearly a decade in December.

Multimedia playback is not supported on your device

The reinstatement of US sanctions last year – particularly those imposed on the energy, shipping and finance sectors in November – caused the drying up of foreign investment and affected exports. of oil.

The sanctions prohibit US companies from trading with Iran, but also with foreign companies or countries that deal with Iran.

As a result, Iran's GDP declined by 3.9% in 2018, according to estimates by the International Monetary Fund (IMF).

The IMF announced in late April that it was forecasting a contraction of the Iranian economy of 6% in 2019. However, this projection preceded the expiration of the sanctions waivers.

- Has the Iranian economy benefited from the nuclear agreement?

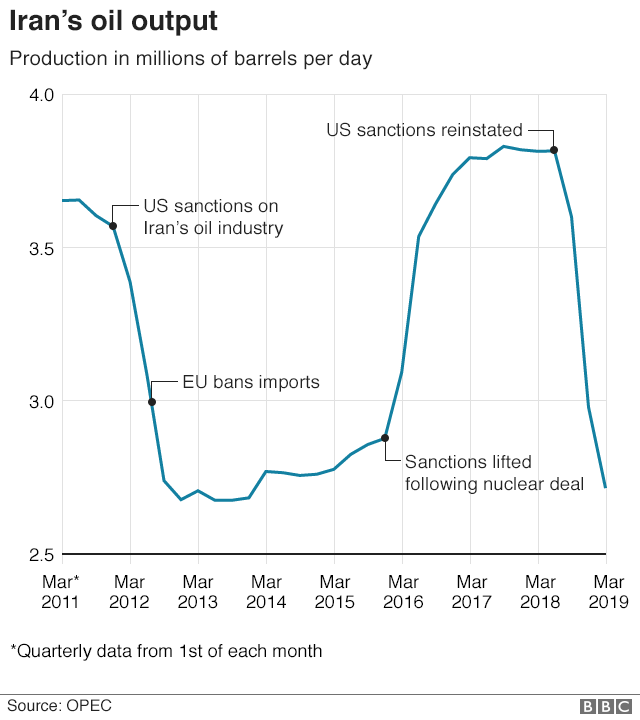

Oil exports more than halved

At the beginning of 2018, Iran's crude oil production reached 3.8 million barrels per day (bpd), according to data collected by the Organization of the Petroleum Exporting Countries (OPEC). The country exported about 2.3 million bpd.

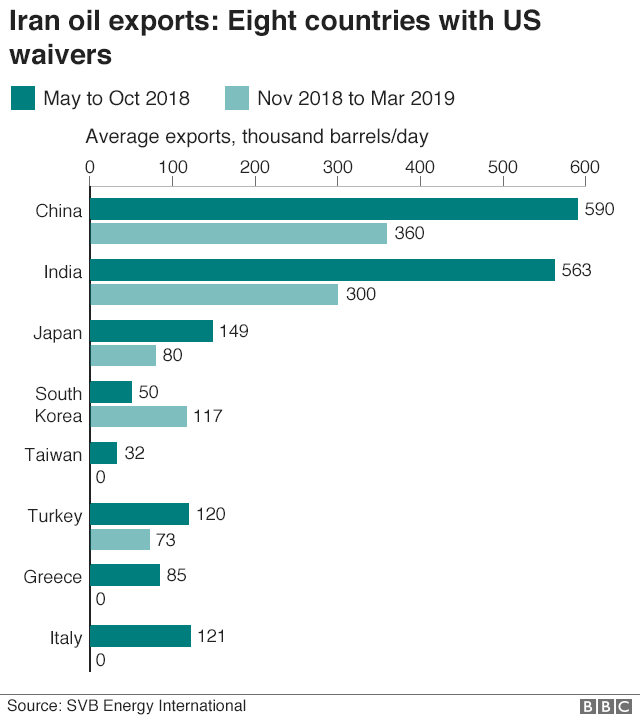

Most of the oil was purchased by eight countries or territories to which the United States granted six-month waivers when sanctions on the Iranian energy sector came into effect: China, India, Japan, South Korea, Taiwan , Turkey, Greece and Italy.

