[ad_1]

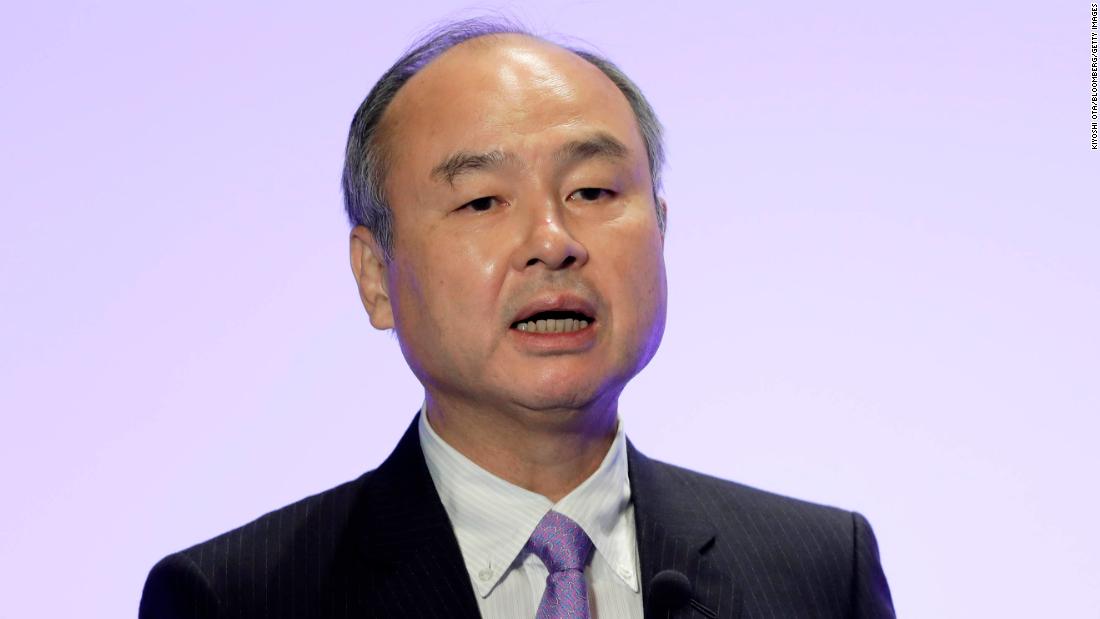

The Japanese billionaire said in a presentation of his results on Tuesday that he would take a cautious approach until the impact of the new regulations is clear.

Chinese companies accounted for 23% of SoftBank Vision Fund’s massive investment portfolio at the end of July. But only 11% of Vision Fund investments have been directed to the country since April, Son said.

“It’s because we would like to wait and see a bit,” he added.

Answer questions from journalists, Son admitted that the company “faces difficult investment challenges in China.”

“It’s true,” he said. “This is something that we would like to watch out for and be careful about. Once we get a better view, we would like to resume. [further] investments. “

Son did not specifically comment on Didi during the presentation, but said he still had “good expectations” of SoftBank’s portfolio companies in China.

He reiterated that the company wanted to “wait and see how things go” as the regulations continued to unfold, adding that there was no specific timeframe for how long they planned to adopt the regulation. approach.

“Is it six months, 12 months? I don’t know yet,” the executive said.

“[But] in a year or two, with the new rules, and with new orders, I think things will be much clearer … Once things are clearer, we will be open to the resumption of active investment. “

Despite the crackdown, Son said he remains optimistic about China for the long term.

“There are still risks there, like the risks in China. But we want to take risks,” he said. “We are neither against nor for the Chinese government, and we have no doubts about [the] China’s future potential. “

– Laura He contributed to this report.

[ad_2]

Source link