[ad_1]

Energy prices jumped on Monday as a result of amazing developments in the Middle East, but it will probably take a little longer before having a broader impact on the economy.

The West Texas Intermediate crude briefly rose more than 11%, surpassing $ 60 a barrel as a result of the drone attack against oil interests held by the Saudis, but this rise was curbed throughout of the meeting, in the hope that, in the worst case scenario, open up its strategic reserve to retain prices.

Although shockwaves continue to resonate with the conflict – Brent's international reference level has further increased on Monday – the long-term implications should not be pronounced.

The "level to watch" is around $ 80 a barrel, said Nick Colas, co-founder of DataTrek Research. The current spike, he said, is probably "unsustainable".

"As dramatic as the events of the weekend may be, it is not as if Iran or its substitutes had taken control of the Saudi oil fields, as was the case in 1990 with the US. Iraq / Kuwait, "said Colas in a daily note to his clients. "Saudi Arabia has every interest in restoring online production, better securing its facilities and returning to peak production, and of course, the United States also has its strategic oil reserve to exploit."

Even the $ 80 level might not mean a more pronounced slowdown in the economy.

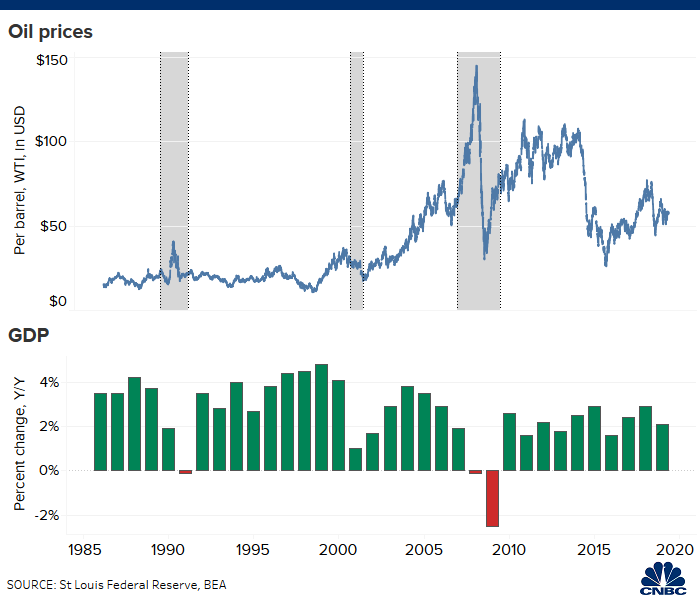

Colas points out that among recessions that the United States has experienced since the early 1980s, none has been without oil spikes of at least 90%. The Great Recession, for example, recorded a rise of 96%, while the collapse of the Internet bubble was up 141% and the 90s were preceded by a jump of 96%.

There are some other notable trends in the history of oil price spikes.

On the one hand, most are more influenced by macroeconomic effects than by industry-specific events. The 2008-09 decision was taken because of the financial crisis, while at least half a dozen other sharp increases were caused by the bear market rebound rather than by long rises. term dictated by secularism.

This makes their impact more effect than cause and therefore less impact on the economy in general.

"The attack on Saudi oil should not be a disaster for the global economy," said Jennifer McKeown, head of the global economic affairs department of Capital Economics, in a note. "Saudi output could resume fairly quickly and even if it were not, the implications for oil prices and inflation in developed economies should be limited."

McKeown considers three possible scenarios: the most likely case, in which Saudi output is rapidly recovering and prices return to Capital's forecast of $ 60 a barrel in 2019; a second which involves "a prolonged failure" and possible additional attacks that would raise the price to $ 85 a barrel, and a third that would cause a "complete conflict between the United States and Iran" which would raise prices to $ 150 a barrel this year before falling quickly.

In any case, McKeown does not see a high probability of long-term impact.

"The moderate and temporary inflationary impact implies that the direct effects on GDP growth of the advanced economy would be small," she said. "This is all the more true as it is highly unlikely that central banks will react to rising global inflation by tightening monetary policy in the current context."

Indeed, the Federal Reserve is meeting this week and should still reduce its benchmark rate by a quarter point. However, the chances of the US central bank retaining the line rose sharply on Monday due to soaring oil prices, traders now attributing the equivalent of 34% chance of not moving.

McKeown warned, however, that tensions in the Middle East were "another hurdle" for a weakened global economy. A "large-scale conflict could therefore trigger a new stage of the global slowdown".

[ad_2]

Source link