Copyright of the image

AFP

In March, Iran's oil exports had fallen to 1.1 million barrels a day on average.

As long as these countries reduced their purchases of Iranian oil during this period, their banks were allowed to continue trading for any purpose whatsoever with the Central Bank of Iran or with any other Iranian bank without risking US criminal sanctions.

By March 2019, Iranian oil exports had fallen to 1.1 million bpd on average, according to consulting firm SVB Energy International. Taiwan, Greece and Italy totally stopped imports, while the two largest buyers – China and India – cut them by 39% and 47% respectively. A US official said the Iranian government had lost more than $ 10 billion in revenue.

President Trump said that he "intended to zero Iranian oil exports" when he decided to allow the expiry of the exemptions to the SRE on May 2.

However, it is unclear to what extent Iranian oil sales will fall again.

China insisted that its trade with Iran was perfectly legal and that the United States was not competent to intervene. Turkey said that she could not cut ties with a neighbor.

Iran could also export oil to cover its humanitarian needs and could also be able to avoid sanctions by secretly exporting oil – which analysts already suspect.

- Is it about to become more expensive to fill my car?

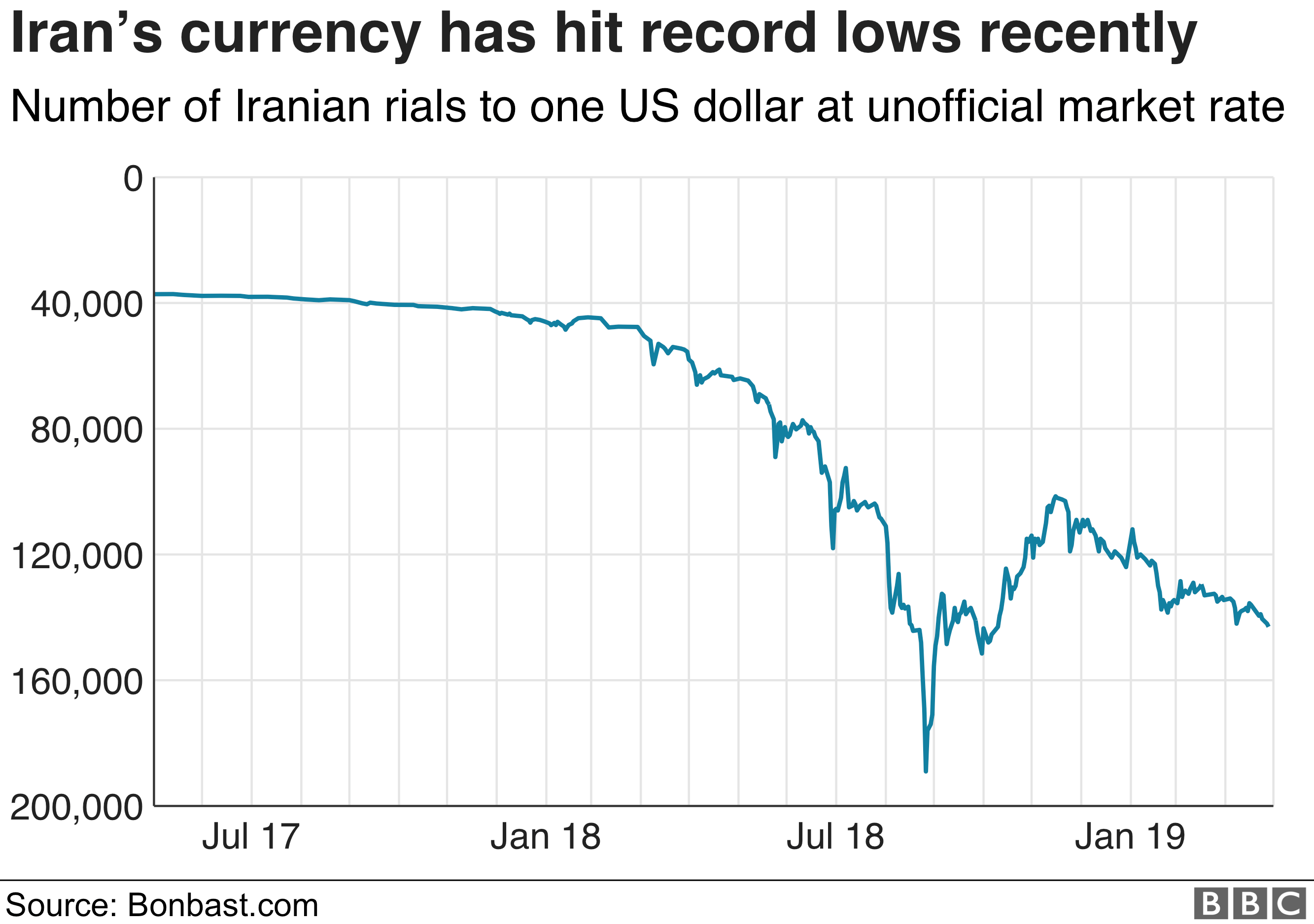

The value of the rial fell

Copyright of the image

AFP

Traders offered 143,000 rials to the US dollar in late April

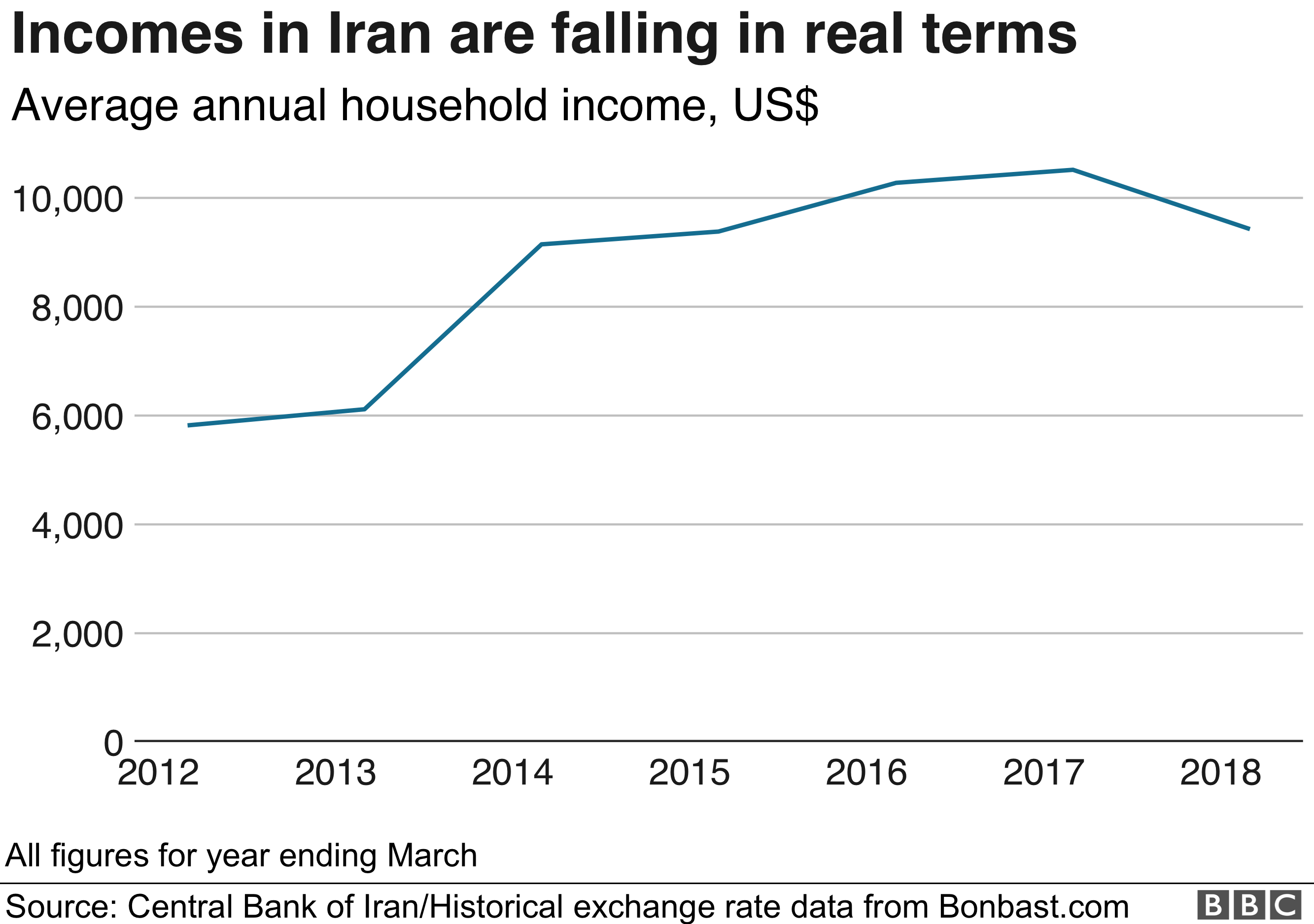

President Rouhani kept the Iranian currency steady for nearly four years. But it has lost nearly 60% of its value against the US dollar on the unofficial market since the reinstatement of US sanctions, according to websites on foreign exchange.

The fixed official rate of 42,000 rials for one dollar is used for a limited number of transactions. Most Iranians therefore rely on currency traders. Bonbast.com said traders were offering 143,000 rials to the dollar on April 30.

The fall of the rial has been attributed to Iran's economic problems and the strong demand for foreign currency on the part of ordinary Iranians who have seen the value of their savings eroding and fear that the situation may be worse. # 39; worse.

The rial has recovered some of its value since September 2018, when the Central Bank of Iran has released more dollars into the market and the authorities have cracked down on foreign currency brokers while prices had reached record levels of USD 190,000.

Iran 's currency problems have also resulted in a shortage of imported products and products made from raw materials from abroad, including baby diapers.

- What baby diapers tell us about Iran's economic difficulties

The cost of living has increased dramatically

Copyright of the image

Anadolu Agency

Over the last year, the cost of red meat and poultry has increased by 57%

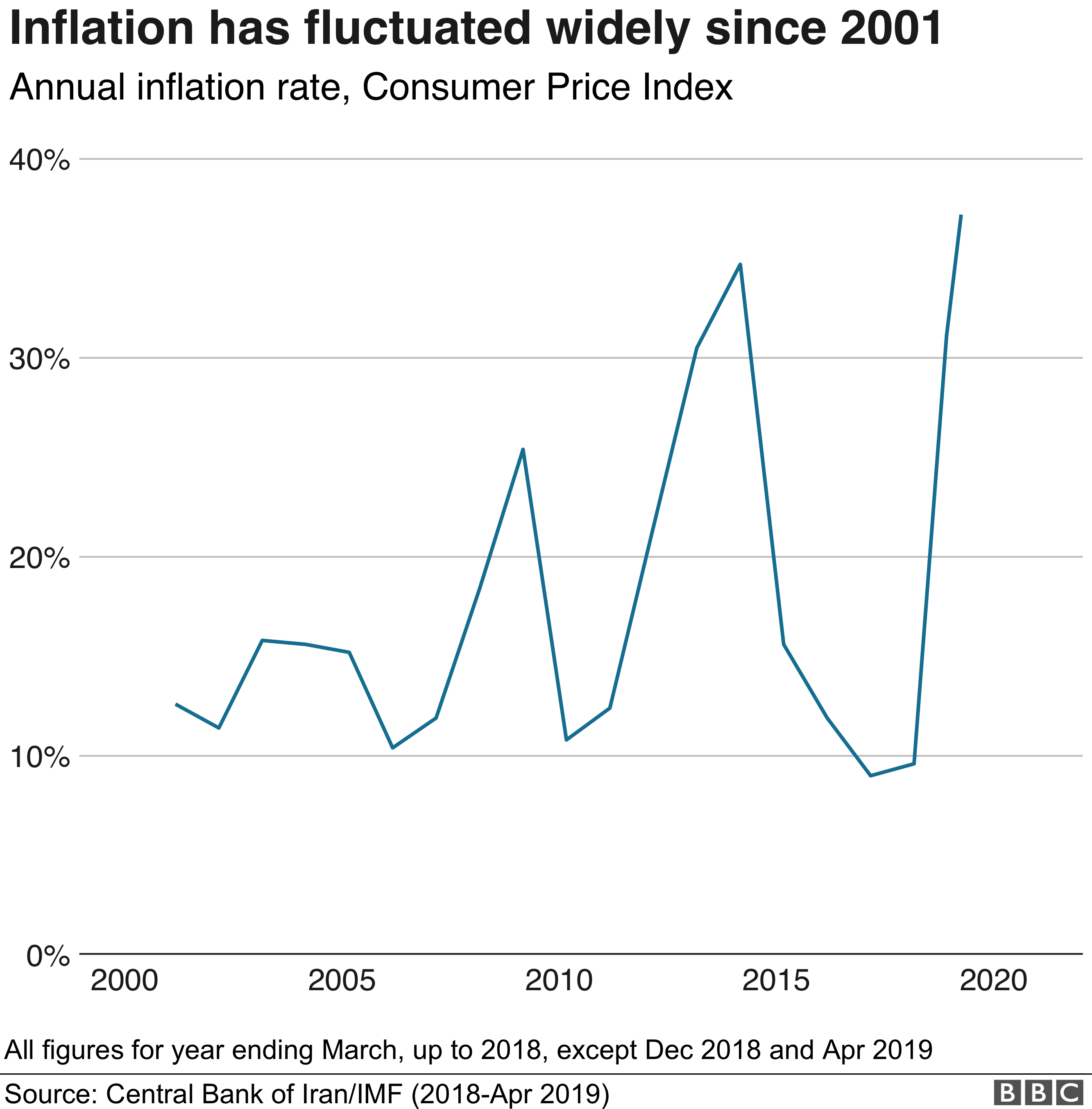

President Rouhani has managed to reduce inflation to 9% in 2017. But the IMF estimates that it would have climbed to 31% in 2018 and that it could reach 37% or more this year if the oil exports continue to fall.

The declining value of the rial affected not only the prices of imported products but also those of locally produced commodities. In the last 12 months, the cost of red meat and poultry has increased by 57%, that of milk, cheese and eggs by 37% and vegetables by 47%, according to the Statistics Center. ;Iran.

Price increases have resulted in long queues in government-subsidized grocery stores, particularly for rationed meat. In an attempt to lower prices, the government banned livestock exports, flying hundreds of thousands of cows and sheep from abroad. According to analysts, some Iranian farmers sell meat in neighboring countries to obtain foreign currency.

There is also a plan to introduce electronic coupons to help the poorest obtain meat and other essentials. About 3% of Iranians – about 2.4 million people – lived on less than US $ 1.90 (£ 1.46) a day in 2016.

The poor have also been hard hit by increases of almost 20% in housing costs and medical services over the last year.

Jihad Azour, of the IMF, told the Reuters news agency last week that Iran could help to control inflation by striving to eliminate the "big money". difference between official and unofficial exchange rates of the rial.

- Iranians describe the impact of US sanctions

.

[ad_2]

Source link